DED trade ideas

Deere & Co Jumps On Farmer Confidence Will possible range between POC and ATH resistance

Best to wait for a confirmed breakout before looking to trade the stock.

EARNings Highlights

(Bloomberg) -- Machinery giant Deere & Co. delivered better-than-expected quarterly results and maintained its outlook for the year as early signs of stabilization in the U.S. farm sector offset a slowdown in construction. Shares surged.

“Farmer confidence, though still subdued, has improved due in part to hopes for a relaxation of trade tensions and higher agricultural exports,” Chief Executive Officer John May said in a statement accompanying its fiscal first quarter results.

While the CEO didn’t mention the coronavirus in the statement, his comments may help ease concerns about how much the outbreak will delay China’s return to U.S. agricultural markets as laid out in the phase one trade deal. American farmers have been cautious on replacing large equipment, Deere’s top moneymaker.

Earnings Highlights

Deere maintained its fiscal 2020 guidance, forecasting a range of $2.7 billion to $3.1 billion. That compares with the $2.9 billion average analyst estimate.

The company’s cautiously optimistic view on agriculture contrasts with the results of a survey released Thursday in which more than half of U.S. farmers said they planned to spend less on capital equipment this year. Fundamentals for American farming remain challenged with increasing competition from South America and the Black Sea region compounded by a strong dollar. Two of Deere’s peers issued disappointing 2020 outlooks.

As Deere reduces production to work through excess inventory and faces weaker demand, Bloomberg Intelligence expects a slow start to fiscal 2020.

Precision Ag

“The Coronavirus has driven investors to a defensive positioning in machinery and Deere has been the defensive play,” Stephens analyst Ashish Gupta said in a Feb. 18 report. “The long-term thesis centers around Deere coming out the farm machinery winner due to investments in precision ag and we do not think an F1Q results shortfall is likely to change that.”

The company reported adjusted earnings of $1.63 a share for the quarter, up from $1.54 a year ago. The average analyst estimate was $1.25. Company-wide sales fell 6%, dragged down by lower construction and forestry shipment volume and unfavorable currency effects.

Shares, down 4.3% this year, rose about 7% before the start of regular trading Friday. Investors will be looking for more detail on the company’s prospects for this year in light of coronavirus on a conference call scheduled for 10 a.m. in New York.

Source Bloomberg

Deere Trying to Break Loose Before China DealTractor maker Deere might be setting up for a breakout as the U.S. and China move toward a trade deal.

DE has been consolidating in an extremely tight range for the last four weeks. It's pressed against near-term resistance around $177. Meanwhile the 50-day simple moving average (SMA) has squeezed up from below as support.

The company's backward-looking results haven't been terrific. Management guided lower on November 27, citing the trade war. But now the market is looking past that with Vice Premier Liu He scheduled to sign "phase one" at the White House on January 15.

Agricultural exports to the Asian country are a big part of that deal. DE is perhaps the most straightforward name for large institutional investors in the U.S. to position for the news.

Buyers may get more active if DE breaks the weekly high near $177. The 50-day SMA can be used for risk management if it goes the other way.

DE Earnings"USDA currently projects farm income in 2019 to reach $88 billion – the highest net farm income since 2014’s $92 billion, but still 29% below 2013’s record high. In addition, nearly 40% of that income – some $33 billion in total -- is related to trade assistance, disaster assistance, the farm bill and insurance indemnities and has yet to be fully received by farmers and ranchers (Is Farm Income Really Up?)."

Quote from- www.fb.org

This leads me to believe that we will see more negative news from Deere's earnings.

Since Oct 18 EPS has missed expectations.

Chickens don't require tractors. Yes it'll increase grain needs for the chicken to eat and what not, but how many brand new tractors do you need per chicken? If my numbers are correct, every 50 lbs of feed (which is only $15) feeds 4 chickens fully grown for a week.

Wheat is currently $5.1525 per bushel, or approximately $191.16 per acre.

Farmer's are broke unless they're growing hemp.

There was a spike in total revenue Q2

This is all speculation. Not advice.

DE Restest/RemountDE has now retested its prior resistance now support level at $171. Since it has remounted nicely at the $173 level and looking to reach new highs at a target of $180. It has been caught in a breakout range of $170-175, with the now retest and remount i'm looking for it to break beyond these levels with a stop alert at $171

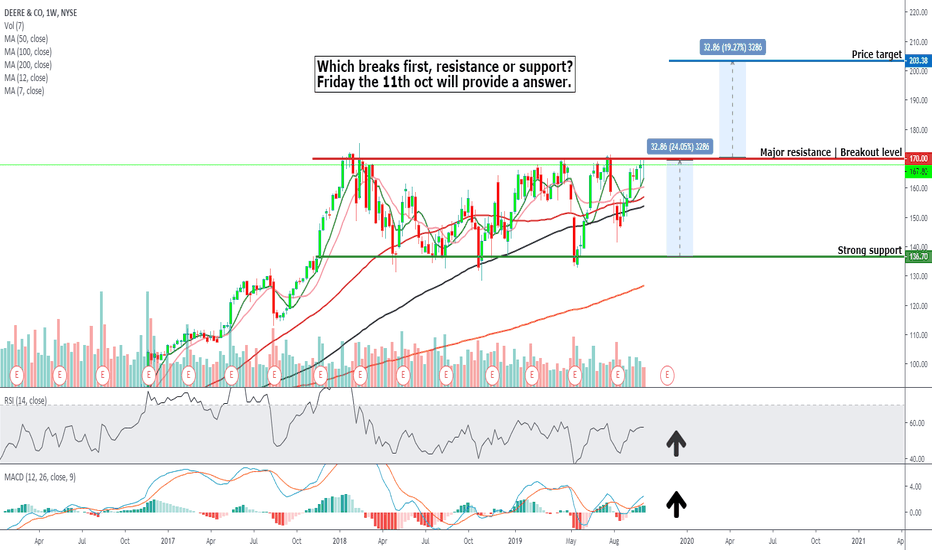

$DE Can DEERE breakout soon ?Resistance has held at $170 despite several very bullish attempts to break through, once gain the price is at that level, and everything is aligning perfectly .

All MA's are bullish and proper sequence.

RSi is also trying to hit a high

MACD and Histogram are in bullish formation.

P/E 16 (reasonable)

Market sentiment is the biggest concern and tomorrows trade talk outcome will determine the long term direction of the stock, if it is a break higher it should be very frantic given the duration of this congestion phase.

Giving DE Short another shot!It doesn't get much more clear as the line in the chart above. We are right at resistance in my most despised trade war stock, DE. The reluctance for this stock to roll over despite tons of bad news, terrible earnings and terrible guidance has been uncanny. I think DE is especially vulnerable here with no good news in the trade war in sight. Let's short DE here.

Short @ 152.60

Target 1: $146

Target 2: 141

Stop on a an hourly closing basis through the drawn line (about ~$1 higher).

$DE #John Deere ShortCurrently in a long put debit spread. Looking to tag bottom of bollinger.

With the current trade war, and farmers being hammered in the midwest, we have technical analysis supporting the bearish macro narrative. Tough year on farmers, isn't the year they are going to be making investments in new big AG equipment.

Trading it short while also COLLECTING time premium. So there is no option decay - you actually get a small gain because of this.