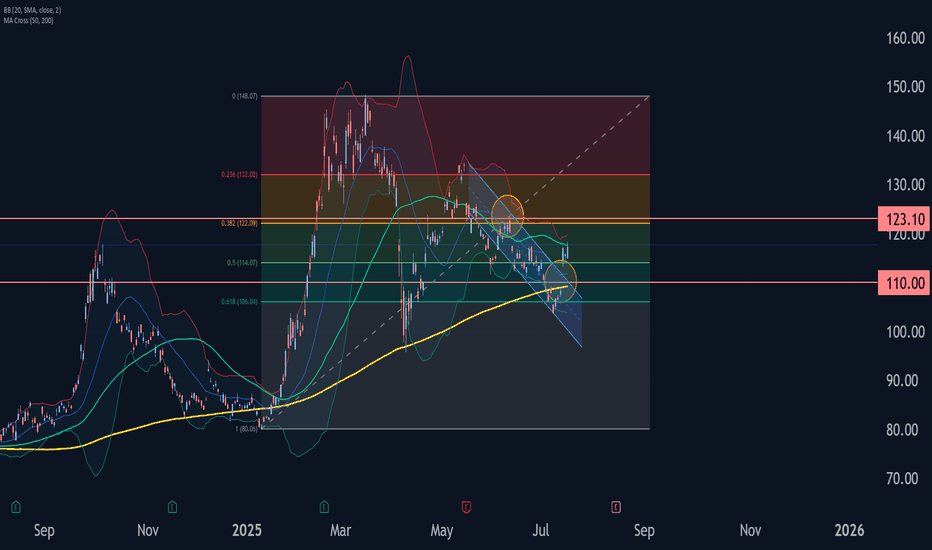

Alibaba Group Wave Analysis – 17 July 2025

- Alibaba Group rising inside impulse wave (3)

- Likely to reach resistance level 123.10

Alibaba Group recently rose with a sharp upward gap, breaking the resistance level 110.00 and the resistance trendline of the daily down channel from May.

The breakout of these resistance levels accelerated the active intermediate impulse wave (3).

Alibaba Group can be expected to rise to the next resistance level 123.10 (the former monthly high and top of wave B from June).

BABA trade ideas

$BABA 160+ before year end looks realistic thanks $NVDA- NASDAQ:NVDA export ban lifted for China will be beneficial for NASDAQ:NVDA for sure but main advantages would be for NYSE:BABA as they can get the shovels from the shop as well so that they can compete in Gold Rush and compete with NASDAQ:GOOGL , NASDAQ:META and other private companies like Open AI and Anthropic.

- There are good universities in China and NYSE:BABA is regional big tech in China which gets great talent. I'm confident that NYSE:BABA would be able to compete with NASDAQ:META & NASDAQ:GOOGL in building LLMs even better with this export ban lift.

- Long NYSE:BABA and short/avoid NASDAQ:META ( overvalued )

BABA – Dollar Cost Averaging Opportunityhi Traders,

Let's have a look at BABA.

Alibaba (BABA) appears to be approaching the end of its correction phase within a well-defined ascending channel. Based on the current price action and technical setup, we believe now is a good time to begin dollar cost averaging into this stock.

Our identified buy zone lies between $108 and $100, where price intersects the lower trendline support and key EMAs (20/50/100/200). This area offers a strong risk-reward setup for medium- and long-term investors.

The mid-term target for this trade is $160, which aligns with the upper channel resistance and previous price structure. However, from a long-term perspective, we anticipate that BABA will resume its growth trajectory and eventually surpass its previous all-time highs.

Supporting this idea, the RSI is stabilizing in neutral territory, suggesting that momentum is resetting and may shift bullish as price finds support.

Summary:

🔁 Strategy: Dollar cost averaging

🟩 Buy zone: $108 – $100

🎯 Mid-term target: $160

🚀 Long-term view: Return to growth and new ATH

📉 Correction nearing completion; bullish structure remains intact

This setup offers an attractive entry point for patient investors aiming to ride the next major upside cycle in Alibaba.

Alibaba (BABA) – Bearish Setup FormingNYSE:BABA

A descending triangle is forming on the chart, with strong resistance around $118 and horizontal support near $102. The structure suggests a potential breakdown, targeting a move of ~−9.8%.

Key observations:

• Price rejected from the descending trendline multiple times

• Stochastic turning down from the overbought zone

• RSI below 50 – room for further downside

• Bollinger Bands show compression, possibly preceding a breakout

📉 Business context:

Alibaba is facing ongoing challenges in its core business. Competition in the e-commerce and cloud sectors has intensified, import/export tariffs are putting pressure on margins, and regulatory oversight from Chinese authorities remains strict. These headwinds may weigh on investor sentiment and stock performance.

My short scenario:

If the price breaks below the $111–$110 zone with volume confirmation, I expect a move toward $102–$100.

Alibaba | BABA | Long at $108.84Like Amazon, I suspect AI and robotics will enhance Alibaba's NYSE:BABA e-commerce, logistics, and cloud computing operations. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NYSE:BABA has a current P/E of 14.2x and a forward P/E of 2x, which indicates strong earnings growth ahead. The company is very healthy, with a debt-to-equity of 0.2x, Altmans Z Score of 3.3, and a Quick Ratio of 1.5. If this were a US stock, investors would have piled in long ago at the current price.

From a technical analysis perspective, the historical simple moving average (SMA) band has started to reverse trend (now upward), indicating a high potential for continued (overall) price movement up. It is possible, however, that the price may reenter the SMA band in the near-term - the $80s aren't out of the question - as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NYSE:BABA is in a personal buy zone at $108.84 (with known risk of drop to the $80s in the near-term).

Targets into 2028:

$125.00 (+14.8%)

$160.00 (+47.0%)

Alibaba (BABA) Shares Fall to Lowest Level in 2.5 MonthsAlibaba (BABA) Shares Fall to Lowest Level in 2.5 Months

Yesterday, Alibaba (BABA) shares dropped to their lowest level since late April. The decline followed the company’s announcement of a planned bond issuance totalling approximately $1.53 billion, with a maturity date set for 2032. The funds will be used to support the development of Alibaba's cloud infrastructure and expansion of its international e-commerce business.

The market’s negative reaction may stem from concerns over rising debt levels and the potential return on these investments.

Technical Analysis of Alibaba (BABA) Share Price

When analysing the price movements of BABA shares in 2025, two key trading ranges stand out:

→ $126–145: This range originates from the long bullish candle on 20 February, following the release of a strong quarterly report;

→ $96–103: This zone was established in late April, as supply and demand stabilised around the psychologically significant $100 level.

The upper range has since acted as a resistance zone, with the price reversing from it in mid-May. The lower range has served as a support area, particularly in early April when the stock came under pressure after tariff-related headlines.

The current price action is notable in that Alibaba shares have:

→ Broken through the June support level at approximately $111.92;

→ Formed a bearish A-B-C structure, marked by lower highs and lower lows.

Using Fibonacci extension analysis, we can reasonably assume:

→ The $111.92 level is now likely to act as resistance;

→ The next potential target for the ongoing downtrend (leg C→D) lies at the 1 Fibonacci level ($100.55) — aligning closely with the previously identified support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

BABA: Testing Daily 200 SMA on Falling Wedge; Gimme Bounce Here!Baba is approaching the key level of the 200 SMA, a zone where price has respected and bounced sharply off in the past! What's crucial to note is this is occurring off of a falling wedge pattern, and RSI in the 30s showing oversold conditions.

- Calling 108 as an interim bottom here

- Looking for 117.7ish as the next leg towards where price is headed

P.S: This name is very undervalued financially with many analysts placing a fair value of around 145 or so, BABA is buying back shares, and inking new customer centric deals/partnerships

I like the risk to reward of going long here!

Alibaba on the lower upward trend lineAlibaba is on the upward trend line after years of a downward trend. The AI business is booming. The fundamentals speak for themselves. The price/earnings ratio for 2025 is around 12 and is on Value level. The conflict with the Chinese party seems to have improved. The company is buying back shares. I have therefore increased my long position today

How to use chart to determine your DCA strategyLooking at the monthly chart of Alibaba, it is unfortunately not out of the woods , yet ! Yes, there has been a slew of good news, government support, foreign investors pouring money into the big tech of China, etc. But, little does this move the bullish needle.

The yellow circle shows a bearish pin bar and if it is supposed to work as it says, then I am looking at 95 price level to accumulate. Of course, there are others who prefer to average on a monthly basis, no matter what the price is. Good for you !

For me, I can deploy my funds to other promising assets like Gold , EURUSD ,etc.

It is a challenge for some traders/investors that they have to part off with their money every time they read the news, see a chart or have a discussion with friends, as if they are afraid of missing out (FOMO).

Relax, the market always give you opportunities to enter the market .

here is the #chart for $BABA Bullish with short-term caution. Alibaba ( NYSE:BABA ) is at $114.08, up 0.13% daily but down 2.92% monthly, as shown in the finance card above. X posts reflect bullish sentiment, citing a breakout above the 200-week moving average and a potential move toward $168-$183.13, driven by strong AI/cloud growth (triple-digit AI revenue for seven quarters) and share repurchases (15.2M shares canceled in May 2025). Analysts rate it a "Strong Buy" with a $153.62 target (34.6% upside). However, technicals show resistance at $120.63-$123.90 and a bearish wave correction, with support at $113.32-$116.54. Tariff risks and a mixed options sentiment add volatility. A break above $120 could target $127; otherwise, a pullback to $113 is possible

BABA undervaluedHello

BABA has invalidated any corrective attempts due to its price action — a 3-month bullish breaker is in play, and the price has yet to test the first level of algorithmic targets around 163–168.

There’s also a critical level to flip near 149, and I’m fairly confident it will be reclaimed if market conditions permit.

NFA

BABA Stock: A Detailed Analysis using Elliott Wave Theory RulesHello Friends,

Welcome to RK_Chaarts,

Let's analyze Ali Baba Group Holdings Limited, also known as BABA, listed on the NYSE. We'll be using the Elliott Waves theory.

Friends, as we can clearly see, after hitting a low of around $95.75 on 9th April 2025, it started an impulse wave. Within this wave, we've completed intermediate degree blue bracketed (1), (2), (3), (4), (5), and primary degree ((1)) in Black. Currently, we're completing primary degree ((2)), with a low around $111.

If it breaks the level of $111, we'll assume we're still in primary degree ((2)), as marked in scenario 2 on the chart. This means wave ((2)) is unfolding, and wave ((3)) might start after wave ((2)) is complete.

If it doesn't break the $111 level, it's likely that wave ((2)) has completed, and we've started a subdivision of wave ((3)) or its further subdivisions. If it moves further up, following scenario 1 (the black line on the chart), this is a possibility.

According to Elliott Wave theory, wave ((2)) cannot retrace more than 100% of wave ((1)). So, our main invalidation level for this count is $95.75. Yes, BABA is turning up against the 95.75 low, and in the near term, we expect the stock to trade higher.

Somewhere, this stock might move towards $150 or $160 if it doesn't break down below $ 95.75.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

BABA (Alibaba Group Holdings) | 1D Chart OutlookPublished by WaverVanir International LLC | 06/11/2025

BABA has broken out of its multi-year base and is now in a potential macro reversal structure. The current retracement near $120 could act as a higher low before a continuation toward the unfilled liquidity zone around $183.13, a major inefficiency level from late 2021.

🔍 Key Technicals:

✅ Long accumulation between 2022–2024

🚀 Breakout above $100 confirmed by strong volume

🔁 Pullback into prior breakout zone (~$115–$120) could offer optimal re-entry

📈 Target: $183.13 (Gap-fill + structural resistance)

📉 Risk Management:

🛑 Invalid below $105 (structure break)

🎯 Risk/Reward favorable if entries are scaled in sub-$125

📊 Probability Weighted Bias:

Bullish Continuation: 65%

Consolidation: 25%

Breakdown/Invalidation: 10%

🧠 Macro Catalyst Watch:

China stimulus or regulatory easing 📉🪙

Fed rate pivot & USD weakness 💵🕊️

Earnings growth rebound in Alibaba’s cloud segment 🌐📊

This setup reflects asymmetric potential as tech re-rates globally. Risk-defined, sentiment-watching, and catalyst-aware traders may consider positioning for a medium-term swing.

#Alibaba NYSE:BABA #SMC #GapFill #TradingStrategy #WaverVanir #TechStocks #ChinaEquities #SwingTrading

Alibaba: A Strategic Long Play Amid Regulatory Easing

Current Price: $119.38

Direction: LONG

Targets:

- T1 = $123.00

- T2 = $127.00

Stop Levels:

- S1 = $116.50

- S2 = $114.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Alibaba.

**Key Insights:**

Alibaba has shown impressive recovery momentum this year, with its stock surging 60% year-to-date. This resurgence is attributed to easing Chinese regulatory pressure, ongoing resilience in its e-commerce sector, and steady progress in cloud computing services. The strategic diversification of revenue streams has also positioned the company to weather economic challenges better than many of its peers. Furthermore, Alibaba's restructuring moves and initiatives in AI and innovative technologies continue to broaden its growth horizons.

