APP trade ideas

APP Weekly Trade Plan – June 20, 2025🟥 APP Weekly Trade Plan – June 20, 2025

🎯 Instrument: APP (Applovin Corp)

📉 Direction: Bearish (Put)

📅 Expiry: 2025-06-20

📊 Confidence Level: 65%

⏰ Entry Timing: Market Open

🔎 Model Consensus Breakdown

Model Direction Summary

Grok/xAI 🔻 Bearish Clear bearish momentum. Recommends $325 put.

Claude ⚠️ No Trade Mixed signals; confidence below 50%.

Gemini 🔻 Bearish Recommends $322.50 put based on RSI/VIX.

Llama ⚠️ No Trade Slightly bearish but low conviction.

DeepSeek 🔼 Bullish Contrarian call ($327.50) against oversold bounce.

🧠 Consensus Takeaway

✅ Most models agree APP is under bearish pressure on the daily chart.

⚠️ Mixed signals emerge due to oversold RSI and elevated VIX (~20.31).

🧨 Watch for short squeezes or rebound attempts off key support ($325–$327).

✅ Recommended Trade (Put Option)

Metric Value

🎯 Strike $325 Put

💰 Entry Price $0.75 (limit)

🛑 Stop Loss $0.38

🎯 Profit Target $0.975+

📈 Confidence 65%

📏 Size 1 contract

📅 Expiry June 20, 2025

💡 This trade bets on short-term continuation lower, possibly breaking $325 support.

⚠️ Risk Management Notes

VIX at 20+ increases whipsaw risk — limit order strongly recommended.

Oversold RSI could lead to a dead-cat bounce.

Respect the stop-loss if APP rebounds above $327 intraday.

🧾 TRADE_DETAILS (JSON Format)

json

Copy

Edit

{

"instrument": "APP",

"direction": "put",

"strike": 325.0,

"expiry": "2025-06-20",

"confidence": 0.65,

"profit_target": 0.975,

"stop_loss": 0.38,

"size": 1,

"entry_price": 0.75,

"entry_timing": "open",

"signal_publish_time": "2025-06-20 15:21:16 UTC-04:00"

}

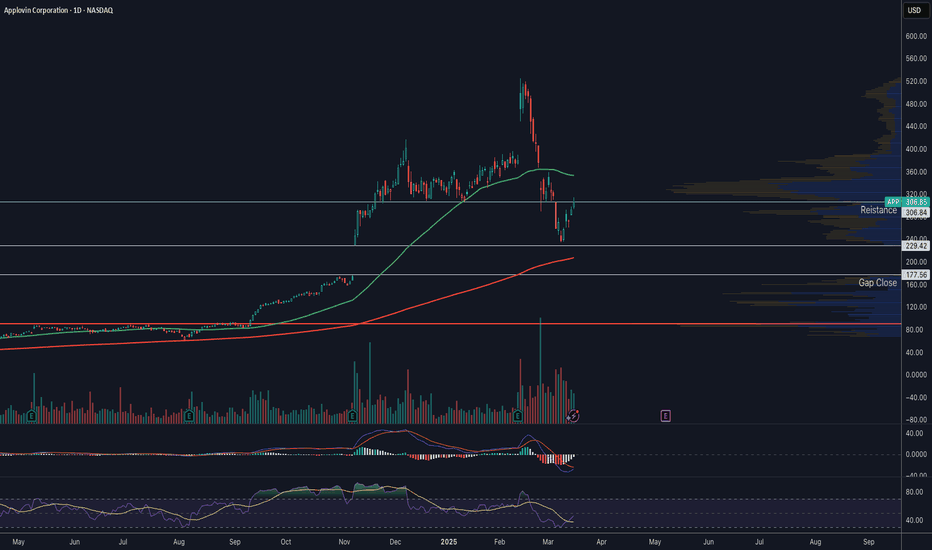

AppLovin - the Shoulders – But Not the Breakdown!🟢 Head and Shoulders Pattern (Bearish)

* The price action is forming a left shoulder , a higher peak (head) , and a right shoulder .

* This classical pattern often signals a reversal from bullish to bearish.

* The dotted orange neckline marks the potential support – if broken, it could trigger a sharper decline.

📉 Key Technical Zones

* Neckline Support: Around $309 . A breakdown below this level may confirm the pattern.

* Previous Support : In case of a breakdown, next strong support lies near $100–110 (long-term zone).

* Upside Scenario : If neckline holds and bullish momentum resumes, the pattern could be invalidated with a breakout over $400 .

📊 MACD Divergence

* MACD shows a bearish divergence (higher price highs vs. lower MACD highs), signaling momentum weakness .

* The histogram is turning red again – a bearish sign.

* A bearish crossover has already occurred, supporting a possible downtrend.

🔄 Possible Scenarios

* Bearish : If neckline breaks → possible drop toward the $200s or lower.

* Neutral : Consolidation between $310–$380.

* Bullish : If price bounces before neckline and breaks above $400 → invalidates pattern.

AppLovin Corporation (APP) – Rewiring Ad Tech with AI at ScaleCompany Snapshot:

AppLovin NASDAQ:APP is shedding its legacy gaming identity and emerging as a pure-play AI advertising infrastructure leader. Post its $900M gaming unit divestiture, the company is laser-focused on AXON 2.0, its next-gen AI ad engine, positioning APP as one of the most transformative players in the digital ad ecosystem.

🚀 Key Growth Drivers:

🧠 AXON 2.0 – AI-Powered Programmatic Ad Platform

Delivers real-time ad bidding with predictive optimization

Retail and eCommerce verticals seeing rapid adoption

Scalable infrastructure = operating leverage + high margin tailwinds

🛠️ Self-Serve & GenAI Expansion

Self-serve ad tools on the roadmap = democratizing access for SMBs

Generative AI ad creatives enable fast, customized campaigns at scale

Broadens TAM beyond top-tier advertisers to long-tail marketers

💰 High-Margin, Asset-Light Model

Post-divestiture, APP’s margins are structurally higher

Lean, software-first model with strong unit economics and cash generation

Flexibility for buybacks, R&D, or strategic M&A

📊 Market Positioning & Flywheel

Network effects: More advertisers = better data = smarter bidding

Competes with The Trade Desk, Google DV360, and Meta in ad optimization

First-mover advantage in mobile AI bidding infrastructure

📈 Financial & Strategic Highlights:

Q/Q margin expansion amid rising advertiser retention

Structural cost improvements post-gaming spinout

Potential for SEED_TVCODER77_ETHBTCDATA:2B + in annualized EBITDA as AI scaling accelerates

🧭 Investment Outlook:

✅ Bullish Above: $255.00–$260.00

🚀 Upside Target: $520.00–$525.00

🎯 Thesis: AppLovin is evolving into the NVIDIA of mobile ad tech—using proprietary AI infrastructure to reshape programmatic advertising. With high-margin growth, expanding use cases, and a clear product vision, APP is a top-tier AI advertising compounder.

#AppLovin #APP #AdTech #AXON #AIAdvertising #Programmatic #DigitalMarketing #GrowthStock

Longs should be careful with this one.boost and follow for more! 🔥

could push to 359-416 short term before it tops out, from risk reward perspective theres much better options in this market.

I personally wouldn't chase this one to the upside with so many options out there, big money may think the same and sell it off. Id be a buyer at trend support or near it.

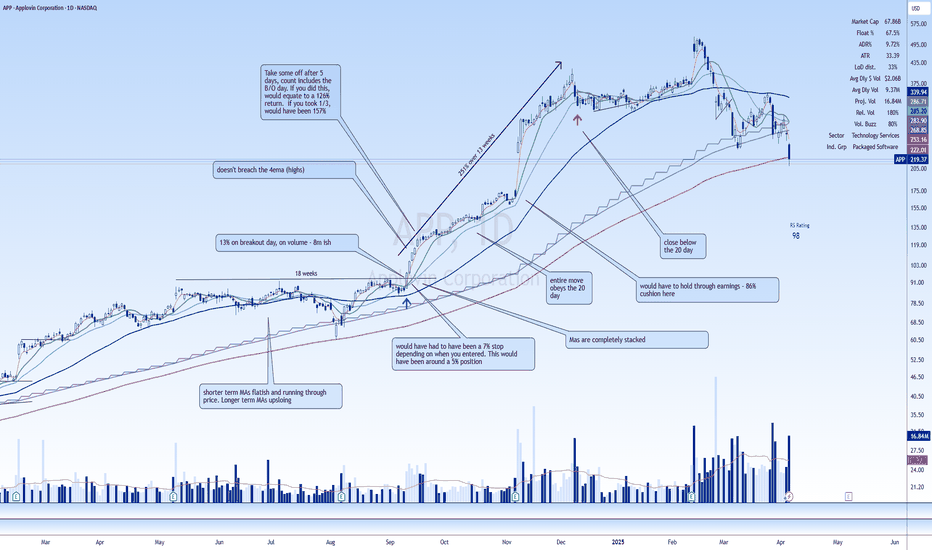

AppLovin the Rocket Ship40% revenue growth quarter after quarter, these guys are the real deal. The stock price reflects the aggressive growth made by AppLovin. Unless there is some serious accounting fraud going on, this is the type of stock you buy on the dip for the next leg up. I entered a swing trade at the confluence of 200 Day moving average and the golden pocket fibonacci level around $237.

The bounce was strong and my stop loss has been moved up to break even . If they have another strong quarter showing 40% growth the 5th Wave could be in play.

Not financial advice, do what's best for you.

APPLOVIN’S Q4 2024—$APP BLASTS OFF WITH AI-AD SURGEAPPLOVIN’S Q4 2024— NASDAQ:APP BLASTS OFF WITH AI-AD SURGE

(1/9)

Good evening, Tradingview! AppLovin’s Q4 2024 earnings hit—$1.37B revenue, up 44% YoY, crushing $1.26B estimates 📈🔥. AI-powered AXON drives a 37% stock pop. Let’s unpack NASDAQ:APP ’s monster quarter! 🚀

(2/9) – REVENUE & EARNINGS

• Q4 Revenue: $1.37B, +44% YoY ($953.3M Q4 ‘23) 💥

• Ad Revenue: $999.5M, +73% YoY

• Apps Revenue: $373.3M, -1% YoY 📊

• EPS: $1.73, beats $1.24 est.

• Net Income: $599.2M, +248% YoY

(3/9) – BIG MOVES

• Stock Surge: +37% post-earnings (Feb 13) 🌍

• Buybacks: $2.1B retired 25.7M shares in ‘24 🚗

• Debt Play: $3.55B notes issued Nov ‘24 💸

• Q1 ‘25 Guide: $1.355-1.385B, tops $1.32B est.

(4/9) – SECTOR SHOWDOWN

• Market Cap: $175B (Feb 13) 🌟

• Trailing P/E: 116 vs. TTD (50), META (33)

• Growth: 44% YoY beats TTD (26%), META (19%)

• 1Y Stock: +1,000%, 2Y: +3,000%

Premium price, growth screams value!

(5/9) – RISKS TO FLAG

• Valuation: 116 P/E—high stakes, no misses 📉

• Debt: $3.51B vs. $567.6M cash—leverage looms ⚠️

• AI Rivals: Google, Meta eye AXON’s turf 🏛️

• Regs & Economy: Ad spend cuts lurk

(6/9) – SWOT: STRENGTHS

• Growth: 44% revenue, $599M profit soars 🌟

• Margins: 62% EBITDA, $2.1B FCF in ‘24 🔍

• AXON: 73% ad surge—AI’s the champ 🚦

NASDAQ:APP ’s a profit powerhouse!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Apps dip (-1%), $3.51B debt 💸

• Opportunities: E-commerce ads, AI edge, acquisitions 🌍

Can NASDAQ:APP turn risks into riches?

(8/9) – NASDAQ:APP ’s Q4 stuns—where’s it headed?

1️⃣ Bullish—AI keeps it soaring.

2️⃣ Neutral—Growth holds, risks balance.

3️⃣ Bearish—Valuation bites back.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

AppLovin’s Q4 dazzles—$1.37B revenue, $599M profit, stock blazing 🌍🪙. High P/E, but AI growth shines. Debt and rivals loom—gem or peak?

AppLovin (APP) AnalysisCompany Overview:

AppLovin NASDAQ:APP is a mobile marketing leader, providing developers with tools for user acquisition, ad optimization, and analytics. The company also benefits from its owned apps, such as Monopoly GO!, which contribute 30% of its revenue.

Key Catalysts:

AI-Driven Revenue Expansion 🤖

AI plays a pivotal role in AppLovin’s success, driving 80% of its revenue growth. This AI advantage helps optimize user engagement and ad targeting, boosting overall platform efficiency.

Mobile Gaming Growth 🎮

The mobile gaming industry is projected to grow at an 8% annual rate through 2027, positioning AppLovin to benefit as a key player in game monetization and marketing solutions.

E-Commerce Ad Expansion 🛒

AppLovin’s new e-commerce ad pilot could generate FWB:30M -$50M in Q4 2024, with a self-service platform launch in mid-2025 targeting the $200B+ global e-commerce ad market.

Analyst Confidence 📊

Oppenheimer has reiterated its Outperform rating, with a $480 price target, citing AppLovin’s earnings potential, robust ad revenue streams, and growing monetization avenues.

Investment Outlook:

Bullish Case: We are bullish on APP above the $380.00-$400.00 range, supported by AI adoption, ad growth, and entry into e-commerce advertising.

Upside Potential: Our price target is $650.00-$670.00, reflecting AppLovin’s potential to expand its revenue base across multiple high-growth sectors.

📢 AppLovin—Driving Innovation in Mobile Advertising and Game Monetization. #AppMarketing #AI #MobileGaming

What I'm doing with APPSo I had call options into the earnings 🥳 , here's my plan... $584 Should act as resistance or potential future support. That's why I'm going to close them there. That protects those options for a potential pullback to $417. If instead Applovin breaks above resistance I'll look for a pullback to consolidate back into the $584 support and get long once again.

Good luck!