Why To Draw Before You Trade ?Hello fellow traders and respected members of the trading community, In a fast paced market dominated by automation and algorithms, we often forget the value of simply picking up a tool and drawing on our charts. Let’s revisit why this fundamental habit still holds the power to sharpen our edge and elevate our decision-making.

Why We Should Draw and Trade? Turning Charts Into Clarity

Introduction-:

In an age of auto-generated indicators, black-box algorithms, and AI-driven signals, many traders are drifting away from one of the most fundamental trading tools: manual chart drawing.

But what if the very act of drawing is not just an old habit—but a powerful trading edge?

This publication explores why actively drawing on charts and trading based on visual context can elevate your market understanding and execution like nothing else.

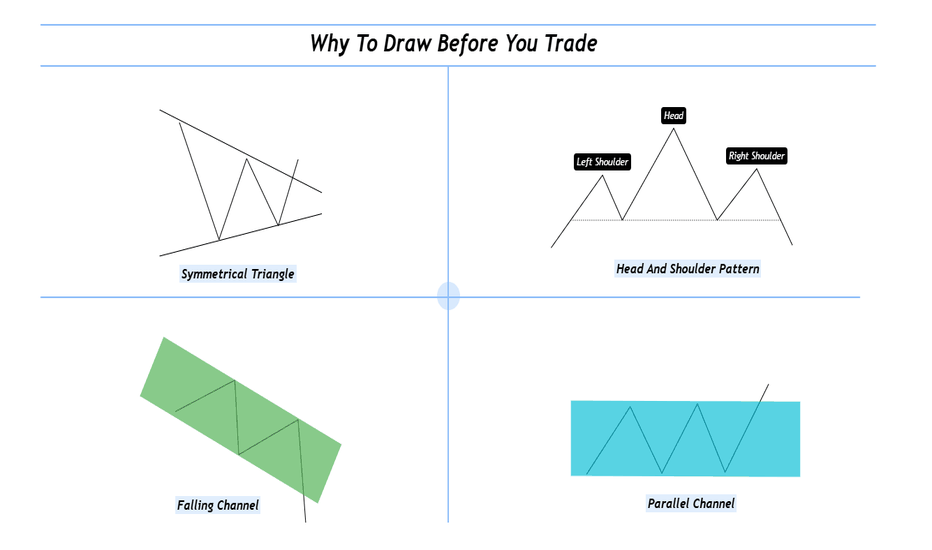

1. What Does It Mean to “Draw and Trade? Drawing isn’t just technical analysis it’s interactive thinking. When you draw, you're mapping the structure of the market using tools like

Trendlines

Support & Resistance zones

Chart Patterns (Head & Shoulders, Flags, Triangles, etc.)

Supply & Demand levels

Gaps, Fibonacci levels, and more

Once the chart is marked, you’re no longer entering trades blindly you’re entering with context, clarity, and confidence.

2. The Psychology Behind Drawing

Manual drawing engages your focus, discipline, and decision-making. You don’t just predict, you process and It forces you to slow down helping reduce impulsive trades. Drawing anchors your emotions and keeps you mindful. The act of drawing becomes a psychological filter—helping you trade from structure, not stress.

3. Why It Beats Indicator Only Trading?

Indicators are reactive. Drawing is proactive.

Here’s the difference:

Indicators show what already happened

Drawing lets you prepare for what could happen

You learn to-:

Anticipate breakouts, fakeouts, and reversals, Understand market structure and Develop your own strategy not depend on someone else's signal. In short you become the strategist, not just a follower.

4. The “Chart Time” Advantage

Just like pilots need flight hours, traders need chart hours. Drawing charts manually gives you those hours.

You start to see patterns that repeat and notice behavior shifts before they show on indicators. Build a visual memory of how the market moves and It’s this visual experience that separates analysts from traders.

5. Real-World Edge: Case Studies

Wyckoff Distribution: Mapping the structure—BC, AR, ST, UT, LPSY—helps anticipate smart money exits.

