AXLUSDT Forming Bullish ReversalAXLUSDT is showing clear signs of a bullish reversal pattern on the daily timeframe, indicating a potential shift in market sentiment from bearish to bullish. This pattern is typically characterized by a slowing of downward momentum followed by a breakout to the upside, and AXL is currently forming higher lows—often the early signal of a trend reversal. The current price action suggests accumulation, and with increasing volume behind the recent moves, we may be on the verge of a significant breakout.

This technical setup is further strengthened by improved market structure and growing interest from traders and investors alike. The volume profile shows increasing participation at current levels, a strong indication that smart money could be stepping in. With bullish momentum building and the price reclaiming key support zones, the technical target points toward a 90% to 100% upside potential in the coming weeks.

AXL has been under the radar, but that may not last much longer. The project fundamentals are solid, and with market participants beginning to recognize the recovery potential, a trend shift seems imminent. As more traders start to identify this bullish reversal, we could see a rapid increase in price, especially if it breaks above resistance with strength.

Traders should keep a close eye on volume confirmation and price behavior around key levels to catch the breakout early. If momentum continues to build and resistance is flipped into support, AXLUSDT could deliver one of the stronger moves in the mid-cap altcoin space this quarter.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

AXLUSDT trade ideas

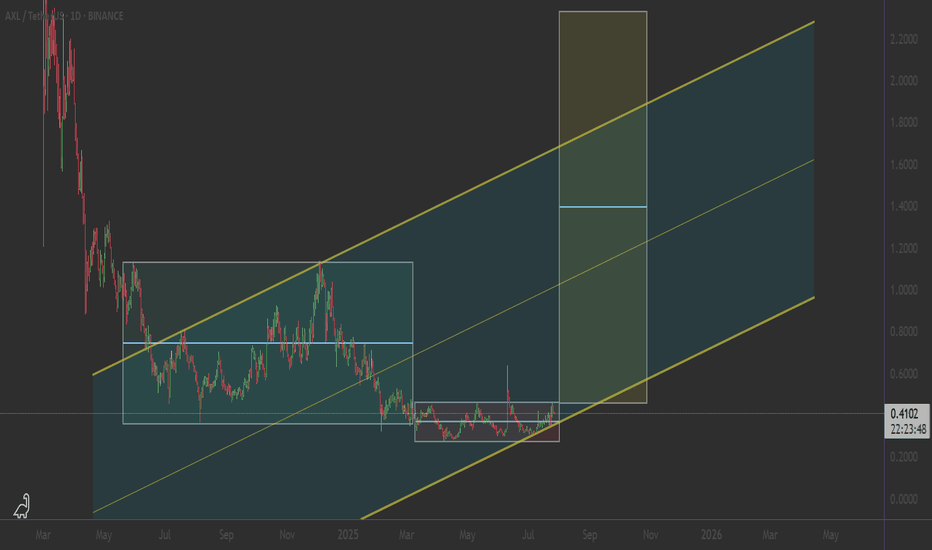

AXL : THE GENERATIONAL WEALTH CREATOR .. coming⚠️ RISK LEVELS (Know Your Exits)

🛡️ Support 1: $0.35 - Triangle support

🔴 ABORT: $0.25 - Major structure break

⚠️ MAX RISK: Never more than 5% of portfolio

⏰ TIMING IS EVERYTHING: THE COUNTDOWN BEGINS

PRICE TARGETS THAT WILL CHANGE LIVES

🚀 CONSERVATIVE TARGETS (High Probability)

🎯 Target 1: $0.80 (+95%) - First major resistance

🎯 Target 2: $1.20 (+192%) - Psychological barrier

🎯 Target 3: $1.60 (+290%) - Triangle height projection

_____________________________

Strategy: Buy and hold through breakout

Entry: $0.30 - $0.35

Stop Loss: $0.25 (Below all major support)

Target: $1.60 - $2.50 (290-500% gain)

Position Size: 3-5% of portfolio

Time Horizon: 2 - 5 months

Risk/Reward: 1:15 to 3:20

⚠️ This is not financial advice. Cryptocurrency investments carry high risk. Only invest what you can afford to lose completely. Always do your own research ⚠️

Altcoins Market Bull Market Confirmed, AxelarThis is the same chart as Ravencoin; These are the same price dynamics and awesomely, the same results.

