AVAX is Back: Subnets, Upgrades, and Institutional Momentum🚀🧠 AVAX: Subnets, Upgrades, and Institutional Momentum 🔧🏛️

Avalanche (AVAX ) is starting to shape up again — not just on the chart, but at the infrastructure and institutional level too.

As part of the Altcoin Series, I continue to trade these setups while preparing for a time when I’ll divorce alts emotionally and treat them for what they are — assets to be traded, not worshipped.

But right now? This one looks strong.

📊 Chart Breakdown

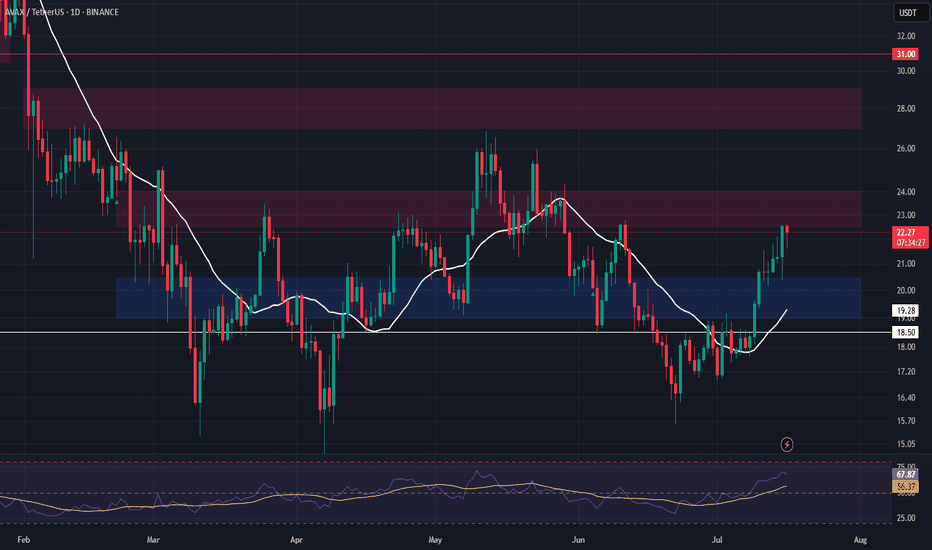

Left side: Macro chart (8H)

✅ We've just completed a successful third touch of structural support — you can see the 1–2–3 test boxed below the $18.64 level

📍 That’s usually where conviction builds, and reversals are born

🚀 A massive breakout confirmation comes if we close above $22.97 — the level to watch

🧱 Above that, the path opens toward higher fib levels: $27.65 → $35.13 → $43.63 and beyond

Right side: Micro structure (30-min chart)

🔍 A descending wedge or coil forming — typical of consolidation before breakout

This price action is tightening into a decision point, right around $20.80–$21

I expect a breakout soon, with a push toward the macro trigger at $22.97

🧩 What’s New with AVAX?

Avalanche 9000 Upgrade is Live

Major performance overhaul: cheaper subnets, faster deployment

Subnets now act more like sovereign L1s, enhancing utility across the board

Developer cost dropped by over 99%, inviting serious builders

DeFi, Real-World Assets & Ecosystem Growth

TVL > $5B

VanEck’s $100M Treasury Fund now tokenized on Avalanche

Over 515M transactions per month

Real-world integrations with Alipay, California DMV, and more

Enterprise Expansion

FIFA subnet launch (NFTs, tickets, collectibles)

Institutional panels at Avalanche Summit London

Avalanche’s vision: a custom chain for every institution

Retro9000 Grant Program

$40M set aside to fuel L1 growth via subnets

Analysts expect 300% subnet growth by Q4 2025

🧠 The Mindset: Trade, Not Worship

AVAX is a great example of why I'm preparing to divorce altcoins at the cycle top.

It’s gone from hype to silence... and now to real infrastructure momentum.

So yes — I’m bullish.

But I’m not here for belief — I’m here for the structure.

✅ Buy over support

✅ Breakout over $22.97

🛑 Stop-loss if structure fails

🎯 Targets: $27.65 → $35.13 → $43.63+

🏁 Final Word

Avalanche is rebuilding — on-chain, in the real world, and on the chart.

It has subnets, speed, and now institutional backing.

Let’s trade it smart.

Let’s trade it without emotions, do your risk management and don't listen to me.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

AVAXUSDT trade ideas

AVAX – Watching for Support Retest After Resistance TestAVAX is currently testing a major resistance level, and we’re anticipating a potential retrace into support. The $19.00–$20.45 zone offers a strong area to enter a long swing position on confirmation of the retest.

