Coca Cola supply and demand analysis and forecastCoca Cola american stock supply and demand trading trading analysis.

Coca Cola stock is in a clear long term uptrend for many months now, creating new demand imbalances and respecting them. No matter which stock trading strategy you use, the bias on Coca Cola stock is bullish unless you are doing intraday or scalping where shorts would also be allowed. As a long term investor, going short or selling short Coca Cola stock with in such a clear uptrend is suicidal.

As a beginner in trading stocks, we recommend you to stay away from lagging indicators. Looking at price action alone without any interference will help you understand how the stock market works, it will help you learn how to trade stocks easier. How to invest in stocks as a beginner? Locate strong bullish impulses that are printing highs higher than previous highs. The strength of the impulse is key to understand where potential new imbalances are created.

Coca Cola american stock has been rallying for months creating new demand levels and retracing to them. The long term bias is bullish with bullish impulses being stronger than market corrections. Demand levels at $37, $41 and $41 have held really way in such a bullish market.

You don’t need huge amounts of money to trade stocks, you can learn how to trade stocks with little money. by joining out trading course.

KOD.B trade ideas

KO Defensive which only dropped 10% in Q4Note how KO only dropped 10% when DIA dropped 20%. A strong defensive and XLP constituent, where it is currently outperforming (XO/XLP). It is possible it may not follow DIA to a double bottom.

46.68 is a nice confluence of the Summer 2018 consolidation top and trend bottom, and neatly fits 1Q19 earnings date.

The KO’s Price Will Surge Above $50 Soon! The Catalyst is CoffeeHey, traders,

That’s the question Coca-cola, one of the world’s largest beverage manufacturers, is asking as it pivots away from its traditional fizzy soft drinks into other niches. After beating expectations of 46 cents earnings per share with 48 cents , KO stock jumped 3%, finally shattering a flat line for the entire year. A lot of that has to do with Coke’s embrace of alternative beverages, including water, sports drinks, and yes, coffee.

Coca-cola coffee??? As odd as it may seem, Coke is going full-in on the coffee biz, buying up coffee chain Costa Coffee, a common staple in European cities. Costa competes with Starbucks, beating out Starbucks in its home market of the UK by 39% to 25% market share.

James Quincy is taking a big risk... The KO CEO is open about his plan to transition the iconic Coke brand from just soda to other beverages, a move he calls ‘total beverage.’ But while consumers love their coke, evidenced by a 1% rise in sales volume of the traditional fizzy drink, it remains to be seen whether they’d be on board for a coffee or energy drink version as well.

Do You Want a Coke With That? Testing Coke Coffee has already launched in 25 overseas markets, including a Coke ‘Plus Cafe Espresso’ and Coke Energy, but none in the US. They’ve also shied away from rebranding Costa as Coke so far, while developing a new line of chilled coffee products under the Costa brand.

Wut We Think: Soda isn’t going anywhere soon, and rising sales volumes means that Coca-cola isn’t going anywhere either. However, this pivot into coffee, and other beverages may prove crucial to Coke’s future success . Keeping an eye on the Southeast Asia market, where ‘Coke Coffee’ was first launched, is a good idea (and if you’re in the area, pick up a Coke Coffee yourself for a test!). If it’s well received and introduced to Western markets, expect a new beverage craze to strike in the near future .

If you like this analysis and would like to receive future updates - Please, follow me on TradingView!

If you follow me, I guarantee you will receive timely updates to this trading strategy in the future, including all new trading signals.

If you agree, please, Like this Idea - This would be the best feedback and encouragement for me!

To your trading success,

Monfex!

Disclaimer

This report is for information purposes only and should not be considered a solicitation to buy or sell any cryptocurrency or cryptocurrency product. Monfex accepts no responsibility for any consequences resulting from the use of this material. Consequently, any person acting on it does so entirely at their own risk.

Ascending Triangle with near-term 5% upsideAfter coming up short on earnings KO seems to have entered an accumulation phase forming an ascending triangle that presents a possible 5% upside move in the near-term. The 3.5% yield also provides an attractive long-term hold incentive if the current uptrend continues and this pattern plays out in our favor.

$KO Having a sip of Coca-Cola pre earnings.Lets hope Pepsi Co Inc gave us a induction of a improvement in the fortunes for Coca Cola. From our perspective we are hoping for a nice jump on earnings to a possible price target of $49.50. Coca Cola is probably the most reconcilable brand name in the world and it has endevoured to offer a more diversified range of products to compete for the dollars of the increasingly health conscious consumers.

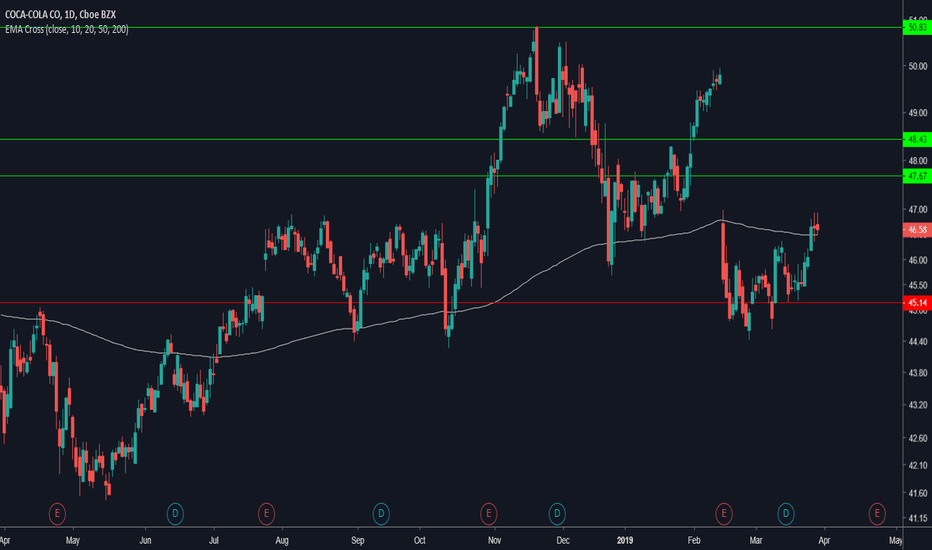

Coca Cola (KO) potential uptrendCoca cola managed to sustain above ema 200 days for 3 trading days.

Going forward, prices could potentially rally towards either of the 3 highlighted targets, as long as prices can above this crucial average.

However a close below $45 could cancel out this uptrend move.

KO potential uptrend?KO managed to close sustain above the 200 days average for the 3rd trading day.

We could potentially see prices rally and retests either of the 3 green targets, as long as prices able to sustain above this crucial average.

However, a close below the red support line will cancel out this uptrend analysis.