Key facts today

MicroStrategy, now known as Strategy, achieved an all-time high market capitalization of $128.4 billion, coinciding with Bitcoin surpassing a record price of $122,000.

−1.05 USD

−1.04 B USD

411.64 M USD

About MicroStrategy

Sector

Industry

CEO

Phong Q. Le

Website

Headquarters

Vienna

Founded

1989

ISIN

ARCAVA4601E2

MicroStrategy, Inc. engages in the provision of enterprise analytics and mobility software. The firm designs, develops, markets, and sells software platforms through licensing arrangements and cloud-based subscriptions and related services. Its product packages include Hyper. The company was founded by Michael J. Saylor and Sanjeev K. Bansal on November 17, 1989, and is headquartered in Vienna, VA.

Related stocks

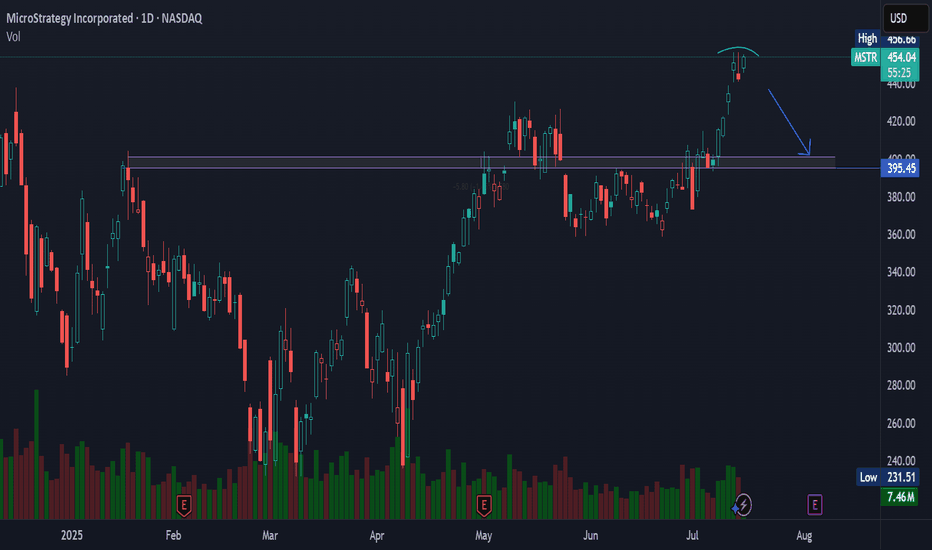

Microstrategy: Renewed Upside MicroStrategy has continued to face downward pressure recently but is now showing more decisive signs of an upward move. We still see greater upside potential in the current magenta wave , though we expect the peak to form below resistance at $671.32. Afterward, the bearish wave should complete t

$mstr can’t get better than this setup Just look how beautiful the chart is. Breakout was imminent after waiting for the right time. This shows how effective the falling wedge pattern always gets out as a winner and everyone loves it because all bitcoin and related stocks mainly depend on falling wedge patterns. Trust the process!!

MicroStrategy ($MSTR) – Bitcoin Proxy Setting Up AgainMicroStrategy Incorporated NASDAQ:MSTR remains the definitive institutional proxy for Bitcoin exposure, uniquely combining its enterprise software operations with a high-conviction, leveraged Bitcoin accumulation strategy. Its $1.42B BTC purchase in April 2025 further cements this thesis, making M

$MSTR Continues on last weeks path!NASDAQ:MSTR continues to breakout above the channel after a retest as support.

High Volume Node at $440 may proof tough but if price breaks through we could see a strong FOMO induced breakout into price discovery.

Analysis is invalidated below the channel at $358.

Safe Trading

MSTR stock has seen a strong rally since JuneSince June, MSTR stock has seen a strong rally—rising from the mid‑$300s to above $430—driven by a few key factors:

Bitcoin’s continued ascent has fueled sentiment. Bitcoin recently hit fresh record highs (above $118K), driven by a weakening dollar and bullish macro trends, which in turn boosted bi

MSTR MICROSTRATEGY As of July 11, 2025, MicroStrategy Incorporated (MSTR) is trading at approximately $434.58 per share on the NASDAQ, showing a strong daily gain of about 3.04% (+$12.84). The stock has experienced significant growth recently, with a 3-month return of around 45% and a 1-year return exceeding 220%.

Key

MSTR -- Cup & Handle Breakout // Long & Short SetupsHello Traders!

There is a beautiful cup and handle pattern that has formed on MSTR (Microstrategy).

This pattern offers us a wonderful long setup, as well as a potential short at the all time high.

Pattern Failure: If price both breaks and confirms below the C&P neckline the pattern is void.

Price

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MSTR5946535

MicroStrategy Incorporated 0.0% 01-DEC-2029Yield to maturity

5.77%

Maturity date

Dec 1, 2029

US594972AR2

MICROSTRAT. 24/29 CV ZOYield to maturity

−0.25%

Maturity date

Dec 1, 2029

US594972AT8

MICROSTRAT. 25/30 CV ZOYield to maturity

−4.69%

Maturity date

Mar 1, 2030

US594972AN1

MICROSTRAT. 25/32 CVYield to maturity

−7.44%

Maturity date

Jun 15, 2032

MSTR6034213

MicroStrategy Incorporated 0.875% 15-MAR-2031Yield to maturity

−8.68%

Maturity date

Mar 15, 2031

MSTR6032672

MicroStrategy Incorporated 0.625% 15-MAR-2030Yield to maturity

−14.29%

Maturity date

Mar 15, 2030

US594972AP6

MICROSTRAT. 24/28 CV 144AYield to maturity

−19.11%

Maturity date

Sep 15, 2028

See all MSTRD bonds

Curated watchlists where MSTRD is featured.