📌 Trade Setup:

• Entry Zone: $19.00 – $20.45

• Take Profit Targets:

o 🥇 $22.50 – $24.00

o 🥈 $27.00 – $30.00

• Stop Loss: Daily close below $18.50

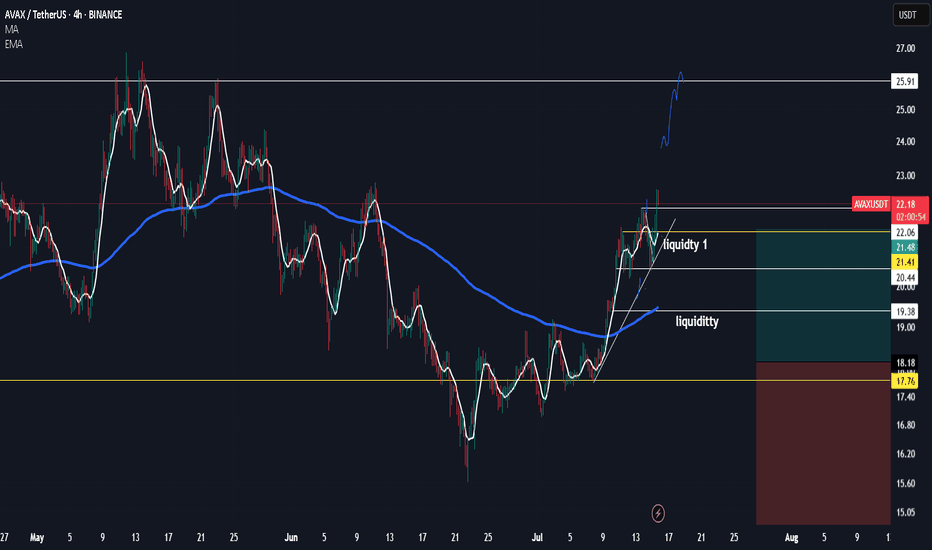

AVAXUSDT – Major Trendline Broken | Targeting Upper RangeAVAX broke out of a long-standing descending trendline and confirmed the breakout with a clean retest.

The previous structure around $20 has now flipped into support.

If momentum holds, bulls could drive price toward $27–$30.

Watching closely for signs of continuation or a fakeout trap.

#AVAXUSDT #Avalanche #Breakout #TrendlineBreak #QuantTradingPro #TradingView

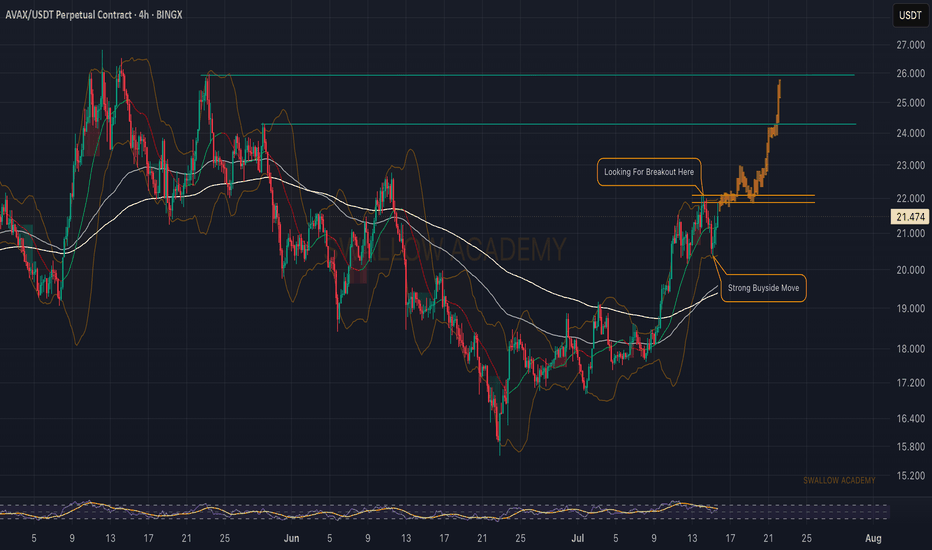

Avalanche (AVAX): About To Breakout | Good Buy OpportunitySeeing a good chance for AVAX to pump just like the rest of the market has been doing so far. We are about to unravel the next altcoin season so be ready. As soon as we see a breakout from the local high, we are going to look for a buy entry.

Swallow Academy

AVAX/USDT - H4 - Wedge Breakout (29.06.2025)The AVAX/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 21.77

2nd Resistance – 24.35

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

AVAX Possible scenarioAVAX is currently in a downtrend and has approached a key support zone. Price action has formed a bearish flag pattern, suggesting a continuation of the prevailing trend. The market is currently in a correction phase within this flag.

