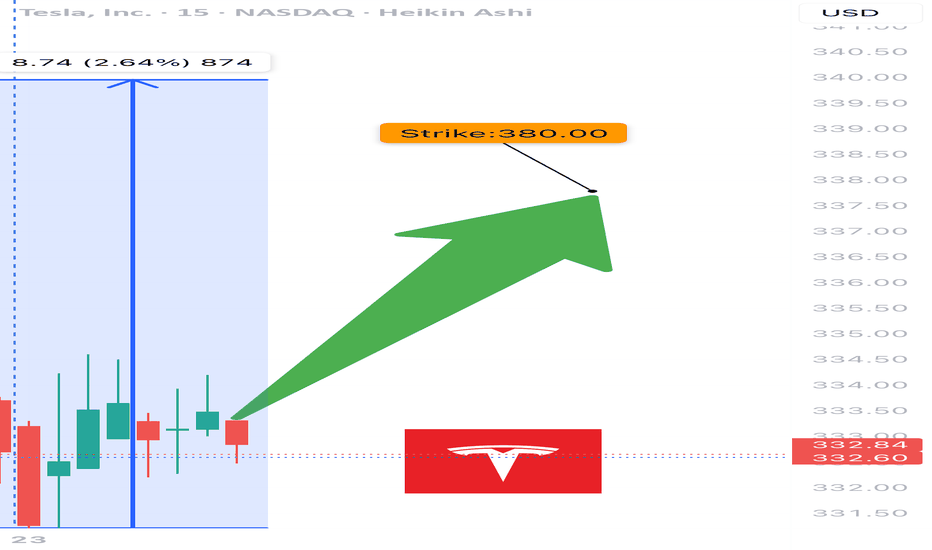

TSLA WEEKLY CALL SETUP — 07/23/2025

🚀 TSLA WEEKLY CALL SETUP — 07/23/2025

📈 AI Consensus Signals 🔥 Bullish Move Incoming

⸻

🔍 SENTIMENT SNAPSHOT

5 AI Models (Grok, Gemini, Claude, Meta, DeepSeek) =

✅ MODERATE BULLISH BIAS

➡️ Why?

• ✅ RSI Momentum (Daily + Weekly = UP)

• ✅ Bullish VIX sentiment

• ⚠️ Weak volume + neutral options flow

• 🧠 No model signals bearish direction

⸻

🎯 TRADE IDEA — CALL OPTION PLAY

{

"instrument": "TSLA",

"direction": "CALL",

"strike": 380,

"entry_price": 0.88,

"profit_target": 1.76,

"stop_loss": 0.44,

"expiry": "2025-07-25",

"confidence": 65%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 380 CALL

💵 Entry Price 0.88

🎯 Target 1.76 (2× gain)

🛑 Stop Loss 0.44

📅 Expiry July 25, 2025

📈 Confidence 65%

⏰ Entry Market Open

⚠️ Risk High gamma / low time (2DTE)

⸻

📉 MODEL CONSENSUS

🧠 Grok – Bullish RSI, cautious due to volume

🧠 Gemini – Momentum confirmed, weekly strength

🧠 Claude – RSI + VIX = green light

🧠 Meta – 3 bullish signals, minor risk caution

🧠 DeepSeek – RSI + volatility favorable, careful on size

⸻

💬 Drop a 🟢 if you’re in

📈 Drop a ⚡ if you’re watching this flip

🚀 TSLA 380C looks primed if we break resistance near $376

#TSLA #OptionsTrading #CallOptions #WeeklySetup #AIPowered #MomentumTrade #TeslaTrade #GammaRisk #ZeroDTEReady

