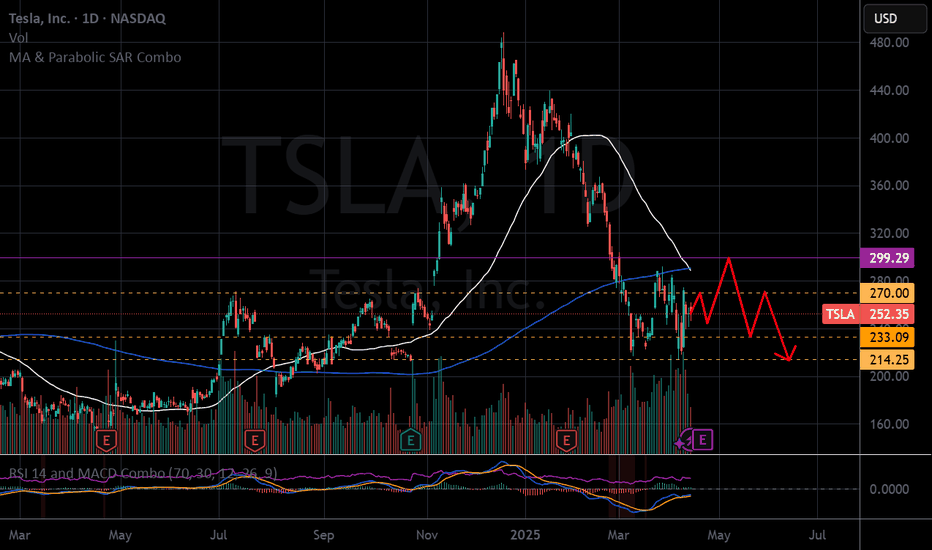

TESLA: $250 | Waiting for Reset and Buy back at Sub $100Royal Arabs of mid east aka pals of Elon booking gains

and informed players wait for buy back of funds

as SHORTS are piling up with momentum kicking in

in addition to Elon spreading himslef as DOGE frontman in Trump's campaign to making America Great Again ...

TSLA trade ideas

$TSLA in penalty box. Stock remains range bound. After the new administration was elected in Nov 2024, AMEX:TSLY stock had a huge bull run since then. It doubled between Nov 2024 to Dec 2024. Since the stock has sold off heavily and has lost more than 50% of its value. It recently bounced back from the lows of 214 $ which was the 0.785 Fib Retracement level if we plot the Fib levels from its highs to the lows. And then it bounced back lower 254 $ which is the 0.618 Fib Level.

AMEX:TSLY is steadily trading within these 2 Fib levels and seems that it fails to break out of this pattern. The stock seems to build a base between 250 and 214 which can be a good place to accumulate the stock. With Elon distracted by DOGE affairs it seems we are missing any catalyst for this stock. So NASDAQ:TSLA fans can keep on accumulating here and wait for a breakout. But to all my NASDAQ:TSLA fans there are already breaks out in other large caps in progress. Look at $MSFT. More regarding NASDAQ:MSFT in the upcoming blogs

Verdict: NASDAQ:TSLA accumulate between 214 – 250 $ if you need to. Else look for other mega caps.

Tesla Bounce Zone?Tesla has been trading in a sideways range between $220 - $290 for the last several weeks, a sign of what may either be a potential accumulation, or another distribution range which ultimately ends in lower prices.

At the moment, we are at an interesting zone, being the low of the range with earnings coming into effect tomorrow.

Although there is a lot of stipulation behind Elon's current credibility working for Trump, it is clear that the overall market sentiment is at extreme lows for Tesla.

Given this, the earnings tomorrow may be a liquidity catalyst event that may shoot this stock back up into a recovery. Perhaps Elon announces his resignation from Doge, or Tesla earnings surprise, or perhaps Tesla is not affected by tariffs as badly as people may think.

