BCS - 6/5/2020BCS - Ichimoku daily chart shows it just break upside of the thick seller's cloud of $6.44. If BCS stays above $6.44 today it could move up to fill the next unfilled gap that was $8.25 from 2/27/2020. Huge upside call buying on 7/17 $6 (33K+ contracts) and 7/17 $7 (48K+ contracts). Not sure what's in the news for BCS, but this could be a catch-up trade as the rest of financials.

BCS/N trade ideas

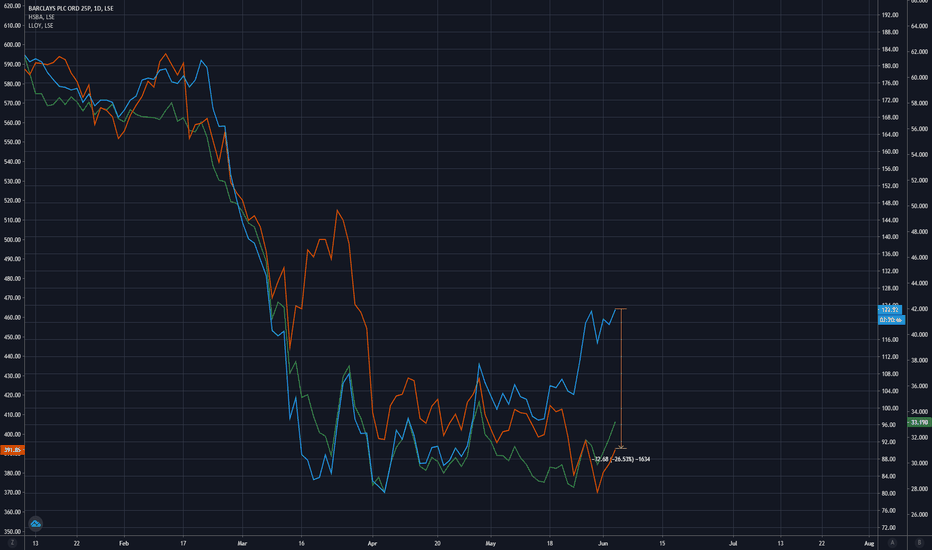

BARCLAYS PLC and huge chance to choose BUY position right nowHello, here is my analysis, where you can see some interesting points of detail about BARCLAYS PLC. There is some explanation, about COVID-19 impacts and bullish position, where you can choose a long term trading position.

Please, don't hesitate to #share your opinion and #LIKE my idea. Thanks and GL

BARCLAYS 2.0 - STILL STRONGBy popular demand, here are my revised predictions for Barclays over the next month or so.

I will mark this chart as long, but READ THIS DESCRIPTION . I am not indicating that you long from the get go. Please read my thesis to see when and how you should enter these positions.

Barclays hit the initial target I set almost instantly. From there, it's been consolidating, choosing where to go from that area. To me, it seems as if it'll be down, and then up. Stocks don't tend to go up, then fall slightly, and then boost right back up. Tying in with the COVID-19 pandemic, I don't think it's likely that Barclays has the heart to fight through the terrors as of yet.

We can see how well Barclays followed the trendline that I set out. It hit is almost perfectly, but then proceeded to push back upwards from there on.This leaves us in a tricky position.

I can only post one thesis on a chart, although I actually have two.

Number one is one NOT on the chart. The thesis for this is that Barclays continue their run upwards off of the trendline and touch it one again, but then print a divergence and get out of the hole that they are in. I think this is more unlikely because of the traction needed to get out of the area that they're in. Their chart looks similar to HSBC, in that it's not unlikely that they will fall back into the bottom range. However, if Barclays manage to hold the consolidation period they're in, and print a nice push upwards, then it's safe to say we will hit the first (and potentially second) target with little to no effort.

Now for my second thesis. This is the one that's on the chart. As you can see, I have planted two buying zones on the chart. The reasoning for this is due to the difference between CFD and Stock trading. If you trade CFD's, it's more worth it to wait until the 75% zone. If you buy and hold stocks, it's safer to buy into the 25% zone AND the 75% zone should it hit. Use both zones at your own discretion. My prediction is that Barclays will lose the trendline, get trapped underneath it, and then proceed to fall under the line to the buying zones plotted. From here, it will try and reclaim its previous trend by pushing through the resistance; to which it should partially falter and then succeed, I have not included the resistance on here because if you enter in the two zones plotted, it should be rather irrelevant.

Hopefully this thesis gives some of you a clearer idea on what to do in this scenario. A recovery in imminent, but not immediate.

- 𝙇𝙄𝙉𝘿𝙀𝙇𝙇

Barclays Earnings go LONGBarclays earnings will push the price upwards tomorrow, they will still pay dividends even if their earnings report is weaker than expected. Expect either a straight push to the first target, or a follow along the trend line until the consolidation period is over and the big push out of the range occurs. Great long term hold especially with bullish divergence!

$BCS “Barclays, now there’s a thought” … sound familiar?