Good morning my fellow Cryptocurrency trader, this is a wonderful day because the altcoins market bull market is already confirmed, let me show you some more proof.

I used first Ravencoin as an early signal showing that the 2025 bull market is here, strong long-term growth; a bullish continuation, a new advance, higher prices next. The biggest bullish wave and bullish action since 2021 for the entire Cryptocurrency market.

Here is the pattern again explained:

1) There is a rise in late 2024, it lasted only one month from November through December. This coming off the August 2024 market bottom, when Bitcoin produced a flush.

2) The December 2024 high leads to a strong correction. This correction has three stop points. 3-Feb. mid-March and 7-April. 7-April marks the bottom for most pairs with the usual variations.

3) An initial recovery from the 7-April 2025 low leads to some growth. Some pairs grew 100-300% while others grew 30-60%.

4) This recovery gets corrected and ends in a higher low.

5) This higher low signal the start of the next advance, very strong bullish action. This is what you see on the chart.

Axelar (AXLUSDT) produced a very strong bullish breakout, we have more than 90% green on a single day. This is only the beginning, and many altcoins will be doing the same. Literally hundreds of altcoins will perform like this in the coming days.

The bull market is here and already confirmed.

It is still early, choose wisely.

Some will move now while others will continue lower.

Some will move but it will take months before they turn green.

Take your time looking at the charts and making your choice, choosing correctly means everything. It means the difference of winning daily and big vs staying holding something doesn't that doesn't grow.

If you agree make sure to follow.

If you have any questions, your comments are welcomed below.

Thanks a lot for your continued support.

Namaste.

AXLUSDT Forming Descending Wedge bullishAXLUSDT is currently showing strong bullish signals after consolidating at a significant support level, with a notable uptick in trading volume. This renewed volume interest often precedes a breakout move, and the technical structure is shaping up for a potential surge. With momentum building and price action tightening, a projected gain of 60% to 70% is realistically within reach in the short to mid-term. This aligns well with historical price behavior and upcoming support-to-resistance flips.

Axelar (AXL) continues to attract investor interest due to its foundational role in cross-chain communication and interoperability. As more blockchains develop in silos, the need for protocols like Axelar grows. Its ability to facilitate seamless transfers across multiple chains makes it a strong contender in the next wave of infrastructure-focused crypto projects. Market participants are increasingly positioning themselves in utility-driven tokens like AXL that solve real scalability and connectivity problems in DeFi and the broader crypto ecosystem.

From a technical perspective, AXLUSDT is forming a bullish continuation pattern, suggesting that the recent consolidation is simply a pause before another impulsive leg to the upside. The presence of strong support zones, combined with increased volume and investor sentiment, makes this a high-probability setup for breakout traders and swing investors alike. If bullish momentum continues, the upside targets fall well within the 60% to 70% projected gain range.

Traders should keep a close watch on breakout confirmation signals and volume spikes, which could mark the start of a sustained bullish rally. As adoption and attention around cross-chain solutions grow, AXL is likely to see further market traction and price appreciation.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

AXL/USDT – Falling Wedge Breakout! Time to Ride the Wave!!🚀 AXL Breakout Alert – 100% Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

AXL has broken out of its long-term falling wedge pattern on the daily timeframe—this is a strong reversal signal and could set the stage for a big move ahead! 🔥

🟢 Entry Zone:

CMP (Current Market Price)

Add more up to: $0.38

🎯 Targets:

🎯 TP1: $0.515

🎯 TP2: $0.634

🎯 TP3: $0.751

🎯 TP4: $1.007+

🛡️ Stop Loss: $0.325 (below wedge support)

💡 Insight:

This breakout is aligning with the overall bullish momentum we're seeing in the altcoin market. Watch for a healthy retest of the breakout zone to confirm strength. 🚀

📊 Risk Management Tip: Start taking partial profits at each target and trail your SL to lock in gains.

Let’s ride this breakout smartly! 🔥

AXLUSDT UPDATE

AXL/USDT Technical Setup

Pattern: Falling Wedge Breakout

Current Price: \$0.3837

Target Price: \$0.73

Target % Gain: 95.47%

Technical Analysis: AXL has broken out of a falling wedge on the 2D chart with a strong bullish candle and 11.48% daily gain. Volume is rising, confirming the breakout with clear upside potential toward \$0.73.