Gap Zones: Marking an old breakaway gap can help predict future rejection or support

Demand Zones + Fib Confluence: Drawing reveals high-probability reversal zones most indicators miss

Each drawing becomes a trade-ready story with logic and risk control.

6. From Drawing to Discipline

Drawing is not just prep it’s planning. You trade with a clear plan and pre-identified entry/exit zones this reduced emotional interference and It becomes your personal visual rulebook. No noise no randomness just structure driven action.

7. Final Thoughts: The Trader’s Mind vs. The Machine

Yes, AI and indicators are useful.

But your most powerful edge?

Your mind.

Your eyes.

Your experience sharpened through drawing.

If you want to evolve from a reactive trader to a consistent performer, here’s the golden rule:

Stop watching. Start drawing. Trade what you see, not what you hope.

I hope you will like this post, Thanks for giving your valuable time for reading.

Regards- Amit

NVDAC trade ideas

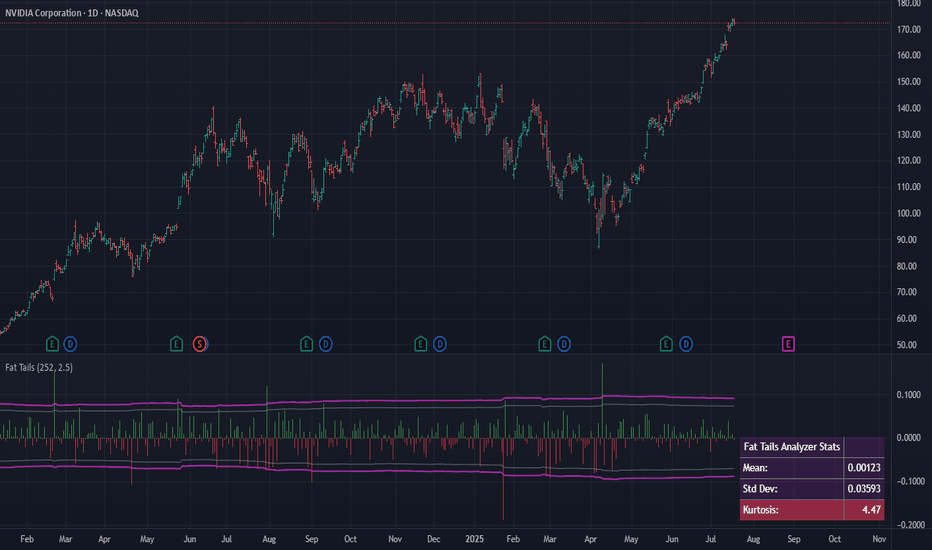

Fat Tails: Why Mean Reversion is a Rarity in Financial MarketsIn financial markets, volatility is a measure of how much asset prices change over time. Traditionally, finance assumes that asset returns fit neatly into a "bell-shaped" normal distribution curve. This implies that prices usually stay close to their average, and extreme surges or drops (beyond three standard deviations) are very rare, with approximately a 0.3% probability. However, reality consistently refutes these expectations, showing that powerful fluctuations occur much more frequently in markets. This is the phenomenon of "fat tails".

What are "Fat Tails"?

"Fat tails" occur when the probability of large price changes (up or down) is significantly higher than predicted by a normal distribution. Instead of a neat "bell-shaped" curve, we see distributions with "thick tails," like Lévy, Pareto, or Cauchy distributions. Such distributions are characterized by "excess kurtosis" (kurtosis > 3). Kurtosis is a statistical measure that shows the "peakedness" of a distribution and the "thickness of its tails." If kurtosis > 3, the tails are "heavier" than those of a normal distribution, and the peak is often higher—meaning that small deviations from the mean also occur more frequently, but extreme events are not as rare as they seem. These distributions better describe how markets behave, especially volatile ones like cryptocurrencies, where extreme movements happen 5-10 times more frequently than normal distribution models would predict.

