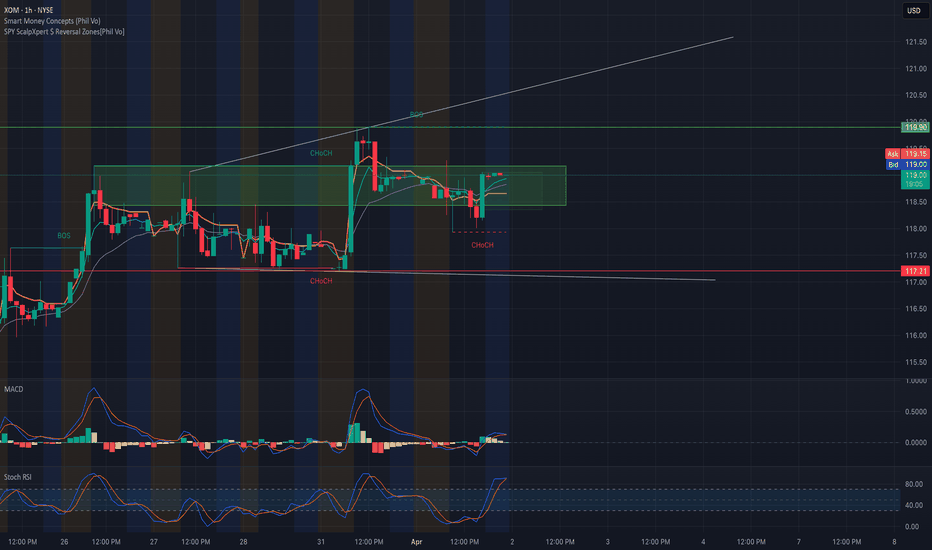

Exxon Mobil Corporation (XOM) – BUY IDEA📌 We’re watching a strong bullish structure in XOM. After a sharp open, price retraces to fill the GAP and respects the key Low zone 🟧, signaling institutional interest.

🟢 Entry aligns with downside liquidity sweep followed by bullish momentum. This trade has confluence between previous liquidity,

Key facts today

Exxon Mobil plans to pay about 60% of its 2025 net income as dividends, exceeding the sector average, with a current yield of 3.5%, attracting income-focused investors.

Exxon Mobil, alongside Chevron, stands to gain from rising demand for natural gas in data centers, potentially boosting their market value as electricity suppliers to tech firms.

Exxon Mobil's shares rose by 0.5% in premarket trading on Friday, attributed to a report showing a significant decline in U.S. crude inventories, which had a favorable effect on oil company stocks.

0.70 USD

29.91 B USD

301.91 B USD

About Exxon Mobil

Sector

Industry

CEO

Darren W. Woods

Website

Headquarters

Spring

Founded

1882

ISIN

ARDEUT110152

FIGI

BBG000DYN3J8

Exxon Mobil Corp. engages in the exploration, development, and distribution of oil, gas, and petroleum products. It operates through the following segments: Upstream, Energy Products, Chemical Products, and Specialty Products. The Upstream segment organizes the exploration of crude oil and natural gas. The Energy Products segment includes fuels, aromatics, and catalyst and licensing. The Chemical Products segment offers petrochemicals. The Specialty Products segment provides finished lubricants, basestocks and waxes, synthetics, and elastomers and resins. The company was founded by John D. Rockefeller in 1882 and is headquartered in Spring, TX.

Related stocks

XOM - Bullish Trade ideaXOM Trade Idea... 🎯 Entry Plan:

Base Entry Zone (accumulation):

ENTRY OPTION 1: $110.60–$111.50 → Retest 12-moving average

ENTRY OPTION 2 momentum trigger: Bullish reversal candle on 2H or 1H + reclaim of $113.00 (this means let price break above $113 after you get a fresh inverse Arc or Level 3

Energy giants surge: Top 5 stocks to watchJune 2025 was marked by heightened volatility across the global energy sector . Amid fluctuating oil prices, geopolitical uncertainty, and ongoing industry transformation, major oil and gas companies delivered mixed results. Let’s break down the key drivers behind the moves in Shell, TotalEnergies,

XOM - Bearish in 4 months more DOWNTREND

The price of XOM has gone too far with the MA200. It will have to return to the MA200 as soon as possible if it does not want to crash.

Let's take a look at its price on the WEEK frame. MA50 and MACD support bearish.

On the DAY frame, the volume decreased, the price movement was low, the c

Oil Prices Rise on Middle East Tensions, Exxon Mobil Corp. SurgeExxon Mobil Corporation (NYSE: NYSE:XOM ) closed at $103.14 on April 11, gaining 3.21% in a single session. The rise comes as oil prices surge, driven by renewed tensions in the Middle East. Ongoing friction between Israel and Iran has heightened concerns over potential supply disruptions. These de

XOM Analysis: Oil's Next Move & Policy ShiftsNYSE:XOM currently piques my interest, particularly with oil prices potentially stabilizing or rising further. Recent geopolitical developments and policy shifts under Trump’s administration—such as rolling back Biden-era energy regulations, reducing methane fees, and easing LNG export permits—coul

EXXON FORECAST Q2 FY25My targets are clear anyways...

Exxon Mobil's stock performance is closely tied to global oil prices, which are influenced by various geopolitical events and policy decisions. Recent developments involving President Trump's administration and OPEC have introduced factors that could exert downward

XOM Coiling Under Resistance: Gamma Breakout or Rejection Setup?1. Market Structure Analysis: XOM has formed a balanced range after printing a Break of Structure (BOS) and two notable CHoCHs on the 1H timeframe. Price is consolidating inside a green supply zone between 118.50–119.90, with wicks tapping the top of the zone but no clean breakout yet. The price str

EXXON MOBIL: This strong rally won't end any time soon.Exxon Mobil is about to turn overbought on its 1D technical outlook (RSI = 67.390, MACD = 2.260, ADX = 52.087) as for the 4th straigh week it is posting gains. This rally started on the first week of March when the stock almost touched the bottom of the 2 year Channel Up. This is a similar bullish w

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PXD5112423

Pioneer Natural Resources Company 2.15% 15-JAN-2031Yield to maturity

4.89%

Maturity date

Jan 15, 2031

PXD5026932

Pioneer Natural Resources Company 1.9% 15-AUG-2030Yield to maturity

4.84%

Maturity date

Aug 15, 2030

See all XOMC bonds

Curated watchlists where XOMC is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks