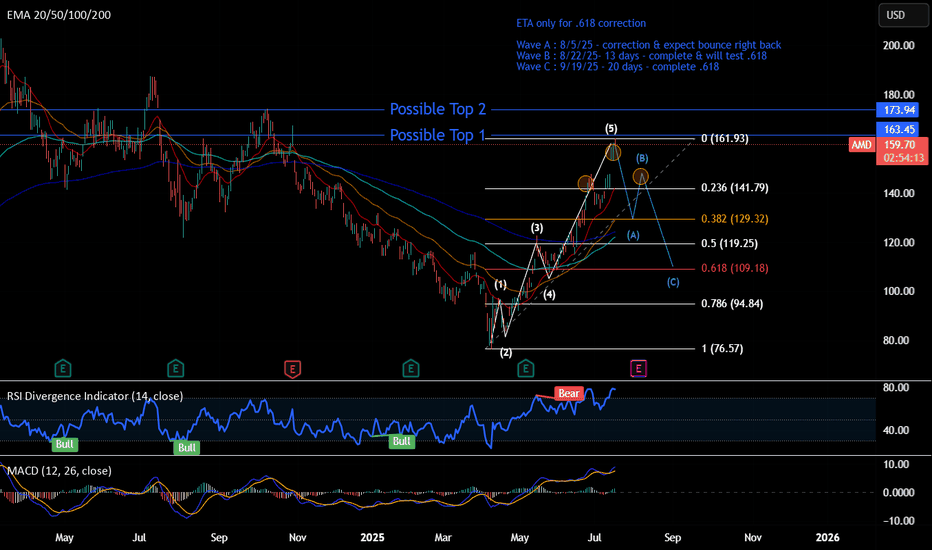

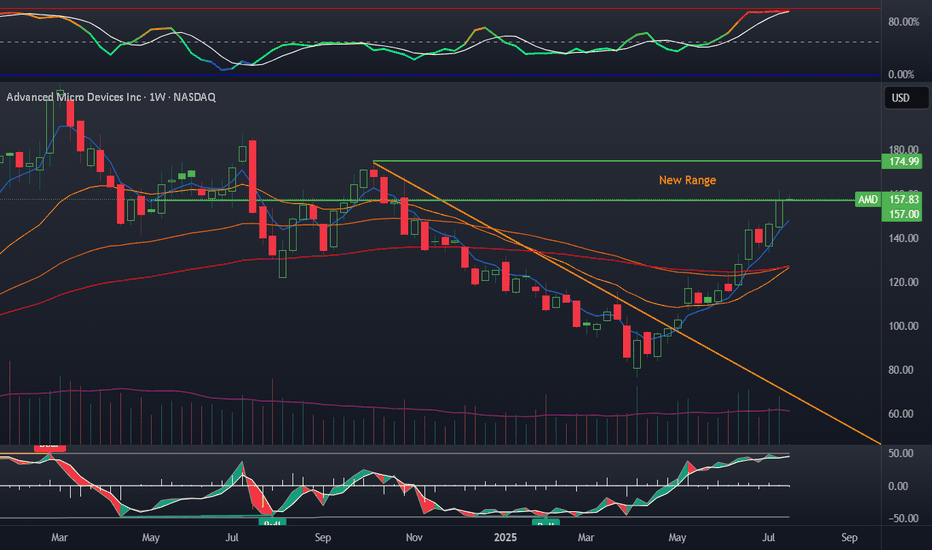

Short - AMDTime period for this play : week to months

Analysis : Elliot wave 12345 ABC. Expect hitting .618 and bounce back up to go higher.

Pattern if wave B completed : Head & Shoulder

Price Target: Wave ABC

ETA Timeline for correction. Please refer to the chart.

Upcoming events:

Tariff active on 8/1/25 - Friday

Earning on 8/5/25 - Tuesday

Top is not in yet, so 2 Possible top-in levels:

Top 1 - $163.45 : Retesting to hit 163.45, rejected, and break $158

Top 2 - $173.94 : Breaking 163.45 and reject at 173.94

=> Overall, It begins trading side way and show some weakness now.

The correction may not pull back to .618, which is the best level. Other scenarios:

