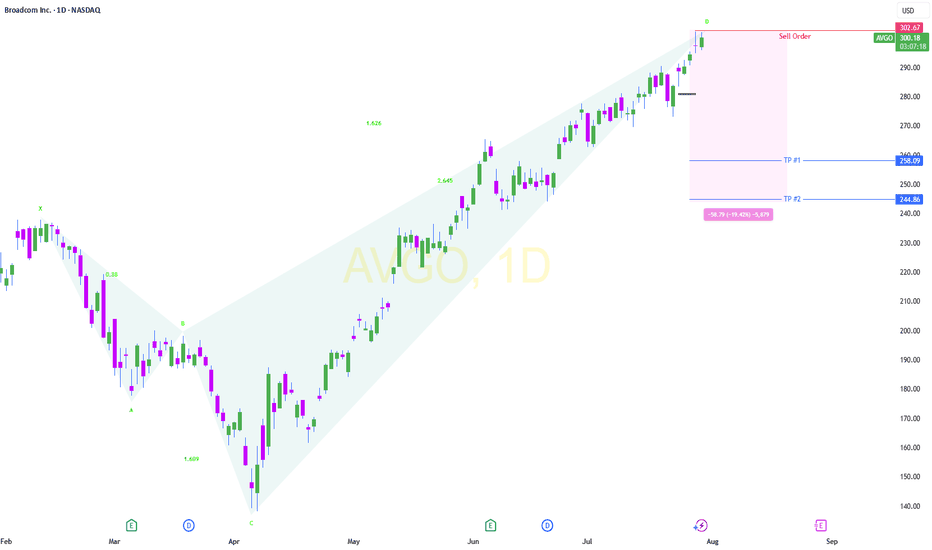

Broadcom (AVGO): Is This the Dip You've Been Waiting For?Broadcom (AVGO) has been demonstrating a remarkably strong bullish trend since early April, carving out a clear path of higher highs and higher lows. This robust upward momentum is well-defined by a series of ascending channels.

Trend and Channel Dynamics:

Initially, we observed price action mov

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.749 USD

5.89 B USD

51.57 B USD

4.61 B

About Broadcom Inc.

Sector

Industry

CEO

Hock E. Tan

Website

Headquarters

Palo Alto

Founded

1961

FIGI

BBG01QVYHKD5

Broadcom Inc. is a global technology company, which designs, develops, and supplies semiconductors and infrastructure software solutions. It operates through the Semiconductor Solutions and Infrastructure Software segments. The Semiconductor Solutions segment refers to product lines and intellectual property licensing. The Infrastructure Software segment relates to mainframe, distributed and cyber security solutions, and the FC SAN business. The company was founded in 1961 and is headquartered in Palo Alto, CA.