TL0 trade ideas

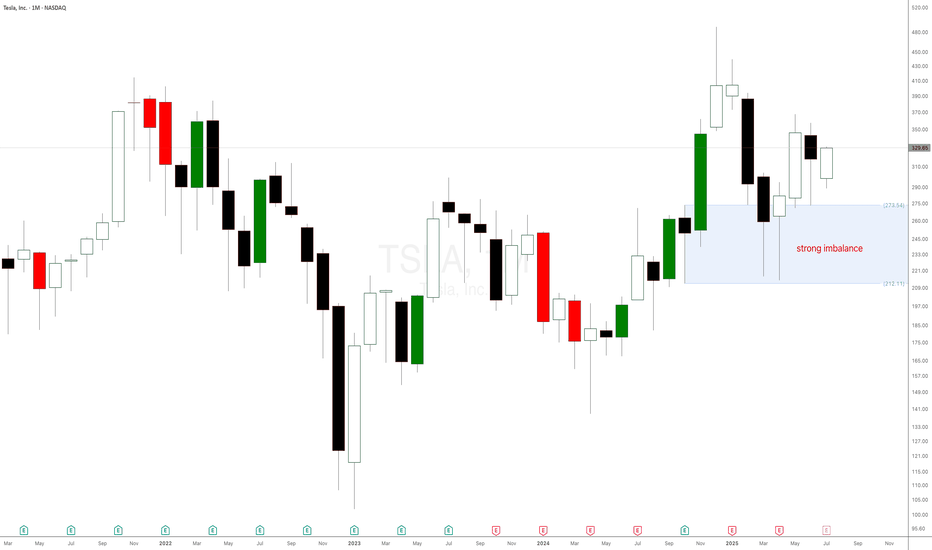

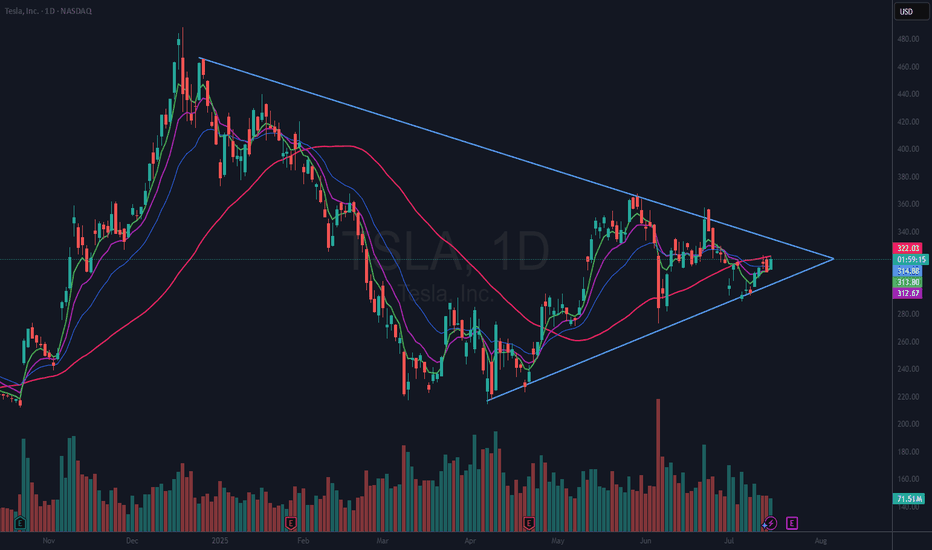

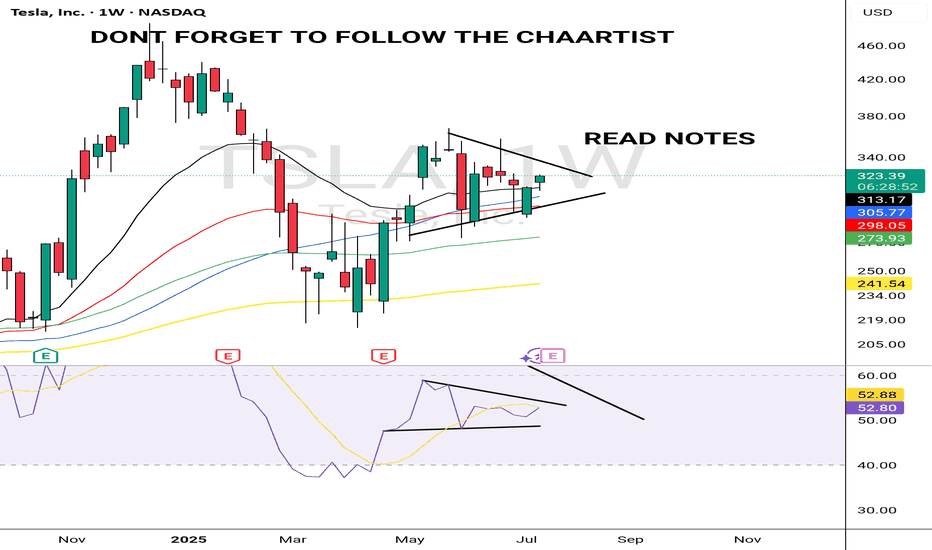

Don’t Listen to Elon Musk – Tesla Stock Chart Tells the REAL StoTesla Stock Set to Break Records: The Power of Monthly and Weekly Demand Imbalances at $273 and $298. Welcome back, traders! In today’s supply and demand breakdown, we’re diving deep into Tesla Inc. (NASDAQ: TSLA) — not from the noisy headlines or what Elon Musk just tweeted, but strictly from raw price action, demand imbalances, and the truth on the charts. Forget the fundamentals, forget the hype, because that’s already been priced in.

This is all about supply and demand, price action, and the power of patience.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

The $273 Monthly Demand Imbalance: The Big Fish Made Their Move

A few weeks ago, Tesla stock pulled back to a significant monthly demand imbalance at $273. This level wasn’t just any zone—it was carved out by a strong impulsive move made of large-bodied bullish candlesticks, the kind that only institutions and whales create when they're loading up.

What happened next?

Boom. The market reacted exactly as expected, validating that monthly imbalance and setting the stage for higher prices. This is why we always trust the bigger timeframes—they hold the truth of what the smart money is doing.

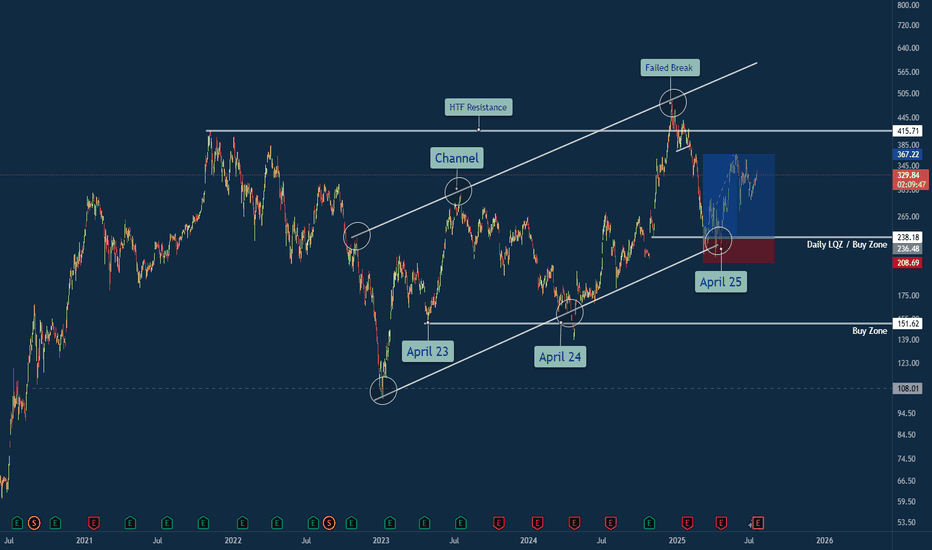

Tesla Trade Breakdown: The Power of Structure, Liquidity & ...🔍 Why This Trade Was Taken

🔹 Channel Structure + Liquidity Trap

Price rejected from a long-standing higher time frame resistance channel, making a false breakout above $500 — a classic sign of exhaustion. What followed was a sharp retracement into the lower bounds of the macro channel, aligning with my Daily LQZ (Liquidity Zone).

🔹 Buy Zone Confidence: April 25

I mapped the April 25th liquidity grab as a high-probability reversal date, especially with price landing in a confluence of:

Demand Zone

Trendline Support (from April 23 & April 24 anchor points)

Volume spike + reclaim of structure

🔹 Risk/Reward Favored Asymmetry

With a clear invalidation below $208 and targets at prior supply around $330+, the R:R on this trade was ideal (over 3:1 potential).

Lessons Reinforced

🎯 Structure Always Tells a Story: The macro channel held strong — even after a failed breakout attempt.

💧 Liquidity Zones Matter: Price gravitated toward where stops live — and then reversed sharply.

🧘♂️ Patience Beats Precision: The best trades don’t chase. They wait. This was one of them.

💬 Your Turn

How did you play TSLA this year? Were you watching the same channel? Drop your insights or charts below — let’s compare notes 👇

#TSLA #Tesla #SwingTrade #PriceAction #LiquidityZone #FailedBreakout #TechnicalAnalysis #TradingView #TradeRecap #ChannelSupport #SmartMoney