For example, in October 1987 (Black Monday), the Dow Jones index plummeted by 22% in a single day—an event that a normal distribution would estimate as practically impossible. In 2020, WTI crude oil prices turned negative (–$40 per barrel), which also doesn't fit standard models. And Bitcoin, throughout its history, has repeatedly shown daily movements of ±20%, which is 50–100 times more frequent than a Gaussian distribution would predict.

Imagine two graphs:

Gaussian Bell Curve (Normal Distribution): Most events fall within ±3σ, and extremes are almost imperceptible.

Fat-Tailed Distribution (e.g., Pareto): The "tails" are thick, and rare events (like crises) stand out like icebergs.

These cases illustrate why classical risk models like VaR often fail. Let's explore how science attempts to address this problem.

What Does This Mean for Risk?

"Fat tails" change the rules of the game for risk management. Nassim Taleb, a prominent voice on this topic, argues that they invalidate conventional methods of financial analysis. Standard estimates of the mean, variance, and typical outliers of financial returns become unreliable. Models like VaR (Value at Risk), which rely on a normal distribution, often underestimate how badly things can go wrong. They are simply unprepared for "black swans"—rare but devastating events that can crash the market. As Taleb stated, "ruin is more likely to come from a single extreme event than from a series of bad episodes".

"Tail risk" is when an asset or portfolio experiences a significant change in value (more than three standard deviations from its current price) due to an unusual and unexpected event. Such events not only impact prices but can also trigger panic, liquidity issues, and spill over into other markets.

Although "fat tails" seem obvious, some economists (e.g., proponents of the efficient market hypothesis) argue that extreme events are merely rare but explainable deviations. They contend that if all factors (geopolitics, liquidity changes) are properly accounted for, the distribution isn't as "heavy-tailed" as it appears. However, the crises of 2008 and 2020 demonstrated that even the most sophisticated models often underestimate tail risk.

How Does Science Address "Fat Tails"?

To grapple with these tails, researchers have developed several approaches:

Extreme Value Theory (EVT): This method focuses specifically on the "tails" of the distribution to better predict extreme events. EVT helps to more accurately estimate risks and VaR, especially when a normal distribution clearly doesn't apply, and data more closely resembles Fréchet or Pareto distributions.

Jump-Diffusion Models: These models explicitly incorporate sudden, discontinuous price changes, or "jumps," in addition to continuous diffusion movements. Robert Merton, as early as 1976, proposed combining smooth price movements with Poisson jumps to better describe the market. Jumps are interpreted as "abnormal" price variations caused by important news or systemic shocks.

Intraday Data Analysis: Barndorff-Nielsen and Shephard (2004) developed a method to decompose total price variation into a continuous component and a jump component using high-frequency data. This helps to more accurately forecast how much the market can fluctuate.

GARCH Models: These models capture "volatility clustering"—the tendency for periods of high volatility to be followed by more high volatility, and periods of calm by more calm.

But if "fat tails" are so prevalent, why do many still believe in "mean reversion"? Here's the catch...

Why Mean Reversion Doesn't Work

The idea of "mean reversion" is that asset prices or returns will eventually revert to their long-term average. It's popular in finance, but with "fat tails," it's not so simple:

Unstable Mean: In markets with "fat tails," the "mean" itself is constantly shifting. If the average value is unstable, then talking about reverting to it becomes less predictable and meaningful. Moreover, in such distributions, the sample mean often doesn't align with the theoretical mean.

Extreme Events Dominate: A single powerful fluctuation can turn everything upside down. Instead of "returning to normal," the market can enter a new regime of high volatility for an extended period.

Jumps Are Not Just Noise: Significant price changes due to news or shocks are not temporary outliers that can be easily smoothed out. They represent serious risks that cannot simply be waited out.

Volatility Clustering: Markets tend to "get stuck" in periods of high or low fluctuations. After a strong move, the market may not calm down but continue to fluctuate, which breaks the idea of mean reversion. Interestingly, "fat tails" arise not only from fundamental reasons but also from irrational crowd behavior. When the market falls, investors massively sell assets, exacerbating the crisis (a positive feedback effect). This explains why tails are "heavier" in cryptocurrencies—there are more speculators and fewer institutional players stabilizing the market.

Conclusion

Mean reversion works only in "calm" times when the market behaves predictably. But in reality, "fat tails" and powerful fluctuations are not rare, but a part of financial market life. To cope with this unpredictability, more sophisticated models and risk approaches are needed. Understanding "fat tails" is key to managing risks in the chaotic financial world.

$NVDA – Going Long Long LONGTaking a long position here at $98 – yes, despite the noise.

There’s no denying the pressure across semiconductors following renewed tariff threats from the Trump administration. But I believe this is more short-term overreaction than long-term damage. Any meaningful negotiation or de-escalation could act as a slingshot for these names, especially leaders like Nvidia.

Nvidia's fundamentals remain incredibly strong. The company is still outpacing its peers in AI, data centers, and gaming hardware. Profitability remains intact, and there’s no indication of a breakdown in their competitive edge.

Technicals are giving us some strong signals:

We're seeing a long-term bullish divergence forming.

RSI is approaching oversold territory – rare for Nvidia and historically a signal for strong bounces.

Price is nearing key long-term support levels that held in previous cycles.

I'm positioning early here because I believe the broader market is mispricing geopolitical risk. If the situation improves – and it often does faster than expected – NVDA is one of the first names that will rebound aggressively.

Let’s see how this plays out, but I’m confident this is a high-conviction entry point in the 80's and 90's.

$NVDA - $270 PT in BULL ChannelThe stock is currently bouncing off of the lower channel line of the rising Bull Channel. Price action has created a Cup and Handle. The projected Price Objective sits at around $270. Remember, the height of the cup is the project target which from current stock price extends to around $270.

NVIDIA ($NVDA) Elliott Wave Outlook: Larger Pullback on the HoriNvidia (NVDA) continues its remarkable ascent, consistently reaching new all-time highs and reinforcing a robust bullish outlook. The ongoing rally, which began from a significant low on April 7, 2025, remains structured as an impulsive wave pattern, indicative of strong upward momentum. However, despite the potential for further short-term gains, the cycle appears mature. This suggests a larger-degree pullback could be imminent. Investors should exercise caution when considering chasing this rally in shorter time frames, as the risk of a corrective move grows.

In the short term, the cycle initiated from the June 2 low is progressing as a lower-degree impulse. From this low, wave ((i)) peaked at $144, followed by a corrective pullback in wave ((ii)) that concluded at $137.88. The stock then surged in wave ((iii)) to $159.42. The subsequent wave ((iv)) correction unfolded as a double-three structure, with wave (w) ending at $151.49, wave (x) at $154.98, and wave (y) completing at $151.10, finalizing wave ((iv)). Currently, Nvidia is advancing in wave ((v)), exhibiting a five-wave subdivision. Within this, wave (i) of ((v)) reached $160.98, with a minor pullback in wave (ii) concluding at $157.34. As long as the pivotal low at $142.01 holds, any near-term pullbacks are likely to attract buyers in a 3, 7, or 11-swing pattern, supporting further upside potential. This technical setup underscores Nvidia’s strength but highlights the need for prudent risk management.

A bit of profit taking on NVDA and then up again?NASDAQ:NVDA is the most talked about and everyone is capitalizing on that. Let's take a look.

NASDAQ:NVDA

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Nvidia Market Capitalisation Reaches $4 TrillionNvidia Market Capitalisation Reaches $4 Trillion

Yesterday, Nvidia’s (NVDA) share price surpassed $162 for the first time in history. As a result, the company’s market capitalisation briefly exceeded $4 trillion during intraday trading (according to CNBC), making Nvidia the first publicly listed company to reach this milestone.

The rise in NVDA’s share price is being driven by both bullish sentiment across the broader equity market—which appears optimistic ahead of the upcoming Q2 earnings season—and evidence of sustained demand for Nvidia’s products, as artificial intelligence technologies continue to gain widespread adoption.

Noteworthy developments include:

→ Nvidia may begin producing a specialised AI chip for the Chinese market this autumn, potentially circumventing current export restrictions;

→ Perplexity, a company backed by Nvidia, is launching an AI-powered browser aimed at competing with Google Chrome.

Technical Analysis of NVDA Chart

In our previous analysis of NVDA’s price action, we:

→ Drew an ascending channel;

→ Highlighted bullish conviction in overcoming the $145–150 resistance zone.

The channel remains valid, with the current price trading near its upper boundary. However, the RSI indicator is showing signs of bearish divergence, suggesting that the stock may be vulnerable to a near-term correction—potentially towards the median line of the existing upward channel.

At the same time, a major shift in the prevailing bullish trend appears unlikely. The $145–150 range may serve as a key support zone for NVDA in the foreseeable future.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVDA: Ready for a Gamma Squeeze or Cooling Off? for July 10NVDA: Ready for a Gamma Squeeze or Cooling Off? Here's the Setup You Need 🎯

Options Sentiment (GEX Analysis):

NVDA is trading around $163.35 and sitting just above the Gamma Wall at $162.50, which also marks the highest positive NET GEX zone—a key resistance created by dealer positioning. Above that, the second CALL Wall is stacked near $165, with further resistance layering in toward $170 and $172.50.

Below, there’s a liquidity pocket around $157.50 (HVL zone), and deeper PUT support doesn’t come in until $152.50–$151.00.

* GEX: Bullish leaning (CALLS 2.6% domination, GEX bar fully green)

* IVR: Low at 5.9, and IVx Avg 38 → Options are relatively cheap.

* Sentiment: Leaning bullish with potential for a gamma squeeze if momentum builds above $165.

🟢 Strategy Suggestion:

Consider 160C or 165C weekly calls (with tight spreads) if NVDA holds above $162.50 and breaks through $165 with volume. A gamma squeeze toward $170 is on the table.

Risk-managed PUTs (e.g., 158P) only if price flushes back below $160 support with momentum.

1-Hour Chart Technical Outlook:

NVDA has broken out of the previous range, flipping internal structure bullish. The CHoCH and BOS confirm trend change earlier this week, and the price is now consolidating just under a resistance zone (purple box) near $164.

Support below is layered at:

* $160 (broken resistance, now key support)

* $158.05 (previous structure low)

* $152.00–151.00 (demand zone + GEX support alignment)

Resistance:

* $164.41 (current high)

* $167.50, $170, $172.50 (GEX option walls)

Structure is showing a rising wedge/channel pattern; however, we’re still trending strong with clean higher lows.

🟢 Long Trade Setup (Bullish Continuation):

* Entry: Above $164.50 with breakout confirmation

* Target: $167.50 → $170

* Stop: Below $160 (or tighter below $162.50 based on risk appetite)

🔴 Short Trade Setup (Reversal Scenario):

* Entry: Breakdown below $160 with rejection from $163–$164

* Target: $158 → $152 zone

* Stop: Above $165

My Thoughts:

NVDA is sitting in a key decision zone. As long as it holds above $162.50, bulls have the edge to push this higher into the next GEX walls. Watch for confirmation on $164.50 breakout for continuation. If it fakes out and drops below $160, that would likely trigger a downside flush to $158 or lower.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

NVIDIA – Best Buy of the Decade (4T Record but now resistance)🚀🔥 NVIDIA – Best Buy of the Decade Post #6

💡📉 Great but why am I taking half profits Today?

Back in July 2021, I named NVIDIA "The Best Buy of the Decade. " Today, it just hit a mind-blowing milestone — becoming the first company to reach a $4 trillion market cap. But here's the thing... that happened right at major resistance.

From our initial call in 2021 , to the target at $143.85 drawn via parabola in 2023, to the April 2025 re-entry at $95, it’s all on the chart — and it's been a textbook ride so far.

At the current level of $163.89, we’re pressing into serious overhead resistance. This doesn’t mean the story is over — not even close. But it could mean we take a breather before the next leg higher.

🧭 Targets ahead remain unchanged:

🔹 First stop: $182.85

🔹 Long-term vision: $227.41

What started as a bold macro call in 2021 has now become a multi-year thesis with precision updates along the way. This is post #6 in the NVIDIA journey — and if you scroll back through the chart, each piece has built on the last with clarity and conviction.

🎯 NVIDIA is not just a tech stock — it’s the AI backbone. But every cycle has pauses, and this one looks ready for a short rest before we see the next breakout.

Stay sharp, follow the structure, and honor the parabola.

One Love,

The FX PROFESSOR 💙

Additional info, for those who like to dive deeper into NVDA:

🔍 Technical Breakdown Version

For the chartists and structure followers, here’s the breakdown:

📌 2021: Original call — "Best Buy of the Decade"

📌 2023: First parabola plotted, projecting toward $143.85 — target hit precisely

📌 April 2025: Market offered $95 re-entry — second parabola begins

📌 Now: Price sits at $163.89, testing resistance from both structure and Fibonacci

📌 Next levels:

- $182.85 → Key extension level

- $227.41 → Long-term target based on full parabolic arc

Current structure suggests a possible pause before continuation. No need for panic — parabola remains valid unless structure is broken. Volume still supportive, and price action is following projection beautifully.

🧠 AI Macro Narrative Version

The big picture? NVIDIA isn't just another semi stock — it’s the nervous system of the AI revolution.

From gaming → crypto → AI, NVIDIA has consistently been first to adapt, and now it’s the leader in AI hardware infrastructure. The $4 trillion milestone is more than symbolic — it represents capital reallocation toward AI as the next dominant sector.

🧠 Key macro takeaways:

AI demand is insatiable

Data centers need NVIDIA

Generative AI isn't slowing down

Institutions are still buying — not selling

The resistance we see now isn’t weakness — it’s the market pausing to digest before another acceleration. Just like every past cycle... we ride, retrace, reload, and resume.

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

NVIDIA made history! First company with $4 trillion market cap!NVIDIA Corporation (NVDA) became today the first company in history to surpass a $4 trillion market value, as A.I. bulls extended the recent rally and pushed the price past the approximate $163.93 level needed to reach this market capitalization threshold.

The long-term trend on the 1D time-frame couldn't look more bullish. Coming off a 1D Golden Cross less than 2 weeks ago, the price has turned the 1D MA50 (blue trend-line) into Support and sits at +88.13% from the April 07 2025 Low.

This is the exact set-up that the market had when it was coming off the 2022 Inflation Crisis bottom (October 13 2022). As you can see, both fractals started with a -44% decline, bottomed and when they recovered by +88.13%, there were just past a 1D Golden Cross. In fact that Golden Cross (January 24 2023) was the last one before the current.

NVIDIA entered a Channel Up (green) on its recovery and for as long as the 1D MA50 was supporting, it peaked on the 2.618 Fibonacci extension before it pulled back below it.

If history repeats this pattern, we are looking at a potential peak around $390, which may indeed seem incredibly high at the moment, but as we pointed out on previous analyses, the market is in the early stages of the A.I. Bubble, similar to the Internet Bubble of the 1990s.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NVDA$ - possible pullback to $50 (-67% from pick) in the making.NASDAQ:NVDA have done this before (67% pullbacks after long rally).

NVDA is following very predictable patterns for many years now, despite excitement around this stock - stock made "new recent low" and current rally maybe just a part of a "head and shoulders" in the making. If "new all time high" is not reached with in the next few weeks - we will see stock pullback to $50 or less in the next 6-9 month.

NVDA Testing Gamma Ceiling — Eyes on 162.5 🔩 Options Sentiment & GEX Analysis

NVDA is pressing into a critical Gamma Wall at 162.5, which aligns with the highest positive NET GEX and second-tier Call Wall concentration. Dealers are likely short calls here, meaning a breakout could trigger gamma-induced hedging, fueling a squeeze.