Related stocks

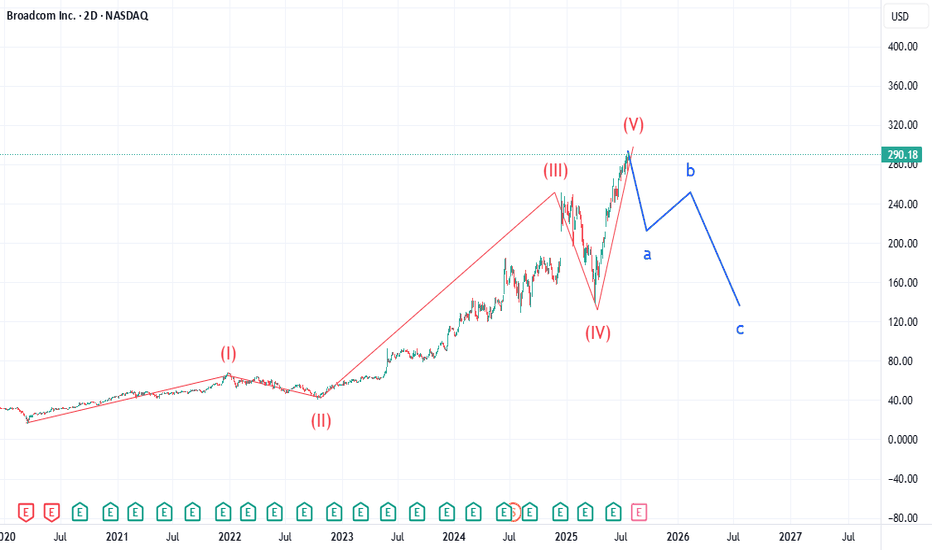

AVGO Bullish Impulse Wave Structure in ProgressAVGO continues its macro advance with a clear 5-wave impulse structure unfolding. The current price action marks the completion of subwave (i) of wave ⑤, setting the stage for a corrective pullback into subwave (ii).

We expect this corrective leg to reach into the 38.2%–50% Fibonacci retracement zo

AVGO: Too Many Similarities Market WideLike my chart on BKNG, AVGO is showing an uncanny similarity to Booking.com's chart. Many indices are showing the end of 5 waves in a super cycle dating back to the drop of March 2020. AVGO pt1 is 211. Expecting selling to increase over the next 90 days. Not certain what the catalyst will be, but lo

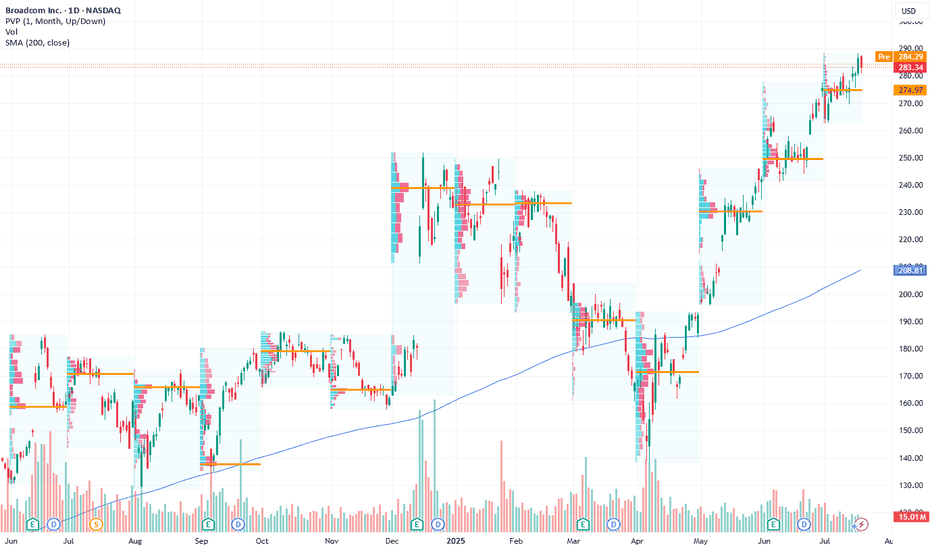

AVGO ( Broadcom.Inc ) NASDAQ:AVGO - Continuation of movement within the ascending channel + potential for a breakout to new historical highs. 🔍 Rationale:

• After a strong correction in the first quarter of 2025, the price formed a reversal and has been moving in a clear ascending channel since the beginning of May.

• T

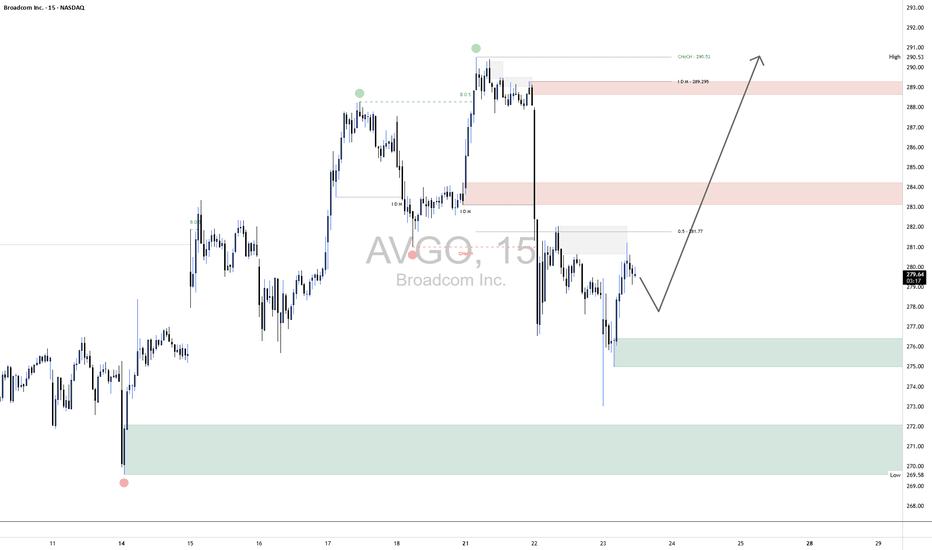

AVGO Long1. Broader Market Structure

1.1 Change of Character (CHoCH)

A clear Change of Character occurred at $290.53, where price broke below a prior higher low. This was a key early signal of a potential bearish reversal, as bullish momentum began to weaken and sellers stepped in with conviction.

1.2 Break

Broadcom: Positioned for Long-Term Growth in AI and EnterprisesCurrent Price: $283.34

Direction: LONG

Targets:

- T1 = $292.00

- T2 = $305.00

Stop Levels:

- S1 = $280.00

- S2 = $275.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AVGO is featured.

Frequently Asked Questions

The current price of AVGO is 286.740 USD — it hasn't changed in the past 24 hours. Watch BROADCOM INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange BROADCOM INC stocks are traded under the ticker AVGO.

We've gathered analysts' opinions on BROADCOM INC future price: according to them, AVGO price has a max estimate of 400.00 USD and a min estimate of 210.00 USD. Watch AVGO chart and read a more detailed BROADCOM INC stock forecast: see what analysts think of BROADCOM INC and suggest that you do with its stocks.

AVGO reached its all-time high on Jul 21, 2025 with the price of 288.230 USD, and its all-time low was 140.600 USD and was reached on Aug 7, 2024. View more price dynamics on AVGO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AVGO stock is 0.52% volatile and has beta coefficient of 2.33. Track BROADCOM INC stock price on the chart and check out the list of the most volatile stocks — is BROADCOM INC there?

Today BROADCOM INC has the market capitalization of 1.36 T, it has increased by 1.05% over the last week.

Yes, you can track BROADCOM INC financials in yearly and quarterly reports right on TradingView.

BROADCOM INC is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

AVGO earnings for the last quarter are 1.58 USD per share, whereas the estimation was 1.57 USD resulting in a 0.69% surprise. The estimated earnings for the next quarter are 1.66 USD per share. See more details about BROADCOM INC earnings.

BROADCOM INC revenue for the last quarter amounts to 15.00 B USD, despite the estimated figure of 14.96 B USD. In the next quarter, revenue is expected to reach 15.82 B USD.

AVGO net income for the last quarter is 4.96 B USD, while the quarter before that showed 5.50 B USD of net income which accounts for −9.78% change. Track more BROADCOM INC financial stats to get the full picture.

Yes, AVGO dividends are paid quarterly. The last dividend per share was 0.59 USD. As of today, Dividend Yield (TTM)% is 0.80%. Tracking BROADCOM INC dividends might help you take more informed decisions.

BROADCOM INC dividend yield was 1.25% in 2024, and payout ratio reached 170.61%. The year before the numbers were 2.19% and 55.79% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 4, 2025, the company has 37 K employees. See our rating of the largest employees — is BROADCOM INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BROADCOM INC EBITDA is 31.09 B USD, and current EBITDA margin is 48.98%. See more stats in BROADCOM INC financial statements.

Like other stocks, AVGO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BROADCOM INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BROADCOM INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BROADCOM INC stock shows the strong buy signal. See more of BROADCOM INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.