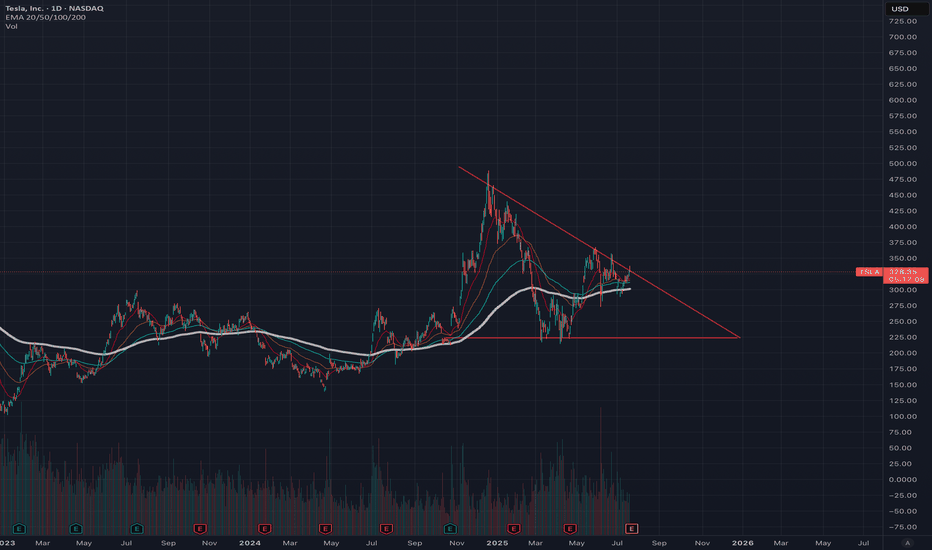

Descending triangle pattern - Major correction possibleAll the recent news regarding Tesla has severely impacted stock confidence. While Tesla's development pipeline appears strong in the short and long term, Elon Musk's politically divisive antics have been difficult to ignore. The EU and the UK, in particular, have been very critical of the CEO and his behavior, causing tensions and reluctance to support Tesla products.

I am confident that this negativity will eventually pass now that Elon has refocused on Tesla and is addressing the fallout; however, it will take some time. Earnings are expected to be affected this quarter and likely next quarter as well. The new Y-model has reportedly not made the significant impact that was anticipated based on media articles/reviews. Although it is a healthy update.

Investing in this stock is a gamble on Tesla's long-term potential, especially regarding both the automated robot taxi aspect and AI development. Personally, I remain very bullish on Tesla's long-term prospects. However, the charts currently tell a concerning story. First, daily trading volume is declining, and there is the formation of a potentially significant descending triangle pattern on the daily chart, which is worrisome. If this pattern breaks to the downside, we could see prices drop into the $136 range or even lower, possibly even to 98 USD.

I plan to set a limit order in the coming weeks within this range, depending on how Apple and other Magnificent Seven stocks perform, as I expect capital to flow from Tesla to those stocks. After all, Tesla has been a profitable stock for a long time, and many holders are currently in profit.

In the short term, I expect Tesla to retest the range of 219 USD and then remain below 295 USD, potentially dropping lower as the pattern completes before re-testing 219, unless a new positive announcement is made. Trade safely..

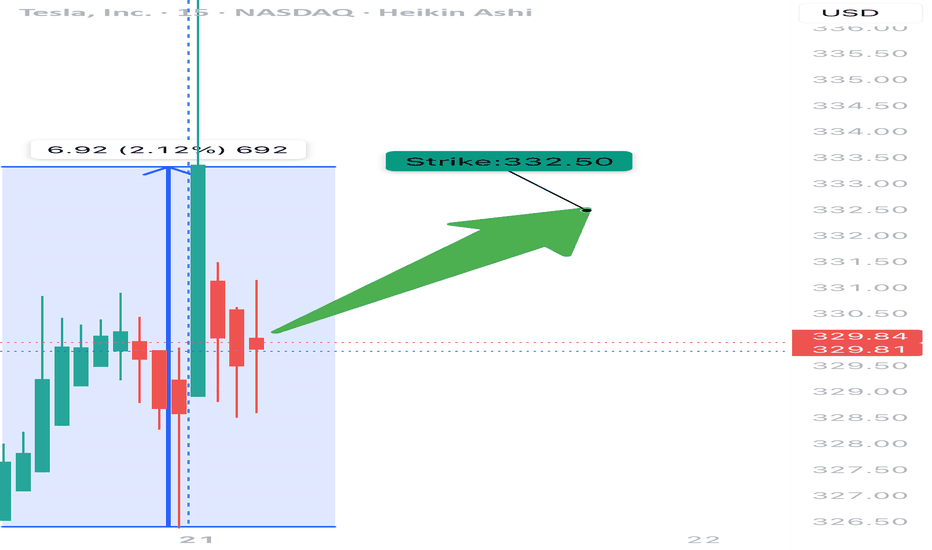

TSLA WEEKLY TRADE IDEA – JULY 21, 2025

🚀 TSLA WEEKLY TRADE IDEA – JULY 21, 2025 🚀

🔔 Bullish Play, But Handle With Caution 🔔

Models split, but momentum wins (for now)…

⸻

📈 Trade Setup

🟢 Call Option – Strike: $332.50

📆 Expiry: July 25, 2025 (Weekly)

💰 Entry: $11.05

🎯 Target: $22.11 (100% Gain)

🛑 Stop: $5.53 (50% Loss)

🕰️ Entry Time: Monday Open

📊 Confidence: 65% (Moderate)

⸻

🧠 Why This Trade?

✅ RSI trending bullish on both daily + weekly

⚠️ Weak volume & bearish options flow (C/P ratio > 1)

📉 Institutions may be hedging into earnings

🌪️ Earnings risk looms – volatility expected

📉 Some models say no trade – we say: controlled risk, tight leash

⸻

🧨 Strategy:

🔹 Single-leg naked call only

🔹 Avoid spreads due to IV & potential gap risk

🔹 Scale out if gain >30% early-week

🔹 CUT FAST if volume + price diverge

⸻

🔥 Quick Verdict:

Momentum > fear, but don’t ignore the smoke.

TSLA 332.5C — Risk 1 to Make 2+

Ready? Let’s ride the wave 📊⚡

#TSLA #OptionsTrading #CallOption #TradingSetup #WeeklyTrade #EarningsSeason #MomentumPlay #TradingViewIdeas #SwingTrade #SmartMoneyMoves

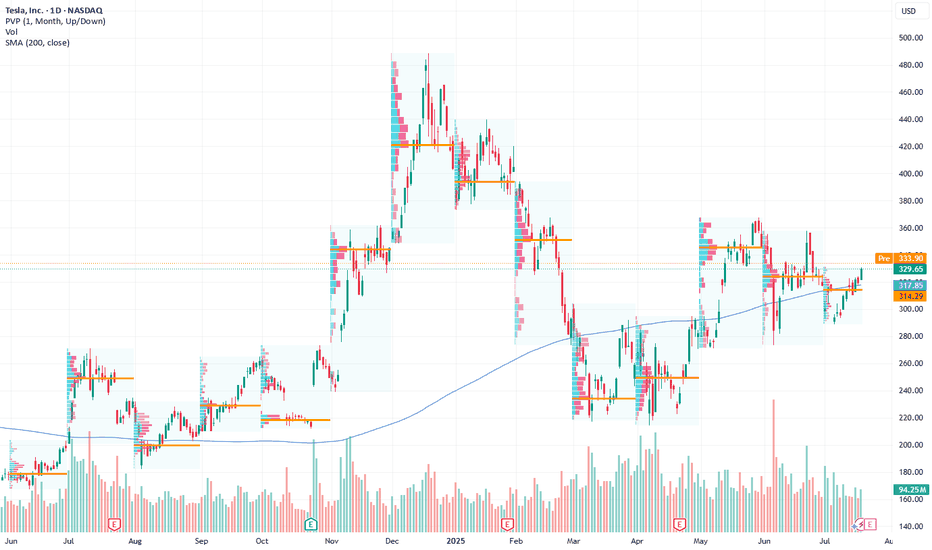

Tesla's Bullish Momentum Builds Ahead of EarningsCurrent Price: $329.65

Direction: LONG

Targets:

- T1 = $333.90

- T2 = $351.80

Stop Levels:

- S1 = $322.70

- S2 = $312.05

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Tesla.

