GOOG trade ideas

Alphabet (GOOGL) Stock Hits 2025 LowAlphabet (GOOGL) Stock Hits 2025 Low

As seen on the Alphabet (GOOGL) stock chart, the price has dropped close to $156—a level not seen since September 2024.

Since the start of 2025, the stock has fallen by more than 18%.

Why Is GOOGL Falling?

As mentioned earlier today, overall market sentiment remains bearish due to the White House’s tariff policies.

For Alphabet (GOOGL), the situation has worsened today due to the following developments (as reported by the media):

➝ Google has admitted liability and agreed to pay $100 million in cash to settle a US class-action lawsuit accusing the company of overcharging advertisers, according to Reuters. Alphabet shares dropped 4.4%.

➝ Google’s division was found guilty of anti-competitive behaviour in India related to its app store billing system.

Technical Analysis of Alphabet (GOOGL)

In February, we noted investors’ negative reaction to the company’s earnings report, which led to a bearish gap (marked by a red arrow).

Since then, bears have maintained control, pushing the price below the lower boundary of the ascending channel that had been valid since 2023. Key signals include:

➝ The $170 level (near the bearish gap on 10 March) acted as resistance on 25 March.

➝ Bears showed little reaction to bulls at the $160 level and have kept the price contained between two downward-sloping red lines.

Bears may now be targeting the psychological level of $150. If bulls want to maintain control over GOOGL’s long-term uptrend, they need to take action soon.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

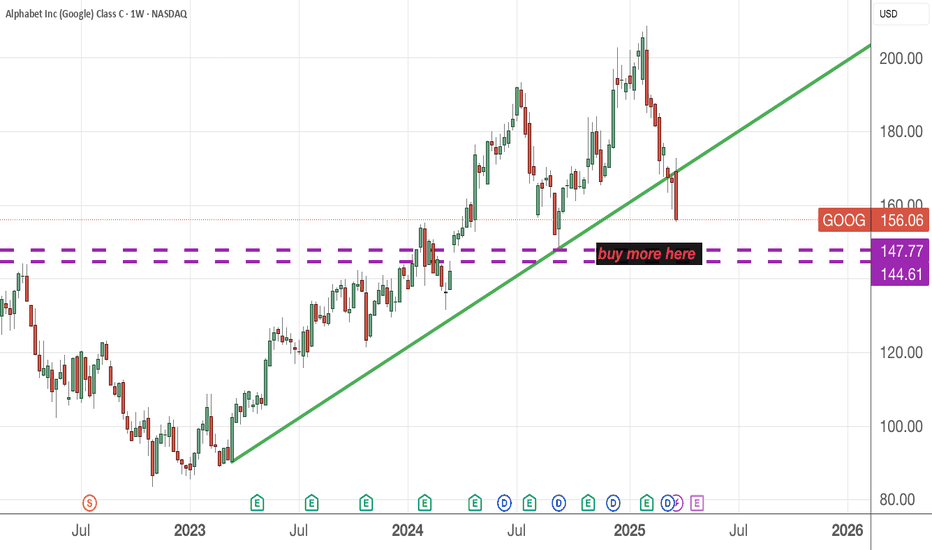

Googl.. where we standMy last post on googl (See below)

I showed you the rising wedge on googl at 200.. 25% later here we are..

This is a long term view. This the great reset back to the primary trendline..

This is logarithmic, logarithmic or log scale comes in handy to chart stocks or indexes that have made a parabolic move .

Here's the monthly trend

As you can see , with exception of the covid pump googl has respected this trend.. Now we are heading back to support.

Since 2009 googl has never broken it's monthly 50 SMA. The monthly 50 SMA + the long term trendline is around 128-135.00

Throw in a Fibonacci level from ATH and 2020 lows and you get a 50% retracement

That's my long term by zone for googl.. I wouldn't buy this stock until the 130's

I will update this later today with some actual tradeable analysis, this was just a long term view

Google Wave Analysis – 28 March 2025

- Google broke key support level 160.00

- Likely to fall to support level 147.30

Google recently broke the key support level 160.00 (which has been reversing the price from September, as can be seen from the daily Google chart below).