- 0.5 fib, where it test wave 3

- 0.328 fib, strong bullish level if it doesn't break & go to the upside faster

AMDCL trade ideas

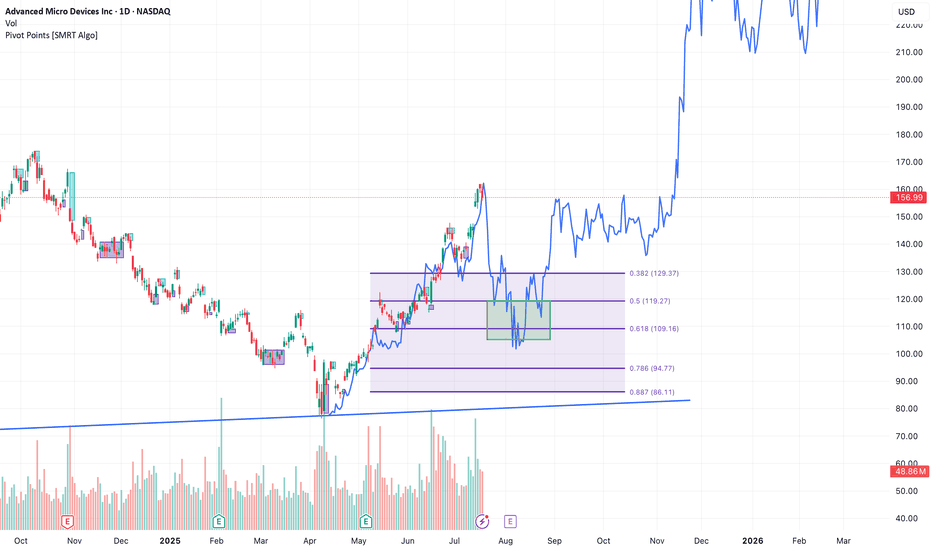

AMD Analysis! Bullish 🔷 📝 AMD Analysis – GEN Methodology & Fibonacci Projection NASDAQ:AMD

✅ Chart Technique:

The blue overlay represents a historical price pattern (GEN Projection) applied to the current AMD chart using Bar Pattern Projection.

This technique forecasts potential timing and price movement based on similar past structures.

✅ Fibonacci Retracement (purple levels):

After the July high, a correction into the Golden Zone (0.618 at $109.16) was expected.

The current price is hovering around the 0.5–0.382 retracement levels ($119–129), suggesting potential support or a mid-term consolidation.

✅ Green box:

Marks a liquidity zone or accumulation area where the price may form a local bottom before continuation.

✅ Overall idea:

If the GEN Projection plays out, AMD could consolidate here before a strong rally towards new highs ($200+) in the coming months.

Invalidation: A clean break and daily close below the 0.618 Fibonacci ($109) would weaken this bullish scenario.

7/15 AMD short AMD just reached a major resistance level and is expected to pull back toward the $135 area. While it may not signal a full trend reversal, a retracement from today’s high is likely.

If the 7/15 candle forms a red shooting star, it would provide further confirmation.

May the trend be with you.

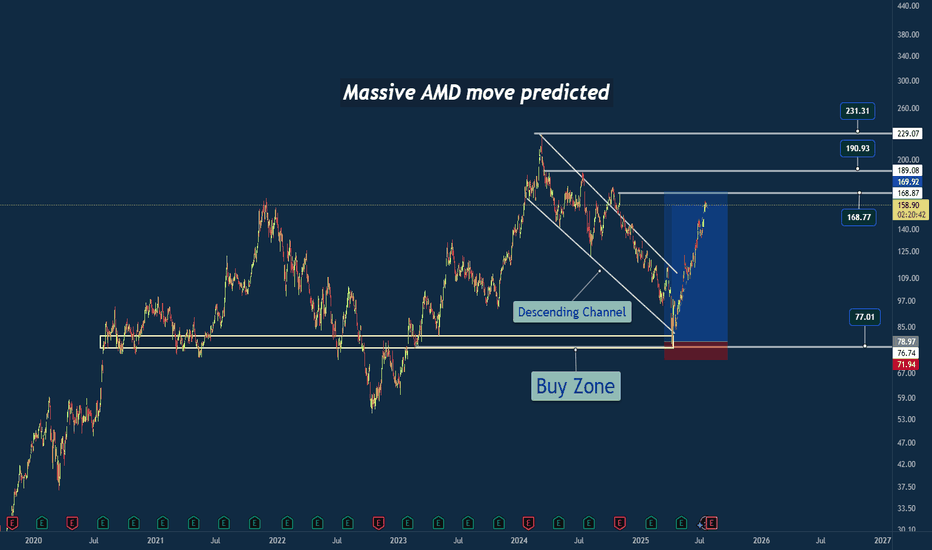

Why I Went Long on AMD Near the 2025 Lows🔍 Reason for the Trade

This wasn’t just a “buy the dip” setup — this was a calculated trade based on strong confluence:

✅ Multi-Year Demand Zone

Price returned to a massive support level that’s held since 2020. This zone had previously triggered multiple large bullish reversals.

✅ Falling Wedge Breakout

A textbook falling wedge pattern formed during the pullback. Once price broke out, the momentum confirmed a structural reversal.

✅ Risk/Reward Optimization

I positioned my stop just under key support, with targets set at prior structure highs. The setup offered a clean 2.5:1+ R/R ratio, perfect for swing conviction.

✅ Institutional Accumulation Area

The volume and wick rejections in this zone screamed smart money stepping in. It was a classic sign of fear-based selling into patient buyers.

