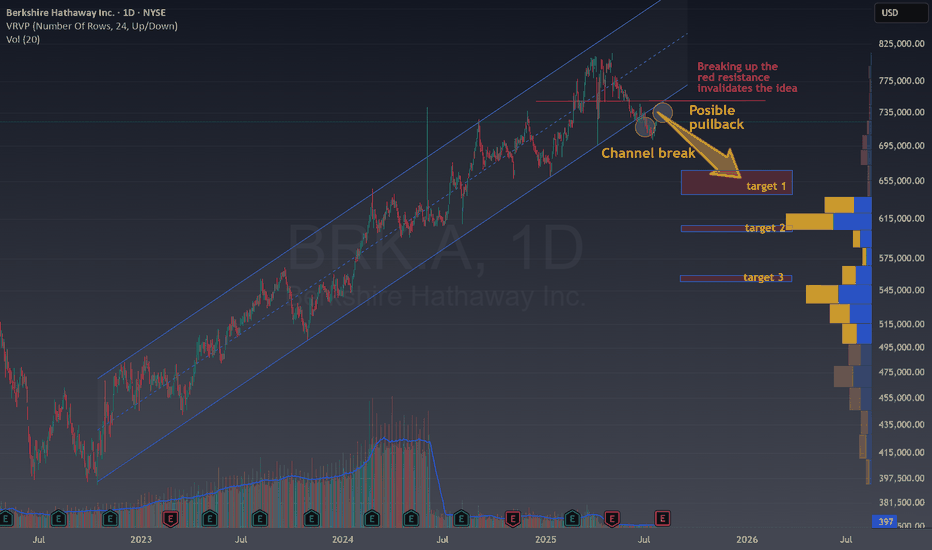

Berkshire is losing the Buffet's premiumTechnical Overview

Looking at the current NYSE:BRK.A chart, several signals suggest a potential shift from the prior bullish trend:

Channel Break : Price has broken down from a long-standing ascending channel, which often marks the end of an uptrend and the start of a consolidation or a bearish phase.

Possible Pullback: After the channel break, the chart highlights a likely pullback toward the broken support, now turned resistance. If BRK.A fails to retake this area, downside follow-through becomes probable.

Targets Identified:

Target 1: Around 655,000 USD, supported by a significant volume cluster.

Target 2: Near 615,000 USD, another high-volume historical support.

Target 3: Around 545,000 USD, marking a deeper retracement in case of extended weakness.

Invalidation: If price strongly reclaims the prior channel and breaks above the highlighted red resistance, the bearish idea should be reconsidered.

Fundamental Arguments

Berkshire’s largest holdings, particularly in tech, are sensitive to market corrections, especially in a rising rate environment, which can weigh on valuation multiples.

Growth in net earnings has moderated, with key segments (insurance, railroad, and energy) facing headwinds or margin pressures.

Diminishing Buyback Impact: With shares previously at all-time highs, Berkshire’s ability to use buybacks as strong downside support is reduced if valuation stays elevated or fundamentals drift.

Trade Setup

Entry Idea: Look for opportunities to go short or trade sideways after a failed retest of the broken channel, as seen on the chart.

Profit Targets: Use the volume-based support zones at 655,000, 615,000, and 545,000 USD.

Stop Loss: A convincing break back into the channel and above local resistance invalidates the setup.

This gives us opportunities to risk around 3 to 4% and earn more than 9%. A great Risk Reward ratio.

Laste note about channels

Trading after a channel break can offer strong open risk/reward setups, especially if fundamental forces align with the technical picture. While Berkshire Hathaway remains a resilient company, markets can enter periods of consolidation or pullback even for top-tier stocks. Always mix technical observation with a view on macro and company fundamentals for improved decision-making.

💬 Does this setup align with your view on BRK?

🚀 Hit the rocket if this helped you spot the opportunity and follow for more clean, educational trade ideas!

