ACN trade ideas

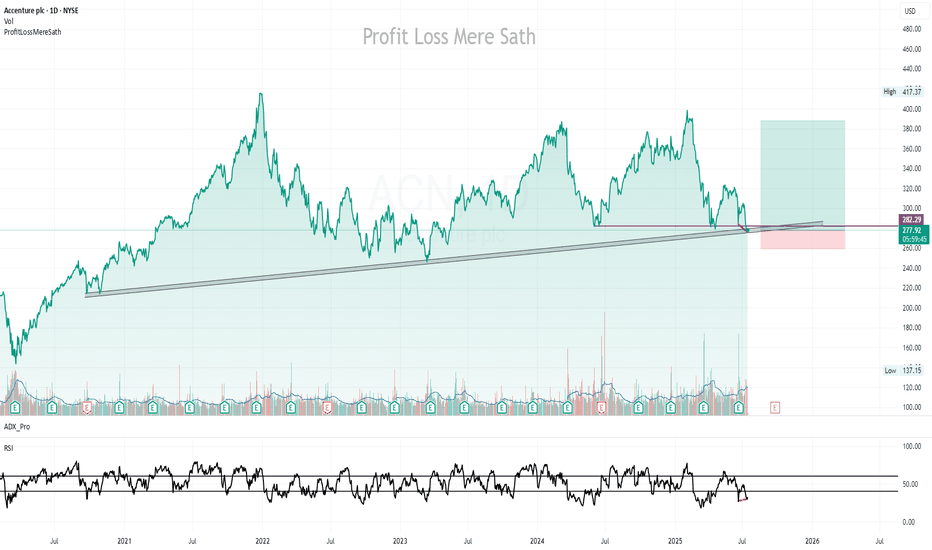

ACN watch $315: Resistance may reject to 280, or break to 340?ACN bounced into a significant resistance around $315

Look for a break and retest which would target $340.

Rejection could drop it to Double Golden fibs at $280.

$ 314.05 - 316.37 is the immediate resistance.

$ 277.51 - 280.31 is the best guess target below.

$ 334.93 - 340.33 would be first target for bounce.

===============================================

ACCENTURE Stock Chart Fibonacci Analysis 042525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 290/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

ACN Accenture plc Options Ahead of EarningsIf you haven`t bought ACN before the previous earnings:

Now analyzing the options chain and the chart patterns of ACN Accenture plc prior to the earnings report this week,

I would consider purchasing the 340usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $11.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Accenture Stock Surges as Generative AI Powers BookingsAccenture (NYSE: NYSE:ACN ), a global leader in business management consulting and technology services, has recently made headlines after its fourth-quarter earnings report exceeded revenue expectations, driven primarily by its leadership in generative AI. With strong financial performance and promising technical indicators, the stock presents a compelling opportunity for investors. Let’s dive into both the fundamental and technical aspects that make NYSE:ACN a stock to watch.

Generative AI and Strategic Acquisitions Drive Growth

Accenture’s fourth-quarter performance reflected strong growth, particularly in the realm of generative AI. New bookings jumped 21% to $20.1 billion, with $1 billion of that attributed to generative AI services. CEO Julie Sweet confidently described generative AI as "the most transformative technology of the next decade," positioning Accenture as a frontrunner in this space. These bookings for AI-related services are expected to grow even further, reaching $3 billion by the end of the fiscal year.

Revenue and EPS Beat

Accenture (NYSE: NYSE:ACN ) reported $16.41 billion in revenue for Q4, a 2.6% year-over-year increase that exceeded analyst forecasts. Adjusted earnings per share (EPS) came in at $2.79, just above the consensus estimate of $2.78. The company’s growth has been further fueled by a series of acquisitions. Notably, acquisitions have contributed 3% to fiscal 2025 revenue growth, with $5.2 billion in acquisitions completed this fiscal year alone.

Positive Fiscal 2025 Outlook

For fiscal 2025, Accenture (NYSE: NYSE:ACN ) predicts revenue growth in the range of 3% to 6%, projecting total revenue between $66.84 billion and $68.79 billion. This growth is further supported by a robust share repurchase program, with an additional $4 billion allocated, bringing the total buyback authorization to $6.7 billion. The firm also increased its quarterly dividend by 15%, reflecting confidence in its future performance.

Technical Outlook:

On the technical side, NYSE:ACN is displaying strong bullish momentum. Following the earnings beat, Accenture shares (NYSE: NYSE:ACN ) surged by 4.33%, pushing the stock above key resistance levels. The stock now trades around $354, up nearly 5% on the day, and has moved into positive territory for the year. The technical indicators are signaling further upside potential.

