Its crazy but possible Short $NVDA targeting 70sOf course it is difficult to short NVDA :) but watching RSI weakness and high volume with red candles suggest short term bearish trend or correction move - the stock in consolidation for almost a year - the idea is to short after earning report on Wednesday - Main supports at 113-104-94 strongest one then the gap at 70

NVDACL trade ideas

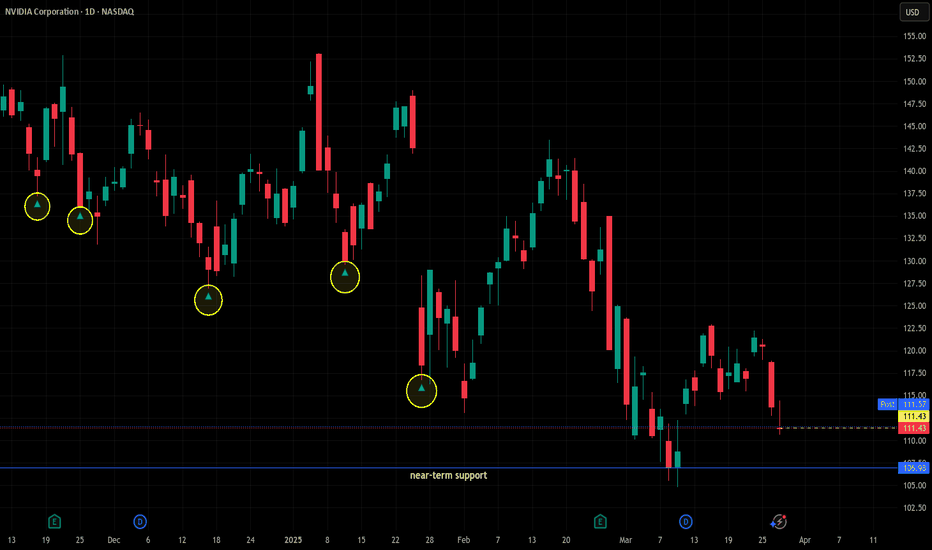

NVDIAgain...long at 111.43This is gonna be my 6th long idea on NVDA since Mid-December. Sorry if this is getting boring, but if it keeps working, why stop?

It's not in a great pattern, but then again it wasn't the other 5 times, either. It has been in a downtrend since early December, but even stocks in downtrends don't have to go down in straight lines, and that's what I'm counting on here. There is some support semi-close by, too.

It's a good company, and trading them in tough times (I think the last 6 weeks qualifies there, don't you?) gives me the best odds of making money. NVDA has never let me down - literally never. Sometimes it takes longer than others, but it always pays. I haven't updated my W/L record on it lately, but the 5 trades on the chart are the last 5 I've made and it was undefeated before all of them. You can go back and look at them if you desperately want to know - I know it's in at least one of those but I don't feel like going back and looking for the exact number right now. I know it's at least 100s to 0. Edit: I felt bad being lazy so I went and looked it up. It's 722-0, and that's a good enough reason for me to trade it today.

So I'm long at 111.43, but I am making a little twist to my usual trade plan. I will be adding if it falls, but not using my usual methodology. It's a twist I've been working on for trading downtrending stocks. It's complicated, so I'll just update here whenever I add, and the adds will still be near the close when I make them. I will still use FPC (first profitable close) to exit any lot on the day it closes at any reasonable profit.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

NVIDIA: Still has a long way to go.NVIDIA turned from oversold to neutral on its 1D technical outlook (RSI = 48.969, MACD = 44.021, ADX = 44.021) and is about to do the same on 1W too, as today's 90-day tariff pause announcement is giving the market an aggressive comeback. Technically though that doesn't seem enough to restore the tremendous bullish sentiment of 2023 and 1st half of 2024 as the trend is currently restricted by not only the 1D MA50 and MA200 but a LH trendline also coming straight from the ATH.