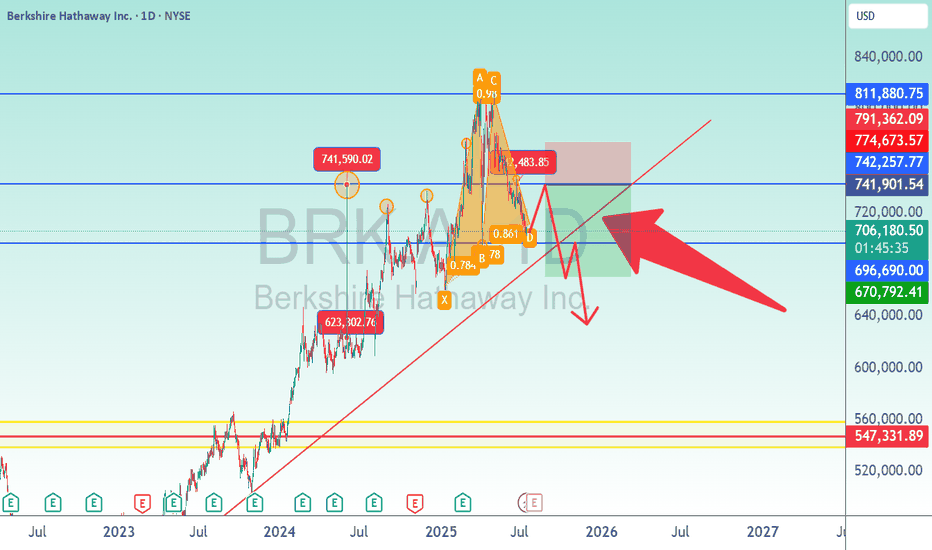

BRKB trade ideas

Bershire Hathaway Stock Analysis/BRK.AI looked at this particular stock because of insane activity from $623,302 to $741,590 in one day. That rejection told me to pay attention Money was coming to the door. So if the market is approaching this area again, rejection is the likely response. Looking at a short is temporary. This market is bullish in nature.

What's the deal with BRK.B?! Where is the short term bottom?I'm pretty new to this, so I'm looking to see if anyone has any thoughts about BRK.B. The best looking support is the April low, but it seems like it could fall below to the Jan 2025 low with the way it is steadily dropping. That would suck! I'm averaged at $491 and prefer not to see it go that low, but I will be holding very long-term anyway.

Any thoughts on a bottom? They hold 300+ billion in cash, so surely they'll figure out what to do with it soon. *Fingers crossed*

Berkshire Hathaway: Time to consider exitsHello,

Despite recent market volatility, Berkshire Hathaway (BRK.A, BRK.B) has demonstrated resilience, with its stock rising approximately 16% year-to-date in 2025, significantly outperforming the S&P 500’s 2% decline. This performance has fueled speculation about Warren Buffett’s strategy, particularly whether the “Oracle of Omaha” is capitalizing on the recent market correction to deploy Berkshire’s record $334 billion cash reserve. Let’s examine Berkshire’s current position

Berkshire Hathaway operates a diversified portfolio anchored by its world-class insurance operations, including GEICO. The company also owns Burlington Northern Santa Fe Railroad, a robust energy division, and a wide range of manufacturing, service, and retail businesses. Its $284 billion equity portfolio, featuring long-term holdings like Coca-Cola, American Express, and a reduced but still significant stake in Apple, continues to generate substantial investment income. In 2024, Berkshire reported approximately $30 billion in operating cash flow, underscoring its financial fortress status.

This diversified revenue stream and immense liquidity position Berkshire as a safe haven for investors during turbulent times. Buffett’s reputation for capitalizing on market downturns—evidenced by his $26 billion in deals during the 2008-2009 financial crisis—further bolsters confidence in the company’s ability to navigate corrections.

Recent market corrections, driven by concerns over President Donald Trump’s tariff policies and fears of a global trade war, have seen the S&P 500 drop over 11% from its February 2025 high. Many investors are watching Buffett, expecting him to deploy Berkshire’s massive cash pile to scoop up undervalued assets, as he famously advises to “be greedy when others are fearful.” However, evidence suggests Buffett has been cautious.

In 2024, Berkshire was a net seller of equities for nine consecutive quarters, offloading $134 billion in stocks, including significant reductions in its Apple (67% cut) and Bank of America (34% cut) holdings. Buffett also halted Berkshire’s stock buyback program in the third and fourth quarters of 2024, despite having repurchased $77.8 billion of its own stock since 2018. This pause, combined with a record cash hoard of $334 billion, indicates Buffett may believe valuations remain elevated or that greater opportunities lie ahead.

