AVAX | Full Analysis Here is the top-down analysis for AVAX as requested 🫡

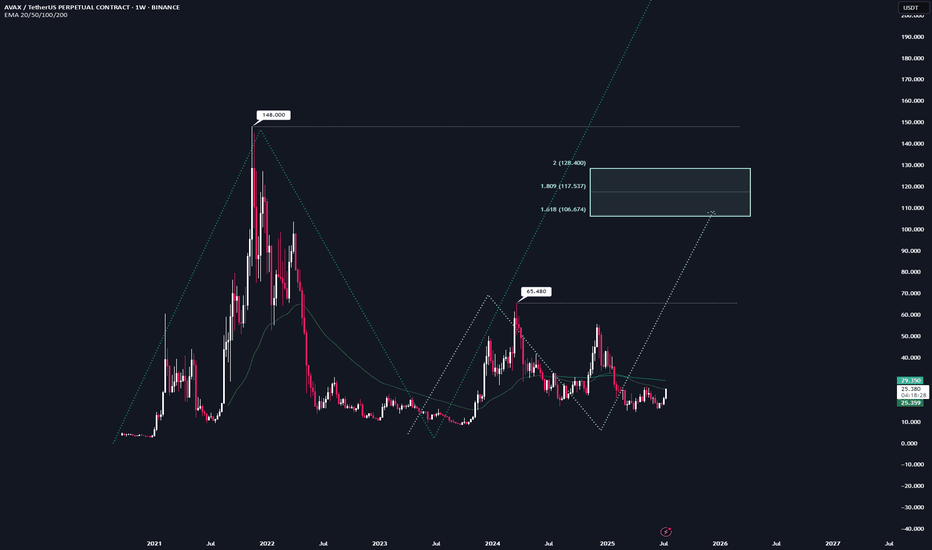

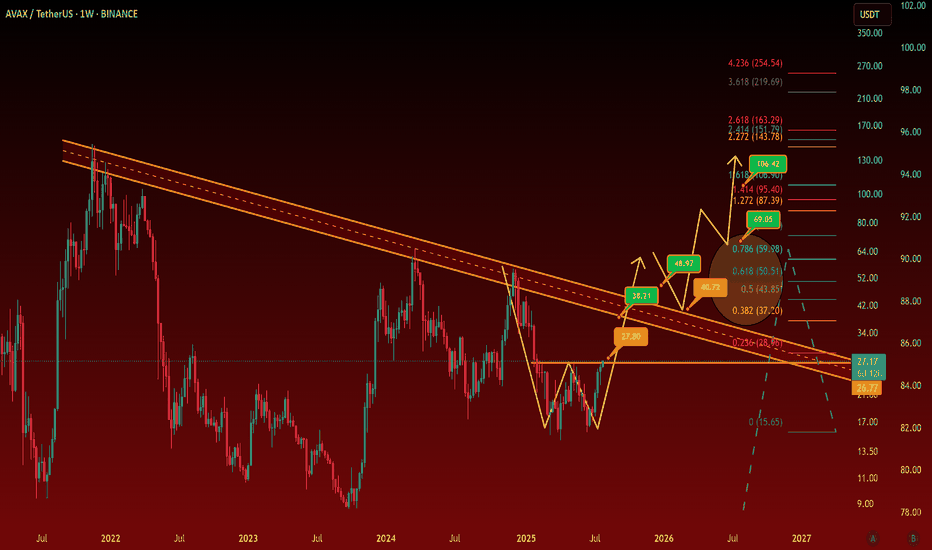

Weekly Timeframe:

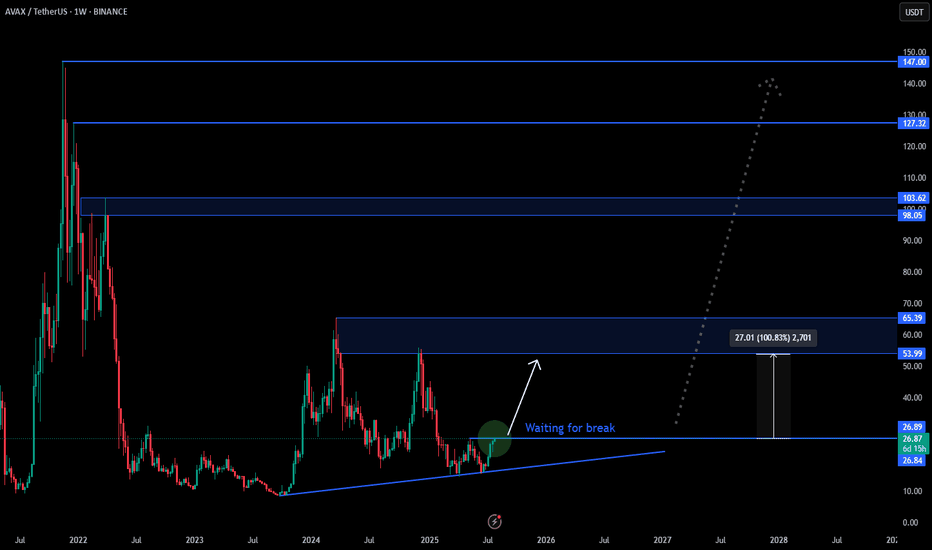

We currently have two potential bullish structures on the weekly chart, but neither has been activated yet.

The first one (light turquoise) will be activated once we break the local high at $65. Until then, there's no valid trade setup. This sequence has it target range at $106–128.

The second structure (turquoise) gets activated once we break the all-time high at $148. It then targets the $242–298 range, which also represents my conservative bull run targets for $AVAX.