Technically, Tesla is sitting at a key zone being the POC (point of control) also known as the most traded zone of the last 4 years. Should a bounce materialize, it would make sense for it to take place around this price. We are also seeing what may be considered a bullish harmonic playing out during this recent volatility.

Either way, we cant predict, we can only manage our risk. The expected move for tomorrow is + or - 10%. Budget accordingly.

Theory: Tesla Stock is just Nvidia Stock in May 2012In this video, I go over the legit possibility of Tesla stock simply looking exactly like Nvidia did in May 2012, and I compare sentiment and chart patterns that look near identical to put together a picture of what the future potentially holds for Tesla stock

Tesla Braces for Q1 Earnings: Will Q1 Results Trigger a sell-offMounting Delivery Pressure, Global Boycotts, and Revenue Misses Leave Tesla at a Critical Turning Point

Overview

Tesla shareholders are on edge ahead of the automaker's Q1 2025 earnings report, set to be released on Tuesday, April 22. The results will cover financial performance from January 2024 to March 2025, a period already clouded by deteriorating delivery volumes, narrowing margins, and rising geopolitical headwinds.

Despite once being the undisputed leader of the EV revolution, Tesla's recent track record paints a troubling picture. The company has missed revenue expectations in five of the past six quarters, raising questions about its ability to maintain market dominance as competition intensifies and global sentiment turns increasingly hostile.

Tesla's Earnings History – The Pressure Is Mounting

Quarter Reported Revenue EstimateSurprise (%)

Sep 2023 $23.35B $24.19B –3.46%

Dec 2023 $25.17B $25.60B –1.67%

Mar 2024 $21.30B $22.22B –4.14%

Jun 2024 $25.50B $24.52B +3.99%

Sep 2024 $25.18B $25.47B –1.12%

Dec 2024 $25.71B $27.26B –5.69%

The $1.55 billion miss in Q4 2024 was the worst in over a year and may signal a more systemic weakness in demand. With every disappointing print, the pressure on Tesla's valuation grows—and investors know it.

Global Factors at Play: Boycotts and Geopolitical Fallout

Tesla's earnings concerns are not only internal. A growing global boycott, fueled by rising international tensions and political backlash against Elon Musk's affiliations with U.S. defence and surveillance initiatives, threatens to cut deeper into global sales—particularly in key markets like Europe and China.

China, once a growth engine for Tesla, is showing signs of resistance amid tightening regulatory pressure and rising national preference for domestic EV manufacturers like BYD and NIO. Similarly, European sentiment toward Tesla is deteriorating as the company becomes entangled in broader geopolitical narratives surrounding U.S. industrial policy.

Stock Price Structure: A Technical Breakdown

Technically, Tesla's stock has formed a disjointed channel since early April, a structure often interpreted as indecision or quiet accumulation/distribution by institutional players.

Key Resistance: $244 (22-month support-turned-resistance)

Immediate Support Levels: $213 → $194 → $182

Upside Targets if Reclaimed key resistance: $263 and $275

The price closed at $241 ahead of the Easter break, down more than 50% from the December 2024 peak, a staggering reversal for what was once Wall Street's darling.

What to Watch Ahead

Delivery Volumes: Investors will focus on whether Tesla can stabilize global deliveries amid mounting competition and boycotts.

Margin Compression: Rising costs and aggressive price cuts have weighed on gross margins for several quarters.

Outlook and Guidance: Any hint of softness in Q1 guidance could trigger further downside.

Institutional Positioning: Watch for post-earnings volume spikes to reveal if big money is unloading or accumulating.

Final Take

Tesla is teetering on the edge of a critical earnings report. If Tuesday's release disappoints, the stock could break down below $213, opening the door to levels not seen since mid-2024. While a bullish recovery isn't off the table, it hinges on a strong beat and improved forward guidance—neither of which is guaranteed.