The same kind of LH kept NVDA at bay on its last main correction to the August 5th 2024 bottom. This started a +44.46% rally that got rejected on the LH trendline. If we apply that today we get a projected 1D MA200 test just under the LH trendline. A TP = 125.00 fits perfectly on the short term, but long term we still have a long way to go.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Phase 4 broken, the hyperwave will be completedWe've seen this cycle across more or less in all kinds of assets. the MAG7 is no exception. As today, we've broken down from Phase 4, despise you like it or not, once these structures break down, PA(price action) will always find its way back to its true fair value.

Already called it, but this time, we get a closer look towards the TA in NVDA.

Sequentials are settled in, we're going for a 9 monthly count of sequential bars down, the intensity of the moves is yet to be known, but alas, we will have to look at SMA's and the range of the monthly Linear Regression, they all have supports around 80, 40, 20.

And as usual, be safe, don't long this.

We’ve seen a solid correction in NVDA - Bullish?We’ve seen a solid correction in NVDA following its rally since early 2024. The stock has broken through key levels and managed to hold within the resistance zone between $80 and $90. We will most likely enter a sideways movement until the situation regarding tariffs becomes clearer. This could extend into June, after which we might expect an upward move toward the $132.95 zone. By early 2026, we are likely to see a new all-time high, especially if the trade tensions and tariffs between China and the US are resolved and overall uncertainty decreases.

NVDA 09-04-2025NVDA fighting for its life trying not to establish confirmation on another bearish trend but price movement will probably continue lower. How much lower remains uncertain but the old support is turning into an established resistance line more and more by the day. If price does a retest and now established a down trend price movement will probably gain enough momentum to move down quite strong. However i will wait and see what price trend the price movement establishes into and then make my position. I would much rather just wait til the bearish trend reverses and buy many shares then for a greater profit margin on my bullish entry then hold a bad short position with uncertain price movements as the NVDA chart right stands as.

NASDAQ:NVDA

NVDA TO $176 BY JUNE THEN $1000 END OF YEARNVDA to $176 by June Then $1000 End of Year: A Bold Thesis

Key Points

It seems likely that NVDA could reach $176 by June 2025, supported by strong AI market trends and upcoming earnings, but reaching $1000 by year-end is highly speculative and controversial.

Research suggests Elliott Wave analysis shows a potential bullish trend, but specific price targets like $1000 lack broad analyst support.

The evidence leans toward significant growth potential due to NVDA's leadership in AI and new product launches, yet such aggressive targets involve high uncertainty.

Current Price and Market Context

As of April 9, 2025, NVDA's closing price on April 8 was $96.30, with pre-market trading at $98.22. This reflects recent volatility, with a 52-week range from $75.61 to $153.13. The stock's performance is tied to its dominance in AI and GPU markets, which are experiencing robust growth.

Analysis for $176 by June

Reaching $176 by June 2025, an 83% increase from $96.30, is ambitious but plausible. Upcoming earnings on May 28, 2025, estimate an EPS of $0.93 and revenue of $43.34 billion, with potential beats driving price surges. Elliott Wave analysis suggests NVDA may be completing a corrective phase, with a falling wedge pattern indicating a possible upward breakout, supporting short-term targets around $176.

Analysis for $1000 by Year-End

The prediction of $1000 by December 2025, a 940% increase, is highly speculative. While some analyses, like a Forbes article, suggest NVDA could see a tenfold rise by 2026 due to the Blackwell architecture, most analyst targets range from $170 to $235. This target lacks broad support and involves significant market and fundamental risks.

Unexpected Detail: Stock Split Impact

An unexpected factor is NVDA's 10-for-1 stock split in June 2024, adjusting prices from over $1,000 to current levels, making historical comparisons complex. This split aligns the $1000 target with post-split valuations, but achieving it requires unprecedented growth.