RSI and Moving Averages

At the time of writing, Accenture’s Relative Strength Index (RSI) sits at 64.49, which is close to the overbought level but still provides room for further growth. An RSI above 70 typically indicates overbought conditions, so the current level suggests a bullish trend without reaching an extreme. Additionally, the stock is trading above key moving averages, including the 50-day and 200-day moving averages, signaling ongoing strength in the upward trend.

Gap-Up Pattern

One particularly noteworthy signal is the gap-up pattern in Accenture’s daily price chart. This pattern, characterized by a sharp increase in price that leaves a "gap" on the chart, often suggests strong investor sentiment and the potential for continued bullish momentum. In this case, the gap-up was fueled by the company's strong earnings report and positive outlook, setting the stage for further upward movement.

Resistance and Support Levels

The stock is approaching a key resistance level around $360. A successful break above this point could see NYSE:ACN test even higher levels, potentially targeting the $380 range. On the downside, the nearest support level sits around $340, which has held strong in previous sessions. With the stock trading above both short- and long-term moving averages, the technical picture suggests that NYSE:ACN is poised for continued growth in the near term.

Conclusion

Accenture’s fourth-quarter earnings report highlights the company’s robust growth trajectory, driven by its strategic leadership in generative AI and ongoing acquisitions. On the technical front, the stock is showing strong bullish momentum, backed by favorable RSI levels, a gap-up pattern, and support from key moving averages. With a positive fiscal outlook, increased dividend, and an aggressive stock buyback program, Accenture is positioned as a compelling buy for investors looking to capitalize on both technological innovation and solid financial performance.

$ACN ProbabilitiesThe project is design to highlight potential support/resistance zones with the rectangles, but also a design of lower/higher probability of reach. The path of the white dots is projected to have a higher probability while the big blue polygon lower probability of penetration.

Marked level could be highly significant in the upcoming developments in this stock, while near the marked time stamps we could see some shifts in sentiment and mood. Shift in volatility and/or mood near the Earnings report and the vertical rectangle.

The squarish looking rectangles are more like milestones for potential developments if we reach those zones in the future. Any support/resistance level can provide reversals but also breakouts in some cases.

Currently at the longer purple rectangle with signs of support, but I wouldn't go long right now. Because of big blue lurking potential "no go" zone, I am little bit biased towards the more bearish toned scenario with a more sliding style of price action rather than power impulse runs, but time will tell.

ACCENTURE Downtrend Line Rejection At $285.35. 20.06.2024Downtrendline Rejection: Observed at $285.35.

Bearish Scenario:

If rejection holds, potential decline to $258.07.

If $258.07 breaks, further drop likely to $224.37.

Bullish Scenario:

If rejection fails, potential rise to $305.41.

If $305.41 breaks, further climb likely to $321.77.

Apply risk management

Risk Warning: Trading in CFDs is highly speculative and carries a high level of risk. It is possible to lose all of your invested capital. These products may not be suitable for everyone, and you should ensure that you fully understand the risks taking into consideration your investment objectives, level of experience, personal circumstances as well as personal resources. Speculate only with funds that you can afford to lose. Seek independent advice if necessary. Please refer to our Risk Disclosure.

BDSwiss is a trading name of BDS Markets and BDS Ltd.

BDS Markets is a company incorporated under the laws of the Republic of Mauritius and is authorized and regulated by the Financial Services Commission of Mauritius ( FSC ) under license number C116016172, address: 6th Floor, Tower 1, Nexteracom Building 72201 Ebene.

BDS Ltd is authorized and regulated by the Financial Services Authority Seychelles (FSA) under license number SD047, address: Suite 3, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, Seychelles. Payment transactions are managed by BDS Markets (Registration number: 143350)

Disclaimer

Trading Accenture Stock Following a Rising Wedge Breakout

Pattern

Accenture (ACN) stock has recently formed a noteworthy technical pattern known as a rising wedge. This pattern is characterized by a series of higher highs and higher lows, with the price action converging toward a single point, forming a wedge-like shape. Typically, a rising wedge is considered a bearish pattern, suggesting that the uptrend may be losing steam and a potential reversal could be on the horizon.

However, in the case of Accenture, the stock has recently broken out above the upper trendline of the rising wedge. This breakout could signify a continuation of the previous uptrend rather than a reversal.

Key Levels:

The key level to watch following this breakout is the top of the wedge, which falls around the $289-$290 price range. If Accenture's stock price can sustain above this level, it would confirm the bullish breakout and suggest potential for further upside.