The breakout of the support level 160.00 accelerated the active impulse waves iii and 1 – both of which belong to the extended downward impulse wave (1) from last month.

Google can be expected to fall to the next support level 147.30 (a former multi-month low from last September).

GOOGLE Bottom confirmed. Laying eyes on $220.Alphabet Inc. (GOOG) has been trading within a Channel Up since the July 10 2024 High. Last week, the Bearish Leg touched the pattern's bottom, completing a -23.92% decline from the top, which is almost symmetrical to the previous Bearish Leg (-23.32%).

At the same time the 1D RSI got oversold (<30.00) and recovered on a Bullish Divergence, while the 1D MA50 (blue trend-line) crossed below the 1D MA100 (green trend-line), forming a Bearish Cross. Last time we had this formation was September 06 2024 and 1 day later, the bottom (Higher Low of the Channel Up) was formed.

Among all this, the 1W MA100 (red trend-line) is holding, which is the market's long-term Support since July 12 2023. As a result, we expect the new Bullish Leg to start and as the previous one did, target the 1.236 Fibonacci extension at $220.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOOGL Facing Major Reversal Zone! Decision Time Approaching!Here's a straightforward breakdown of GOOGL based on the 1-hour chart and GEX insights:

📈 Technical Analysis (TA):

* GOOGL currently hovering within a critical green reversal zone around $167–$168, showing possible bullish exhaustion.

* Recent Break of Structure (BOS) indicates bullish sentiment, but price action within this green reversal zone is critical.

* A strong red reversal zone at $157–$160 indicates robust support below, confirmed by a significant Change of Character (CHoCh).

* Watch closely how GOOGL behaves in the current zone. Any rejection could quickly see a retracement.

📊 GEX & Options Insights:

* Highest positive NET GEX and critical CALL resistance clearly marked at the $170 level, a significant gamma magnet.

* Strong PUT support positioned firmly at $160, aligning closely with the red reversal zone. Essential for downside protection.

* IV Rank moderate at 31.4%, suitable for either debit or credit spread strategies.

* CALL sentiment low at 9.8%, indicating cautiously optimistic sentiment but alertness at reversal zones.

💡 Trade Recommendations:

* Bullish Scenario: On a solid breakout above $168, target the $170 gamma resistance using calls. Maintain tight stops around $165.

* Bearish Scenario: Monitor for rejection signs in the green reversal zone; consider puts targeting lower support at $160.

* Neutral Approach: Given moderate IV, consider balanced credit spreads or Iron Condors between clear support/resistance ($160–$170).

🛑 Risk Management: Always adhere to disciplined risk management, especially near pivotal reversal zones.

Stay alert and trade wisely!

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

GOOGL: Bullish Bounce Before a Bigger Drop? Here's My RoadmapGoogle NASDAQ:GOOG NASDAQ:GOOGL is shaping up to look bullish in the short term, and I believe that in the next few weeks to months, we could see a solid upside move - before things could turn ugly again later on. Let me explain why.

Big picture: we’re currently in a Wave (2) corrective structure, which is playing out as a complex WXY correction (marked in orange). This type of correction follows a 3-3-3 wave pattern, and everything we’ve seen so far fits that structure. Since the top in February, NASDAQ:GOOGL has dropped around 24% , which is significant - but also not unexpected within this context.

What’s interesting now is that we’ve just printed a bullish divergence on the RSI for the first time in this move down. That’s the first green flag. The second? The lower wick, which I currently mark as sub-wave ((a)) has been very well respected so far. That’s the second sign that this could be the turning point - at least temporarily.

I’m expecting a move up in the coming weeks toward the 2024 VAH, around $178, where we could see a first rejection. From there, the price should continue higher in a 3-wave structure toward Wave ((b)), likely reaching between $187.80 and $196.30 (the 61.8% to 78.6% retracement zone).

But let’s be clear: this is not the start of a new bullish trend. After Wave ((b)), I expect a 5-wave move to the downside, completing Wave ((c)) - and that means lower prices ahead , potentially in Q3, Q4 2025 or even into 2026.

Until then, I’m keeping a close eye on this structure. As long as the current Wave ((a)) low holds, this short-term bullish scenario remains valid. If we get a strong breakout in the coming days / weeks, I’ll be looking to enter on a retest, targeting that $187.80–$196.28 zone.

Let’s see if the market plays it my way.

Make sure to follow me for future updates on this scenario and other setups !

Alphabet Inc. (GOOGL) has declined by 21% since peaking at 207With its long-term bullish structure compromised, Alphabet could repeat its previous 45% correction. Although closing at 163.99, slightly above the critical 156-160 support zone, any rebound might be capped at 167.35, 174.00, 185.58, and 192.70. A break below support could see shares fall toward 144-137 or even 126-119, marking a 42% correction

GOOGL – Potential Reset Structure Similar to March 2024 | Price This chart outlines a potential reaccumulation and continuation setup on GOOGL, mirroring the March 2024 price reset structure that preceded a strong rally into late 2024.

After a healthy correction from recent highs, price has now retraced into a key equilibrium zone, sitting just above the 200-day moving average and reclaiming the long-term ascending trendline.

We could be witnessing the formation of a higher low, potentially setting the stage for another strong leg up — projecting a ~35% move from the current structure lows, aligning with previous historical expansions over similar time frames (notably 119 days from low to high).

🔍 Smart Money Insights:

•Discount zone tapped, showing buyer interest and possible accumulation.

•Price is recovering above trendline + EMA confluence.

•Premium zone around $215 may act as the next major target/liquidity area.

🧠 Thesis:

If this monthly candle closes strong and confirms support around the $160–165 range, we may see a March-like reset that kicks off a Q2-Q3 continuation, targeting the $215 level.

Google Wave Analysis – 21 March 2025

- Google reversed from key support level 160.00

- Likely to rise to resistance level 167.00

Google recently reversed up from the key support level 160.00 (which has been reversing the price from October) intersecting with the lower daily Bollinger Band.

The upward reversal from the support level 160.00 created the daily Japanese candlesticks reversal pattern Hammer – which stopped the previous impulse wave C.

Given the strength of the support level 160.00 and the bullish divergence on the daily Stochastic, Google can be expected to rise to the next resistance level 167.00.

Google in a distributive phase?Could be printing a distribution here. Early signs, so very early on this idea. Would need to see PA evolve like showed in the graph. Alternatively if it makes a HH, it could be printing a UTAD. Either way, I'll be looking for signs whether Wyckoff Distribution does indeed play out.

Goog make or break trendlineDid you know this market geometry/symmetry:

When a (strong) trendline is broken, the market will fall equal distance or more from the trendline as from the peak to the breakpoint.

If google breaks (or has it?) it could fall another 20% and meet the long term trendline, if doesnt then the recent breakpoint would

become resistance

GOOGL Approaching Key Breakout Level – Will Bulls Gain Control?Technical Analysis & Options Outlook

📌 Current Price: $167.24

📌 Trend: Bullish Momentum Facing Resistance

📌 Timeframe: 1-Hour

Price Action & Market Structure

Strong Recovery from Support – GOOGL bounced off the $158–$160 demand zone, signaling aggressive buying interest.

Breakout Watch – Price is now testing the descending trendline resistance near $167.50–$170. A breakout above this range could lead to a sharp upside move.

Possible Pullback Before Breakout – If rejected at $167.50–$170, expect a retest of $164–$160 before another breakout attempt.

MACD & Stoch RSI – Both indicate bullish strength, but Stoch RSI suggests an overbought condition, signaling potential short-term consolidation.

Key Levels to Watch

📍 Immediate Resistance:

🔹 $167.50 – Trendline Resistance

🔹 $170 – Major CALL Resistance & Gamma Wall (45.86%)

🔹 $172.50 – Strong Breakout Confirmation Zone

📍 Immediate Support:

🔻 $164 – Breakout Retest Zone

🔻 $160 – Strongest PUT Support (-48.34%)

🔻 $158 – Secondary PUT Wall (-23.69%)

Options Flow & GEX Sentiment

IVR: 40.1 (Moderate Volatility)

IVx: 34.2 (-1.41%) (Volatility Cooling, Favoring Breakouts)

GEX (Gamma Exposure): Bullish Bias Strengthening ✅ ✅ ✅

CALL Walls: $170 & $172.50 (Upside breakout zones)

PUT Walls: $160 & $158 (Key demand liquidity areas)

📌 Options Insight:

Above $170, expect a gamma-driven move toward $172.50–$175.