Survey Note: Detailed Analysis of NVDA's Potential Price Surge to $176 by June and $1000 by Year-End

Introduction

NVIDIA Corporation (NVDA), a leader in graphics processing units (GPUs) and artificial intelligence (AI), is currently trading at approximately $96.30 as of April 9, 2025, based on the closing price from April 8, with pre-market activity showing a slight uptick to $98.22. This analysis explores the feasibility of NVDA reaching $176 by June 2025 and an ambitious $1000 by the end of the year, leveraging Elliott Wave theory and other validated analytical methods. Given the stock's recent performance and market context, we examine technical patterns, fundamental catalysts, and long-term growth potential.

Current Market Position and Historical Context

NVDA's stock has shown volatility, with a 52-week range from $75.61 to $153.13, and a year-to-date change of -11.36% over the past week and -12.23% over the past month, per recent data. The all-time high was $153.13 on January 6, 2025, indicating significant upside potential from current levels. The market capitalization stands at $2.35 trillion, with a beta of 2.40, reflecting high volatility. Key financial metrics include an EBITDA of $83.32 billion and an EBITDA margin of 63.85%, underscoring strong profitability.

A critical context is the 10-for-1 stock split in June 2024, which adjusted share prices from over $1,000 to current levels, making historical comparisons complex. This split, detailed in a CNBC article (Nvidia announces 10-for-1 stock split), was aimed at making ownership more accessible, aligning with the user's post-split price targets of $176 and $1000.

Metric Value

Closing Price (Apr 8) $96.30 USD

Pre-Market Price (Apr 9) $98.22 USD

52-Week Range $75.61 - $153.13 USD

Market Cap $2.35T USD

Beta (1Y) 2.40

Earnings Next Report May 28, 2025, EPS Estimate $0.93, Revenue Estimate $43.34B USD

Last Quarter EPS $0.89 (estimated $0.85, +4.96% surprise)

Dividend Yield (TTM) 0.04%

Elliott Wave Analysis: Technical Insights

Elliott Wave theory, a method identifying market psychology through wave patterns, suggests NVDA may be in a corrective phase, potentially completing wave (4) of a larger five-wave structure. Recent analyses, such as those on TradingView (NVIDIA Stock Chart), indicate a falling wedge or ending diagonal formation, often signaling a reversal and start of an upward trend. This could support a move to $176 by June, as wave (5) projections often extend to 1.618 times wave (1), potentially aligning with such targets.

Specific Elliott Wave analyses, like those from ElliottWave-Forecast (Elliott Wave Expects New All Time High), suggest NVDA has completed corrections and is resuming higher, with wave counts indicating impulsive rallies. However, these analyses lack explicit price targets reaching $1000, focusing more on trend continuations.

Short-Term Target: $176 by June 2025

Reaching $176 by June 2025, an 83% increase from $96.30, is ambitious but supported by several factors. The earnings report on May 28, 2025, is a critical catalyst, with estimates for EPS at $0.93 and revenue at $43.34 billion. Given NVDA's history of beating estimates, as seen in the last quarter with EPS of $0.89 against an estimate of $0.85, a strong report could drive significant price appreciation.

Technical indicators, such as a breakout from the falling wedge, align with this target. Analyst price targets, ranging from $125 to $220 with an average of $177.19 per Zacks (NVIDIA Price Target), also support the possibility, with some forecasts reaching $235.92 (NVDA Forecast). However, achieving this in two months requires sustained bullish momentum and favorable market conditions.

Long-Term Target: $1000 by Year-End 2025

The prediction of $1000 by December 2025, a 940% increase from current levels, is highly speculative. Most analyst forecasts, such as those from MarketBeat (NVIDIA Stock Forecast) and TipRanks (Nvidia Stock Forecast), range from $170 to $235, far below $1000. However, a Forbes article from May 25, 2024 (Nvidia Stock Tops $1,000), suggests NVDA could see a tenfold rise by 2026 due to the Blackwell architecture, potentially supporting a $1000 target by late 2025 if growth accelerates.

Blackwell, a new GPU architecture, is expected to enhance NVDA's AI and data center offerings, potentially driving revenue growth. CoinCodex forecasts a high of $260.32 by December 2025 (NVIDIA Stock Forecast), still below $1000, indicating the target is outlier and involves significant risk. Market volatility, competition, and macroeconomic factors, such as tariff impacts noted in CNN reports (NVDA Stock Quote), add uncertainty.

Fundamental Catalysts and Risks

NVDA's fundamentals are strong, with consistent revenue growth and high EBITDA margins. The company's expansion into AI, autonomous systems, and supercomputers, as noted in LiteFinance (Nvidia Stock Price Prediction), supports long-term growth. However, short-term corrections due to overvaluation or market sentiment, especially around tariff concerns, pose risks.

X posts, such as one from @1000xStocks (X post), highlight NVDA's EPS growth reflecting AI monetization, suggesting bullish sentiment, but lack specific $1000 targets. Another from @ravisRealm (X post) notes adding positions at lower prices, indicating confidence but not supporting the $1000 target.

Conclusion

While reaching $176 by June 2025 is plausible with strong earnings and technical breakouts, the $1000 target by year-end is highly speculative, lacking broad analyst support and requiring unprecedented growth. Investors should monitor earnings reports, product launches like Blackwell, and market trends, while employing risk management strategies given the high uncertainty.

NVIDIA About to TANK? Or Just Cooling Off?After one of the most explosive bull runs in tech history, NVIDIA is showing signs of exhaustion — and this chart’s screaming a massive correction incoming.

🧠 Chart Insights (2W Time Frame):

Current Price: ~$96.30

All-Time High: $152.89

Key Breakdown Levels:

🔵 Pullback Zone: $134.29 — Broken & Completed

🟠 Neckline Support: $90.69

🎯 Major Fibonacci Target: $66.25 (61.8% retracement)

💀 Extreme Support Zone: $10.81 (not likely unless disaster strikes, but chart says what it says...)

🔎 What’s Really Happening:

Bull run started October 2022 and went parabolic into late 2024

Price attempted to consolidate above $130–140 (pullback zone) but failed to hold

Bearish momentum confirmed as we’ve broken through key zones

We’re now headed straight toward the $90s neckline, with $66.25 as a Fibonacci target if trend continues

⚠️ Why This Matters:

This isn’t fear — it’s structure. Nvidia doesn’t have to collapse to zero, but even a healthy correction to $66 would be a 30%+ drawdown from current levels.

That would:

✅ Flush out weak hands

✅ Offer long-term buyers a better setup

✅ Rebalance the overextended rally from 2023–2024

👀 What to Watch:

Retest of $90.69 neckline

Reaction at the 61.8% retracement

Volume spikes on weekly red candles

If bulls don’t step in soon, this is just the beginning of the cooldown

📌 This is not financial advice — just chart surgery.

🔖 Hashtags:

#NVIDIA #NVDA #StockMarketCorrection #BearishStructure #TechStocks #TradingViewCharts #MarketMomentum #PriceAction #FibonacciAnalysis

NVIDIA: Time for a Graphic Comeback?🔍Analysis:

Following up from a previous breakdown, NVIDIA has now tapped into a high-probability Weekly Order Block (OB) just above the sell-side liquidity zone at $88.97. This level also aligns with a structural area of support, making it a prime zone for a potential bullish reversal.

Key signs:

Price is showing early signs of displacement from the OB.

If this zone holds, we could be looking at a 77% move back up to the buyside liquidity at $157.92.

Watch for a strong weekly candle close above $96.30 to confirm the bounce.

🛑 Invalidation:

If price fails to hold this OB and breaks below $88.97, expect a deeper move into the $76.06 zone.

💡 Summary:

Patience is key. We’re sitting on a solid base for a potential bullish push — now it’s all about the confirmation candle. 📊

DYOR — Don't just HODL, study the chart!

NVDA Technical Analysis – April 9, 2025NVIDIA (NVDA) just got rejected at the top of a falling wedge channel on the 1H chart and is showing clear signs of continued bearish pressure. After testing a key resistance around the $102–$103 zone, price has sharply reversed and is now threatening to revisit lower trendline levels.