If the support fails and the pattern breaks to the downside, AVAX may slide toward the next bearish target around $14.

However, if the resistance of the flag is broken to the upside, it would invalidate the bearish setup and could shift momentum toward a recovery, with a potential move toward $22.5 as the first bullish target.

Let’s monitor how the price reacts near the edges of this pattern to assess whether continuation or reversal plays out.

Avalanche, Why with Leverage? Exponential Moving AveragesOn the 10th of July AVAXUSDT finally managed to break above EMA55 and EMA89 on a very strong, full green candle. This is the day the market bias turns bullish and is fully confirmed. Bullish of course happens soon with the higher low, 22-June, but confirmation only comes after certain resistance levels are cleared, after the pair in question trades at a certain price.

Notice yesterday's candle, there was a rejection but prices remained above EMA89—blue dotted line on the chart. Today, we have a small candle with the same dynamics: A little lower then higher but still, above EMA89. The action is happening above 0.148 Fib.

These levels, EMA55, EMA89 and 0.148 Fib. extension all expose a strong support zone. As long as AVAXUSDT trades above them, we can expect maximum growth. That's why leverage is possible. With a well defined support range we can set the stop-loss right below and let the market take care of the rest.

Since both days failed to move prices lower, yesterday and today, and we know where the market is headed thanks to Bitcoin and the other altcoins that moved ahead, we can bet that Avalanche will grow and will do so strong. This is a safe bet.

Remember to do your own research and planning. Leveraged trading should be approached by experienced traders only. The same chart setup can be approached spot with minimum risk. Below 5X is also very low risk but higher is possible on this setup. Buy and hold, the market takes care of the rest. Great prices and entry timing.

Your support is appreciated.

Namaste.

Lingrid | AVAXUSDT Bullish Surge Potential After BreakoutBINANCE:AVAXUSDT is attempting a breakout from the long-standing downward trendline after rebounding from the 17.62 support area. Price is consolidating just beneath the descending resistance, hinting at an imminent breakout toward the 21.30 target level. If bulls maintain pressure above the breakout zone, this move could invalidate the previous bearish momentum and initiate a mid-term bullish reversal.

📈 Key Levels

Buy zone: 17.60–18.00 (above rebound base and trendline test)

Buy trigger: confirmed breakout above 18.50 with strong volume

Target: 21.30 intermediate resistance zone

Sell invalidation: break below 17.00 may reintroduce selling pressure

💡 Risks

Failed breakout may trap buyers and push price back below 17.60

Broader bearish structure still intact unless price clears 21.30

Thin momentum could result in choppy price action before breakout

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

AVAX Tightening Into Apex — Will This Breakout Stick?AVAX has been forming higher lows while capping out at diagonal resistance, tightening into a symmetrical triangle. Stochastic RSI is nearing the top, suggesting an explosive move could be near.

🟢 Scenario 1 – Bullish:

Breakout above the triangle + 50 EMA ($19.30) could push price toward $22–$24. Look for strong volume confirmation.

🔴 Scenario 2 – Bearish:

Failure to break out may lead to a rejection and revisit of major support around $15.50. Watch for loss of ascending structure as a warning sign.

This post is not financial advice.

AVAX - CLEAN W - Pattern BULLISHAVAX has formed a clean double-bottom pattern on the weekly chart, signalling potential reversal after an extended downtrend. Price is now holding above support and showing signs of early bullish structure, with a higher low forming and compression tightening.

Setup Thesis:

A breakout from this base structure could trigger a mid-term rally toward the $29–30 zone, which aligns with prior structure resistance. This setup targets continuation if buyers defend the current level and break the neckline convincingly.

Trade Plan:

Entry: Around $18.00–18.20

Stop Loss: Below $14.90 (beneath the recent low)

Target: $29.00–30.00

Structure: Double-bottom with early signs of trend reversal

Timeframe: Mid- to long-term swing (weekly confirmation needed)

Key Notes:

This is a higher-timeframe setup. Patience is key — let the candle close strong and look for follow-through. A break and hold above $21 would further validate the bullish shift.

Clean structure, defined invalidation, asymmetric reward.

TradeCityPro | AVAX Holds Key Support in Sideways Structure👋 Welcome to TradeCity Pro!

In this analysis, I want to review the AVAX coin for you. It’s another Layer1 and RWA project whose coin has a market cap of 7.48 billion dollars and ranks 16th on CoinMarketCap.

📅 Daily Timeframe

On the 1-day timeframe, as you can see, the price is sitting on a very important and strong support at the 16.46 zone, which I’ve marked as a range for you.

🔍 This range is where buyer makers are heavily present, and the price has touched it three times so far and has been supported each time. This shows the high strength of this zone.

