SHOP trade ideas

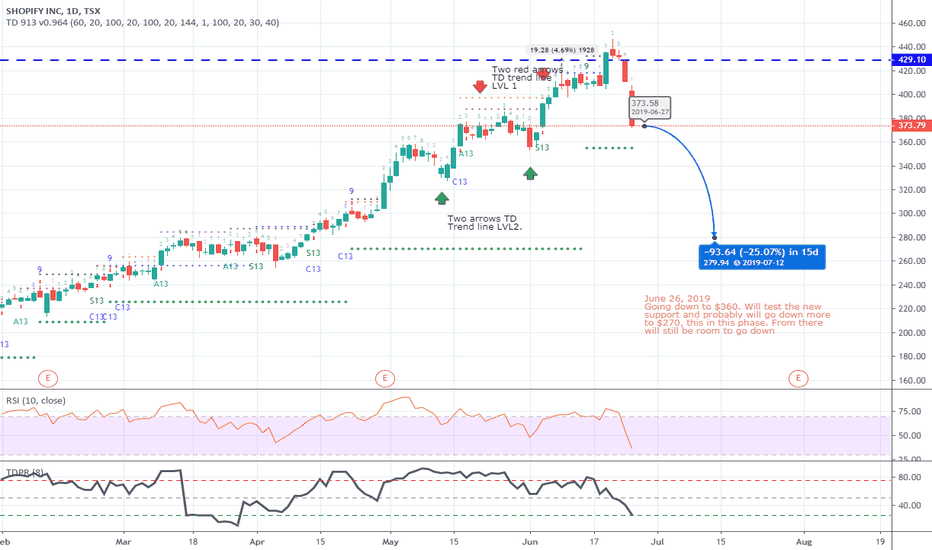

TOPIFY? Shop at the top of the Long Term ChannelSHOP looks ready to roll technically - heavy resistance at the top of the long term channel, along with a 1.618 extension off the all time low. Timing wise, we have a TD8 on the weekly bar. Very potent cocktail of technicals. I would expect a retrace to the 230-260 range, at minimum.

Decoupled from Facebook -- Making me rich legally. Excited to see how this market opens....

Watch previous thoughts...

Shopify is good ecosystem (customers, customer customers, developers,...) not just a company...

Believe me such ecosystems are goldmines....

My DAD told me...

Would like to see a retest from the upper red line (to cool RSI).. good price action from there...

Would consider reentering.... sold 33% @200 earlier from a long position since @180...

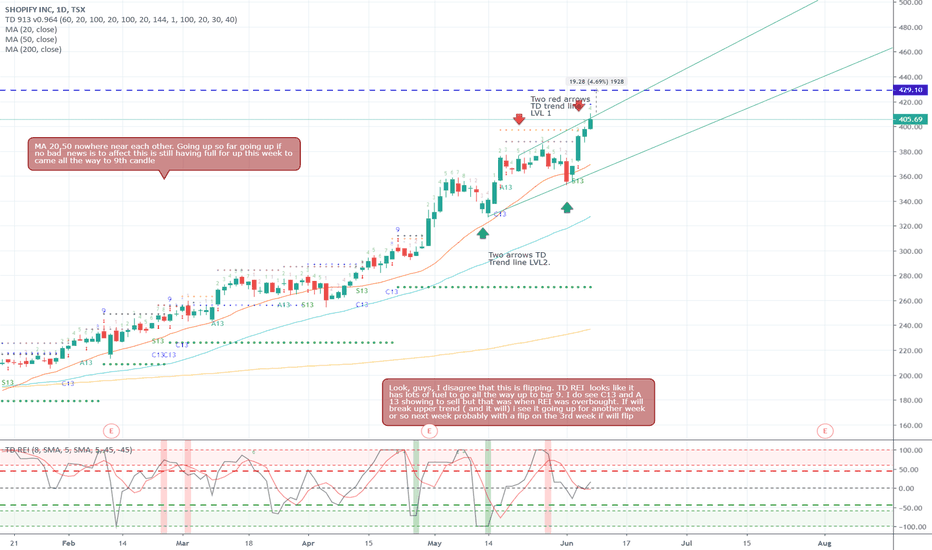

SHOP - Breakout from Bull Flag?Did SHOPify breakout of a bull flag?

1) Bullish open and close candle above the trend line.

2) MACD bullish (although histogram is slowing)

3) Force Indicator is bullish

4) RSI is not overbought or showing any signs of bearish divergence.

5) Parabolic SAR is bullish

6) 20 EMA is above the 40 EMA indicating a bullish trend

7) 50 EMA is above the 200 EMA also supporting a bullish trend

8) However, is the price to far overextended from the 20 EMA? Might it pull back? Is this a false breakout?

SHOP - Breakout from Bull Flag? Did SHOPify break out of a bull flag?

1) Bullish open & close candle above the trend line

2) MACD bullish (though the histogram is slowing)

3) Force Indicator is bullish

4) RSI is not overbought or displaying any signs of bearish divergence

5) Parabolic SAR is bullish

6) 20 EMA is greater than 40 EMA indicating a bullish trend

7) 50 EMA is greater than 200 EMA also indicating a bullish trend

8) HOWEVER - is the price breakout overextended from the 20 EMA? Might it pull back? Is this a false breakout?

Shopify following old trendsDrew this chart almost 2 months ago, and it's been hitting its trendlines perfectly ever since without any adjustments, which lead me to believe that this will continue on in this fashion for the foreseeable future

Leaning more towards a long position here with entries on the small dips in between these two major trendlines

Daily DOUBLE TOP !!!SHOP clearly hit a double top it was right to the penny at $190.00 If we can break 190 we looking for next resistance in the low $200. However, in the past when SHOP had double top there was a bearish reversal. Also Apple bearish reaction to earnings may have some negative effect on the tech sector

SHOP Setting up for a potential double bottom SHOP hit the low of 166.00 on Oct 11th when the initial dump bottomed out. Since the stock had a nice bounce reaching 190.00. Which would be a nice trade. Right now with some market weakness SHOP is back to the 166 area Closing 166.07 Friday. It may signal that the bulls are defending the 166 range. I will watching and may make a potential entry if Monday the 166 level holds. Than we can watch for SHOP to set a lower high compare to 190 before continuation to higher highs and higher lows. I will keep my eye on SPY (seeing some correlation) and if there is further market weakness SHIOP could see breaking the 166 support and hit to lower lows. If we loosing the 166 support level the next support is in the mid 140 range.