* Call Walls: 162.5 → 165 → 167.5 → 170

* Put Walls: 157.5 → 155 → 152

* GEX Skew: Strong bullish exposure into 162.5, suggesting a resistance zone but also potential fuel if breached.

* IVR: 6.6 — Implied Volatility remains cheap, ideal for directional plays.

* IVx Avg: 38.6 — still elevated, giving edge to debit spreads.

* Put/Call Ratio: 0.2% Puts – overly call-heavy positioning adds risk of dealer chasing if breakout occurs.

🧠 GEX-Based Option Trade Ideas

📈 Bullish Gamma Squeeze Play

* Setup: Buy 160/165 Call debit spread (Jul 19 or Jul 26 expiry).

* Trigger: Break & close above 161 with volume.

* Target: 165 → 167.5

* Why: Breaching Gamma Wall at 162.5 opens room to next Call Walls. Dealer hedging could force rapid upside.

📉 Bearish Fade Setup

* Setup: Buy 160/155 Put debit spread

* Trigger: Failure to reclaim 161–162.5 zone with clear rejection pattern.

* Target: 157.5 → 155

* Why: Rejection at GEX ceiling could unwind recent rally, especially if broader market rolls over.

🧭 1-Hour Technical Chart Overview

NVDA is consolidating tightly under its Gamma resistance within a clear ascending channel.

🔍 Structure & SMC Highlights

* Series of Breaks of Structure (BOS) confirms bullish trend.

* CHoCH zones have been retested and flipped bullish around 157.5.

* Current price is compressing under a key supply zone at 160.98–162.5, with rising trendline providing support.

* A clean bullish reaction from the 157.5 order block shows buyer interest is intact.

🔨 Levels to Watch

* Key Resistance: 161 → 162.5 (GEX ceiling, prior swing highs)

* Support Zone: 157.5 → 155 (prior CHoCH and OB zone)

* Trendline: Acting as dynamic support from June lows

📌 Trading Plan (1H Price Action Focus)

Long Setup

* Trigger: Break above 161 with bullish candle close and volume

* Entry: 161.20–161.50

* Stop: Below 159.80 (last demand zone wick)

* Target: 165 first, then 167.5

* Bias: Trend continuation + gamma squeeze

Short Setup

* Trigger: Rejection at 162.5 with bearish engulfing or shooting star

* Entry: 161.80–162.50

* Stop: Above 163

* Target: 157.5 → 155

* Bias: Fade extended rally into gamma wall

🧠 Summary

NVDA is perched just under a powerful options-driven ceiling. Whether this turns into a breakout squeeze or a sharp rejection depends on how price reacts to the 161–162.5 zone. Traders should prepare for both scenarios with defined-risk debit spreads and lean into price confirmation before committing.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk carefully.

Nvidia - New all time highs!Nvidia - NASDAQ:NVDA - breaks out now:

(click chart above to see the in depth analysis👆🏻)

Within two and a half months, Nvidia rallied more than +70%. Following this recent bullish strength, a retest of the previous highs was totally expected. But this does not seem to be the end at all. There is a much higher chance that we will see new all time highs soon.

Levels to watch: $150

Keep your long term vision🙏🙏

Philip (BasicTrading)

NVIDIA (NVDA)-Trade PlanNVDA, After an explosive run powered by GenAI infrastructure and bullish earnings, the chart is setting up for either a bullish continuation or a healthy pullback.

With volatility tightening and volume compressing, this is a great moment to prepare for either breakout or breakdown scenarios.

🎯 Trade Plan – Tiered Long Setup

📌 Entry Zones (Tiered Buying):

🔹 $150

🔸 $140

🔻 $120

📈 Profit Targets:

TP1: $160

TP2: $175

TP3: $200+ – Long-term continuation play if AI macro momentum persists

📌 DISCLAIMER: This idea is for educational purposes only. Always use proper risk management and assess your own strategy

NVDA at a Make-or-Break Zone – Trade Setups Ahead 🔍 Options GEX Insights (Gamma Exposure):

* GEX Map Observation:

* NVDA is currently trading near 158, slightly under the major Gamma Wall at 160.98.