🧠 Lessons Reinforced

- Wait for the Zone, Then Act: Patience paid off — the best trades come from the best levels.

- Structure Over Emotion: I trusted the technical, not the bearish headlines.

- R/R Always Wins: You don’t need to be right every time, but when you’re right — let it run.

#AMD #SwingTrade #TechnicalAnalysis #SupportAndResistance #WedgeBreakout #RiskReward #PriceAction #StockMarket #TradingView #TradeRecap

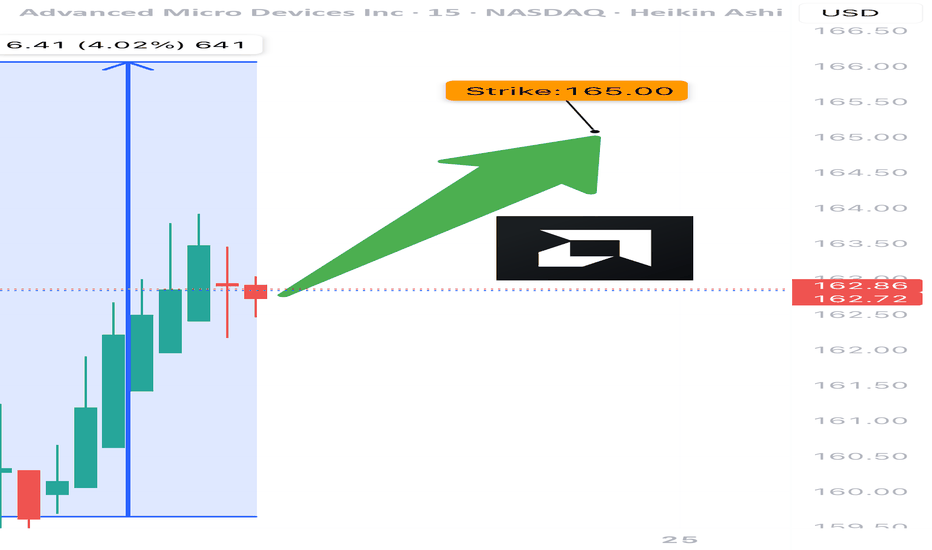

AMD TRADE ALERT (07/24)

🚨 AMD TRADE ALERT (07/24) 🚨

Options flow is screaming bullish 📈

🧠 Key Insights:

• Call/Put Ratio: 1.80 (🔥 heavy call bias)

• RSI: Daily 75.5 / Weekly 77.2 = strong momentum

• Volume = weak ⚠️ but sentiment remains bullish

• High gamma risk = explosive potential near expiry

💥 TRADE IDEA

🟢 Buy AMD $165 Call exp 7/25

💰 Entry: $0.80

🎯 Target: $1.60

🛑 Stop: $0.48

📊 Confidence: 75%

⚠️ Quick expiry = fast moves. Monitor closely.

#AMD #OptionsFlow #UnusualOptionsActivity #TradingView #OptionsTrading #BullishSetup #TechStocks #DayTrading #GammaSqueeze #OptionAlerts

AMD 1W: If Not Now — Then When?The weekly chart of AMD looks like it’s holding its breath: a well-defined falling wedge, double bottom support, and price pressing right against long-term trendline resistance. Everything’s in place — now it just needs to break and run, preferably without tripping over nearby Fibonacci levels.

The stock is trading around $114 and attempting to hold above the 50-week MA. Just ahead is the 200-week MA (~131) — not only a technical hurdle but also a psychological pivot. A move above it could reignite talk of $150+ targets.

The wedge has been narrowing since late 2024. After repeated bounces off support, price has returned to the top of the pattern. A confirmed weekly close above the wedge could trigger a real breakout. Without that — it risks yet another scripted pullback.

Key Fibonacci levels:

0.618 — $133.60

0.5 — $151.42

0.382 — $169.25

0.236 — $191.30

0.0 — $226.95 (all-time high)

The roadmap looks clean — but only if volume follows through. There are signs of quiet accumulation at the bottom, but no explosive buying just yet.

Fundamentals:

AMD delivered solid Q1 results: revenue is growing, EPS beat expectations, and margins are holding. More importantly, the company launched a new $6 billion stock buyback program — showing clear internal confidence in its long-term trajectory.

There’s also a strategic AI partnership underway with a Middle Eastern tech group. This move positions AMD to challenge not just for GPU market share, but for future AI infrastructure dominance — long game stuff.

Analyst sentiment has turned bullish again, with new price targets in the $130–150 range. All of this makes the current chart structure more than just technical noise — it’s backed by strong tailwinds.

AMD: Potential Mid-Term Reversal from Macro SupportPrice has reached ideal macro support zone: 90-70 within proper proportion and structure for at least a first wave correction to be finished.

Weekly

As long as price is holding above this week lows, odds to me are moving towards continuation of the uptrend in coming weeks (and even years).

1h timeframe:

Thank you for attention and best of luck to your trading!

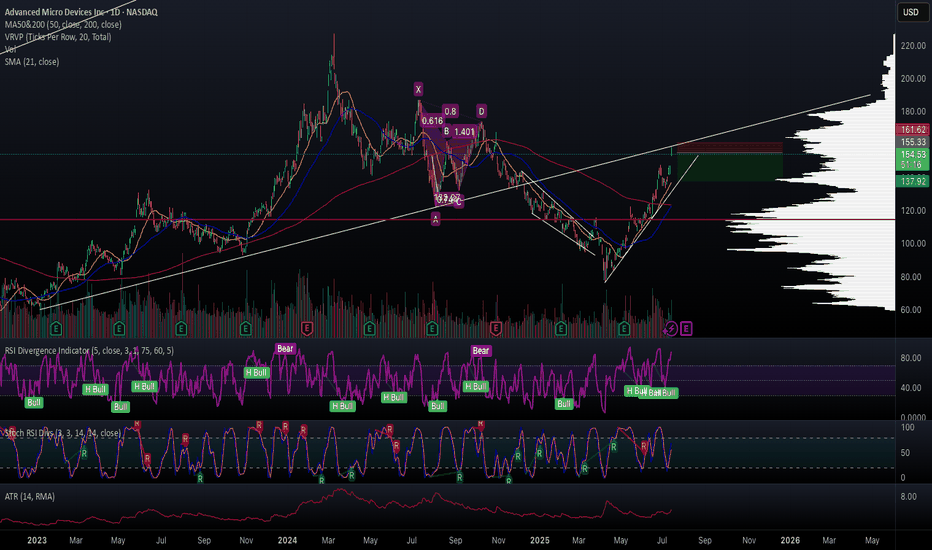

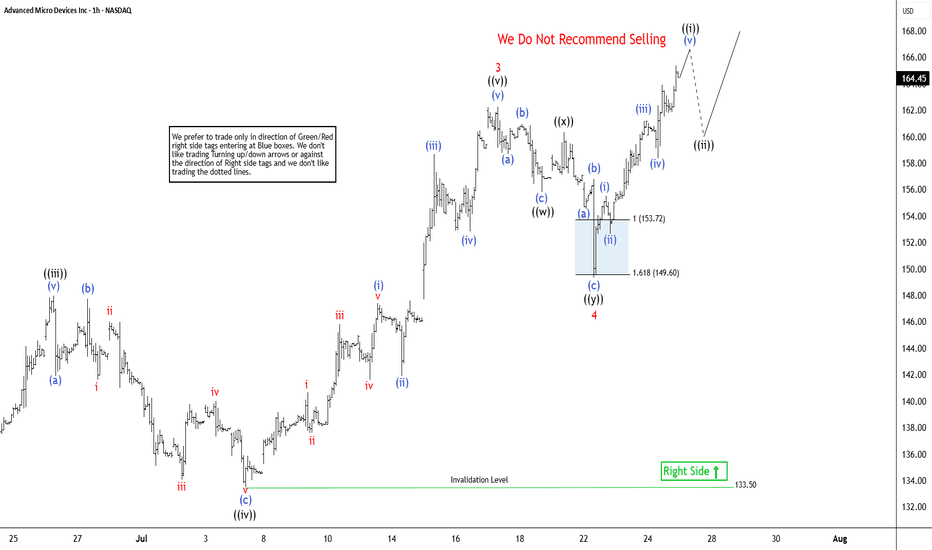

Elliott Wave Outlook: AMD Expects Pullback Soon Before RallyThe Advanced Micro Devices Inc., (AMD) favors rally in impulse Elliott Wave sequence from 4.09.2025 low & expect upside in to 168.36 – 190.36 to finish it. Impulse sequence unfolds in 5, 9, 13, 17…., swings & ends with momentum divergence. In daily, it ended pullback in 3 swings at 75.22 low in blue box area from March-2024 high. It is trading higher in nest & expect 13 swings to finish the impulse ((1)) before correcting next. Currently, it favors rally in 7th swing in daily & expect end soon in to 165.63 – 179.16 area before correcting in (4) as 8th swing. In 4-hour, it ended (1) of ((1)) at 97.91 high, (2) at 83.75 low in 4.21.2025 & favors rally in (3) as extended wave. Within (3), it placed 1 at 122.52 high, 2 at 107.09 low, 3 at 162.36 high, 4 at 149.34 low of 7.22.2025 & favors rally in 5. It is showing higher high since April-2025 low.

Below 3 high of 162.36, it ended 4 pullback in double three correction at 149.34 low. It ended ((w)) at 155.81 low, ((x)) at 160.34 high & ((y)) at 149.34 low. Above 4 low, it favors rally in ((i)) of 5 in to 165.44 – 170.43 before correcting next. Within ((i)), it ended (i) at 155.53 high, (ii) at 152.66 low, (iii) at 161.20 high, (iv) at 158.36 low & favor higher in (v). It appears three swings in (v) & expect pullback before final push above 161.52 low before correcting in ((ii)). Alternatively, the current cycle from 4 low can be 5 of (3) before it corrects in (4). In either the case, the next pullback should remain supported. In 4-hour, it is trading in 11th swing & expect pullback in 12th swings later before final rally. We like to buy the pullback in 3, 7 or 11 swings at extreme area for the upside in ((1)).

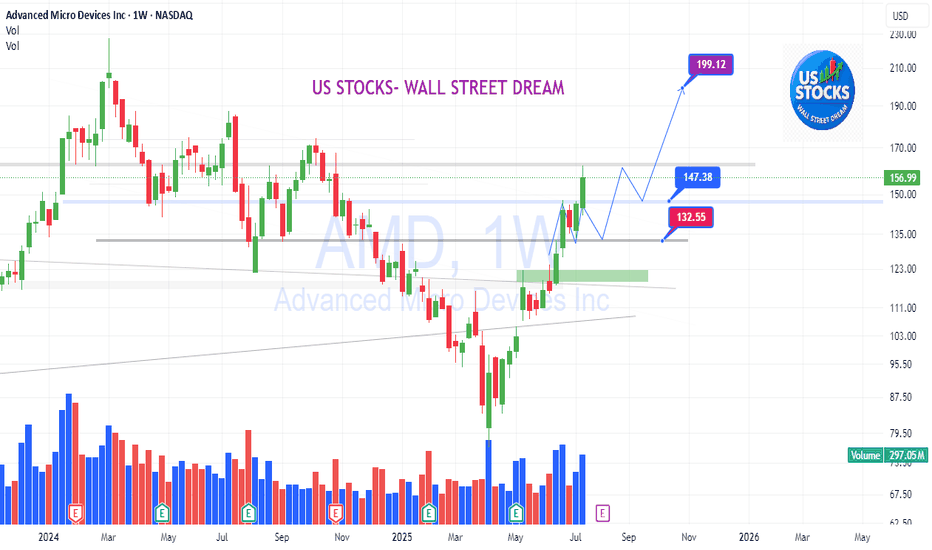

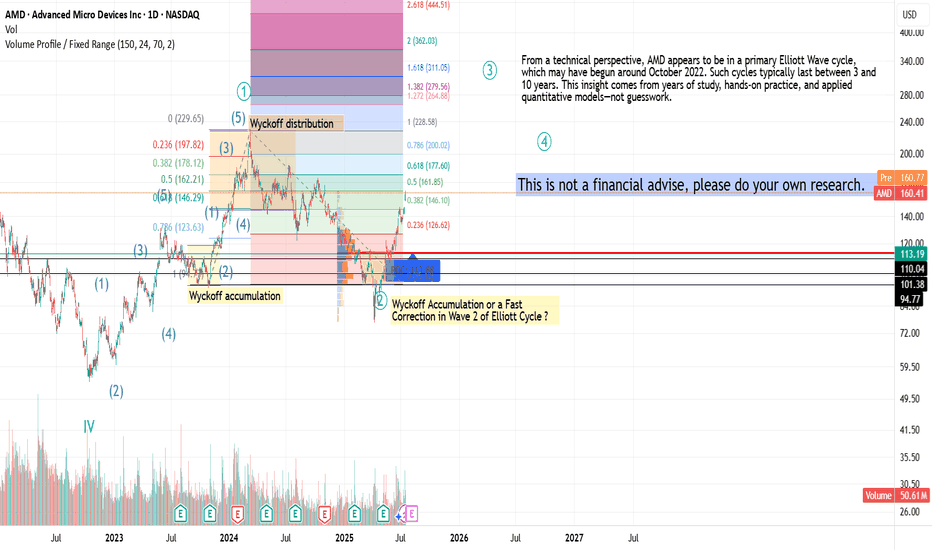

AMD Overview & Elliott Wave CycleAMD recently reported strong Q2 2025 results, with growth driven by Data Center and AI segments, notably thanks to the Instinct MI300 chip family. Revenue rose +15% YoY, with a significant boost from AI-related demand. Future projects include next-gen GPUs, AI platforms, deeper cloud integration, and investments in 3nm architectures.

From a technical perspective, AMD appears to be in a primary Elliott Wave cycle, which may have begun around October 2022. Such cycles typically last between 3 and 10 years. This insight comes from years of study, hands-on practice, and applied quantitative models,not guesswork.

If you found this interesting, share it with others: spreading thoughtful analysis matters.

Advanced Micro Devices | AMD | Long at $126.00Advanced Micro Devices NASDAQ:AMD may be the sleeping giant in the semiconductor / AI space. While all eyes on NVidia NASDAQ:NVDA , earnings for NASDAQ:AMD grew by 800% over the past year... and are now forecast to grow 40% per year. Any other company would be soaring right now (like NVidia), but that company is getting all the attention. And, to me, this means opportunity for the future. The cashflow is likely to grow tremendously for

NASDAQ:AMD into 2027 and beyond, which may inevitably reward investors with dividends.