TSLA Setting Up for the Next Big Move?🚘Tesla's been cooking up some serious price action — and now it’s getting interesting. After holding above key supports, bulls might be eyeing their next shot. Here’s the plan I’m watching:

📥 Entry zones:

• 240 (aggressive)

• 215 (ideal support zone)

• 195 (deep discount territory)

🎯 Profit targets:

• 265

• 290

• 355+ (if momentum takes off)

TSLA has been showing signs of accumulation — and if buyers step in near 215–195, we could be looking at the early stages of a powerful move. Of course, nothing is guaranteed. The EV space is competitive, and macro volatility can flip the script fast.

🔍 Keep an eye on volume, trend confirmations, and news that could push sentiment one way or the other.

⚠️ Disclaimer: This is not financial advice. Just sharing my personal analysis and trade idea. Always do your own research and manage risk according to your own strategy.

TSLA Elliott wave Analysis 20/4/2025For me, I think that TSLA have already End the Cycle (count from the first day TSLA is IPO).As you can see there is a clear divergence at the wave 5 of the A wave,suggesting that A wave of the corrective wave should be end and ready for the huge B wave that might take a lot of time (Since it is the B wave of the massive wave 2).But there is a change that the wave A that is coming down might be the part of WXY pattern or others pattern so we have to keep an eye on.

We potentially about to see a HUGE move on TSLAWe broke a SUPER LONG-TERM BEARISH TRENDLINE (blue) on the weekly timeframe.

+

We have been RANGING for quite some time...

+

TSLA has a personality of explosive, crazy moves

+

TSLA builds HUMAN ROBOTS... (SUPER HIGH VALUE in my opinion, the potential for this is astronomical)

What do we actually need for this move to materialize?

We need the market in our favor.

Lets see if the market will push strongly up or bleed down.

Please also note that before explosive move previously that no one believed it would happen, the earnings reports of TSLA were RED the same as now.

ALWAYS MAKE SURE YOU MANAGE YOUR RISK.

TSLA Weekly Options Trade Plan 2025-04-17TSLA Weekly Analysis Summary (2025-04-17)

Below is an integrated analysis of the reports and market data:

──────────────────────────────

MODEL REPORTS – KEY POINTS

• Grok/xAI – Price and moving averages on both 5‑min and daily charts are below key EMAs; RSI and MACD point to current bearish momentum. – Notable technical support at about 239.75 with resistance above near 242. – The options chain shows heavy put activity at the $240 strike (premium about 0.67), and max pain is at 245, although that level is less relevant for a near‐term (0DTE) trade. – Recommendation: Trade the TSLA $240 PUT at an ask of 0.67 at the open, aiming for roughly a 100% gain and using about a 50% loss as a stop.

• Gemini/Google – Technicals on short‐term and daily timeframes are mixed: the daily chart is clearly bearish while some 5‑min indicators hint at stabilization. – Conflicting signals (including the max pain pull toward 245 and falling VIX) result in not having a high‑conviction directional bias. – Conclusion: “No trade” is recommended today because the conflicting indicators raise the risk of getting whipsawed.

• Claude/Anthropic – Technical analysis on both 5‑min and daily confirms a moderately bearish bias (price well below major EMAs, RSI below 50). – However, one suggested trade was a TSLA $237.50 PUT at an extremely low premium (0.13) which seems less attractive given the preferred premium range. – In essence, the model sees downside potential but selected a strike a bit further out from the current price.

• Llama/Meta – A moderately bearish setup is noted, with the technical picture similar to the others on very short‐term charts. – However, the model also flags the influence of max pain at 245 and concludes that a naked call (for example, at the $240 or $242.50 strike) could profit if the upward “max pain pull” works in play. – Ultimately, this view contrasts with the put trades favored by others.

