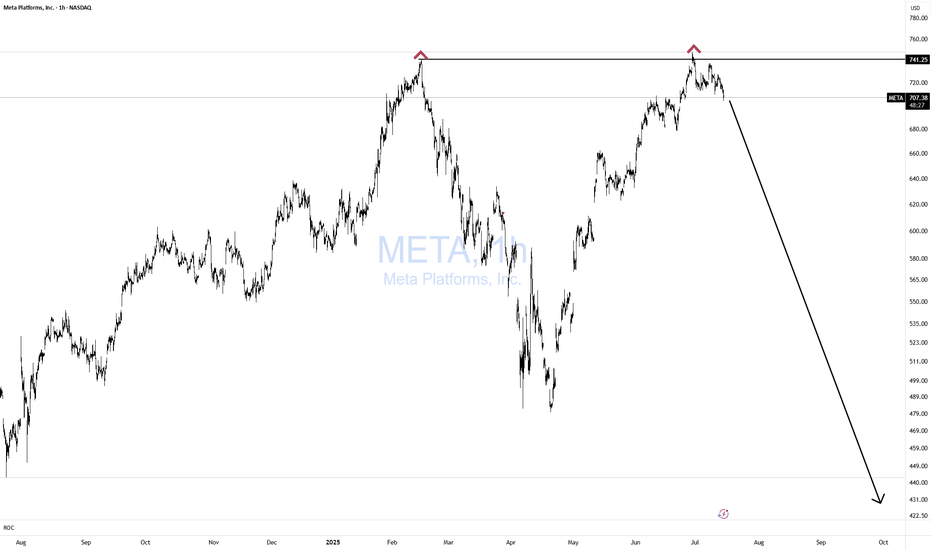

Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time wil

Key facts today

Meta Platforms is set to contribute significantly to S&P 500's second-quarter earnings, with nearly 30% expected from the Information Technology and Communications Services sectors.

Meta Platforms is investing heavily in AI, planning multiple large data centers. The first, Prometheus, is set to launch in 2026, with more clusters in the works.

In Q1 2025, ByteDance outpaced Meta Platforms (META) in revenue, earning over $43 billion versus Meta's $42.31 billion, with both seeing over 20% growth from advertising.

1.00 USD

55.39 B USD

146.11 B USD

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

ISIN

ARBCOM460168

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

META (Meta Platforms Inc.) – Macro Compression Before Expansion META sits at a decisive macro juncture:

A clean SMC structure combined with Fibonacci premium zones signals an imminent directional expansion.

🧠 Macro Thesis:

Price is coiled just under 0.786–0.886 Premium Zone ($729–$760)

↳ This is a known trap area for retail liquidity – institutions often engine

META: Testing Alternative Interconnection TypeResearch Notes

Given expression like this:

Fractal Corridors can be used for horizontal perspective of the same pattern manifestation. Alternative frames of reference exposes how historic swings of various magnitude in some way wire the following price dynamics. www.tradingview.com helps to s

MetaSince the last post I made price has yet to make a new high. It has managed to chop in this area with a slight downward bias. If we're on the verge of the top of the indices, there is no reason to think Meta will continue higher much longer. This pattern, which is clearly corrective in nature, is wa

META | Accumulation Zone Identified — Road to $990?🧠 META | Accumulation Zone Identified — Road to $990?

📊 Ticker: META (Meta Platforms Inc.)

🕒 Timeframe: 1H

📍 Current Price: $717.36

📈 Bias: Bullish accumulation → Expansion

🔍 WaverVanir DSS Thesis

Our system has flagged a liquidity harvesting and accumulation phase between $676–$740. Institutional

META at the Pivot Zone: Big Options Energy Building Ahead of CPIGEX-Based Options Analysis:

META is currently trading at $720.70, right beneath the highest positive GEX wall at $725, which aligns with the Gamma Resistance zone. The call structure above is dense, with strong walls at 730, 735, and 740, suggesting sellers may be active on strength unless price can

3 Reasons the Meta (META) Double Top Is a Buy Signal3 Reasons the Meta (META) Double Top Is a Buy Signal – Rocket Booster Strategy Explained

Meta Platforms Inc. (META) recently printed what looks like a double top pattern on the 4-hour chart.

Many traders are expecting a reversal. But from my perspective, this setup could actually be a trap for e

META (Meta Platforms) – Battle at the Premium | WaverVanir Resea🚨 META is coiling at a critical inflection zone.

We're observing textbook Smart Money Concepts (SMC) behavior on both the daily and intraday timeframes:

🧠 Key Observations:

Price is hovering below the Premium Zone (0.786–0.886 Fibonacci: ~$729–$760) – a known liquidity trap.

15M structure shift s

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

META PLATF. 22/32 144AYield to maturity

15.48%

Maturity date

Aug 15, 2032

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.31%

Maturity date

Aug 15, 2062

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.29%

Maturity date

Aug 15, 2052

US30303M8K1

META PLATF. 22/62Yield to maturity

6.26%

Maturity date

Aug 15, 2062

FB5458293

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.11%

Maturity date

Aug 15, 2052

USU59197AD2

META PLATF. 22/32 REGSYield to maturity

6.01%

Maturity date

Aug 15, 2032

US30303M8W5

META PLATF. 24/64Yield to maturity

6.01%

Maturity date

Aug 15, 2064

US30303M8V7

META PLATF. 24/54Yield to maturity

5.93%

Maturity date

Aug 15, 2054

US30303M8R6

META PLATF. 23/63Yield to maturity

5.93%

Maturity date

May 15, 2063

US30303M8Q8

META PLATF. 23/53Yield to maturity

5.86%

Maturity date

May 15, 2053

FB5458289

Meta Platforms, Inc. 3.5% 15-AUG-2027Yield to maturity

5.28%

Maturity date

Aug 15, 2027

See all METAC bonds

Curated watchlists where METAC is featured.

Big software stocks: Red pill gains

9 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

See all sparks