UnitedHealth: Deeply oversold but worth a closer lookUnitedHealth (UNH) is the largest private healthcare company in America. Eight million Medicare Advantage members. Optum’s network reaches tens of millions more. It has the data, the reach, and the pricing power. At today’s valuation, it’s worth adding to your watchlist. Forward P/E at 11× versus a

12.79 B USD

355.53 B USD

About UnitedHealth Group Incorporated

Sector

Industry

CEO

Stephen J. Hemsley

Website

Headquarters

Eden Prairie

Founded

1977

ISIN

ARBCOM460390

UnitedHealth Group, Inc. engages in the provision of health care coverage, software, and data consultancy services. It operates through the following segments: UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx. The UnitedHealthcare segment utilizes Optum's capabilities to help coordinate patient care, improve affordability of medical care, analyze cost trends, manage pharmacy benefits, work with care providers more effectively, and create a simpler consumer experience. The OptumHealth segment provides health and wellness care, serving the broad health care marketplace including payers, care providers, employers, government, life sciences companies, and consumers. The OptumInsight segment focuses on data and analytics, technology, and information to help major participants in the healthcare industry. The OptumRx segment offers pharmacy care services. The company was founded by Richard T. Burke in January 1977 and is headquartered in Eden Prairie, MN.

Related stocks

Turning Stock Declines Into Your Best Trading OpportunityTurning Stock Declines Into Your Best Trading Opportunity

When stocks fall dramatically, many investors panic. But what if those drops were actually the set-up for some of the most lucrative opportunities?

In this article, you’ll discover why sharp declines can set the stage for outsized gains

Generational Buying Opportunity?UnitedHealth Group, a complete sh*t show of a company. The CEO gets murdered, public sentiment towards insurance companies remain at an all time low.

Is this business salvageable? Well, we now have the veteran CEO return to his former job, he was already on the board and understands the company an

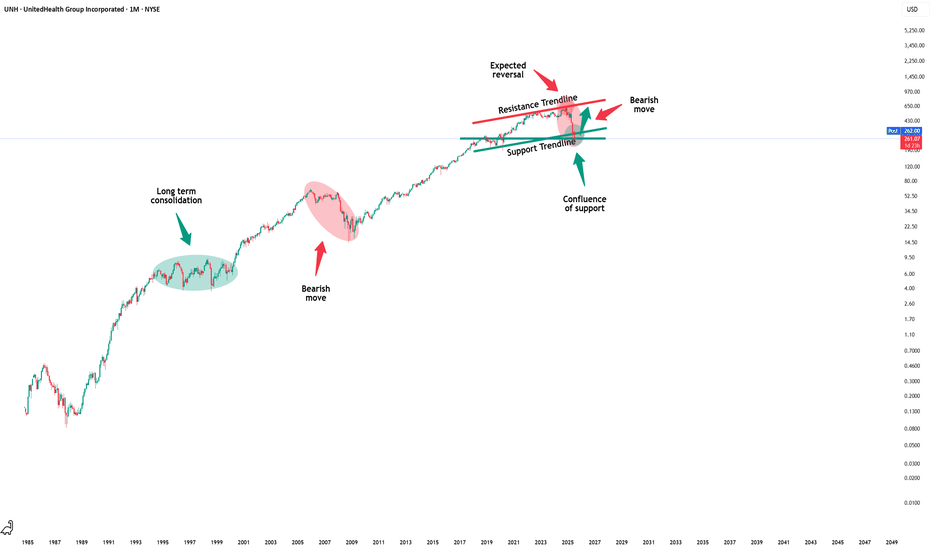

United Health - The perfect time to buy!⛑️United Health ( NYSE:UNH ) finished its massive drop:

🔎Analysis summary:

Over the past couple of months, United Health managed to drop an incredible -60%. This drop however was not unexpected and just the result of a retest of a massive resistance trendline. Considering the confluence of su

Big Money Is Betting on UNH — Are You In Yet?## 🚀 UNH Weekly Trade Idea: Bullish Momentum Brewing at \$260! 📈💥

UnitedHealth Group (\ NYSE:UNH ) is flashing bullish signals across the board:

📊 **Call/Put Ratio: 3.12** → Heavy institutional bullish flow

📈 **Daily & Weekly RSI: Rising**

💰 **Volume Increasing** → Accumulation Mode?

⚠️ **Gamma Ri

UNH – Force Bottom with Bullish Divergence at Support(Weekly Chart) NYSE: UNH remains a fundamentally strong company, even though healthcare is not currently the market’s leading sector. On the weekly chart, price action shows a force bottom (double bottom with take-out stops pattern), flushing stop-losses below the previous low at $248.88.

Last week

$UNH This Behemoth Is Not Going Anywhere and I am Loading Up United HealthGroup is extremely Appealing to me at these valuations. Health Insurance Is something all people need. I Don't See Medicaid/Medicare Cuts affecting NYSE:UNH To the extent People believe it will. Legislation can be temporary, This Company Produces 20B Plus in Free Cashflow Every single

UNH : Stubborn is my First Name Hello friends,

While stubbornness and determination are very different concepts, "stubborn" is more meaningful for events whose outcome we cannot predict.

1- First of all, hedge amount for this trade should be allocated to very safe and more stable financial instruments, at least 6-7 times the posit

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UNH4987619

UnitedHealth Group Incorporated 3.125% 15-MAY-2060Yield to maturity

7.22%

Maturity date

May 15, 2060

UNH4987618

UnitedHealth Group Incorporated 2.9% 15-MAY-2050Yield to maturity

7.14%

Maturity date

May 15, 2050

US91324PEF5

UTD. HEALTH 21/51Yield to maturity

6.99%

Maturity date

May 15, 2051

US91324PDU3

UTD. HEALTH 19/49Yield to maturity

6.80%

Maturity date

Aug 15, 2049

UNH4862956

UnitedHealth Group Incorporated 3.875% 15-AUG-2059Yield to maturity

6.73%

Maturity date

Aug 15, 2059

US91324PDF6

UNITEDHEALTH GRP 17/47Yield to maturity

6.71%

Maturity date

Oct 15, 2047

US91324PDL3

UNITEDHEALTH GRP 18/48Yield to maturity

6.50%

Maturity date

Jun 15, 2048

US91324PCZ3

UNITEDHEALTH GRP 17/47Yield to maturity

6.48%

Maturity date

Apr 15, 2047

UNH5186803

UnitedHealth Group Incorporated 3.05% 15-MAY-2041Yield to maturity

6.40%

Maturity date

May 15, 2041

UNH4987617

UnitedHealth Group Incorporated 2.75% 15-MAY-2040Yield to maturity

6.40%

Maturity date

May 15, 2040

UNH4779905

UnitedHealth Group Incorporated 4.45% 15-DEC-2048Yield to maturity

6.35%

Maturity date

Dec 15, 2048

See all UNHD bonds

Curated watchlists where UNHD is featured.