• DeepSeek – Confirms the overall technical picture: price is below key averages, with bearish momentum evident on both 5‑min and daily charts. – Emphasizes the high open interest on $240 puts and the near-term support at 239.75. – Recommends buying the TSLA $240 PUT at its 0.67 ask price for this weekly (0DTE) option. ────────────────────────────── 2. AREAS OF AGREEMENT AND DISAGREEMENT

Agreements: – Most reports note that TSLA is trading in a moderately bearish state with price below the relevant moving averages and key support levels near 239.75. – There is broad recognition that options activity is concentrated around the $240 strike—especially on the put side, where volume and open interest are very high, underscoring bearish positioning. – Technical indicators (RSI, MACD, Bollinger Bands) on short‑term and daily charts lean toward bearishness despite some very short‑term signals of stabilization.

Disagreements: – Gemini/Google sees too many conflicting signals (including the upward pull implied by max pain) and hence recommends no trade, while the majority of the other analysts view the setup as tradeable. – Llama/Meta is open to trading a naked call (capitalizing on the max pain influence) whereas Grok/xAI, DeepSeek, and to a lesser degree Claude/Anthropic advocate for a bearish put trade instead. ────────────────────────────── 3. CONCLUSION & TRADE RECOMMENDATION

Overall Market Direction Consensus: Most opinions point to a moderately bearish bias for TSLA on a near-term, 0DTE weekly horizon. Even though conflicting signals (like max pain toward 245 and some stabilization on very short timeframes) introduce uncertainty, the weight of the technicals and put side open interest lean toward downside pressure.

Recommended Trade: Trade a single‑leg, naked PUT (weekly option) on TSLA.

Trade Parameters: – Instrument: TSLA – Strategy: Buy a TSLA $240 PUT – Expiration: 2025‑04‑17 (weekly, 0DTE) – Premium: Approximately $0.67 per contract (slightly above the preferred range, but justified by high liquidity and clear technical support) – Entry Timing: At the open – Profit Target: Around 100% gain from the entry premium (i.e. exit near a $1.34 premium) – Stop‑Loss: Roughly a 50% loss at about $0.33 per contract – Confidence Level: Approximately 65% – Key Risks & Considerations: • The mixed signals (especially Gemini’s caution and the max pain theory) mean price could quickly reverse if TSLA rebounds near 245. • Very short‑term trading (0DTE) carries risks related to rapid time decay and volatility spikes. • A failure to break important support (around 239.75) would warrant an early exit. ────────────────────────────── 4. TRADE_DETAILS (JSON Format)

{ "instrument": "TSLA", "direction": "put", "strike": 240.0, "expiry": "2025-04-17", "confidence": 0.65, "profit_target": 1.34, "stop_loss": 0.33, "size": 1, "entry_price": 0.67, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

THE DEATH CROSSDeath Cross Triggered During Consolidation: What It Could Mean

The 50 SMA (blue) just crossed below the 200 SMA (red), signaling a Death Cross—a traditionally bearish indicator. But here’s the catch: this didn’t happen during a steep downtrend. It happened during consolidation.

That changes the narrative.

When a Death Cross forms during a period of sideways chop instead of a clear downtrend, it often reflects lagging momentum, not accelerating weakness. It can trap shorts expecting a breakdown, especially if price is coiling above strong support or forming a basing pattern.

💡 Key things I’m watching:

Does price respect the consolidation range low?

Are we forming a bullish divergence on RSI or MACD?

How does volume behave around the cross?

This may not be a "short and hold" moment—this might be a shakeout before trend resolution. Stay sharp. Don't trade the cross, trade the context.

TESLA | Monthly Analysis After NASDAQ:TSLA hitting its ATH target, 87% - 90% retracement is next target

start of 2027 = will be a buying signal for tesla unless there's some issues involving with Elon Musk, then tesla could experience under performance

Long term investors - prepare for down side inside buying channel

TSLA Diamond Penet BreakoutThe "TSLA Diamond Penet Breakout" strategy suggests monitoring two critical levels: if Tesla's stock price breaks below the "red" level, it indicates a short position opportunity; conversely, breaking above the "green" level suggests taking a long position. This strategy also forecasts a potential 3% price movement following a breakout in either direction, emphasizing the importance of these defined thresholds for trading actions .