On the weekly chart, the strategy is to HODL. I wouldn't buy at this point, and I definitely wouldn't sell—because if we see another altcoin season (which in my view is nearly guaranteed), there's no reason AVAX shouldn't reach its targets around $242.

I would personally start taking profits at $106, then again at $148, and be fully out at $242.

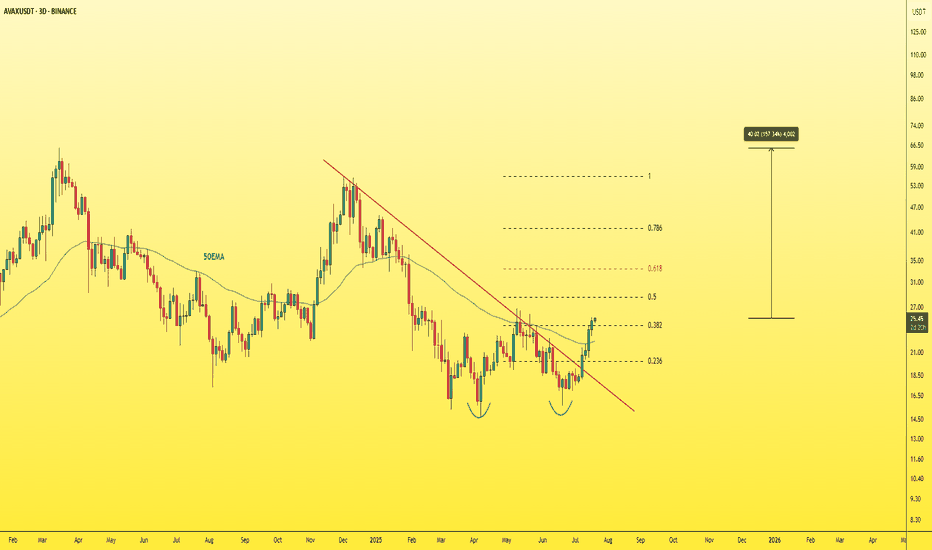

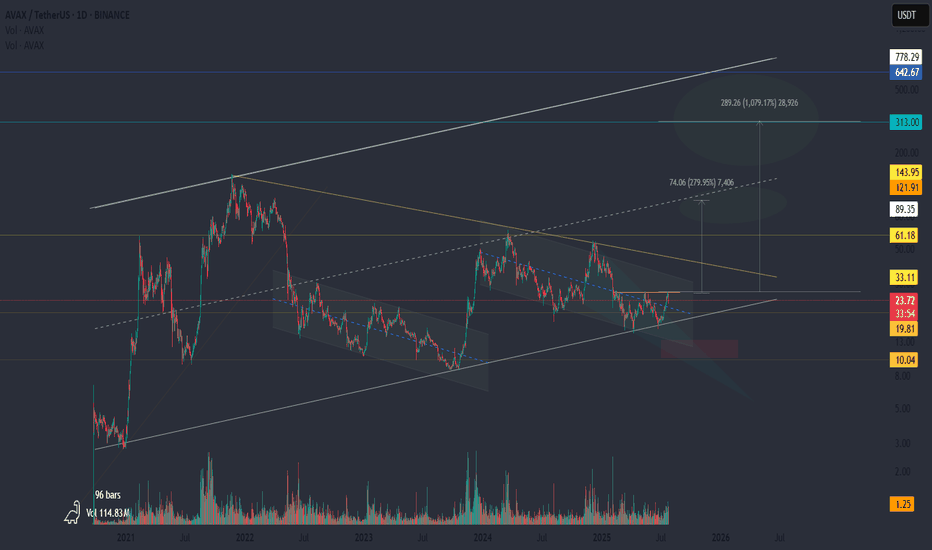

Daily chart:

Here we have a potential structure that will be activated once we break the recent high at $26.

From that point on, according to the rulebook, every pullback into the B–C correction level (Fib 0.5–0.667) becomes a tradable opportunity.

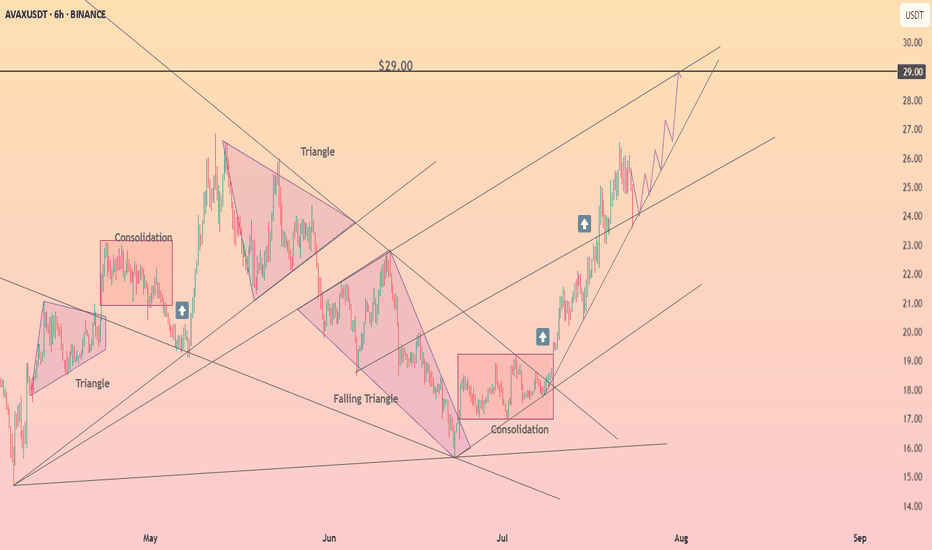

Local Priceaction:

Three days ago, we successfully broke through the bearish reversal zone (red) and reached the bullish target zone (turquoise).