Market Structure & SMC Insight:

* NVDA remains in a strong downtrend with price confined in a descending wedge.

* There was no confirmed CHoCH (Change of Character) or BOS (Break of Structure) indicating strength—only a lower high rejection.

* A red resistance zone remains around $103.70, while major support lies around $86.74.

* MACD is curling down after a bearish cross.

* Stoch RSI is pointing lower from the mid-zone, signaling more downside may be ahead.

* Volume has increased on this rejection, giving the move more credibility.

TrendInfo Sentiment Summary:

* MA: Bearish (-2.21%)

* DMI: Bearish (38.33)

* RSI, MACD, Stoch: All showing bearish confirmation.

* DPR (Directional Pressure Ratio): Bearish (43.5%)

* Fear & Greed: Fear (-15.78), overall Sell rating of 75%.

This suggests that short-term traders are risk-off and sentiment is skewed toward more downside.

Options GEX Analysis (Gamma Exposure & Sentiment):

* Current GEX shows strong PUT dominance at 28%, aligning with a bearish directional expectation.

* IV Rank (IVR) at 107.2 with IVx avg at 108.7 indicates high volatility; premiums are rich, great for credit spreads or directional put plays.

* Key Put Support at $90 with heavy GEX clustering below. This is your downside magnet.

* Call resistance sits near $102–$105 range, aligning with the recent rejection. Gamma walls at $108–$111 cap the upside.

Trade Scenarios:

Bearish Scenario:

* Rejection confirmed. If NVDA breaks $94 again, a fast drop to $90 and even $86 support is on the table.

* Put Options with strikes at $90 or debit spreads can work well.

* Watch for continuation volume confirmation.

Bullish Reversal Setup (Low Probability for Now):

* Needs a reclaim of $103.70 with volume.

* A CHoCH + strong bullish candle would trigger potential upside targets of $108 and $111.

* Call debit spreads or long shares only if reversal is confirmed.

My Thoughts: NVDA continues to reflect sector-wide weakness in semis. Without strong market support, the path of least resistance remains down. Given the macro volatility and sentiment tilt toward fear, it's wise to position conservatively and trade with tight risk.

Final Suggestion:

* Put Bias Active

* Avoid heavy call exposure unless reclaim of $103 occurs

* Sell premium if IV stays elevated (e.g. credit spreads)

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

An end to Jensen Huang's prancing.Jensen Huang is one hang of a gasbag. Have you ever seen a human gasconading like that? Saying AI will eliminate the need for coding was Huang hell of an idiotic statement. And the the leather jacket is like a tiny tube on a mole. Just like his company's oversized stock price. Final target is around 50 usd.

NVIDIA on Bear Market territory. Will the 1W MA100 save the day?NVIDIA Corporation (NVDA) has officially entered Bear Market territory as it has declined by almost -45% from the January 2025 All Time High (ATH) and just hit its 1W MA100 (green trend-line) for the first time since the week of January 30 2023.

This is the strongest correction the stock has seen since the 2022 Inflation Crisis and based on the Time Cycle Indicator of the last two Cycle Tops, the week of Jan 06 2025 falls indeed on the third count. This high degree of symmetry isn't only present on the price action but on the 1W RSI sequence itself as the current time range from the RSI High (March 18 2024) to today's Low is fairly consistent (54 weeks, 378 days) with the top-to-bottom range of the previous two Bear Markets, 2022 and 2018 (red Channel Down patterns).

So far the current correction looks similar to the September - December 2018 as not only their RSI counts are similar but both are more aggressive and fast than the 2022 Inflation Crisis. The 2018 correction though didn't top on the 1W MA100 but almost reached the 1W MA200 (orange trend-line) before making a bottom, but it did so in less than 2 months and declined by -57.40%. The current correction is already running for 3 months.