Time Frame: 2D

Risk Management Tip: Always use proper risk management.

#AXL/USDT#AXL

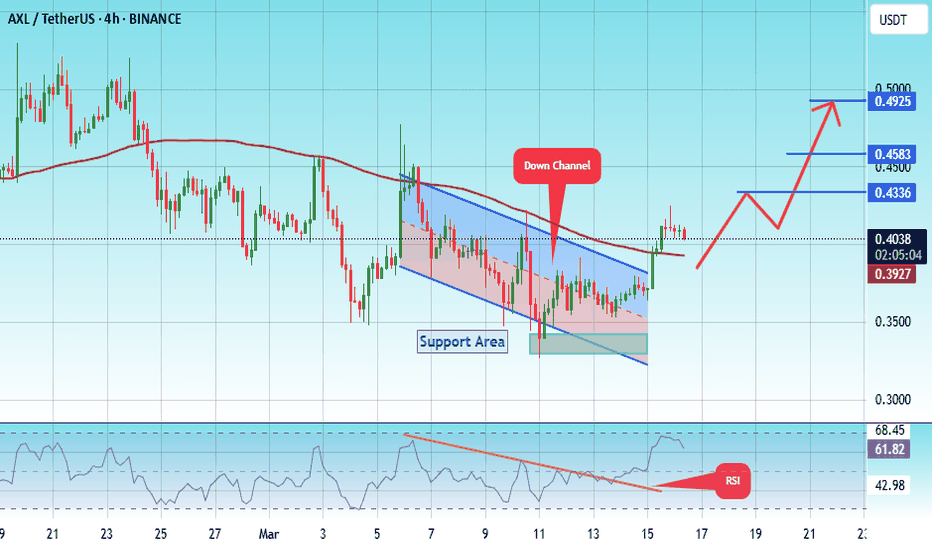

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.3360.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.4040

First target: 0.4336

Second target: 0.4580

Third target: 0.4925

#XAL/USDT #XAL

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.6090

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.6380

First target 0.6786

Second target 0.7225

Third target 0.7640

#AXL/USDT#AXL

The price is moving within a bearish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in green at 0.5000

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum, upon which the price is based higher at the discount

Entry price is 0.5720

The first target is 0.7670

The second target is 0.9000

The third goal is 1.05

AXL/USDTKey Level Zone : 0.7420 - 0.7470

HMT v4.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

AXL/USDT: MAJOR ASCENDING CHANNEL - 85% PROFIT POTENTIAL SETUPTechnical Analysis: 🎯

- Trading within a strong ascending channel since August 2024

- Current price: 0.7145 USDT

- Price retesting major channel support - prime entry zone

Entry Strategy:

✅ Strategic Entry: 0.7007 USDT

- Perfect channel support confluence

- Higher lows pattern maintained

- Volume profile showing accumulation signs

Target Projection:

🎯 Primary Target: 1.3114 USDT (87% ROI potential)

- Channel resistance alignment

- Historical resistance zone

- Clear upward trajectory within channel

Risk Management (CRITICAL):

⚠️ Stop Loss: -4% below entry

- Protected by channel support

- Clear invalidation level

- Impressive 1:21.75 Risk-Reward ratio

Key Technical Factors:

- Ascending channel providing clear direction

- Multiple touches validating channel strength

- Price action showing healthy pullback to support

- Volume confirming key reversals at support

Trading Plan:

1. Enter at 0.7007 USDT

2. Stop loss at -4% for capital protection

3. Partial profits recommended at channel midpoint

4. Final target at upper channel resistance

⚠️ Important Notes:

- Channel trades require patience

- Watch for bullish confirmation at entry

- Volume confirmation crucial

- Always use proper position sizing

🔔 Remember:

- DYOR (Do Your Own Research)

- Risk management is crucial

- Market conditions can change

- Follow your trading plan strictly

#TechnicalAnalysis #AXL #Crypto #SpotTrading #ChannelTrading #CryptoTrading

Would you like me to provide alternative title options or elaborate on any aspect of this analysis? 🚨

TradeCityPro | AXL : Steady Uptrend & Potential Breakout Ahead👋 Welcome to TradeCityPro!

In this analysis, I will review AXL, the token of the Axelar project, which serves as a Crosschain platform and also features a blockchain explorer.