From a technical analysis perspective, NASDAQ:AMD just entered my historical simple moving average zone. This area (currently $108-$126) is where I will be gathering shares. Something tremendous would have to change regarding the fundamentals of this company (like a scandal) for the overall thesis to change. There may be some near-term price pains as NVidia gets all the focus, but to meet demand in the semiconductor and AI space, NASDAQ:AMD is poised to fulfill that roll in the future.

Target #1 = $158.00

Target #2 = $175.00

Target #3 = $188.00

Target #4 = $205.00

AMD LongKey Technical Insights:

Clean Rejection from Demand Zone:

Price recently tapped into a well-defined demand zone (highlighted green) around $152–$155.

The immediate bounce suggests that buyers stepped in with strength, likely absorbing sell-side liquidity.

Liquidity Grab Below Short-Term Lows:

Before the move up, price dipped just enough to trigger stops below recent lows, clearing out weak hands.

This kind of liquidity sweep is often used by smart money to build long positions before a directional push.

Current Price Action:

Price is consolidating just below a minor supply zone around $159–162.

This pause is constructive: it signals that momentum may be building for a breakout higher.

Upside Outlook (Based on Your Arrow)

Your arrow points to a bullish breakout — and that aligns well with current price structure.

Once supply near $161 is absorbed, price has a clear path to push toward the mid-160s and beyond.

The current higher-timeframe trend supports continuation, and any short-term dip into the $155–156 range may offer re-entry opportunities.

The AMD Long Heist – Ready to Rob the Bulls?!🚨 AMD Stock Vault Heist: Bullish Breakout Plan with Thief Trading Style! 📈💰

🌟 Greetings, Wealth Raiders & Market Mavericks! 🌟

Hello, Ciao, Salaam, Bonjour, and Hola to all you savvy traders! Ready to crack the AMD Stock Vault (Advanced Micro Devices Inc.) with our 🔥 Thief Trading Style 🔥? This high-energy strategy blends technical precision with fundamental firepower to execute the ultimate market heist. Let’s dive into the plan, lock in profits, and escape the high-risk resistance zone like pros! 🏆💸

📝 The Heist Plan: AMD Bullish Breakout Strategy

Our chart lays out a long-entry blueprint designed to capitalize on AMD’s bullish momentum. The goal? Swipe the profits and exit before the bears take control at the resistance zone. This is a high-reward, high-risk setup, so stay sharp! ⚠️

📈 Entry: Crack the Vault!

Timing: Strike when the vault is open! Place buy limit orders on pullbacks within a 15 or 30-minute timeframe targeting the most recent swing low or high.

Tactic: Use a Dollar Cost Averaging (DCA) or layering strategy to stack multiple entries for optimal positioning.

Pro Tip: Look for bullish confirmation (e.g., candlestick patterns or volume spikes) to ensure you’re entering with momentum. 🚀

🛑 Stop Loss: Secure the Getaway!

Place your stop loss below the nearest swing low on the 3-hour timeframe (around $148.00 for day/swing trades).

Adjust based on your risk tolerance, lot size, and number of layered entries.

Why? This protects your capital from sudden reversals while giving the trade room to breathe. 🛡️

🎯 Target: Cash Out Big!

Aim for $179.00, a key resistance zone where bears may counterattack.

Watch for signs of overbought conditions or consolidation near this level—be ready to take profits and treat yourself! 💪🎉

💡 Why AMD? The Fundamental Fuel ⛽

AMD’s bullish surge is powered by:

Tech Sector Momentum: Strong demand for semiconductors and AI-driven chips.

COT Report Insights: Institutional buying pressure (check latest Friday COT data, UTC+1). 📅

Macro Tailwinds: Favorable economic conditions and positive sentiment in tech indices.

Geopolitical Stability: No major disruptions impacting tech supply chains.

Intermarket Edge: Monitor NASDAQ 100 and semiconductor ETFs for correlated moves. 📊

For a deeper dive, review:

Macroeconomic trends

Sentiment analysis

Index-specific correlations

Future price projections (overall outlook score: Bullish). 🌎

⚠️ Trading Alert: Navigate News & Volatility 📰

News releases can shake up the market like a rogue alarm system! To stay safe:

Avoid new trades during major news events (e.g., earnings or Fed announcements).

Use trailing stop-loss orders to lock in profits and protect open positions.