**Key Insights:**

Tesla remains on a bullish trajectory supported by critical technical signals, including a golden cross—a strong indicator of upward momentum. The company's strategic focus on artificial intelligence and autonomous driving is fueling long-term enthusiasm among investors. However, macroeconomic risks, including rising competition from Chinese EV manufacturers, require careful monitoring. Tesla's upcoming earnings report is widely anticipated as a key event likely to influence short-term price movements, with a potential for heightened volatility.

Tesla's ability to innovate and adapt to highly competitive EV markets makes it a central player within the "MAGA7" stocks, where technology companies dominate market trends and sentiment. A combination of strategic moves in AI, energy, and automotive autonomy creates strong bullish undercurrents.

**Recent Performance:**

Tesla has seen consistent upward momentum in recent sessions, buoyed by optimism over production numbers and product launches. Its share price recently benefited from renewed sentiment in the consumer discretionary sector, positioning Tesla as a market leader. While its recent gains have reinforced long-term investor confidence, the stock remains vulnerable to volatility ahead of the upcoming earnings announcement.

**Expert Analysis:**

Analysts are optimistic about Tesla's prospects based on several tailwinds, including its first-to-market edge in full self-driving (FSD) technology and its expected rollout of the affordable Model Q. While improving gross margins remain a focus, competition in China poses a near-term challenge. Historically, Tesla's shares have shown considerable movement following earnings, with realized volatility averaging 10.2% compared to implied volatility of around 6.3%. Current technical indicators, such as rising moving averages, bolster the bullish case.

**News Impact:**

Recent headlines surrounding Tesla's robo-taxi fleet ambitions and accelerated AI developments have positioned the company as a leader in future technologies. Meanwhile, regulatory advancements, including possible approval of its FSD system in China, could unlock significant revenue streams in the Asian market. However, policy concerns regarding EV tax credits and ongoing macroeconomic uncertainties introduce downside risks.

**Trading Recommendation:**

Tesla offers an attractive long opportunity given its robust technical setup and multiple near-term catalysts, including its imminent earnings report and innovations in AI and autonomy. Anchored at $329.65, the stock is expected to test $333.90 as the first resistance level, with a stretch target of $351.80. Maintain disciplined risk management with stop levels at $322.70 and $312.05, as macro headwinds and earnings volatility remain potential risks to the bullish outlook.

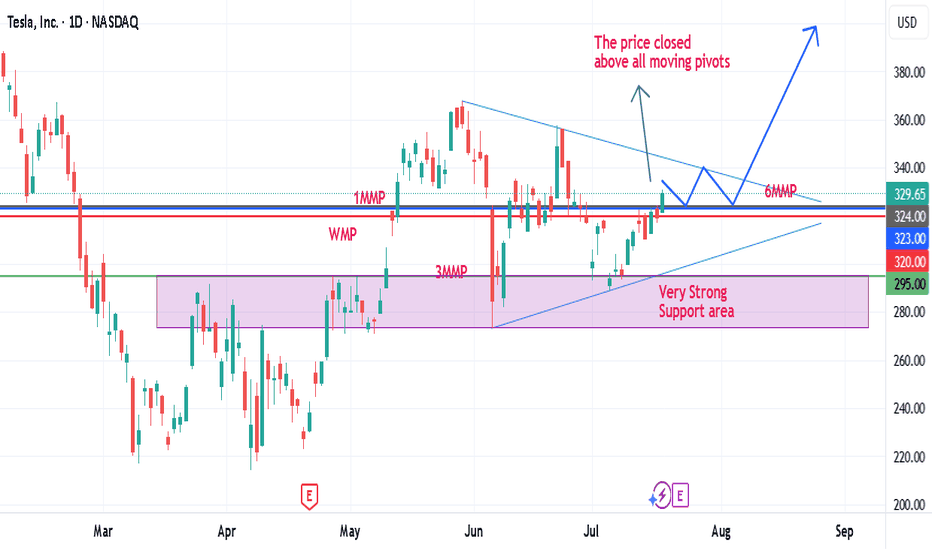

TESLA IS COMPLETELY READY TO SKYROCKET TOWARDS 400$-HERE IS WHYDear traders, based on the daily chart, the price experienced a very important daily as well as weekly close above all its moving pivots, i.e., weekly, monthly, 3 months and 6 months. Besides the price is well above all of its important moving averages supporting by positive 9D, 14D, 20D, 50D and 100D macds as well. These all confirm a great potential for a massive move towards 400$ and beyond in coming days/weeks. The support area is well established between 280-300$ and this area will hold the price for a decisive upward movement. Let's See!

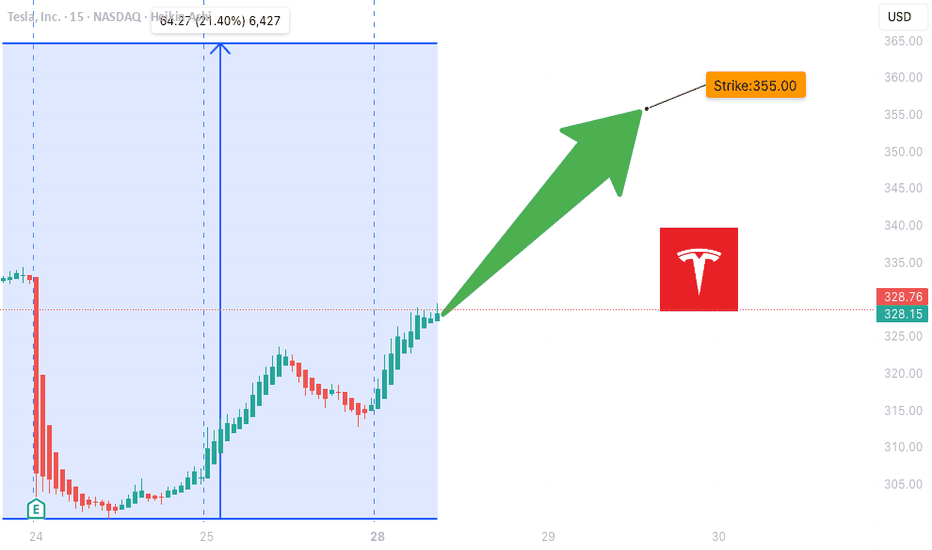

TSLA WEEKLY OPTIONS SETUP

### 🚗 TSLA WEEKLY OPTIONS SETUP (2025-07-28)

**Big Call Flow. Low VIX. Can Bulls Hold \$325?**

---

📊 **Momentum Overview:**

* **Daily RSI:** 48.2 🔻 → *Neutral-to-Weak*

* **Weekly RSI:** 57.1 🔻 → *Still bullish zone, but falling*

⚠️ **Interpretation:** Momentum is softening, trend in question.

📉 **Volume Context:**

* **Volume Ratio:** 1.3x ⬆️ (vs. last week)

* **Price Change:** -0.77% despite that volume

🔍 *Distribution Alert:* Institutions may be selling into strength.

📈 **Options Flow:**

* **Call/Put Ratio:** **1.70** = 🚨 *Bullish flow confirmed*

* **Volatility (VIX):** 15.16 🟢 Favorable for directional plays

✅ Strong setup for options traders riding short-term momentum

---

### 🧠 **Weekly Sentiment Scorecard:**

* ✅ **Bullish Signals (2):** Options Flow, Volatility

* ⚠️ **Neutral Signals (2):** Daily & Weekly RSI

* ❌ **Bearish Signal (1):** Volume pattern = distribution risk

**Overall Bias:** 🟢 *Moderate Bullish*

---

### 🔥 **TRADE SETUP IDEA:**

🎯 **Strategy:** Long Call Option

* 📌 **Instrument:** TSLA

* 💵 **Strike:** \$355C

* 📅 **Expiry:** Aug 1, 2025

* 💸 **Entry:** \~\$0.75

* 🎯 **Profit Target:** \$1.50

* 🛑 **Stop Loss:** \$0.45

* 🔒 **Key Support to Watch:** \$327.50 — lose that = exit fast

📈 **Confidence Level:** 65%

⚠️ **Gamma Risk:** High → trade small, manage tight.

---

### 📦 TRADE\_DETAILS (JSON Format for Algo/Backtest):

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 355.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.50,

"stop_loss": 0.45,

"size": 1,

"entry_price": 0.75,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

### 🧭 **Quick Notes for Traders:**

* ✅ Bulls have short-term edge — but **momentum is fading**

* ⚠️ If TSLA breaks below **\$325**, exit fast.

* 🔍 Watch for fakeouts: options flow is bullish, but volume says “not so fast.”

---

📊 TSLA \$355C → Risk \$0.75 to potentially double 📈

💬 Will this hold, or is it a bull trap before a dump? 👀

Comment below ⬇️ and follow for Monday updates!

---

**#TSLA #OptionsFlow #WeeklyTrade #TradingSetup #GammaRisk #AITrading #TeslaStock #UnusualOptionsActivity #SmartMoneyMoves**

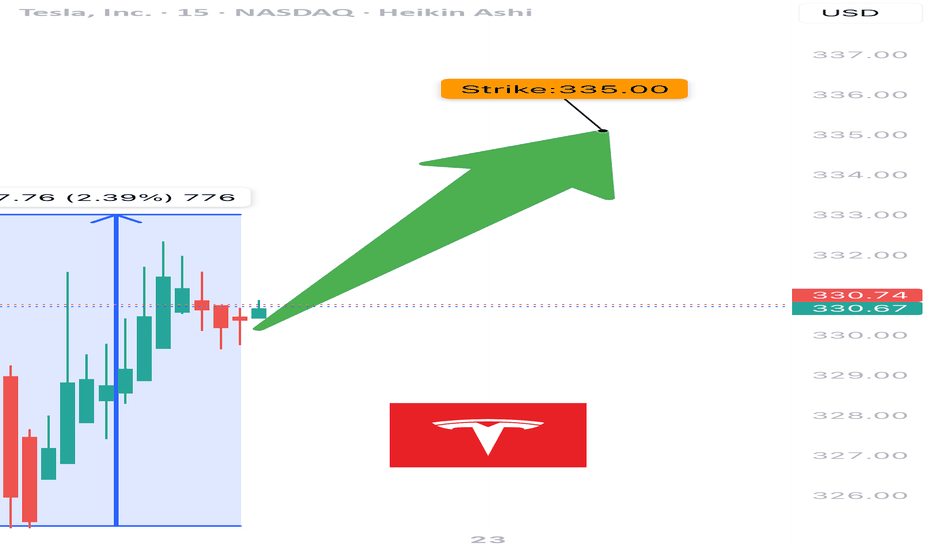

$TSLA Weekly Call Play – 07/22/25

🚀 NASDAQ:TSLA Weekly Call Play – 07/22/25

RSI Bullish 📈 | Options Flow Strong 🔁 | Volume Weak 💤 | 3DTE Tactical Entry

⸻

📊 Market Snapshot

• Price: ~$332–335 (spot near strike)

• Call/Put Ratio: 🔁 1.24 – Bullish Flow

• Daily RSI: ✅ 57.6 – Rising momentum

• Weekly RSI: ⚠️ 54.8 – Neutral / flattening

• Volume: ❌ Weak – Institutional absence

• Gamma Risk: ⚠️ Moderate (DTE = 3)

• VIX: ✅ Favorable

⸻

🧠 Trade Setup

{

"Instrument": "TSLA",

"Direction": "CALL",

"Strike": 335.00,

"Entry": 9.90,

"Profit Target": 15.00,

"Stop Loss": 6.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔬 Sentiment Breakdown

Indicator Signal

📈 Daily RSI ✅ Bullish – confirms entry

📉 Weekly RSI ⚠️ Flat – no long-term edge

🔊 Volume ❌ Weak – no institutional bid

🔁 Options Flow ✅ Bullish (C/P = 1.24)

💨 VIX ✅ Favorable for upside trades

⏳ Gamma Decay ⚠️ High risk (3DTE)

⸻

📍 Chart Focus

• Support Zone: $328–$330

• Breakout Watch: $335+

• Target Zone: $340–$345

• ⚠️ Risk Watch: Volume divergence + gamma decay on low move

⸻

📢 Viral Caption / Hook (for TradingView, X, Discord):

“ NASDAQ:TSLA bulls flash 335C with confidence, but volume’s asleep. RSI’s in, gamma’s ticking. 3DTE lotto with caution tape.” 💥📉

💵 Entry: $9.90 | 🎯 Target: $15.00+ | 📉 Stop: $6.00 | ⚖️ Confidence: 65%

⸻

⚠️ Who This Trade Is For:

• 🔁 Options traders chasing short-term call flows

• 📈 Momentum scalpers riding RSI pop

• 🧠 Disciplined risk managers eyeing 3DTE setups

⸻

💬 Want a safer bull call spread (e.g., 330/340) or risk-defined iron fly for theta control?

Just ask — I’ll build and optimize it for you.

TESLA 400 BY END OF YEAR !! 5 REASONS !!!

1. **Strong Earnings and Revenue Growth**

Tesla has a track record of exceeding earnings expectations. If the company reports robust financial results in Q3 and Q4—driven by higher vehicle deliveries and growth in its energy storage business—investors are likely to gain confidence. This could push the stock price upward as Tesla demonstrates its ability to scale profitably.