Below $164, risk increases for a pullback to $160–$158, where major liquidity resides.

My Thoughts & Trade Recommendation

🚀 Bullish Case: If GOOGL breaks and holds above $167.50, expect a continuation to $170–$172.50.

⚠️ Bearish Case: If GOOGL fails at $167.50, a pullback to $164–$160 is likely before another breakout attempt.

Trade Idea (For Educational Purposes)

📌 Bullish Play:

🔹 Entry: Breakout above $167.50

🔹 Target: $170–$172.50

🔹 Stop Loss: Below $164

📌 Bearish Play (Hedge Idea):

🔻 Entry: Rejection at $167.50

🔻 Target: $164–$160 PUT Wall

🔻 Stop Loss: Above $170

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own research and manage risk accordingly.

Final Thoughts

GOOGL is testing a critical resistance zone near $167.50–$170. A breakout could push the stock toward $172.50, while failure could trigger a pullback toward $164–$160 before another attempt. Wait for confirmation before taking a trade.

GOOG’s Hot Setup: Fib, 100-Day, and Reversal Alright, I know the week ain’t over yet, but I’m seeing something pretty hype on Google’s chart (GOOG) that’s got me pumped! The stock’s pulling back to that 0.786 Fibonacci level, and guess what—it’s chilling right at the 100-day moving average.

What a wild coincidence, right?

On top of that, the weekly candle so far is looking like a reversal—unless something crazy flips it last minute. If GOOG can hold strong by the end of this week and close higher next week, it’s setting up for a solid shot at a new wave up, potentially hitting $225 by September. Oh, and I forgot to mention—it’s been riding this sweet ascending price channel like a pro, which makes that timeline more of an educated guess than a wild stab. Let’s see if this tech giant can flex its muscles and make that climb!

I’m not saying make any investment moves based on this—I’m just sharing my analysis,

Sabah Research Goes Long on Google: EW 2.0 Signals 45% Upside !Sabah Equity Research is taking a bullish stance on Alphabet (GOOGL) as Elliott Wave 2.0 suggests a 45% upside from current levels. With the stock trading at an attractive valuation, this presents a strong opportunity for long-term investors.

Elliott Wave 2.0 Predicts the Next Leg Up

After completing a healthy ABC correction, Alphabet is now primed for a Wave 3 expansion, historically the most powerful phase in the Elliott cycle. The technicals suggest that GOOGL’s recent consolidation is a launchpad for the next move higher.

Catalysts for Growth

Massive Cybersecurity Acquisition

Google’s parent company, Alphabet, is set to acquire Wiz, a leading cloud security firm, for over $30 billion—its largest deal ever. This strengthens Google’s cloud security dominance and accelerates revenue growth.

Undervalued Growth Potential

Despite its leading position in AI, cloud computing, and search, Alphabet trades at a discount compared to peers. This disconnect presents a compelling buying opportunity before sentiment catches up.

AI and Cloud Expansion

Google’s aggressive push into AI and cloud services positions it for massive future gains. With rising demand for AI-driven search, advertising, and enterprise solutions, Alphabet’s growth runway remains robust.

The Trade Setup: Positioning for the Upside

With Elliott Wave 2.0 pointing to a 45% rally, Sabah Equity Research sees Alphabet as a strong long-term play. The combination of cheap valuation, a game-changing acquisition, and a favorable technical setup makes this an ideal entry point.

Smart money is accumulating—will you? 🚀

Google Nice buy, Super Oversold into Longer term TrendGoogle has experienced a large recent drawdown of over 30% from the peak in Q1 2024. The drop has failed to produce any real relief rallies, being a move straight down. The context then suggests that perhaps Google is due for some relief to the upside as it hits a major support trendline spanning from the start of the bull market.

I would like to see this stock start consolidating and building steam for what may be a potentially voilent rally once the smoke clears.