Stay agile—monitor real-time updates to adjust your strategy. 🚨

📌 Risk Disclaimer

This analysis is for educational purposes only and not personalized investment advice. Always conduct your own research, assess your risk tolerance, and align your trades with your financial goals. Markets move fast—stay informed and adaptable! 📚

💥 Boost the Heist! 💥

Love this Thief Trading Style? Smash the Boost Button to supercharge our robbery squad! 💪 Every like and share fuels our mission to conquer the markets with ease. Join the team, steal the profits, and let’s make money rain! 🌧️💰

Stay tuned for the next heist plan, you legendary traders! 🤑🐱👤🚀

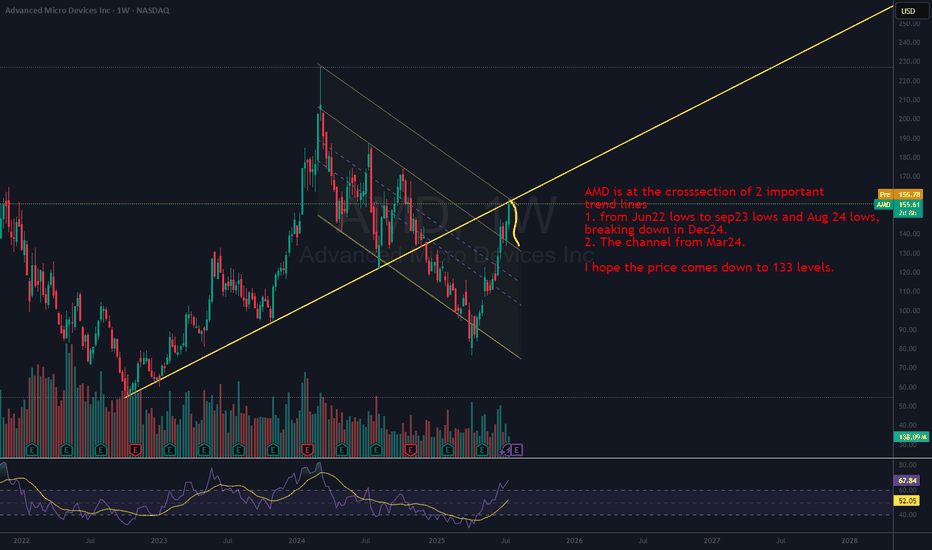

Must go down to go upI think AMD needs to cool off before it continues further, possibly tapping $160 first before a serious correction. Targets are listed at the strong support ending at $120. RSI printing bearish divergence on multiple time frames

Look at the red line, look at the direction of price. It's still a downtrend.

AMD preparing to break out or fail at resistance🔍 Chart Structure & Key Levels

Horizontal Resistance:

The stock is repeatedly testing the $147.75 level, which is acting as a horizontal resistance (shown in orange). Price has stalled here for several sessions, creating a tight range just below resistance—a common precursor to breakouts.

Ascending Trendline Support:

A long-term upward trendline (dashed yellow) supports the current move. Price has respected this line multiple times, showing a strong bullish structure over the past few months.

Volume Analysis:

Volume has decreased during the recent consolidation near the highs, which is typical before a breakout. However, we want to see a volume spike on a confirmed breakout above $147.75 to validate strength.

Symmetrical Triangle / Coil:

There's a tightening pattern forming between the rising trendline and the flat resistance, indicating price compression. This type of structure is often resolved with a large directional move.

✅ Bullish Scenario

A confirmed breakout above $147.75 with volume expansion could trigger a strong upward move.

Price could quickly target the psychological level near $150, and potentially beyond to $155+, based on the height of the prior impulse wave.

⚠️ Bearish Breakdown Scenario

If price fails to break above $147.75 and breaks the ascending trendline, a pullback to $140 or $135 becomes likely.

A breakdown would invalidate the current bullish structure and signal a potential short-term reversal.

🧠 Summary

This chart is in a bullish consolidation with a coiled setup just under major resistance. A breakout above $147.75 is the critical level to watch for upside continuation. Traders should monitor volume and candlestick confirmation before entering positions.

Safe Entry Zone AMDPrice Rejected From Resistance.

Safe Entry Green Zone.

Target after that 162$ price level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock (safe way):

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

Take Care & Watch OUT !

Trading Thesis: Silicon Whiplash – AMD Coiling for a Re-Launch🧠 Trading Thesis: “Silicon Whiplash – AMD Coiling for a Re-Launch to $164+?”

📉 Ticker: NASDAQ:AMD

🗓️ Timeframe: Daily (1D)

📍 Current Price: $144.42

📈 Fibonacci Expansion Target: $164.54 (1.236 extension), $174.98 (1.382 extension)

📉 Support Zone: $120.78

🔭 Play Duration: 2–4 weeks (event-based structure)

🔍 WaverVanir Thesis

Advanced Micro Devices ( NASDAQ:AMD ) is presenting a high-conviction pullback-to-launchpad setup.

After reaching the $147.75 resistance (1.0 Fib extension), AMD has begun carving out a potential W-pattern reaccumulation that could send it to $164.54+. This setup aligns with AI infrastructure momentum and strong GPU/CPU roadmap tailwinds into Q3.