On the downside, the bottom of the wedge, around the $280 level, now becomes a crucial support level to monitor. If the stock were to fall back below this level, it could negate the bullish implications of the breakout and suggest a potential false breakout.

Price Action:

The price action leading up to and following the breakout has been bullish. Accenture's stock price has been making a series of higher highs and higher lows, indicating strong upward momentum. The breakout itself was decisive, with the stock gapping up and closing well above the upper trendline of the wedge.

Relative Strength Index (RSI) has been trending upward, suggesting that bullish momentum is building. However, the RSI is approaching overbought territory, which could signal a potential short-term pullback or consolidation.

Accenture turning down for the worst to $283Head and Shoulders seems to be forming on Accenture.

This pattern started on 11 December 2023, the price headed to a high at $386.00 and right back down again.

Now it has reached some semblance of support but could be forming a right shoulder.

If we see a price break, then it is likely for the market to drop all the way down to $283.

Medium Probability

Price<20

Price>200

Target $283

POSSIBLE PROBLEMS:

Shift in Demand:

There may be a shift in demand within the services offered by Accenture, with clients possibly prioritizing different areas of investment due to changing market conditions

Operational Challenges:

Any operational challenges or inefficiencies within Accenture could also lead to increased costs or reduced profitability, affecting share price

Strategic Investments and Acquisitions:

While Accenture has been active in acquisitions aimed at expanding its capabilities and market reach, the initial costs and integration challenges of these ventures could impact short-term financial performance, affecting investor perspectives

ACNAccenture plc is a US multinational professional services company based in Dublin, specializing in information technology services and consulting.

This is my preferred setup which includes an upward trend and pullback toward the previous breakout level. I'm expecting a further consolidation before a potential resumption of the upward trend.

ACN March 22, 24: Breaking Down MA-50On March 22, 24, NYSE:ACN broke down its MA-50 on huge volume after earnings were out.

A breakdown below MA-50 on huge volume while the overall market is in uptrend is a sell signal.

I am not holding NYSE:ACN and I am not shorting it, have no plan to short it.

However if I bough it before, I will sell it now.

There are many lessons about stocks which seems cheap but are actually not a good buy.

ACN Stock Outlook: Potential Upside in Q2 2024ACN is currently exhibiting some short-term weakness, but the broader bullish pattern suggests potential for improved performance in the second quarter of 2024. The range between 330 and 350 could attract interest for potential buyers. A target around 410 is being considered, indicating a potential upside of over 20%

Accenture Faces Headwinds as Fiscal-Year Revenue Guidance FallsAs the Dublin-based global tech services and consulting firm grapples with shifting tides, its recent fiscal second-quarter earnings report has left investors on edge. Despite beating estimates, Accenture's decision to revise its full fiscal year revenue outlook downwards has sent shockwaves through the market, prompting a sharp decline in Accenture ( NYSE:ACN ) stock.

Navigating Turbulent Waters:

Accenture's fiscal second-quarter earnings, though impressive on the surface, reveal underlying challenges. While adjusted earnings per share stood at $2.77, representing a modest 3% decrease, revenue, bolstered by acquisitions, rose by 5% to $15.8 billion. However, it's the company's revised full-year revenue growth forecast, now pegged at 1% to 3%, that has investors concerned, marking a significant deviation from the earlier projection of 2% to 5% growth.

Accenture's Struggle: Consulting Conundrum

One area of concern highlighted by analysts is the apparent weakness in Accenture's consulting segment. Despite the company's ongoing efforts to diversify its portfolio and expand into burgeoning sectors like digital marketing, cloud computing, and artificial intelligence (AI), challenges in the consulting realm persist. However, amidst the gloom, there's a glimmer of hope as demand for AI projects continues to surge, with fiscal Q2 bookings witnessing a remarkable 50% quarter-over-quarter increase, reaching $600 million.

Investor Sentiment and Strategic Moves:

The market's response to Accenture's ( NYSE:ACN ) earnings report was swift and decisive, with shares plummeting by 5.9% to near 357.99. But shortly after the stock surged to about $380 per share price. This sharp decline signals a departure from the stock's earlier trajectory, which had seen an 8% increase in 2024. Looking ahead, analysts remain cautious, with revenue projections for the third fiscal quarter falling short of expectations.

Despite the headwinds, Accenture ( NYSE:ACN ) remains proactive in its approach, bolstering investor confidence through strategic initiatives. In 2023, the company demonstrated its commitment to shareholders by hiking its quarterly dividend and expanding its stock buyback program. Moreover, Accenture's relentless pursuit of acquisitions underscores its determination to stay at the forefront of innovation, particularly in key growth areas like AI and digital marketing.