Now, every pullback into the B–C correction area becomes a valid long entry. If the price turns around and reaches that area again, I’ll trade each level with a stop-loss just below the next key level.

--------

Thats the my full Analysis for CRYPTOCAP:AVAX , hope it was helpful if yall have anymore questions feel free to ask, and if you want me to do another analysis for any other pair just comment down below.

Thanks for reading❤️

AVAXUST trade ideas

AVAXUSDT - THE real treasure must be hunted!Let's not forget about CRYPTOCAP:AVAX — it's one of the must-have assets in any crypto portfolio.

Currently trading at a discounted price after dropping from its previous top at $55, AVAX now shows strong bullish potential with plenty of upside ahead.

🚀 Key bullish signs:

-Successfully broke through multiple resistance levels, including the 0.382 Fibonacci retracement, 50 EMA, and the main descending trendline.

-A daily close above the 26$ level is a very positive signal.

With a solid project, reliable fundamentals, and low risk compared to potential reward, this could be a highly profitable opportunity.

Don’t sleep on it.🎯

AVAX Long Swing Setup – Waiting for Support RetestAVAX has been rallying for two straight weeks, showing strong momentum. We’re watching for a healthy pullback into the $22.50–$24.00 support zone to position for continuation. If this zone holds, the risk/reward setup favors bulls with clear upside targets.

📌 Trade Setup:

• Entry Zone: $22.50 – $24.00

• Take Profit Targets:

o 🥇 $27 – $29

o 🥈 $33 – $35

o 🥉 $40 – $44

• Stop Loss: Daily close below $20.50

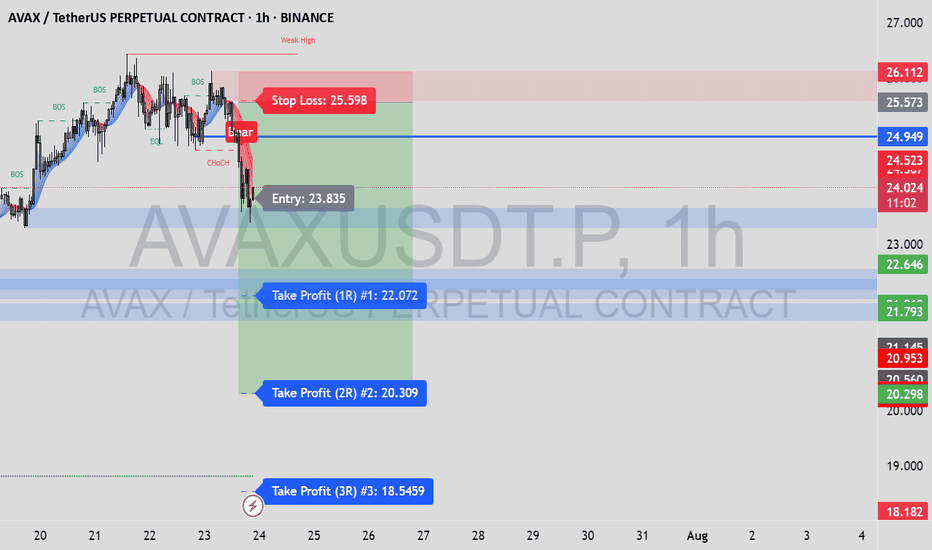

AVAXUSDT.P – High-Risk/Reward Short Setup | Smart Money Play (1H📉 AVAXUSDT.P – High-Risk/Reward Short Setup | Smart Money Play (1H)

🔍 Trade Type: Short

🕐 Timeframe: 1-Hour (1H)

📊 Entry Trigger: Change of Character (CHoCH) after Equal Highs

🎯 Target: 20.298

🛑 Stop Loss: 25.573

💰 Risk/Reward Ratio: 9.79

📌 Trade Breakdown:

This AVAX short was taken based on Smart Money Concepts, using a combination of liquidity structures and market psychology:

✅ Key Confluences:

Equal Highs (EQL) formed above internal structure – clear inducement/liquidity pool.

CHoCH confirmed as price broke below a major internal low → bearish intent confirmed.

Retracement into Bearish Order Block in the Premium Zone offered an optimal entry.

Strong follow-through from institutional selling after liquidity grab.

🧠 Why I Took This Trade:

This setup offered a clean narrative:

Liquidity above = taken

Internal structure = broken

OB in premium = respected

Imbalance/fair value gap below = price magnet

This alignment made it a high-confluence short with an excellent R:R ratio.

🎯 Target Zone (20.298–20.953):

This area contains unmitigated demand and prior support. I anticipate price to:

Tap into this zone to rebalance price inefficiency

Potentially react from there (watch for reversal setups)

⚠️ What I'm Watching:

Possible reaction around 21.793 support – consider partial profits

Maintain awareness of higher timeframe trend (H4/D1)

Volume shift or bullish CHoCH may signal exit before TP

Will AVAX (Avalanche) reach $100?Avalanche (AVAX) has been steadily growing across various sectors for quite some time.

We are also witnessing the silent rise of Avalanche's DeFi ecosystem, which continues to expand quietly yet steadily.

If the daily candle closes above this resistance level, we could start moving toward higher targets.

Don’t forget that breaking the long-term trendline is a crucial event — and with Bitcoin dominance on the decline, it might finally be AVAX’s time to shine.

Let’s also not forget that AVAX ETFs are on the way.

