DED trade ideas

DE - looks temptingThe recent pullback for NYSE:DE looks tempting, but I'm not adding right now. I will monitor price until we get in between the FOMC and earnings in May. I'm eying anything between 347-360 as a strong opportunity to accumulate.

DE is a core holding for me. They have strong dividend growth, low payout ratio, and a strong history of earnings beats. They are a leader in their space, switching costs are high, demand for products in their sector will continue to grow, and replacement demand can only be postponed temporarily. The management team seems to have navigated adversity well, which is critical with geopolitical tensions running hot.

DE has a history of volatility around earnings releases and outlook for industrials is influenced by monetary policy. The industrials surged 26% from the September lows to the March highs. They corrected sharply after the March FOMC and their recovery pulled back again when the ISM manufacturing PMI came in below forecast. DE's price movements coincide with its index, but it typically outperforms the S&P, where the index tends to underperform the S&P.

In this chart we see that movement into the lower portion of the rising channel are an infrequent and rewarding opportunity. Momentum and lack of meaningful company updates suggests that the current downtrend will follow the industrial index and that we may see such an opportunity. I will take any opportunity that I see near the center of the blue circled area and then likely take some profit above the solid green trendline. I've drawn a fib time zone that starts with the April 2022 drawdown. It has aligned with major price reversals and has an upcoming marker in May in between the FOMC and earnings.

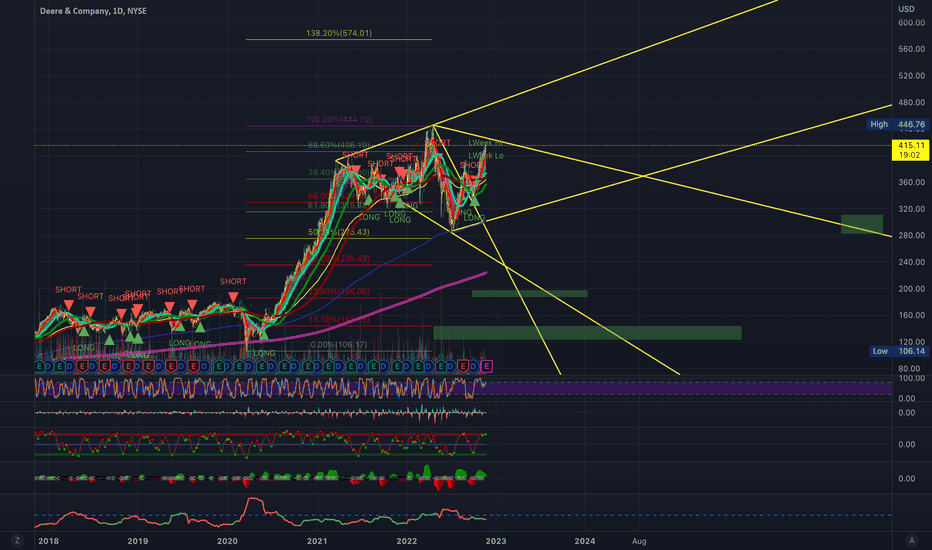

Deere and Co Continues to Meet with Gravity. DEABCD completed, reverse confirmed by break of trendline. Fibonacci for incoming retracement, and it already looks like this was an early catch.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

Will Deere Start Running Again?Industrial stocks have outperformed in the past month. Today’s chart examines a big name in the sector: farm-equipment maker Deere.

First consider the high basing pattern above $400 so far in 2023. It’s a higher low than the troughs of July and September, potentially establishing new support near the previous all-time high from last April.

Next, DE was relatively extended the last time it challenged resistance. But this time it’s rested, which could make some traders expect a breakout.

Third, you have the pair of bullish gaps in November and February after quarterly results beat estimates. That could suggest investors have a positive fundamental view.

Fourth, MACD has turned higher in recent weeks.

Finally, prices are bouncing at their 50- and 100-day simple moving averages (EMA). The eight-day EMA has also crossed back above the 21-day EMA, a potential sign of short-term momentum shifting toward the bulls.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

Beginning Wave V of Impulse off July LoEnd goal is 506-510 by as early as April, but more likely May

Near term there is a decision point at 434 that will at least be tested for breakout in the coming weeks. If it breaksout expect 450, then pullback to test 434 for support, then finally move to low 500s.

Risk is definitely present with the possibility of filling gap down to 404.97; however, assume wave V is realized then it would be proceeded by a corrective wave to apprx. the wave IV low (in this case it would wait and fill gap down then and not now).

Highly recommended stock long-term based on my research on the company, IBD has 448.50 as the Buy-Point. DE impressed on earnings on Feb. 17, which can act as near-term catalyst if buyers pile in on this 0.618 pullback.

Not Financial Advice, but this is a Buy atm.

Oh dear, did you miss Deere & Co ?The weekly chart looks impressive with a strong rally since March 2020....

It is now in a peak zone where the probability of it retracing to 397 price level is quite high.

Once it reaches there, wait for bullish signal before going LONG. If it falls further to 284 to 321, that would be much more attractive price to get in.

Ag Sector (DE and AGCO) trading inline with Ag Commodity FuturesThe peak highs in DE and AGCO during bullish markets tend to coincide with the highs in Corn Futures.

DE (Deer & Co) and AGCO are attractive growth and dividend paying stocks that do well in steady to strong economies even without strong Ag futures markets because of their exposure to the construction and infrastructure sectors . They tend to over-perform in years of Bullish Commodity Markets and Inflationary driven markets just as they have done since the 2020 lows. But just like Ag Futures, the stocks rise Fast and Fall hard. If the Funds decide to leave one (either equities or futures), the other seems to follow lower.

$DE to 330$?Hello dear Traders,

Here is my idea for #DE

Price closed below yellow line (previous month low)

Targets marked in the chart (green lines)

Invalidation level marked with red line

Good luck!

❤️Please feel free to ask any question in comments. I will try to answer all! Thank you.

Please, support my work with like, thank you!❤️

Double top on Deere & Company (DE)With Caterpillar and Deere both reporting stellar earnings and DE being up 57% in last 5 months, add the double top to the mix, this seems like a great opportunity to start a small size short position for both short term and long term swing traders. Short term, we could see a pullback to 400$, long term, this is going back to minimum 300$ within the next year.

oh Deere oh Deere getting some conflicting signals maybe it wants to squeeze to $420 but it's encouraging a diamond with a potential to really take a nose dive... GL trade safe not saying i don't believe in them in the long term, but the short term could really bring some pain. I believe in their robotics and AI development as well as the need for farming to make huge upgrades in machinery over the coming years, but best to stay on the sidelines here and wait to plant some seeds another day imho.

Earnings 11-23 BMOEarnings on the 23rd BMO.

Price hit C in an ABC Bullish pattern and it was off to the races.

A rising wedge has formed that is not valid as the bottom trendline has not been broken.

Rising wedges can stay bullish for quite a while. Neutral until broken.

The wedges are also on hourly.

Possible targets in green valid if price does not break the support or bottom line of the rising wedge it has been in since C is not broken.

Target 1 in larger green type. It is very possible to break up and out of a Rising Wedge. Personally I steer clear of them unless I am already in a security when a wedge forms.

If I am already in I tighten my stop so I am not caught in the fall.

I do not have the .236 marked on this chart, but price is above it.

No recommendation.

Safety is free so use plenty of it (o: