What Does Salesforce’s Chart Say Heading Into Earnings?Customer-relationship-management technology giant Salesforce NYSE:CRM will release fiscal Q1 results next Wednesday (May 28). What do CRM’s chart and fundamentals say heading into the report?

Salesforce’s Fundamental Analysis

Next week’s numbers could be key for shareholders, as readers might

Key facts today

Salesforce is in early talks to acquire Informatica, aiming for a deal valued at $10 billion. Salesforce's stock fell 3.9% to $272.15, while Informatica's rose 19% to $22.92.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.441 USD

6.20 B USD

37.90 B USD

934.59 M

About Salesforce

Sector

Industry

CEO

Marc Russell Benioff

Website

Headquarters

San Francisco

Founded

1999

FIGI

BBG01QVXZJ04

Salesforce, Inc. engages in the design and development of cloud-based enterprise software for customer relationship management. Its solutions include sales force automation, customer service and support, marketing automation, digital commerce, community management, collaboration, industry-specific solutions, and salesforce platform. The firm also provides guidance, support, training, and advisory services. The company was founded by Marc Russell Benioff and Parker Harris in 1999 and is headquartered in San Francisco, CA.

CRM not looking EWVwap acted as support

good price by trend

everyone are still fearful

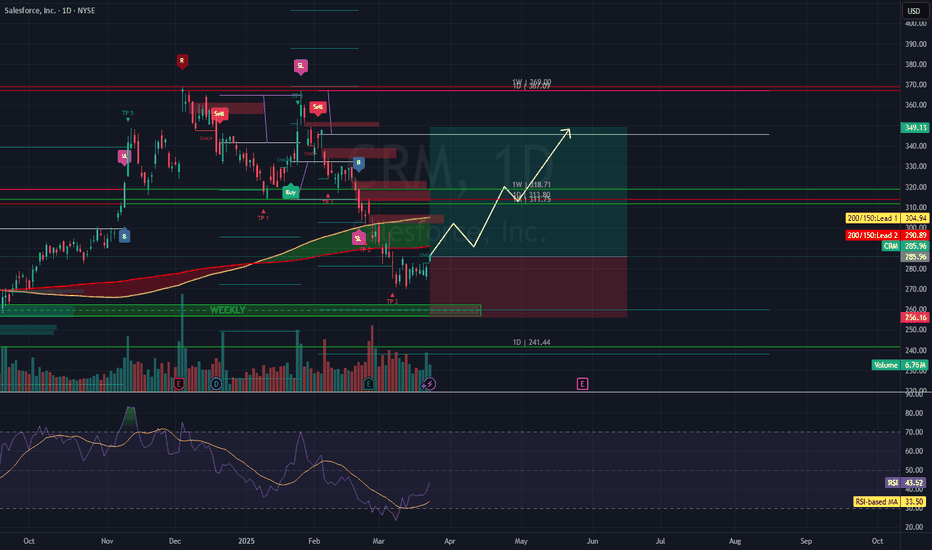

BECAUSE theres a hidden RSI bearish divergence i will only take this long IF it retraces to previous resistance trendline and it acts as support (market structure change and reversal)

if it sweeps 290 I will look for the retr

CRM watch $236.70-239.08: Resistance flip to support for bottomCRM looking weak along with the tech sector.

Watching a key support zone at $236.70-239.08

Look for Break-n-Retest or consolidation above.

.

Previous Plots below:

Topping Call after Tariff Relief pump:

Bottom Call at $212:

Profit Taking levels after bottom pump

=============================

CRM to rise on back of bad economyAs business shut down around the world, jobs will get funneled into America's agents: Employees that never need to eat, rest or ask for bonuses.

America is geared towards a service economy. While the money in goods exports and imports dries up, CRM is the grand exception.

CRM eyes on $262-265: Golden Genesis + Covid fibs for next leg CRM got a Tariff Relief bounce into resistance.

Looking for a dip or break and retest to buy.

If you missed the lower support, look here.

$ 262.54-265.36 is the exact zone of interest.

$ 254.42 below is first support for dip entry.

=========================================

Learn how to identify Fundamental levels with Technical AnalysisYes, you can see fundamental levels using your technical analysis in your charts. Dark Pool Buy Side institutions buy a stock incrementally ahead of its earnings season often weeks ahead. The fundamentals are right in your charts and are easy to see and recognize once you understand the dynamics of

CRM's Rebound Rally!Salesforce Inc. (CRM) is exhibiting potential bullish momentum, with a notable weekly gap around the $260 level. A breakout above the $313.80 level could signal further strength, positioning the stock to target the $349.13 resistance. This trade setup offers an attractive risk-to-reward ratio, with

CRM-Uptrend and Fibbo Retrace?It appears when looking at the weekly, CRM began an uptrend starting Dec '22. On the daily, the Fibbo retracement looks to have pulled back to the bottom of the golden retrace range. With both of these being touched, along with the 80 DMA on the daily, is CRM ready to run again?

If so, it looks to

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US79466LAM6

SALESFORCE 21/61Yield to maturity

7.39%

Maturity date

Jul 15, 2061

US79466LAL8

SALESFORCE 21/51Yield to maturity

7.19%

Maturity date

Jul 15, 2051

US79466LAK0

SALESFORCE 21/41Yield to maturity

6.83%

Maturity date

Jul 15, 2041

US79466LAJ3

SALESFORCE 21/31Yield to maturity

4.94%

Maturity date

Jul 15, 2031

US79466LAH7

SALESFORCE 21/28Yield to maturity

4.45%

Maturity date

Jul 15, 2028

US79466LAF1

SALESFORCE 18/28Yield to maturity

4.31%

Maturity date

Apr 11, 2028

See all CRM bonds

Curated watchlists where CRM is featured.

Related stocks

Frequently Asked Questions

The current price of CRM is 280.200 USD — it has increased by 14.96% in the past 24 hours. Watch SALESFORCE INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange SALESFORCE INC stocks are traded under the ticker CRM.

CRM stock has risen by 14.96% compared to the previous week, the month change is a 14.96% rise, over the last year SALESFORCE INC has showed a 9.80% increase.

We've gathered analysts' opinions on SALESFORCE INC future price: according to them, CRM price has a max estimate of 440.00 USD and a min estimate of 200.00 USD. Watch CRM chart and read a more detailed SALESFORCE INC stock forecast: see what analysts think of SALESFORCE INC and suggest that you do with its stocks.

CRM stock is 13.02% volatile and has beta coefficient of 1.27. Track SALESFORCE INC stock price on the chart and check out the list of the most volatile stocks — is SALESFORCE INC there?

Today SALESFORCE INC has the market capitalization of 271.93 B, it has increased by 3.93% over the last week.

Yes, you can track SALESFORCE INC financials in yearly and quarterly reports right on TradingView.

SALESFORCE INC is going to release the next earnings report on May 28, 2025. Keep track of upcoming events with our Earnings Calendar.

CRM earnings for the last quarter are 2.78 USD per share, whereas the estimation was 2.61 USD resulting in a 6.53% surprise. The estimated earnings for the next quarter are 2.55 USD per share. See more details about SALESFORCE INC earnings.

SALESFORCE INC revenue for the last quarter amounts to 9.99 B USD, despite the estimated figure of 10.04 B USD. In the next quarter, revenue is expected to reach 9.75 B USD.

CRM net income for the last quarter is 1.71 B USD, while the quarter before that showed 1.53 B USD of net income which accounts for 11.85% change. Track more SALESFORCE INC financial stats to get the full picture.

Yes, CRM dividends are paid quarterly. The last dividend per share was 0.42 USD. As of today, Dividend Yield (TTM)% is 0.57%. Tracking SALESFORCE INC dividends might help you take more informed decisions.

SALESFORCE INC dividend yield was 0.47% in 2024, and payout ratio reached 25.15%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of May 24, 2025, the company has 76.45 K employees. See our rating of the largest employees — is SALESFORCE INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SALESFORCE INC EBITDA is 12.71 B USD, and current EBITDA margin is 34.93%. See more stats in SALESFORCE INC financial statements.

Like other stocks, CRM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SALESFORCE INC stock right from TradingView charts — choose your broker and connect to your account.