⚡ Catalyst Radar

🚀 MI300 AI GPU Rollout: Recent guidance confirms massive momentum in AMD's data center AI segment, expected to double in Q3. MI300X is gaining traction in the hyperscaler race (vs. NVDA).

💰 AI Arms Race: AMD is aggressively capturing GPU demand in sovereign AI, defense compute, and private AI stack builders (OpenAI, Anthropic, Meta).

📅 Earnings Catalyst: Next report in early August. Expect YoY revenue growth rebound + margin guidance upgrade.

📐 Technical Blueprint

📉 Support Zone: $120.78 (Golden Pocket reversion area)

📊 Pullback Scenario: If price rejects from $147.75 again, a W-pattern retrace to $124–121 would offer a prime long entry.

📈 Upside Targets:

Target 1: $164.54 (1.236 Fib extension)

Target 2: $174.98 (1.382 extension)

🔍 WaverVanir DSS Signal

The DSS signal model confirms:

Smart Money Concepts (SMC) bullish orderblock was reclaimed at $115

Volume profile shows breakout from low-volume node — setting up for a clean sweep to higher liquidity zones

Momentum divergence on RSI and MACD supports the "cool-off before liftoff" thesis

🧠 Strategic Setup

Scenario Trigger Action

Bullish Continuation Break + close above $148 Chase breakout with $155/$165 calls

W Reversion Entry Drop to $124–121 with holding wick Long entry with call spreads into earnings

Bearish Breakdown Close below $118 Wait and reassess — structure invalidated

⚠️ Risk Management: Tighten stops below $117. Risk defined. No long if structure breaks down on high volume.

✅ Summary

AMD’s structure screams accumulation, not distribution. The convergence of technical structure, fundamental catalysts, and AI expansion cycles makes this one of the highest-risk-adjusted setups heading into earnings season. We are watching for pullbacks to enter long toward $164–175.

🧩 #Tags:

#WaverVanir #AMD #Semiconductors #AITrade #MI300 #GPUWar #FibExpansion #TradingThesis #NVDA #OptionsFlow #AIInfrastructure #SmartMoneyConcepts #VolumeProfile #WPattern #NASDAQ100

How 3 Bullish Timeframe Signals Suggest a Buy Opportunity on AMDHow 3 Bullish Timeframe Signals Suggest a Buy Opportunity on AMD Stock

AMD stock has flashed a compelling multi-timeframe buy signal based on a weekly breakout, daily reversal, and 4H stochastic

momentum shift—all aligned with the 50 and 200 EMA and Stochastic RSI indicators.

---

Advanced Micro Devices (AMD) is showing a promising technical setup for bullish traders. An alignment across the weekly, daily,

and 4-hour charts is sending a powerful message: momentum may be shifting in favor of buyers.

This article breaks down how two key indicators—EMA (50 and

200) and the Stochastic RSI—are lining up across three timeframes to support a potential upward move.

---

Weekly Chart: Breakout in Progress

The first signal comes from the weekly chart, where AMD has broken above a recent resistance level. Price has cleared previous

consolidation highs while staying well above both the 50 EMA and 200 EMA, a classic sign of long-term strength.

This breakout is significant because weekly chart patterns carry more weight and often lead to sustained price trends. The bullish

separation of price from the 50 and 200 EMAs is a signal that long-term traders are regaining control.

---

Daily Chart: Reversal Pattern Confirmed

On the daily chart, a clear reversal has taken shape. After a recent pullback, AMD found support near the 50 EMA and bounced

higher. The 200 EMA remains below, confirming the overall bullish structure.

This bounce is further validated by the Stochastic RSI crossing

back above the oversold region, a strong signal that short-term selling pressure has been exhausted. When momentum indicators

and price structure both confirm a reversal, it often leads to an upward follow-through.

---

4-Hour Chart: Early Momentum Reversal

Drilling down into the 4-hour chart, a timely reversal is unfolding.

AMD rebounded strongly from a lower support zone while holding above the 50 and 200 EMAs. Most notably, the Stochastic

RSI has crossed bullishly, confirming the momentum shift from sellers to buyers.

This 4-hour signal adds precision to the daily and weekly bullish bias. Short-term traders may use this to fine-tune entries, while

longer-term investors may see it as confirmation to scale into positions.

---

Conclusion: Multi-Timeframe Confluence Supports a Buy Bias

When the weekly, daily, and 4-hour charts align with bullish

signals from both price action and indicators like the EMA (50 and 200) and Stochastic RSI, the odds often favor the bulls.

While no signal is guaranteed, this kind of multi-timeframe confluence is rare and valuable. It suggests momentum is building

from the ground up—starting with short-term traders and expanding into longer-term buying interest.

---

Disclaimer:

This article is for educational purposes only and not financial advice. Use a simulation trading account before you trade with

real money and learn risk management and profit-taking strategies. Trading is risky and past performance does not

guarantee future results.

---