Avalanche (AVAX): Waiting For Proper Breakout | 3 Step BreakAvalanche is slowly gaining some kind of bullish volume, where we are expecting to see smaller upward movement.

On bigger timeframes we are sitting just at the major neckline area so this is why we also considered the current zone to be a good bounce area, so let's wait for a proper breakout now.

Swallow Academy

Avalanche · Early or Late? · Targets & TALook at AVAX. It traded at $18 for 21 days, three weeks, and now its price is already at $27, 50% higher. That's how it all changes in a matter of days. In just 19 days Avalanche is trading much higher and soon you won't be able to get a buy below $50. $18 will seen like an old dream. Gone so long ago but it was available just recently. The same will happen with the current price.

Avalanche is still cheap below $30. The all-time high is $147. We can easily aim for $100 just to see how things will go. We know this level can hit easily so buying below $30 should be an easy decision and choice. That is if you like this pair.

This is another strong project, another bullish chart but always focused on the long-term. If you are looking at it very close, we can have days red but nothing changes. This will not change the bigger path that is being travelled to a new all-time high. So only leveraged traders should be careful when opening a new LONG position because the market can shake the next day. If you trade spot, buy and hold; buy and accumulate with no worries necessary because it is still early.

You can do great in this bull market; we can all do great. More opportunities will continue to develop and the market will continue to heat up.

The next major target for this project mid-term is $64, followed by $96 and then the ATH.

Once we enter the price discovery phase, new all-time high territory, anything goes. The action can continue rising and hit levels hard to imagine, for months, or it can stop just after a few weeks. It all depends on how much money into the market flows.

Namaste.

AVAX: A Quiet Rocket?This might be the calm before the cycle.

📍 All the liquidity is above.

Levels like 33 and 61 aren’t just resistance — they’re fuel. Clusters of short liquidations and forgotten limit orders are sitting right there. If we get a breakout, it could be sharp. And if there’s another pullback? Don’t panic. That would be the test — the shakeout before the move.

🚀 If the cycle kicks in, AVAX could be one of the silent leaders.

While the crowd is focused elsewhere, AVAX has been building quietly: structure, accumulation, time. The kind of setup that doesn’t scream hype, but whispers opportunity.

AVAXUSDT Double Bottom Confirmation.AVAX has formed a textbook double bottom pattern on the daily chart, signaling a potential reversal after months of downtrend. The neckline around the $27 zone has been broken decisively, confirming the bullish breakout.

Key Points:

- Double Bottom Structure: A strong bullish reversal pattern with a clean neckline breakout.

- Breakout Level: $27, which was acting as resistance for the past several weeks.

- Volume Surge: Noticeable increase in volume during the breakout, adding strength to the move.

- Target: $48–$50 region. ( Channel resistance)

-Stop-Loss Idea: Below $22.0

AVAX appears ready to trend higher as momentum builds. If bulls hold above the breakout zone, the rally may accelerate in the coming weeks.

Cheers

Hexa

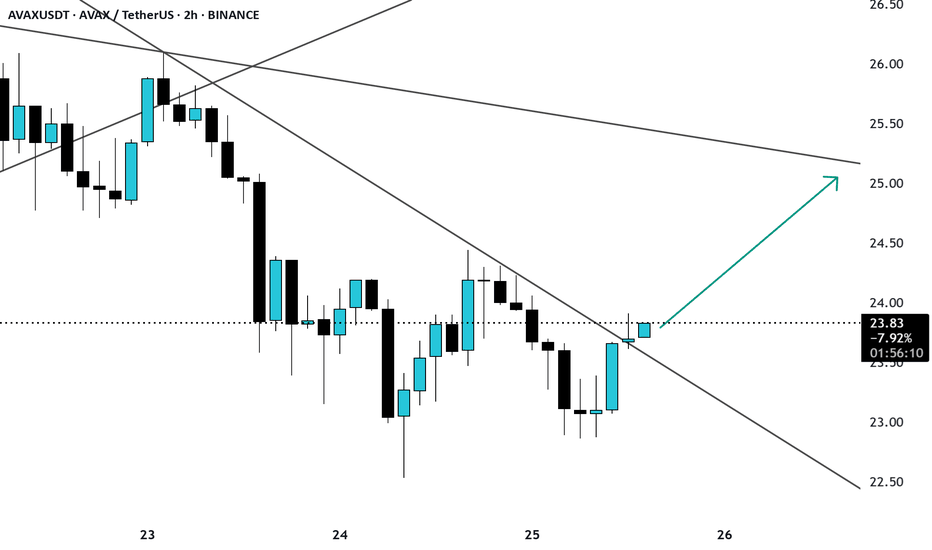

Lingrid | AVAXUSDT Corrective Move In The MarketThe price perfectly fulfilled my previous idea . BINANCE:AVAXUSDT retraced sharply from the 27.34 resistance zone after making a higher high but found support above the descending trendline. The recent corrective move has paused at a key structure level near 24.96, hinting at potential bullish continuation. A breakout above this local resistance could trigger a rally toward the 26.50–27.34 target zone. Momentum builds as long as price remains above the trendline and higher low structure.

📈 Key Levels

Buy zone: 24.80 – 25.30

Buy trigger: Break and hold above 25.30

Target: 26.50

Invalidation: Close below 24.00

💡 Risks

Downward trendline still active and could act as resistance

Potential for bearish fakeout before breakout

Failure to reclaim 25.30 quickly weakens bullish scenario

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

#Avalanche (AVAX) Setup | Can Subnets Ride the ETF Wave?📌 Coin: AVAX (Avalanche)

💰 Buy Levels:

✅ First Entry: $25.00

✅ Second Entry: $22.00

✅ Third Entry: $19.00

🛑 Panic / SL Level: Weekly close below $17.00

🧠 Fundamental Analysis (FA) – In Short

*️⃣ Sector: Layer 1 / Modular Smart Contract Platform

*️⃣ Use Case: Avalanche is a high-performance blockchain enabling scalable, low-latency dApps, tokenized assets, and Web3 games through custom subnets.

