AUDZAR trade ideas

AUD/ZAR: Long-Term Bullish Trend with Key Consolidation LevelsKey Observations:

Support and Resistance Levels:

All-Time Low: Around 5.5000

Highlighted Support Zones:

Around 8.7722 - 9.0948 (Red shaded zone) - This has been tested

Around 11.0000 (Recent support zone marked as HL)

Highlighted Resistance Zones:

Around 12.5000 (Green shaded zone, near HH and All-Time High) - This has been tested

All-Time High and major level at around 12.6800

Ascending Trend Line : Connecting higher lows (HL) from 2018 onwards.

Higher Highs (HH) and Higher Lows (HL):

Higher Highs (HH) : Indicate a bullish trend in the long term, showing that the price is making new highs over time.

Higher Lows (HL) : Indicate continued bullish sentiment as lows are higher than previous lows, supporting the trendline.

Current Price Action:

Current Price: Around 12.1581, showing a slight positive movement (+0.0229 or +0.19%).

Price Consolidation: The price is consolidating between the support level of 11.0000 and the resistance level of 12.5000.

Ascending Trend Line Support: The price is currently supported by the ascending trend line, suggesting that the long-term bullish trend is still intact.

Potential Scenarios:

Bullish Scenario:

If the price breaks above the resistance zone around 12.5000 and sustains above it, it could aim for the next resistance level near the all-time high of 13.0000-13.5000.

Continued higher highs and higher lows would confirm the bullish trend.

Bearish Scenario:

If the price fails to hold the ascending trend line support and breaks below the recent support around 11.0000, it might test lower support levels around 8.5000.

A break below the ascending trend line could signal a reversal or a more extended correction phase.

Sideways Movement:

The price might continue to consolidate between 11.0000 and 12.5000, forming a range-bound movement until a clear breakout direction is established.

AUDZAR BUYI am seeing it go all the way up from the technical side but fundamentals always have the last word . The first reason why I see a buy is the fact price reached a previously tested support and gives us a third touch confirmation as you can see with the rectangle.

The second reason I buy id the fact I seer the price has tested the bullish channel's support .

I am crazy about technical analysis , but for me to enter a trade I will always wait for the fundamental confirmation . So as third confirmation , on the Australia Company Gross Operating Profits QoQ news release we have an actual reading of 7.1 % and is 4.1% more than the forcast being 3.0% , I am sure it will move the price up.

I do not use technical indicators because they can be lagging behind the prices sometimes . I hate entering late .

If you have a certain setup with indincators that helps you and you are willing to share , feel free to let me know. Thank you !

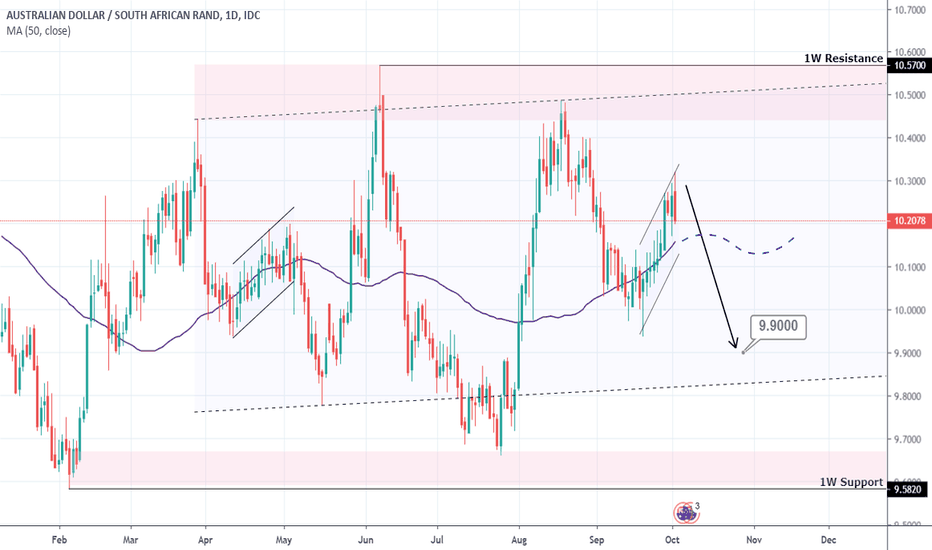

AUDZAR ForecastAUDZAR H4 -Down

.

Khiwe

At this profile page, the shared analysis, ideas and also, the strategy of a chart belong to Khiwe with some being influenced. The technical set-ups are speculative, they are not guaranteed for accuracy or in completeness in the form of any content; -it is not to advice on financial markets. Please apply your own analysis and confirm it with price action.

Short for this pair, cant trade it because Im on Ouanda, o wellRespecting 50ema line, down trend. Supports become resistance. Its going downnnn

Long term bullish trendSouth African Rand is entering a relative strength period against the Australian Dollar that unleash 2 trading Ideas.

First Idea: buy for 10-20% profit with similar stop-loss.

Second Idea: buy for long term (at least 1 year) and benefit from both positive interest differential and positive trend for at least 30% estimated gain with 20% stop-loss.