However, significant risks remain. Short-term market fluctuations driven by macroeconomic uncertainties, competitive pressures from local and international e-commerce firms, and global trade dynamics could weigh on investor confidence. Yet, long-term prospects remain fundamentally sound for those willing to endure the interim volatility.

**Recent Performance:**

Alibaba's stock has recently consolidated around the $119 mark after a remarkable 60% gain earlier this year. This stabilization suggests a more balanced sentiment among traders, with buyers and sellers finding equilibrium. Notably, investor optimism surrounding regulatory easing in China and Alibaba's ability to sustain profitability in a challenging environment has kept the stock buoyant.

**Expert Analysis:**

Market experts emphasize that Alibaba's continued dominance in e-commerce and its ambitious strides in cloud computing make it a strong candidate for long-term portfolio inclusion. The company's investments in international expansion also provide exposure to diverse market opportunities. However, some analysts urge caution, noting that intensifying competition, both at home and abroad, and uncertainties in China’s economic policy could create headwinds.

Technical indicators reflect bullish sentiment in the near term, with moving averages forming strong support zones. Volume trends indicate steady accumulation, pointing to positive outlooks among institutional investors.

**News Impact:**

Recent announcements related to Alibaba's restructuring plans and its involvement in AI research have sparked renewed interest in the stock. Furthermore, signs of regulatory easing in China have fueled optimism regarding Alibaba's ability to regain its leadership footing in key markets. Investors should monitor news on any potential government support for Chinese tech giants, as this could be a decisive factor in shaping the company's trajectory.

**Trading Recommendation:**

Given the easing regulatory environment and Alibaba’s strategic initiatives aimed at driving long-term growth, a LONG position appears prudent for the medium term. With defined stop levels and upward targets, traders can balance risk while capitalizing on the stock's growth potential. Sustained focus on news flow, particularly regulatory and sector news, is critical to maintaining an informed trading strategy.

BABA Weekly Options Play – 2025-06-10🧾 BABA Weekly Options Play – 2025-06-10

Bias: Moderately Bearish

Timeframe: 5 trading days

Catalysts: Weakening momentum, max pain gravity, fading upside catalysts

Trade Type: Single-leg PUT option

🧠 Model Summary Table

Model Direction Strike Entry Price Target Stop Loss Confidence

Grok Bullish 125.00C $0.77 $1.16 $0.385 65%

Claude Bearish 117.00P $1.75 $2.63 $1.23 65%

Llama Bearish 119.00P $2.85 $3.42 $2.28 65%

Gemini Bullish 125.00C $0.77 $1.35 $0.38 68%

DeepSeek Bearish 114.00P $0.79 $1.19 $0.55 70%

✅ Consensus: Moderately Bearish

📉 Core Setup: Downside pullback toward $115–118 support zone

⚠️ Outlier: Gemini and Grok see potential call upside on sentiment rebound

🔍 Technical & Sentiment Recap

Trend: Mixed structure—price stuck between declining intraday EMAs and longer-term resistances

Momentum: Bearish MACD and RSI signals across M5 & daily on 3/5 models

Sentiment: VIX 16.8 (neutral), Max Pain at $118 = gravitational anchor

Options Flow: Heavy call OI near $124–125 (potential cap); Put flows dominate below $118

✅ Final Trade Recommendation

Parameter Value

Instrument BABA

Strategy Single-leg PUT (weekly)

Strike $115.00

Entry Price $1.13 (ask)

Profit Target $1.70 (~50% gain)

Stop-Loss $0.79 (~30% loss)

Size 1 contract

Entry Timing At market open

Confidence 65%

🎯 Rationale: Favorable risk-reward in short-dated put to capture downside drift toward $115 zone. Models align around a modest pullback, driven by technical weakness and lack of fresh bullish catalysts.

⚠️ Risk Factors

Sharp bounce from short-term oversold RSI

Sudden news catalyst (AI/cloud deal, macro relief) could fuel call side squeeze

Weekly options decay accelerates sharply by Thursday

Max pain shift or volatility compression could mute movement

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: BABA

🔀 Direction: PUT (SHORT)

🎯 Strike: 115.00

💵 Entry Price: 1.13

🎯 Profit Target: 1.70

🛑 Stop Loss: 0.79

📅 Expiry: 2025-06-13

📏 Size: 1 contract

📈 Confidence: 65%

⏰ Entry Timing: open

🕒 Signal Time: 2025-06-08 23:55:22 EDT