*️⃣ Tech: Uses Avalanche consensus across three chains (X/P/C), delivering near-instant finality, sub-second transaction speed, and flexible design.

*️⃣ Narrative Fit: Strong narrative alignment with RWA (Real World Assets), Web3 Gaming, and future ETF inclusion due to institutional activity.

*️⃣ Enterprise Adoption: Already used by JPMorgan pilot programs, Citi, Deloitte, MasterCard, and more — making it one of the few real-world-tested chains.

*️⃣ Unique Angle: Subnets allow permissioned chains, native gas tokens, and fully custom blockchains — ideal for both DeFi and enterprise.

📊 Tokenomics & Market Data

(As of July 2025)

🪙 Current Price: ~$23.30

🧾 Market Cap: ~$9B

🔢 Rank: Top 15

🧮 Circulating Supply: ~395M AVAX

🔒 Max Supply: 720M AVAX

🔥 Deflationary Mechanism: AVAX burn from fees, reducing long-term supply

🛠️ Validator Rewards: Distributed through staking + subnet usage

🎯 Bull Market Target (Realistic)

Target Range: $48 – $65

*️⃣ Based on prior cycle resistance, subnet growth, and DeFi/gaming recovery.

🚀 Mega Bullish Target (Speculative Top)

Target Range: $95 – $135+ $200

*️⃣ Avalanche is at the front of RWA tokenization, already powering platforms like Intain, and involved in enterprise pilots with Citi, JPMorgan, and Mastercard.

*️⃣ If RWA becomes the core crypto narrative, Avalanche’s modular subnet design could drive institutional adoption at scale.

*️⃣ While not yet in ETFs, its technical credibility + enterprise presence makes it a top candidate for future L1 ETF exposure or crypto asset baskets.

*️⃣ Combine institutional flow + Web3 gaming + subnet scaling, and you get a realistic path to triple-digit price discovery.

✅ Final Take

🧠 Avalanche is a technically mature Layer 1 with real-world traction and modular scaling via subnets — giving it strong utility and upside.

we ask Allah reconcile and repay

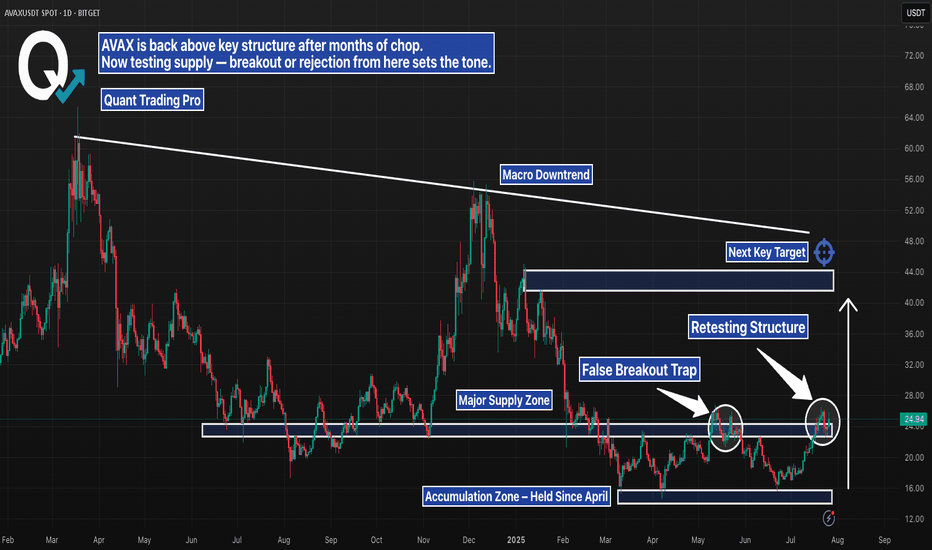

AVAX Daily – Breakout or Another Trap?AVAX just pushed into a major supply zone, testing structure that’s capped price since early 2024. After months of chop and accumulation, bulls have finally reclaimed key support — but the real test is happening now.

Here’s the setup:

– Retesting structure after first rejection

– Sitting below a clear macro downtrend line

– Above an accumulation zone that held for months

– Next key target sits near $40–44, with confluence from prior highs and trendline resistance

This is the kind of move that either builds serious momentum — or turns into another trap. Wait for confirmation. Volume and reaction here will say everything.

#AVAX #Altcoins #CryptoBreakout #SupplyZone #TrendlineResistance #TechnicalAnalysis #QuantTradingPro #PriceAction

