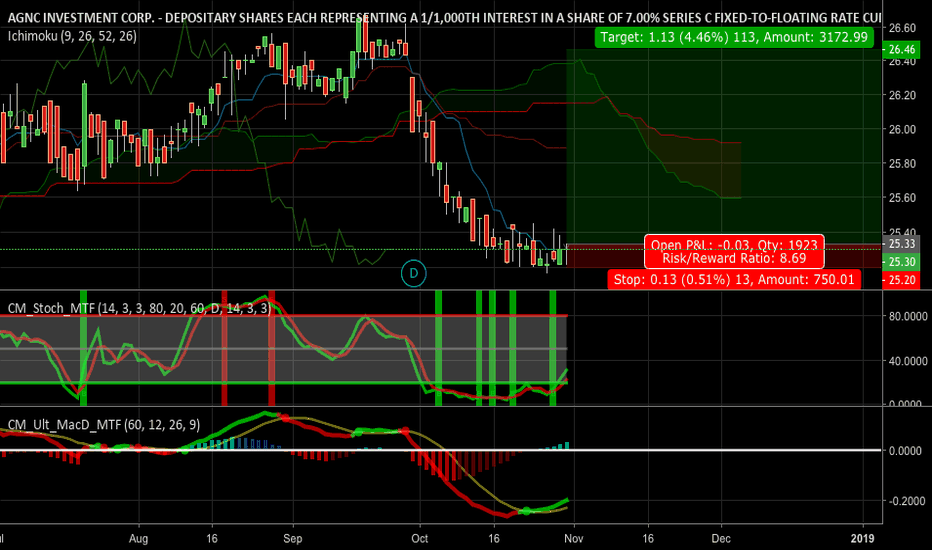

Buy AGNCLooks like a cup and handle setup - accumulation pattern - smart money

Technically speaking

Dont understand all that redeemable blah blah...

Gap to fill Sept 27

Stoch showing multiple confirmation of bottoming process - rounding bottom

MACD confirming up trend

Really dont like the noise in the c

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.12 MXN

17.99 B MXN

101.66 B MXN

1.01 B

About AGNC Investment Corp.

Sector

Industry

CEO

Peter J. Federico

Website

Headquarters

Bethesda

Founded

2008

FIGI

BBG00JX0PYF3

AGNC Investment Corp. engages in the operation of a real estate investment trust. The firm invests in residential mortgage pass-through securities and collateralized mortgage obligations for which the principal and interest payments are guaranteed by the United States government-sponsored enterprise or by the United States government agency. It also invests in other types of mortgage and mortgage-related securities, such as credit risk transfer securities and non-Agency residential and commercial mortgage-backed securities, where repayment of principal and interest is not guaranteed by the United States government-sponsored enterprise or by the United States Government agency, and other assets related to the housing, mortgage, or real estate markets. The company was founded on January 7, 2008 and is headquartered in Bethesda, MD.

Related stocks

AGNCP ....An IHSAGNCP appears to have put in an Inverse Head and Shoulders (IHS) bottom with a head at $24.20, neckline at $25.50 and target of $2650. Last week AGNC has broken above the $25.50 neckline, setting up the potential move to the IHS target of $26.70. Also notice at the initial $20.5 price low in july th

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AGNC is 179.01 MXN — it has increased by 0.17% in the past 24 hours. Watch AGNC INVESTMENT CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange AGNC INVESTMENT CORP stocks are traded under the ticker AGNC.

AGNC stock has risen by 2.78% compared to the previous week, the month change is a 1.06% rise, over the last year AGNC INVESTMENT CORP has showed a −1.84% decrease.

We've gathered analysts' opinions on AGNC INVESTMENT CORP future price: according to them, AGNC price has a max estimate of 194.88 MXN and a min estimate of 167.04 MXN. Watch AGNC chart and read a more detailed AGNC INVESTMENT CORP stock forecast: see what analysts think of AGNC INVESTMENT CORP and suggest that you do with its stocks.

AGNC stock is 1.12% volatile and has beta coefficient of 0.51. Track AGNC INVESTMENT CORP stock price on the chart and check out the list of the most volatile stocks — is AGNC INVESTMENT CORP there?

Today AGNC INVESTMENT CORP has the market capitalization of 183.89 B, it has decreased by −1.39% over the last week.

Yes, you can track AGNC INVESTMENT CORP financials in yearly and quarterly reports right on TradingView.

AGNC INVESTMENT CORP is going to release the next earnings report on Oct 27, 2025. Keep track of upcoming events with our Earnings Calendar.

AGNC earnings for the last quarter are 7.13 MXN per share, whereas the estimation was 7.69 MXN resulting in a −7.33% surprise. The estimated earnings for the next quarter are 7.11 MXN per share. See more details about AGNC INVESTMENT CORP earnings.

AGNC INVESTMENT CORP revenue for the last quarter amounts to 15.57 B MXN, despite the estimated figure of 16.18 B MXN. In the next quarter, revenue is expected to reach 16.44 B MXN.

AGNC net income for the last quarter is −2.63 B MXN, while the quarter before that showed 1.02 B MXN of net income which accounts for −356.37% change. Track more AGNC INVESTMENT CORP financial stats to get the full picture.

Yes, AGNC dividends are paid monthly. The last dividend per share was 2.25 MXN. As of today, Dividend Yield (TTM)% is 14.83%. Tracking AGNC INVESTMENT CORP dividends might help you take more informed decisions.

AGNC INVESTMENT CORP dividend yield was 15.64% in 2024, and payout ratio reached 154.84%. The year before the numbers were 14.68% and 2.79 K% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 53 employees. See our rating of the largest employees — is AGNC INVESTMENT CORP on this list?

Like other stocks, AGNC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AGNC INVESTMENT CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AGNC INVESTMENT CORP technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AGNC INVESTMENT CORP stock shows the sell signal. See more of AGNC INVESTMENT CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.