That said, Buffett has made selective purchases. In Q4 2024, Berkshire initiated new positions in Constellation Brands, Pool Corporation, Domino’s Pizza, Occidental Petroleum, VeriSign, and Sirius XM, with investments like VeriSign ($73 million) and Constellation Brands ($1.24 billion) reflecting Buffett’s preference for companies with strong fundamentals and competitive moats. These moves suggest Buffett is cautiously optimistic about specific sectors, particularly those tied to consumer spending and stable cash flows, but is not yet aggressively buying the broader market dip.

Berkshire’s stock has delivered a compounded annual return of 19.9% since 1965, nearly doubling the S&P 500’s performance over the same period. However, with a market capitalization exceeding $1 trillion and a price-to-sales ratio of 2.67 (a 34% premium to its 10-year average), significant near-term upside may be limited. The conglomerate’s size makes it challenging to find needle-moving investments, and Buffett’s recent restraint in buybacks suggests he views Berkshire’s stock as fully valued at current levels.

For long-term investors, Berkshire remains a compelling hold due to its diversified business model, strong cash flow, and Buffett’s disciplined capital allocation, now transitioning to designated successor Greg Abel. However, those expecting rapid gains should temper expectations, as Berkshire’s scale limits its ability to achieve exponential growth. Investors seeking to emulate Buffett’s strategy might consider his recent picks, such as VeriSign, which benefits from a near-monopoly in internet domain registries, or stalwarts like Coca-Cola, a Dividend King with a 3% yield.

For those considering new positions, waiting for a deeper market pullback could align with Buffett’s value investing principles, especially given his current cash-hoarding stance.

Berkshire Bounce ImminentNYSE:BRK.B Ready To Bounce!

- Breakout and now retesting descending wedge

- Overnight gap up from June 23rd to 24th was filled today

- Retesting top band of 200ema cloud

Targets:

- 3% to 50ma

- 10% to gap fill at $535

If you take anything away from this post, remember this:

Do NOT fade Uncle Warren.

We will go long equity tomorrow at the open. This is your advance notice.

-READ THE CHARTS 6/25/25

BRK.B Long The stock has been trading within a defined channel for nearly five years, suggesting it may be approaching a pivotal bottom. If this turns out to be the case, we could have the opportunity to acquire additional shares of this outstanding company at more attractive prices. It's crucial to stay vigilant and monitor any developments related to this stock, as market conditions can change rapidly. By keeping a close watch on the company's performance and any news that may impact its valuation, we can capitalize on potential buying opportunities that arise. Investing in a fundamentally strong company at lower price points could significantly benefit our long-term investment strategy.

BRK.B: Channel-Bound & Targeting New HighsThis chart for Berkshire Hathaway Class B (BRK.B) presents a clear and actionable technical setup, operating within a well-defined long-term bullish channel.

Dominant Bullish Channel: BRK.B is clearly trading within a well-established, upward-sloping channel. This channel dictates the long-term trend, confirming a robust bullish bias as price consistently finds support at the lower band and resistance at the upper band.

Recent Pullback from All-Time Highs: After reaching its "All Time High" around the 530- 540 resistance zone, the stock has experienced a healthy corrective pullback, aligning with the typical behavior within an ascending channel.

Key Support Levels Identified for Re-accumulation: The chart highlights two critical support zones for potential re-entry or accumulation: a primary support between 470− 480, which perfectly aligns with the lower boundary of the active bullish channel, and a deeper, secondary support at 430 - 440 should the first level fail.

Clear Upside Target Post-Support Validation: Following a potential bounce from either of the identified support levels, the analysis projects a renewed push towards the "All Time High" zone (530-540). This move represents a compelling 8% to 10% upside target from the current vicinity, validating the strength of the bullish trend and the expected retest of previous resistance.

This reinforces a "buy the dip" strategy within the confines of this established channel.

I have almost good fundamental views about Berkshire HathawayHello Traders and Investors,

According to my fundamental analysis considering EPS revisions and forecasts and also by taking the analysis TP and recommendations. I give a good score to BRK-B.

By considering the technical matters I think BRK.B, while is not a really good option for short-term, could be a great option for the mid-term investment.

I'll have more BRK-B in my portfolio.