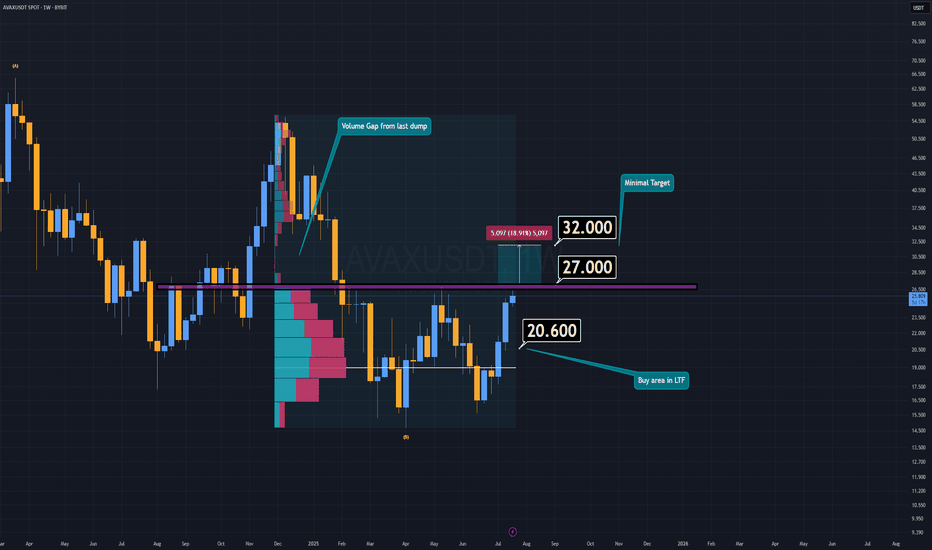

AVAX Analysis (1W)AVAX is currently attempting to form a double bottom pattern, which could signal a strong bullish reversal if confirmed. Earlier this week, AVAX made an effort to break down the key support/resistance zone, but it lacked the necessary volume to succeed.

If AVAX manages to reclaim the resistance area around $27 or higher, and confirms the breakout with a daily candle retest, the minimum target sits at $32.

However, if AVAX fails to break through resistance, there’s potentially an even better buying opportunity in the lower timeframes—a demand zone between $20 and $20.6.

I believe altcoins will offer another chance to catch up while prices are still far below their future valuations.

-S Wishes you the best in luck.

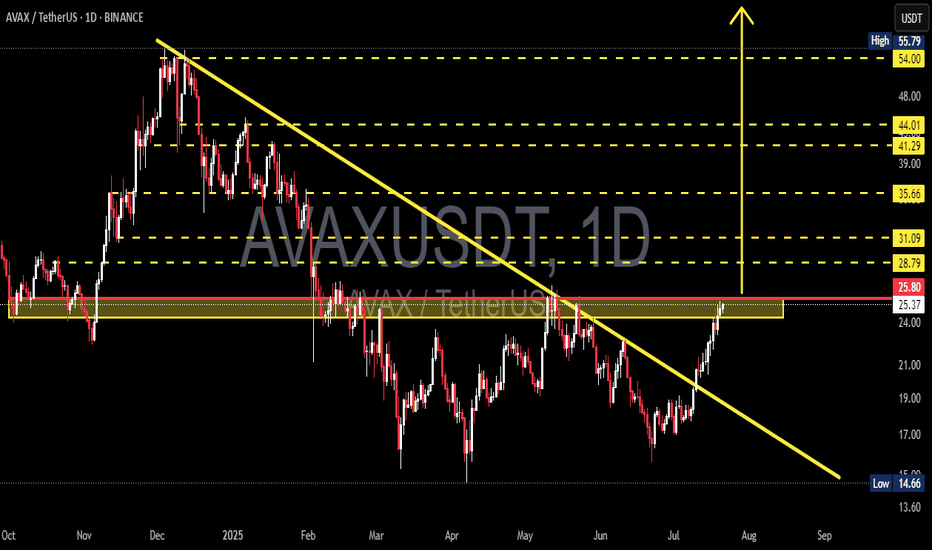

AVAX/USDT Massive Trend Reversal: Breakout from 8-Month DowntrenAVAX has just delivered one of its most technically significant moves in recent months. After spending over 8 months trapped under a descending resistance line, price action has finally broken free — suggesting a potential trend reversal and the beginning of a much larger bullish phase.

🧠 Pattern & Structure Breakdown:

📌 Descending Trendline Breakout

AVAX had been forming a descending triangle pattern, characterized by consistent lower highs and a horizontal support zone between $14.66 – $22. The recent bullish breakout from this structure, accompanied by strong volume, is a highly encouraging sign for bulls.

📌 Accumulation Zone Identified

The yellow zone on the chart ($14.66 – $22) has proven to be a strong demand zone where buyers consistently stepped in. The recent rally originates from this base, indicating possible institutional accumulation.

📌 Critical Horizontal Resistance at $25.80

Price is now testing the $25.80 resistance zone, which historically acted as a supply area. A successful daily close and confirmation above this level would officially flip the structure bullish.

📈 Bullish Scenario – Multi-Level Upside Targets:

If AVAX confirms the breakout above $25.80, these are the key bullish targets ahead:

🎯 Target 1: $28.79 – minor resistance & potential short-term TP zone

🎯 Target 2: $31.09 – previous price equilibrium

🎯 Target 3: $35.66 – key pivot from past market structure

🎯 Target 4: $41.29 and $44.01 – heavy historical supply zones

🎯 Target 5 (measured move): $54.00 to $55.79 – the projected breakout target from the descending triangle pattern

This move would represent a full technical recovery if AVAX aligns with broader market sentiment and Bitcoin remains stable or bullish.

📉 Bearish Scenario – Pullback Risks:

On the flip side, if price fails to sustain above $25.80 and gets rejected:

⚠️ A retest of $24.00 – $22.00 is likely

⚠️ If that zone breaks down, next support lies at $19.00 – $17.00

⚠️ A loss of the $17 level may trigger a return to the critical low near $14.66

This would invalidate the bullish breakout and return AVAX into a sideways or downward consolidation phase.