So what remains to be seen is if the 1W MA100 will manage to hold and kick-start a bullish reversal on its own, despite this correction being 'only' -43.39%. The 1W RSI dropped close enough to 30.00 (the oversold limit) though, which has historically been a very reliable indicator for a long-term buy on NVDA.

If those work in favor of the 1W MA100 holding, expect to see a strong rebound, that will confirm the new Bull Cycle with a break above the 1W MA50 (blue trend-line) and can technically aim for at least a +1000% rise from the bottom, as both previous Bull Cycles did.

If the 1W MA100 fails, we expect a bottom by the end of June 2025 around the 1W MA200 between $65-60. Again a +1000% rise from that level is technically plausible, potentially giving a Target estimate of at least $660.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NVIDIA Support Breakdown, Targeting Lower LevelsFrom a technical perspective, the chart shows a break of daily support at 126.86 and 129.51. This could lead to a long squeeze and increased selling pressure, targeting levels of 109.9, 100.44, and 90.56. A sell position between 135.05 and 129.51 might be considered, but a stop loss at 148.95 is crucial.

NVDA Flash Crashed! Will $90 Hold or More Blood Ahead?The market took a violent turn after Trump’s tariff bombshell, and high-flyers like NVDA are now in a fragile freefall. Is this a dead-cat bounce or a rare buying opportunity?

📉 Technical Breakdown (1H Smart Money Concepts)

* Bearish structure confirmed via BOS at $103 and $95.

* Trading inside a well-defined downward channel—respecting trendlines.

* Currently in a consolidation box near $92, inside potential demand.

🔑 Key Levels:

* Support: $90 (must hold) → below that, $87 and $85.

* Resistance: $95.60 (highest negative NETGEX), then $102–$104 (gap fill).

* MACD & Stoch RSI showing early signs of reversal—but no confirmation yet.

🧲 Options Sentiment via GEX (1H)

* Highest Negative NETGEX at $95.60 → massive short interest.

* PUT Wall: $90 (crucial support), next level at $85.

* CALL Wall: $108–$110 = strong rejection zone this week.

* Options Oscillator:

* IVR: 65.2 | IVx avg: 92.9 → volatility priced in.

* Calls%: Only 8.7% bullish participation → extremely bearish positioning.

* GEX color: 🔴🔴🔵 = bearish zone, but potential for volatility-based reversal.

🧠 Scenarios to Watch

🔻 Bearish Trade Setup:

* Short rejection from $95–$96

* Target: $90 → $87

* Stop: $98

🔼 Bullish Scalp Idea:

* Long on confirmed reclaim of $95.60

* Target: $102–$104 (gap-fill)

* Stop: $92.50

🧳 Investor Perspective

We’re entering accumulation zones. Start building long positions below $90 in steps. Major long-term support lies between $85 and $80. Use time-based entries, not emotion.

📌 NVDA Takeaway:

* Market sentiment is fear-driven, but AI fundamentals are still intact.

* $95 = battlefield. $90 = line in the sand.

* Stay nimble. Be patient. Watch volume and flow.

🔔 Follow for daily TA with SMC + GEX setups

💬 Drop a comment: Bullish or Bearish NVDA this week?

❗Disclaimer:

This is not financial advice. This post is for educational purposes only. Do your own research and manage your risk.

🧵 Hashtags:

#NVDA #NVIDIA #OptionsFlow #GammaExposure #TechnicalAnalysis #SmartMoneyConcepts #GEX #TradingView #StockMarketCrash #TariffNews #InvestorMindset #BearMarketBounce

Head & Shoulders Pattern + 0.786 Fib + Gap WIndowThe measured move off the Head & Shoulders pattern presents a measured move target of $73 if price continues to fall on NVDA. The 0.786 Fib 0.786 retrace had a perfect touch on Friday. Expect a 11% bounce from the 0.786 to the gap fill above. Retrace target = 0.618 Fib. This would establish another Lower High. Trend still presents with downward momentum. Then, expect the next move down towards $75.04