Emotional 4% gap on Warren Buffett "leaving"Keeping eye on possible 10-day option entry on 4% gap that is just irrational quick sell-off.

reasons for gap to fill up:

-nothing changes, Buffet was not making decisions single-handedly anyway and passing knowledge is his strong side, not the opposite

- he will remain chairman of the board

-honestly what do people expect? him trade until he´s 100 years old?

-Trump meanwhile has a complete meltdown on his tarrif policies not working, he hinted that easing is comming because basicly he has nowhere to got and got cornered. By extension this would bring uplift for all the stocks.

reasons to not fill up:

-any new idiotic policies by Trump that we can not predict

BRK.B Technical Analysis – May 2025Berkshire Hathaway (BRK.B) has pulled back about 38.2% from its 2025 high, a key Fibonacci retracement level that’s often seen as potential support in strong uptrends. It’s also sitting right at the anchored VWAP from this year’s low, which adds weight to this level as a possible bounce zone.

The stock gapped down on May 5 following earnings, with Buffett announcing his future step-down—a major sentiment shift. This created two key gaps above:

• Weekly gap closes at $524

• Daily gap closes at $535.26

These levels could act as magnets if bulls regain control. A long trade here could make sense with a tight stop just below recent lows and an initial profit target at the $524 gap close. A push beyond that could fill the daily gap at $535.26 and potentially retest all-time highs.

On the bearish side, a decisive break below the 38.2% retracement and anchored VWAP could lead to further downside. First support comes in around $480, where a trendline from October 2023 lines up. Below that, a more significant move could take the stock to the $450.30 daily gap fill, which aligns with a second fan line going back to the 2022 bear market low.

Despite the pullback, BRK.B remains in a strong longer-term uptrend, but the company’s cautious tone—highlighted by its large cash position—signals potential uncertainty. Whether that’s fear or preparation for a big move remains to be seen.

Bottom line:

• Bullish setup: Bounce from VWAP + 38.2% retracement, targeting $524–$535.

• Bearish setup: Break below current support opens move toward $480 and possibly $450.

• Still a strong stock, but sentiment has shifted. Watch how price reacts at current levels.

"BRK.B Consolidation Near Support: Awaiting Next MoveTechnical Analysis Report: BRK.B (Berkshire Hathaway Inc.)

Timeframe: 4H Chart

Period Reviewed: 2024 – May 9, 2025

Candle Type: Heikin Ashi

🔹 1. Market Trend Structure

Primary Trend: Strong bullish trend from 2024 to early 2025, forming higher highs and higher lows within a well-defined ascending channel.

Recent Structure Change (April–May 2025 ): Price broke below the upper trendline and appears to be r etesting former support levels . A possible trend exhaustion or reversal is forming.

🔹 2. Key Support and Resistance Levels

Major Resistance:

$541.94 All-time high; psychological barrier.

Resistance:

$522.04 Local high before recent downturn.

Current Price :

$513.53 Hovering below broken structure.

New Support Zone:

$513.25 Retest area (former top).

Support 3:

$499.25 Needs to hold to preserve bullish bias.

Support 2 :

$482.11 Former range low and mid-channel support.

Support 1:

$462.34 Key level—loss of this implies deeper drop.

🔹 3. Channel and Pattern Analysis

Main Ascending Channel: Price respected both boundaries until the April 2025 peak.

Breakdown & Retest : Price has broken the channel and is testing lower highs—suggesting possible distribution.

Bearish Wedge -like Structure: Formation between April–May resembles a rising wedge followed by breakdown—bearish continuation pattern.

🔹 4. Price Action Behavior

Volume: Spike in volume near peaks, suggesting distribution by large holders.

Heikin Ashi Trend Candles : Recently showing more red-bodied candles with upper wicks—sign of selling pressure.

Failed Bullish Momentum : The most recent attempt to reclaim $522 failed, showing weakened buying interest.

🔹 5. Potential Scenarios

✅ Bullish Recovery Scenario:

Price reclaims $522 and sustains above $513.60.

Targets: $541.94 and new highs beyond.

Needs volume confirmation and bullish candle formations.

❌ Bearish Breakdown Scenario:

Price loses $499.25 and closes below $482.

Key breakdown below $462.34 = strong bearish shift.