📅 Daily Timeframe: Uptrend and SMA Slope Change

On the daily timeframe, we observe a steady and gradual uptrend with a low slope. A clear ascending trendline is also visible, which has been tested by the price four times so far.

📈 The token has broken out of its box’s ceiling at 0.8318, but it hasn’t started its main bullish movement yet. A pullback to this level has occurred, and if 1.1281 is broken, the price could initiate its primary upward wave.

👀 Apart from the 1.1281 resistance, there is another significant resistance at 1.2781, located near this zone. Thus, the range between 1.1281 and 1.2781 forms a strong resistance zone, and breaking above this area could mark the start of the uptrend.

🧩 Given the upward slope of the SMA99, I believe we will soon see its influence, pushing the price higher.

🚀 If this zone is broken, the next targets are 1.6587 and 2.2828, with the second target being close to the ATH.

📉 Correction Scenario

In the event of a correction, the first key area is 0.8318, which has already been tested once and held firm. For deeper corrections, the initial zone to watch is the ascending trendline, and if the trendline breaks, 0.6386 becomes the next notable support.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

AXL prepares for key level breakoutAXL is a unique project to connect multiple networks. Now its price is quite attractive! There was a consolidation above the 50 EMA, the price continues to move to the level of 1.0872$, which is the key level. If this level is broken, we will see an incredible growth. My target at the 4$+ MACD area also signals the strength of the bullish trend!

Horban Brothers.

$AXL/USDT : Potential 5x growth

BINANCE:AXLUSDT

AXL is the native token of the Axelar network. The protocol also supports the cross-chain transfer of several native tokens via their wrapped ERC-20 versions, including AVAX (Avalanche), ETH (Ethereum), FTM (Fantom), GLMR (Moonbeam), and MATIC (Polygon).

Meanwhile, Axelar has raised capital from top-tier investors, including Binance, Coinbase Ventures, Dragonfly Capital, Polychain Capital and others.

Rank: #106

Mcap: 642m $

ATH: 2.66 $

ATL: 0.3136 $

Current price: 0.788 $

Team just announced TON x Axelar partnership. TON blockchain will integrate Axelar's Mobius Development Stack (MDS) as an interoperability layer, connecting the TON Ecosystem with new builders, users + liquidity

Trend:

For the past 70 days we had higher highs and higher lows. Since we had a long term downtrend before these HH & HLs plus increase in on balance volume (OBV) but price is still below a key S/R level, I consider this move as an accumulation period. Key level is at 0.8 ~0.88 $ which act as supply area now

Ichimoku:

Price crossed above the cloud for first time in W1 time frame less than a month ago. Base and conversion line targeted for the possible pull back and buying opportunity.

RSI:

Strongly high just below the overbought level. Bearish divergence in RSI in D1 is obvious that signs for a pullback in short term. In W1 yet RSI gaining momentum and far from being overbought. This accompanied with trend analysis signs for a good midterm bullish rally.

MAs:

W1: Price successfully claimed EMA20 (0.646$) and moves above it. Not tested it yet and pullback to this level is a buying opportunity. D1: Price Supported by EMA20 and EMA50 so far but EMA200 hasn’t claimed yet. After 4 attempt to break this level it seems weak and might break soon. This breakout is a sign for bullish run and might not give us the buying opportunity. Closing a D1 above 0.8 $ is the confirmation and buy call for me.

Wyckoff method:

We’ve already seen SC, Spring and LPs and in final steps we observed SOS at local highs and, so Backup around 0.7 $ is ideal for breakout of accumulation.

🛒 Pair: AXL/ USDT 🛒

👑 Bitcharge 👑

🕰 18/10/2024 🕰

POSITION : 🟢"Buy"🟢

2 % of capital

Ex: Binance, MEXC, KUCOIN,

🛒 Buy1: 0.65 – 0.70 🛒

🛒 Buy2: 0.60 🛒 DCA

👉Sell Targets👈

🎯TP1: 079 🥉

🎯TP2: 0.89 🥈

🎯TP3: 0.99 🥇

🎯TP4: 1.09 🚁

🎯TP5: 1.24 ✈️

🎯TP6: 1.34 🚀

🎯TP7: 1.49 🛰

⛔️ SL: 0.54 ⛔️ by closing D1 Below

This is my personal idea about this coin and it might be wrong. As always, please DYOR.