2. **Advancements in Autonomous Driving**

Tesla’s Full Self-Driving (FSD) technology is a game-changer in the making. If Tesla achieves significant progress toward Level 4 or 5 autonomy—where vehicles can operate with little to no human intervention—it could position the company as a leader in transportation innovation. Such a breakthrough would likely excite investors and drive the stock price higher.

3. **Battery Technology Innovation**

Tesla is working on developing cheaper, longer-lasting batteries, which could lower production costs and improve profit margins. If the company announces advancements in battery tech—such as improvements from its Battery Day initiatives or new manufacturing processes—it could signal a competitive edge, boosting the stock to $400.

4. **Global Expansion and Production Increases**

Tesla’s new Gigafactories in Texas and Berlin are ramping up production, while potential market entries like India loom on the horizon. Increased output and access to new customers signal strong growth potential. If Tesla successfully scales its operations, investors may see this as a reason to push the stock price toward $400.

5. **Favorable Market Trends and Government Policies**

The global shift toward sustainable energy and electric vehicles (EVs) is accelerating, supported by government incentives and regulations favoring clean energy. If EV adoption continues to rise and policies provide a tailwind—such as subsidies or stricter emissions standards—Tesla, as an EV leader, could see increased demand and a higher stock valuation.

While reaching $400 by year-end is ambitious, Tesla’s strong brand, innovative edge, and leadership under Elon Musk could make it achievable. That said, risks like market volatility and growing competition from other EV makers could pose challenges. If these five factors align, however, Tesla’s stock has a solid shot at hitting that target.

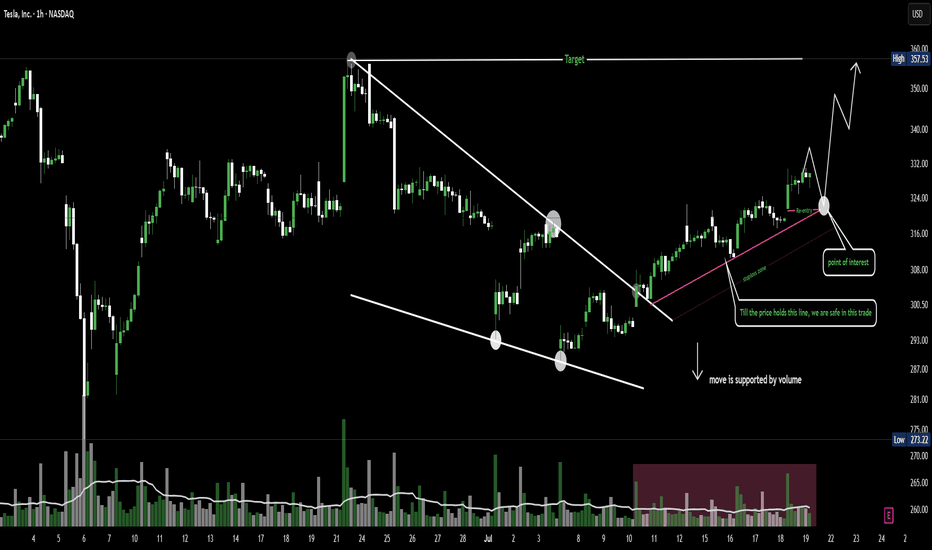

Tesla 1H chart showing room for a 10% upside - Bullish setup This Tesla 1H chart showcases a falling wedge breakout with strong volume support, followed by a steady uptrend. The price has respected a rising support line, with a clean re-entry zone and a defined stoploss for trade protection. As long as the price holds above the trendline, the chart remains bullish with a target around $357.

"Tesla 1H chart showing room for a 10% upside — bullish setup unfolding."

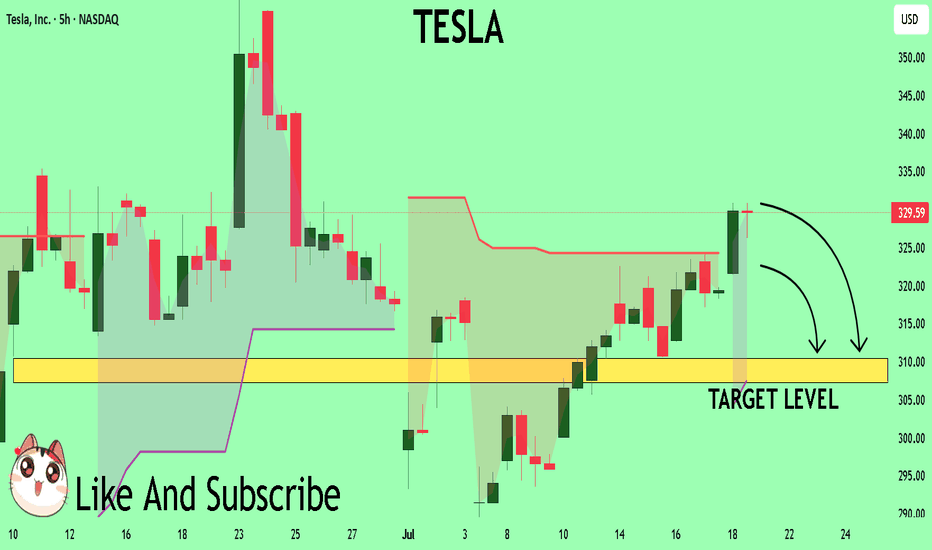

TESLA My Opinion! SELL!

My dear subscribers,

My technical analysis for TESLA is below:

The price is coiling around a solid key level -329.59

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 310.44

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

TESLA SELL PLAN – BEWARE BUYERS, FUEL IS BELOW📉 TESLA SELL PLAN – BEWARE BUYERS, FUEL IS BELOW

🔻 Market Structure:

Recent bullish push retraced into a bearish fair value gap (FVG), indicating potential exhaustion in buying.

🟥 Supply Zone Hit:

Price revisited the FVG zone and faced rejection twice, showing sellers are active at that level.

👁️ Liquidity Eyes:

Two major liquidity pools are clearly marked below – price may seek these resting liquidity areas.

🔻 Bias:

Bearish, as price reacted from premium FVG and is forming lower highs.

📍 Execution Plan:

Monitor for continuation patterns on lower timeframe within context.

Ideal short entries can be found after confirmation rejections from FVG zone.

Expect internal liquidity sweeps before the major drop.

🎯 Target:

Watch for price to draw down toward the external liquidity zones below, especially near previous macro demand areas.

⚠️ Note for Buyers:

Current retracement is likely corrective. Until price breaks structure and invalidates the bearish FVG, upside is risky.