Bearish targets: $440 → $400 → potentially $360–$343 (unfilled gap zone).

📌 Conclusion: Bearish Tilt Emerging

The overall long-term trend remains bullish , but short-term structure has shifted bearish due to:

Breakdown from ascending channel

Failure to reclaim resistance

Lower highs forming

Selling pressure with bearish candle structure

If support at $499.25 fails, expect acceleration to $482 → $462. Below $462 confirms trend reversal and bearish continuation into summer 2025.

Buffett’s Planned Exit Isn’t Berkshire Hathaway’s Only ProblemI guess we knew it had to happen sooner or later. Warren Buffett, often considered the greatest fundamental investor of all time, announced over the weekend that at age 94, he’s finally stepping aside as CEO of Berkshire Hathaway NYSE:BRK.A NYSE:BRK.B .

What does Berkshire’s technical and fundamental analysis say as Buffett prepares to leave the conglomerate by year’s end?

Let’s check it out:

Buffett’s Departure and Berkshire Hathaway’s Fundamental Analysis

It’s worth noting that Buffett, who served as Berkshire’s CEO since 1970, will apparently stay on as the company’s chairman. But he’ll hand over the CEO role to Greg Abel, currently vice chair of Berkshire's non-insurance operations.

Buffett and late Berkshire Vice Chair Charlie Munger anointed Abel as the firm's eventual day-to-day chief executive in 2021. The incoming CEO will eventually have the final word on all operational issues and capital deployment.

Buffett, an investor that I’ve often tried to emulate, lost Munger -- his career-long friend and business partner -- at age 99 some 18 months ago. For decades, they reportedly talked everything over.

Buffett’s CEO job must have become more difficult and less fun without someone who served as both a sounding board and idea generator for more than half a century.

As for Berkshire stock, BRK.B shares were up 13.9% year to date and 27% over the past 12 months as I wrote this Thursday afternoon.

Shares have risen even though Berkshire reported seemingly underwhelming Q1 results Saturday at the company’s annual shareholder meeting (where Buffett also announced his retirement as CEO).

Berkshire posted $9.6 billion in operating earnings on $89.7 billion in revenue. Operating earnings actually fell year over year, while revenues contracted by 0.2%.

Net income attributable to Berkshire shareholders also sank by a gnarly looking 63.8% to $4.6 billion after accounting for such items as interest, taxes and non-operating income/expenses. Meanwhile, total costs and expenses increased by 2.3% to $78.268 billion.

What happened?

Well, the firm's investment portfolio -- which has long been Buffett's forte -- really took its toll on performance during Berkshire’s latest quarter.

Investment results dropped from a $1.9 billion gain in the year-ago quarter to (wait for it) a $6.4 billion loss in the latest period. Yikes!

However, Buffett has long said that Berkshire invests not to perform well over one quarter, but to do so over decades.

Berkshire Hathaway’s Technical Analysis

Now let’s look at BRK.B’s chart going back some 2-1/2 months through Wednesday (May 7):

Readers will first see a so-called “double top” pattern of bearish reversal, as denoted by the two red boxes marked “Top 1” and “Top 2.” That pattern set up very accurately in time for last Saturday's shareholder meeting.

BRK.B has also recently given back its 21-day Exponential Moving Average (or “EMA,” marked with a green line above). That probably turned some swing traders against the name.

However, there’s been a genuine fight around the stock's 50-day Simple Moving Average -- or “SMA,” as marked with a blue line above. That likely has portfolio managers exhibiting some uncertainty about the stock.

Should BRK.B fall below the 50-day SMA, portfolio chiefs will potentially face pressure from their risk managers to reduce long-side exposure to the stock.

Readers will also note that Berkshire rebounded off of its 200-day SMA (marked with a red line at $462) in early April. That’s not a downside target for the stock, but rather a downside pivot that could indeed signal even lower prices to come.

Meanwhile, BRK.B’s Relative Strength Index (the gray line at the chart’s top) is currently neutral, but that’s not the case with the stock’s daily Moving Average Convergence Divergence indicator.

The MACD -- marked with gold and black lines and blue bars at the chart’s bottom -- had been in decent shape, but that’s recently changed.

First, the histogram of Berkshire’s 9-day EMA (marked with blue bars) recently flipped from positive to negative. That’s typically a bearish sign.