🔍 Additional Technical Insights:

✅ Volume is steadily increasing — showing renewed buying pressure

✅ Indicators like RSI and MACD (if applied) are likely showing bullish divergence

✅ Overall altcoin sentiment is improving, providing a tailwind for AVAX's potential breakout continuation

🧩 Final Thoughts:

AVAX is at a pivotal moment in its medium-term price structure. The breakout above the long-term downtrend line is a strong technical shift. A confirmed breakout and hold above $25.80 could trigger a multi-week or multi-month rally targeting $40 – $55+.

However, traders should be cautious of possible pullbacks and manage risk accordingly — especially as resistance zones from previous structures are being tested.

#AVAX #AVAXUSDT #CryptoBreakout #TechnicalAnalysis #Altcoins #BullishCrypto #DescendingTriangle #ReversalPattern #AVAXAnalysis

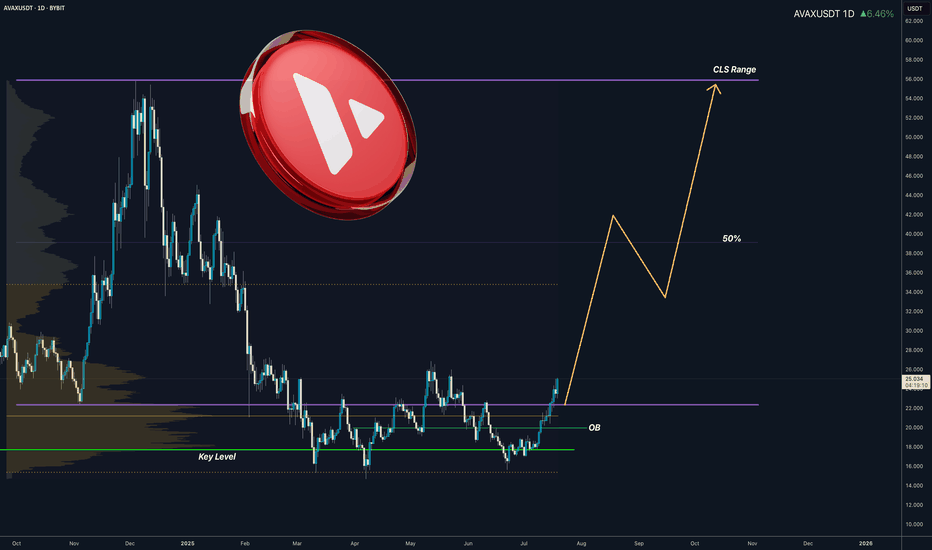

AVAX I 3M CLS Range I Model 1 I 50% partial full range potentialYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Comment any Coin I ll give you my quick view

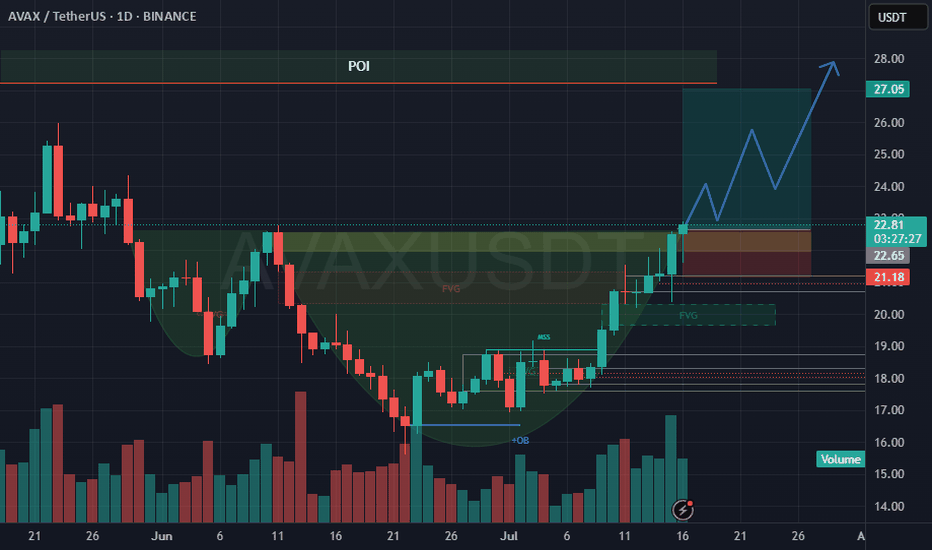

LONG ON $AVAXThe AVAX/USDT chart presents a bullish continuation setup supported by a completed cup formation, bullish market structure shift (MSS) and fair value gap (FVG) fills. With rising volume on the right side of the cup and a clean break above recent resistance, the market shows clear signs of institutional interest and buyer strength. The price is approaching a Point of Interest (POI) near $27, which is likely to serve as a target zone or temporary supply barrier.

A long trade setup is valid between $21.50 and $22.60 which aligns with the retest of the FVG zone, previous structure breakout and early handle development. Stop loss should be placed at $20.9, protecting the setup from invalidation while maintaining a strong risk-reward profile. Target levels include $24.50 (TP1) for an early exit, $26.80 (TP2) near the POI base and $27.05\$27.20 (TP3) at the top of the expected move. R:R range from 2:1 up to 5:1 depending on point of entry.

To execute, traders should watch for bullish confirmation on lower timeframes (1H–4H) within the entry zone, such as a bullish engulfing candle, BOS or a volume-backed rejection. A scaling entry strategy can improve average price and partial profit-taking at key levels ensures the position remains protected as the trade unfolds. Overall, the structure, volume, and Smart Money signals support a high-probability long from the $21.50\$22.60 range toward the $27 POI.

