PM trade ideas

Hard habit to breakFor the last few months, when you were out doing your grocery shopping and donning the face masks, did you notice how the smokers slow down and try to take a puff while adjusting their face mask uncomfortably?

You see, we are all creatures of habits. And I don't want to sound like a broken record, educating why smoking is bad for health, blah blah blah.......

I was an ex-smoker so I fully understand how hard it was to quit .......anyway, that for another story.

You will be surprised that people smoke for many illogical reasons like :

I have nothing better to do

when I smoke, I get more creative

It helps me to destress

I sleep better at nite

So, I aint going to judge whatever the reasons the smokers smoke.

Chart wise, it looks great with a strong support at 67.16. If it breaks out from the bullish trend line (dotted), we can then expect it to rise to 72 level before going higher.

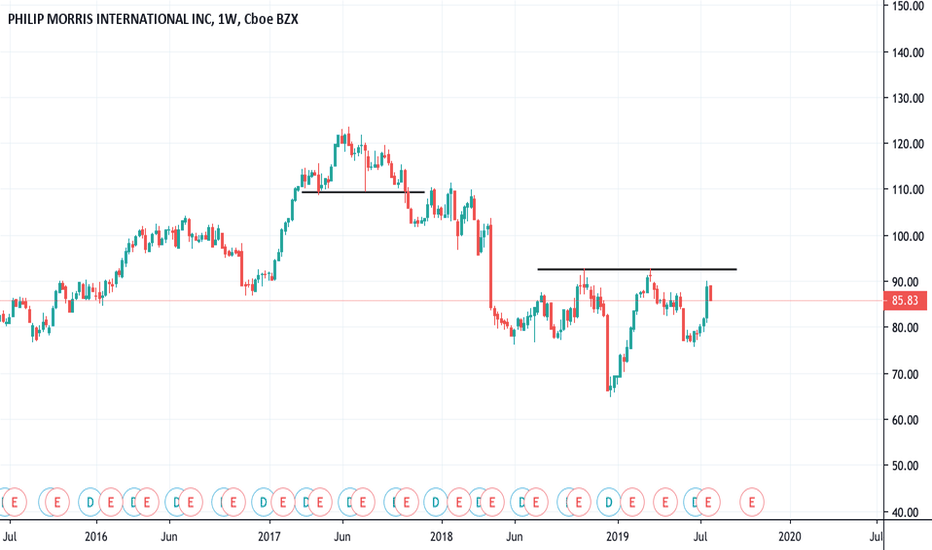

PM, Philip Morris International Inc.- Head & ShouldersNYSE:PM

Do you know this pattern? The so-called head and shoulders in the analysis of financial markets is an opportunity to be taken if you trade. Do you know why? It's all about math and probability. Staying on the statistical side in your favor is what creates potential financial growth, which in turn will give you time to do what you like.

Daily PM stock price trend forecasts analysis 15-JUL

Investing position: In Rising section of high profit & low risk

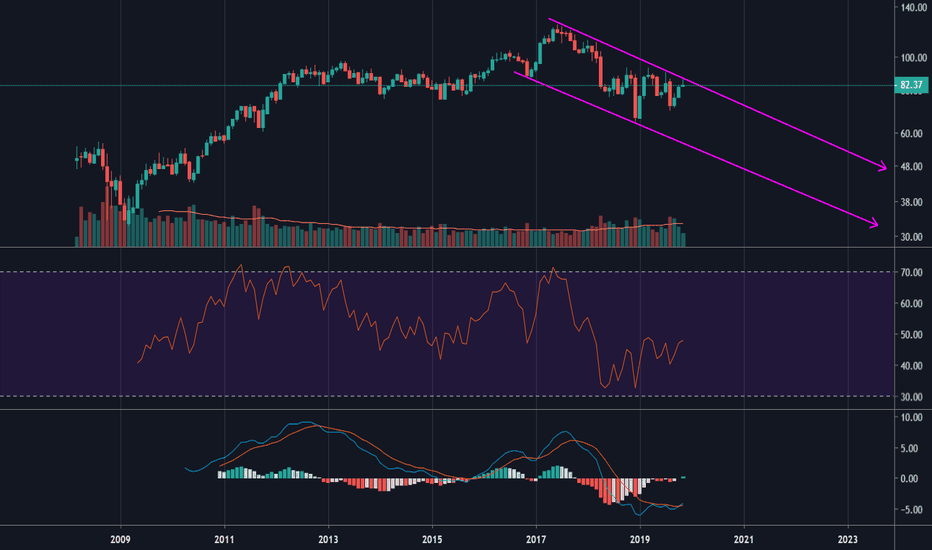

S&D strength Trend: In the midst of an adjustment trend of downward direction box pattern price flow marked by limited rises and downward fluctuations.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

Forecast D+1 Candlestick Color : RED Candlestick

%D+1 Range forecast: 0.3% (HIGH) ~ -1.6% (LOW), -0.6% (CLOSE)

%AVG in case of rising: 1.4% (HIGH) ~ -0.6% (LOW), 1.1% (CLOSE)

%AVG in case of falling: 0.4% (HIGH) ~ -1.3% (LOW), -0.7% (CLOSE)