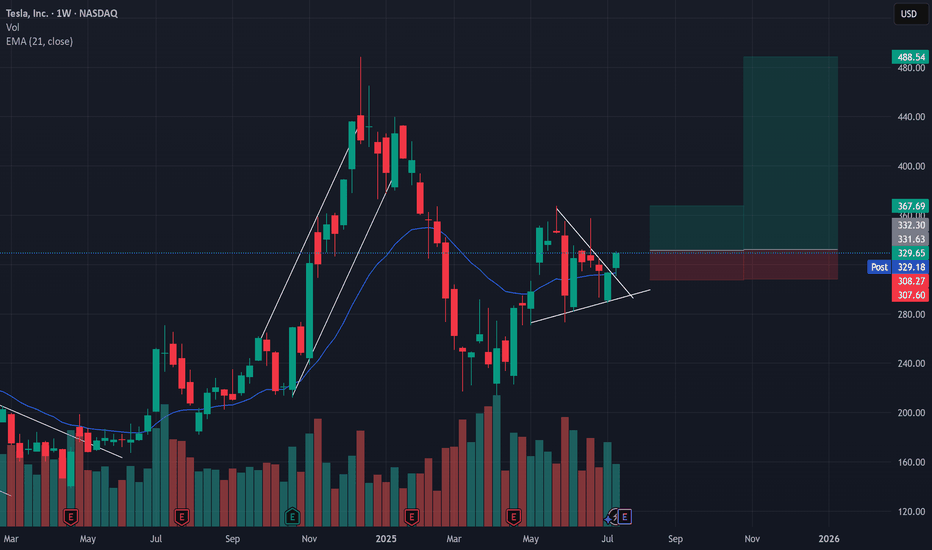

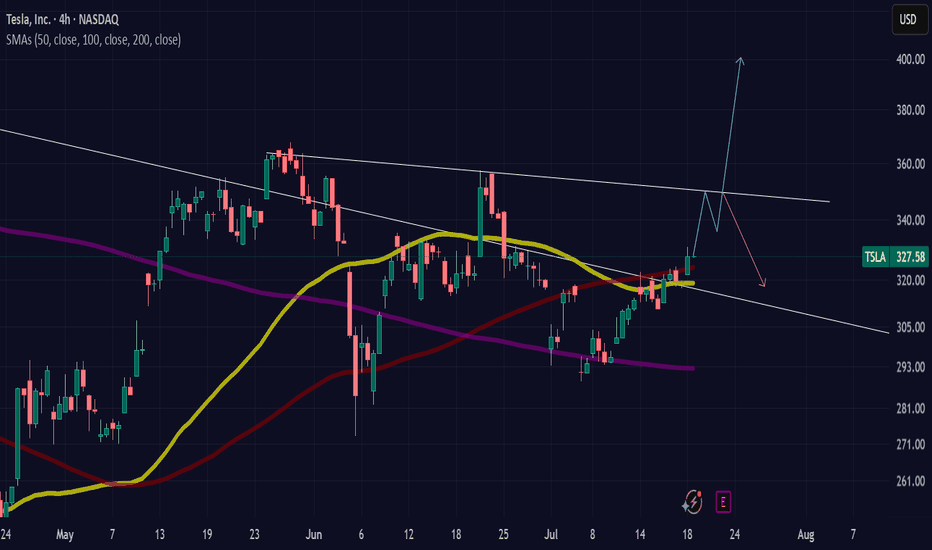

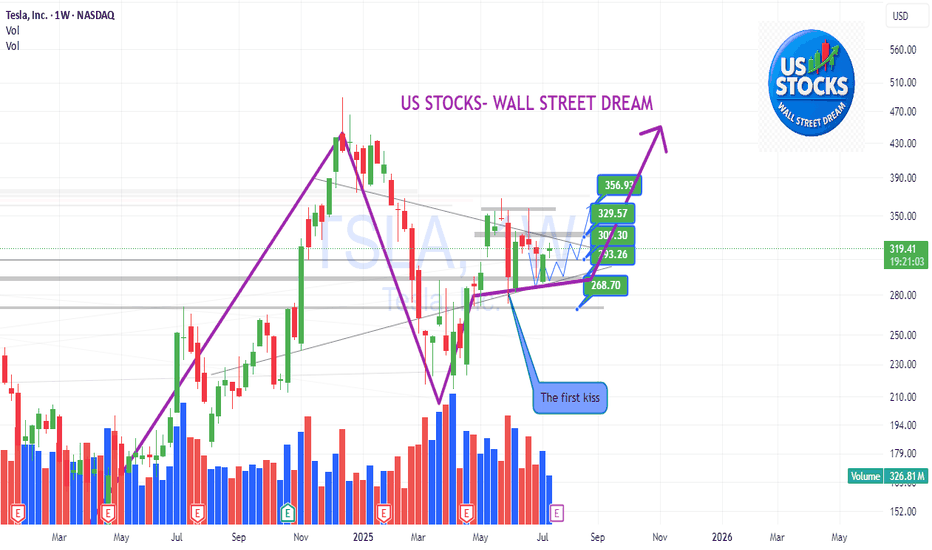

Retested Wedge Bullish Breakout = New Highs?

NASDAQ:TSLA

NASDAQ:TSLL

Tesla has currently showcased two very bullish setups with one already taking place.

Over the past 2 month we've seen TSLA swing dramatically from a high of $368 to a low of $278 while producing lower highs and higher lows AKA a wedge formation.

Wedge formations are a low probability set up and typically produce a 50/50 breakout, however there are a couple of bullish signals on the weekly chart that have kept me in my TSLL position expecting a retest of either the $368 high and/or $490.

Bullish insights -

1 - After a strong push above the 21d EMA, TSLA had a 2 legged pull back with last week being a short failure and closing above the 21d EMA

2 - this week's candle retested the breakout trendline and closed in a very bullish candle.

3 - Tesla's $488 high was an overshoot which produced a strong breakout to the low end, however there was no new high formed meaning there is a high probability chance that we will revisit ~$500.

Trade set up Idea:

If next week's candle forms higher than this weeks bullish candle, target is $368, Stop loss is set at $306 for a 1:1.5 Risk vs reward.

Or

If next week's candle forms higher than this weeks bullish candle, target is $348, Stop loss is set at $306 for a 1:6.5 Risk vs reward.