At the same time, the stock’s 12-day EMA (black line) has crossed below its 26-day EMA (gold line). Both are still above zero, but many investors view having a stock’s 12-day line below its 26-day one as sub-optimal.

What might happen from here? A lot will depend on how Berkshire performs during the current quarter.

We know that many of its investments have come back recently in value, and it would certainly be rough to see Buffett -- one of Wall Street’s all-time greats -- ride off into sunset in a less-than-graceful fashion.

But for now, Berkshire’s chart doesn’t look especially bullish to me.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle had no position in BRK.A or BRK.B at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

"BRK.B 4H: Monitoring Price Action Between $520 and $498"Strategic Trade Outlook:

🔴 Sell Setup :

Sell if price fails to reclaim $520 and breaks below $498

Targets: $482 → $462

Stop: Above $521

🟢 Buy Setup :

Only valid if price reclaims and holds above $520 with bullish volume

Target: Retest of $539–$542 upper wedge

Alert Message (Short-Term Bearish) :

"Sell pressure confirmed under $520. If $498 breaks, expect a deeper drop to $482 and $462. Avoid longs unless $520 is reclaimed with strength."

Visit the Harmonic Museum in the Warren Diamond BuildingThe Diamond Glass Building, home to the Warren Buffett Harmonic Museum, is truly a sight to behold! As you enter, you'll find a fascinating display of creatures.

On the left, there's a charming exhibit featuring a crab vendor that catches the eye.

In the center of the hall, you can marvel at the wild bat, a remarkable fossil that tells a story of the past.

To the right, however, is where things get exciting—a live bloodthirsty shark!

While the crab and bat have been fossilized, the shark is very alive, so be sure to keep your distance and enjoy the view and trade safely.

Buy only on a confirmed close above $545 Breakout Traders: Buy only on a confirmed close above $545 with strong volume.

Target zones: $585, then $600+ based on the ascending triangle projection.

Sell Setup (if price opens & stays below $523): base on pre-market Chart If it still 522

Entry: $521–523

Stop Loss: $530

Targets:

TP1: $510

TP2: $500

TP3: $490 (extended)

Buffett Steps Down, Berkshire Shares Pull Back from Record HighBuffett Steps Down, Berkshire Shares (BRK.B) Pull Back from Record High

Berkshire Hathaway has released its quarterly report, which came in slightly below analysts’ expectations:

→ Earnings per share: actual = $4.46, forecast = $4.72

→ Revenue: actual = $90.8bn, forecast = $89.7bn

However, the bigger news was not the weaker results, but the decision of legendary 94-year-old Warren Buffett to step down as head of the company after nearly 60 years in charge. According to Reuters:

→ Vice Chairman Greg Abel will take over leadership;

→ Buffett will still influence decisions and has said he does “not intend to sell a single share of Berkshire”.

In pre-market trading today, BRK.B shares are priced around $526, compared to Friday’s close above $541, which marked a historic high. The decline suggests a natural negative reaction by market participants to the news.

Technical Analysis of BRK.B Stock Price

The Berkshire Hathaway stock price is moving within an upward channel, and:

→ In 2025, it has outperformed the broader equity index, showing a strong recovery following the early April market selloff;

→ Following the recent news, the price will likely retreat from the upper boundary of the channel toward the median line, which may act as support (as it did in late April, as shown by the arrow).

The recent price action appears to be a false bullish breakout above the $535 resistance — a bearish signal.

It’s possible that the initial emotional market reaction may fade, and BRK.B shares could continue to outperform the S&P 500 (tracked via the US SPX 500 mini on FXOpen). Whether this scenario plays out will depend on the leadership and decisions of Greg Abel, especially as the company now holds a record cash reserve of nearly $350 billion.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

U.S. Stock Swing TradeBRK.B

This stock remains one of the few in the U.S. market that continues to exhibit technical strength, maintaining a well-defined uptrend.

Current price action suggests a potential buy-on-dip opportunity near key support levels.

Entry Zone: 494 – 501

Take-Profit Target: 518 – 530

Stop Loss: 488

That said, it remains essential to closely monitor the S&P 500 index, along with prevailing macroeconomic developments, which continue to exert significant influence on market sentiment.