* This level marks the highest positive net GEX – strong resistance due to heavy call positioning.

* Above that, additional call walls stack at 162.5 → 165 → 167.5, creating a squeeze zone if price breaks out.

* Below, support levels sit at 155 (2nd PUT wall) and 152.5 (3rd PUT wall).

* Volatility & Options Sentiment:

* IVR: 8.8, IVx: 40.8 – low implied volatility rank = cheap options.

* Put Positioning: Only 1.4% = call-heavy environment, skewed bullish.

* Positive GEX (+) across expiries shows dealers will hedge upward if we move beyond 161.

🟢 Bullish Scenario (Breakout/Squeeze Setup):

* Break over 160.98 could ignite a gamma squeeze toward 165–167.5 range.

* Ideal for low delta CALL verticals or debit spreads targeting the 165 zone.

* Weekly options are cheap due to low IV.

🔴 Bearish Rejection Scenario:

* If price stays pinned under 160 and loses 155, dealers start to de-hedge – momentum toward 152/150.

* Consider put spreads or a cautious fade if it breaks structure.

📌 GEX Summary Suggestion:

If NVDA stays under 160, price may remain pinned or retrace. But above 161 opens the gamma doors to 165+. Cheap IV = opportunity.

📊 1-Hour Price Action Technicals:

* Market Structure:

* Previous BOS toward the upside has stalled inside a consolidation box under 160.

* Multiple CHoCH zones form below current price, hinting at exhaustion.

* Price is stuck within a wedge, coiling beneath resistance = compression phase.

* Support & Resistance Zones:

* Resistance: 159.34 → 160.98 (Gamma Wall and price supply).

* Support: 155.34, then 151.10.

* Bullish OB remains untested around 151 area if price flushes.

* Volume & Trend:

* Volume declining during chop = balance phase.

* RSI & MACD show slight bearish divergence, favoring caution near top of range.

⚙️ Trade Thoughts:

* Scalp Setup:

* Above 160.98 = scalp long toward 162.5/165, tight stop at 159.3.

* Below 155 = scalp short toward 152 zone.

* Swing Setup:

* Long only on strong breakout close above 161 with volume.

* Short swing possible under 155 if CHoCH confirms trend flip.

Conclusion:

NVDA sits at the pivot point of either breaking out toward 165+ or rejecting and retracing toward 152. GEX and price both hint at a coiled move ahead. Stay nimble, follow the volume.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trade at your own risk.

NVDA ShortNVDA is currently exhibiting short-term bearish order flow on the 15-minute chart, with price making lower highs and lower lows following a clear CHoCH (Change of Character) to the downside. The current leg suggests continued weakness as price retraces toward the highlighted bullish order block around the 156.20–157.00 range, aligning closely with the 50% equilibrium level of the last bullish impulse.

This area represents a high-probability demand zone where we anticipate a potential bullish reaction. A confirmation entry (e.g., bullish BOS or lower timeframe CHoCH within the OB) will be required to validate a long setup from this zone. Should confirmation present itself, upside targets can be trailed back toward recent highs near 159.00–160.00.

Risk Management Note:

Always wait for confirmation before entering against the prevailing short-term trend. Use a well-defined stop-loss below the order block and calculate your position size based on your overall risk tolerance (typically 0.5–1% of account equity per trade). Avoid overleveraging, and remember that patience and discipline are key to capital preservation.

How To Spot The Breakout In 3 Steps Or More..In this video we dive into how to spot the breakout

but here is a catch we are using the Stochastic RSI

to spot these breakouts.

Also this spotting of these breakouts is happening

together with the Rocket booster

strategy.

Watch this video to learn more.

Disclaimer:Trading is risky please learn risk management and profit

taking strategies.Also feel free to use a simulation trading account

before you trade with real money.