I'm holding for the second one ;)

Current position - 7400 shares of TSLL

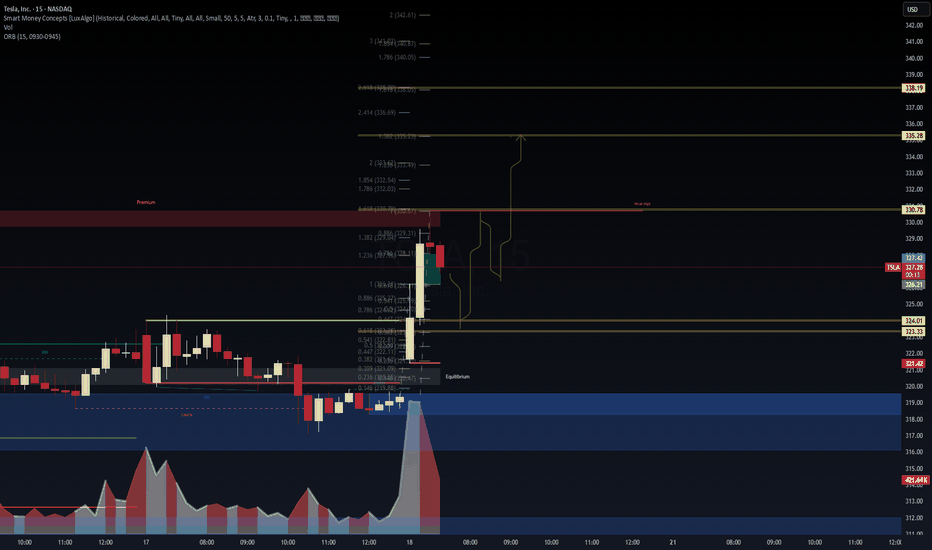

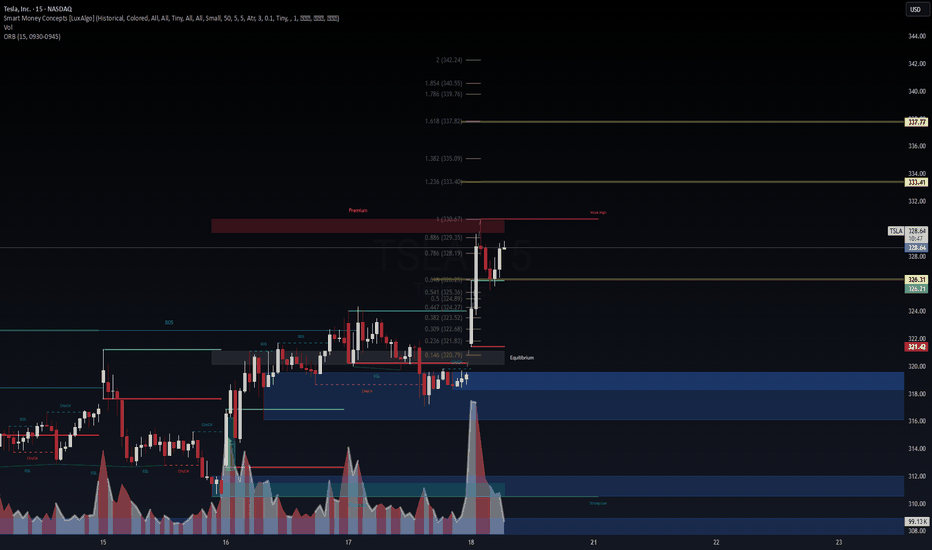

$TSLA Fibonacci Expansion Targets in Play – VolanX Precision Le🔋 NASDAQ:TSLA Fibonacci Expansion Targets in Play – VolanX Precision Levels

TSLA just powered through a clean bullish reversal from the discount zone and now trades inside the premium supply block near 330.67. This zone aligns with:

📍 0.886 Fib (329.35)

📍 Weak high at prior inefficiency

📍 VolanX ORB resistance (326.21–330.67)

🧠 WaverVanir VolanX Setup:

✅ CHoCH → BOS → Premium Tap

✅ ORB (15) broken to upside with volume (76.6K)

🟡 Currently testing equilibrium/premium confluence

🎯 Fibonacci Expansion Targets:

1.236 → 333.40

1.382 → 335.09

1.618 → 337.77

2.0+ range → 342–347 (if melt-up continues)

⚠️ Trade Logic:

A pullback to 326.30 may serve as a re-entry zone.

Watch for rejection at 330.67 — if it fails, bulls could reclaim control into the 333–337 fib cluster.

Macro + flows suggest continuation, but premium rejection remains possible. Stay nimble.

📌 #TSLA #Tesla #WaverVanir #VolanXProtocol #SmartMoneyConcepts #ORB #Fibonacci #LiquidityZones #BreakoutSetup #TradingView #OptionsFlow #Scalping #MacroMomentum

$TSLA Giant Wedging Pattern (VCP)NASDAQ:TSLA is in a giant 7 month wedging pattern. It can be seen as a VCP (Volatility Contraction Pattern) as well. These types of patterns can break either way. However, in this case we have a rising 50 DMA (red). That suggests to me that this will break to the upside.

I already have a small position in TSLA and I will look to add if or when it breaks above the 50 DMA and again if or when it breaks above the upper downtrend line. If it breaks the lower line, I am out.

Be aware that Tesla reports earnings in 7 days, Wednesday, July 23rd, after the bell.

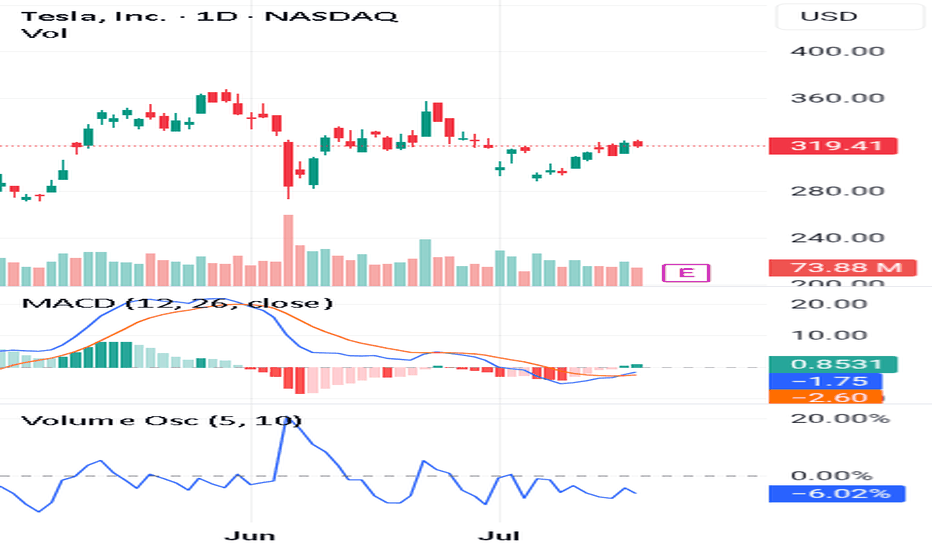

(Learn More)Use These 3 Steps To Spot Long-Lasting Trends👉Trade before the earnings report

👉Make sure the volume oscillator is below zero

👉Make sure the MACD lines give you a Bullish signal

If you look at this chart you can see all the steps alignment.

This is very important because you want to catch a long term trend.

Also it has to follow the 3step rocket booster strategy.

In order for you to learn more about this strategy 🚀 Rocket Boost This Content.

Disclaimer ⚠️ Trading is risky please learn how to use Risk Management And Profit Taking Strategies. Also feel free to use a simulation trading account before you use real money.

TSLA: Anyone knows this pattern?TSLA:

Anyone knows this pattern?

Think contrarily to the market — seek opportunities in things that few people notice or pay attention to, and when you do, opportunities will come to you earlier than they do to the crowd.

.

US STOCKS- WALL STREET DREAM- LET'S THE MARKET SPEAK!