✨ Currently, after being supported from this zone, the price has reached the 18.77 level and is fluctuating below this level. Volume is also gradually decreasing, and we have to see what happens next.

📊 If the volume keeps decreasing like this, the price will probably continue ranging between 16.46 and 18.77 until volume enters the market. But if strong buying or selling volume enters, the price can make a move and exit this range.

✔️ If buying volume enters and the price wants to move upward, we can enter a long position with a break of 18.77 and even buy in spot. A confirmation for this position could be the RSI breaking above the 50 level.

🛒 I personally consider this trigger suitable for a long position, but for spot I suggest waiting for a break of 25.78. More important than that is Bitcoin dominance, and in my opinion, as long as the long-term trend of Bitcoin dominance is bullish, buying altcoins is not logical and we have to wait until dominance changes trend.

📉 If the price wants to move downward and selling volume enters the market, the break of this same support range would be the best trigger. With a break of 16.46, we can enter a short position, and if you already bought this coin in spot, you can activate your stop-loss as well.

💥 A momentum confirmation for this position would be the RSI breaking below the 30 level and the oscillator entering the Oversell zone.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Avalanche 2025 All-Time High, Accumulation & Bullish ZonesI am using $495 as the next bullish cycle top. The 2025/26 bull market all-time high. It can be more but it can also be less. We can only guess at this point because the Cryptocurrency market is just so young that everything becomes possible. We err by being conservative.

Avalanche is trading within a long-term accumulation zone. The best possible prices, literally.

The purple-rounded bottoms on the chart denotes an excess.

This year, 2025, the accumulation zone was activated in February. The action then moved within this orange-zone in March and this is where everything is happening now.

If you wanted to put tens of millions of dollars into this project at the best possible prices pre-2025 bull market wave, then you would need to do it based on the long-term. Back in July-August-November 2024 and February, March, April, June and so on 2025.

If you were to buy too big too fast it would push prices up. So whales wait months in order to accumulate. After years of accumulation at low prices, they send the signal and the market can move. Once the market starts moving, the consolidation/accumulation period is over, there is no going back.

The "neutral zone" here is light blue. This is already bullish but not ultra-bullish because there is no continuation inside this zone. Only when Avalanche (AVAX) moves and stays above it we can get a new bull market cycle. Since it only happens every four years, like clockwork, there is no need to guess.

Pre-2021 we buy as much as we can and sell when prices are high up. Post 2021 bearish, SHORT, SHORT, SHORT. After 2022 comes the transition period, the long-term accumulation and consolidation phase. In 2025 is the next bull market, this is where we are at now.

So now we can buy as much as we can but only with the intention to sell when prices are up.

An investor does not sell, only buys forever more. But still, if you are an investor, you shouldn't buy when prices are high. The time is now to accumulate on everything.

A trader sells every few weeks, every few months. Each wave. Buy support (low) and sell resistance (high). Buy low (red) and sell high (green).

You need to know clearly if you are trading or investing. Getting things confused can result in loses. Getting this topic confused simply means lack of planning.

We are entering a major bullish cycle and wave. This is not the time to be a trader if you've never traded before. This is the time to invest, accumulate; buy and hold. Sell only when prices are astronomically high.

When the bullish cycle is over and if you find a pair trading at support, you can buy to sell again within weeks or months. But not now. Now, after you buy, you hold. Makes sense?

We are in this together.

I love you!

Your continued support is appreciated, truly.

Namaste.

AVAX/USDT – Bullish Channel Setup with Strong Risk/RewardAVAX is currently respecting a clear bullish channel on the 1H timeframe. Price just tapped the lower trendline and key Support Zone #1, forming a potential higher low setup.

If this trendline holds, I’m expecting a bounce targeting the 19.50–20.00 resistance zone — aligning with the top of the channel.

📌 Entry Zone: Around 17.50

🎯 Target: 19.50–20.00

🛑 Stop: Below 16.90

This setup offers a clean risk-to-reward and follows the broader channel structure. Watching for a confirmation bounce or bullish engulfing candle off support before entering.

💬 Let me know what you think — bullish continuation or deeper pullback incoming?

#AVAX #CryptoTrading #PriceAction #BullishChannel #TradingView #TA #Altcoins

Avalanche AVAX price analysis🔴 Do you think that the price of CRYPTOCAP:AVAX has bottomed out and is completing a "double bottom" pattern?

📉 Will there be another downward movement in the price of OKX:AVAXUSDT , for example to $14, followed by the long-awaited upward trend?

Either way, in both cases, there is every chance that the price of the #Avalanche token could reach $45 by the end of 2025.

P.S:

The price of #AvaxUSD is moving nicely along the established channels — take advantage of this and make a profit!

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more