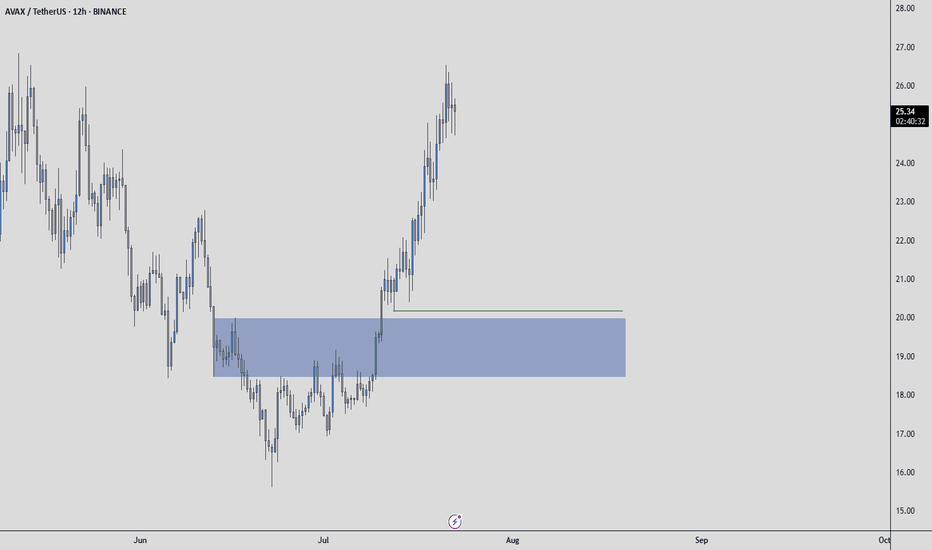

AVAXUSDT: Mid-Term AnalysisThe blue box under liquidity may do the job.

📍 Plan

If price drops into the blue box:

✅ Watch for footprint absorption (buyers stepping in)

✅ Look for CDV support or bullish divergence

✅ Confirm with a structure reclaim before entry

⚡ Reminder

No chasing. No forcing trades.

If the setup aligns, I’ll take it with clear risk.

If not, I’ll wait.

The right price, or no trade.

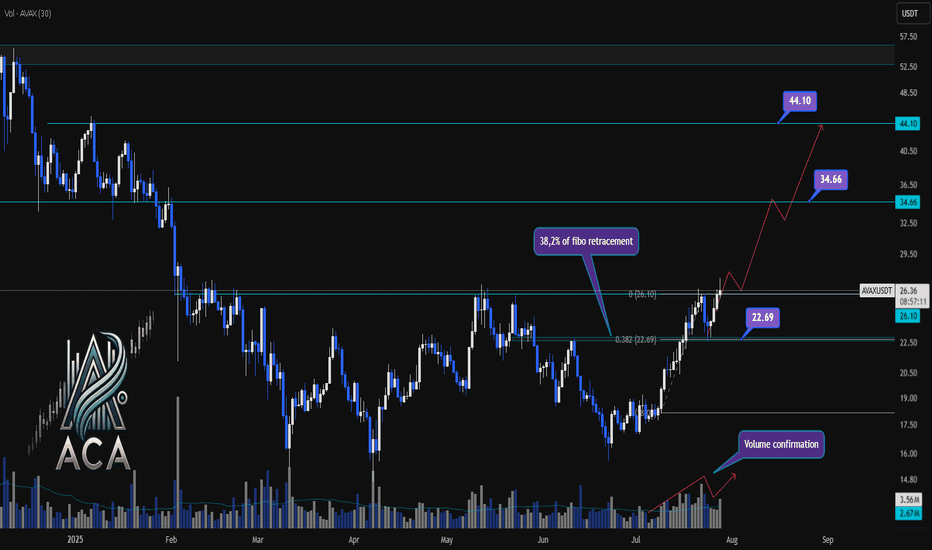

AVAXUSDT Trend Analysis | Will Volume Confirm the Next Big Move?AVAXUSDT Trend Analysis | Will Volume Confirm the Next Big Move?

🔍 Let’s break down the AVAX/USDT setup, examining its technical structure and mapping out key opportunities as it gears up for a decisive move.

⏳ Daily Overview

AVAXUSDT has been exhibiting a bullish structure, recently reacting to the 0.382 Fibonacci retracement level (around 22.69USDT) where price paused for a correction. This correction was technically healthy, as it occurred with declining volume, while upward impulses were marked by notable volume surges—signaling strong bullish participation and confirming accumulation phases.

🔺 Bullish Scenario:

The next area to watch is the resistance at 26.10USDT, which has acted as a major barrier in recent trading sessions. A decisive daily close above this level—preferably supported by a clear uptick in volume—would confirm breakout momentum and set the stage for further advances.

Upon confirmation, the chart points to medium- and long-term targets at 34.66USDT and eventually 44.10USDT. These levels are derived from key Fibonacci extensions and historic price reactions, offering logical take-profit zones for trend-following strategies.

📊 Key Highlights:

- 0.382 Fibonacci level (22.69USDT) acted as a reaction zone and healthy correction point.

- Volume profile validates trend: increased buying volume during upswings, decreased volume on dips.

- 26.10USDT is the next crucial resistance for confirmation.

- Breakout (with volume) opens path to 34.66USDT and 44.10USDT targets.

- Failure to clear 26.10USDT could result in consolidation or another retest lower.

🚨 Conclusion:

All eyes are on the 26.10USDT resistance. Wait for a clear daily close and volume confirmation before considering entries. A breakout above this level could propel AVAXUSDT towards higher Fibonacci targets, while a rejection may prompt another retest of prior supports or consolidation.

Stay sharp and plan your trades with discipline!