PROs:

Trading at 53.4% below its fair value

Earnings are forecast to grow 15.96% per year

Earnings grew by 54.1% over the past year

BARC is good value based on its PE Ratio compared to the UK market

BARC is good value based on its PEG Ratio

BARC is good value based on its PB Ratio compared to the GB Banks industry average

BARC’s forecast earnings growth (16%) is above the savings rate (0.5%)

BARC’s earnings are forecast to grow faster than the UK market per year

BARC’s revenue is forecast to grow faster than the UK market

BARC’S current net profit margins (12.5%) are higher than last year (8.1%)

BARC has become profitable over the past 5 years, growing earnings by 47.5% per year

BARC’s earnings growth over the past year (54.1%) exceeds its 5-year average

BARC earnings growth over the past year (54.1%) exceeded the bank's industry (26.6%)

BARC insiders have bought more shares than they have sold in the past 3 months

CON’s:

Highly volatile share price over the past 3 months

BARC’s 1 year return = -43.5%

BARC is poor value based on its PE Ratio compared to the Banks industry average

BARC’s revenue (2.6% per year) is forecast to grow slower than 20% per year

BARC has a high level of bad loans

BARC does not pay a dividend

Report:

Fundamentally the picture doesn't look all that bad, although there is a lot of negative news out there surrounding Barclays and banks in general.

From a Technical standpoint, the symmetrical triangle is located at the bottom of a steep decline, which can have a tendency for another leg lower. The 20 period moving average is also just above the apex capping further gains at this stage.

Bottomcatcher’s Opinion: Wait for a convincing break out of the triangle, to determine what direction we could be heading. A break to the upside and above the 100.00 level, would perhaps get my attention (providing we hold above the 100.00 level on the weekly chart) and only then I would consider taking a long position, to hold for the medium to long term.

Note: Levels are subject to change over time.

SHORT Barclays (BARC)Ok guys, so time for a change up. We've been super aggressive with SL's of late and as a result have had a few stops activated by only a handful of pips. Time to adjust

Today we're shorting Barclays. A bank having fiscal trouble during these times you ask? I know, who'd thought it, right??

The narrative of the chart also supports these banal comments, so let's get into it!!

Limit order triggered at 85.44 with SL of 92.89

Target 1: 81.76 RRR 0.51

Target 2: 68.95 RRR 2.24

Target 3: 46.46 RRR 5.40

Thanks for reading and GL everyone

Bullish towrds Resistance level 135$Stock under correction after 3-week sell-off, coming days all stock, bank and forex, crypto need correction before new cycle for sell.

🛑SUPPORT/RESISTANCE

✅S1= 90$

✅S2=82$

✴️R1= 120$

✴️R2=135$

Please like, share, comments and follow me to get daily base analysis

Thank you for your support, I appreciate it.

Falling Wedge pattern Barlcays- BULLISHHello traders! Barclays has a classic falling wedge pattern. This is a very bullish pattern. The SP500 has also broken the channel it was in to the upside. The market appears to have made a decision which direction it wants to go. I expect large gains from this stock.

Barclays Growing Daily Pessimism Likely To Halt ShortlyAfter Barclays Bank Plc Impulsive run from mid-September last year, the stock is now in the early stage of its correction. The correction/pullback causing some pessimism may likely see a halt shortly to begin another phase.

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades

Positional view on weekly TF...looks bullish in "C" wave...???Market Commentary:

If the trend is upside or in downside i will inform in the chart and there will be a PB can occur and some correction may start so MIND that DONT TRADE THE CORRECTION and what i am expecting the CORRECTION....Wait for the PB ends...and give entry in the trend side...If u r doing the PB and correction u will took loss ....trade only in trend side....try to identify the short term PB and the long term PB...then trade in small lots in the short term and trade with big lots in the Long term trend...

READ THE MARKET COMMENTARY IN THE CHART CAREFULLY...AND TRY TO LEARN THE ELLIOT WAVES...OTHERWISE ITS TOUGH TO UNDERSTAND MY ANALYSIS

YOU CAN COMMENT ONLY FOR DOUBTS IN LEARNING EW AND NOT FOR ENTER OR EXIT IN THE TRADE OR ASKING ME OR SUGGESTING ON WHAT U TAKEN, ACCORDING TO YOUR ANALYSIS.

All information given inside the chart and i shared this for educational purpose only. Maximum i wont give the followup or update in the old chart posted as educational trade idea, sometimes i will...so please make sure if i posted the new chart for the same pair, it could be a possible wave count changed or updated. Make sure that old one was invalid or possible or alternate wave and the new one is valid. Good luck and cheers.

This is a educational post only...my ambition is to create a awareness to the traders who lose the money and treating like a gambling...this is a pure business and not only buy and sell apart from that we have to fine tune ourselves in various part of trading...cheers once again.

The short term market consensus for Barclays Plc have changeThe short term market consensus for Barclays Plc(BCS) have change to Bullish.

Barclays Plc operates as a bank holding company that engages in the business of providing retail banking, credit cards, corporate and investment banking and wealth management services. The company operates through two divisions: Barclays UK and Barclays International. The Barclays UK division comprises the U.K. retail banking operations, U.K. consumer credit card business, U.K. wealth management business and corporate banking for smaller businesses. The Barclays International division comprises the corporate banking franchise, the investment bank, the U.S. and international cards business and international wealth management. Barclays was founded on July 20, 1896 and is headquartered in London, the United Kingdom.

Our Proprietary Trading System indicates the following:

The Long Term Trend (LTT) given by the Global Monthly TIME BAR (GMTB) is currently Bullish

The Medium Term Trend (MTT), given by the Global Weekly TIME BAR (GWTB) is currently Bullish

The Short Term Trend (STT), given by the Global Daily TIME BAR (GDTB) is currently Bullish

The Micro Trend (MT), given by the Global Four Hour TIME BAR (GFHTB) is currently Bullish

In light of the above trend analysis we will execute a bullish trade on Barclays Plc(BCS)

Trade #1:Executed from GATS#4

Global Entry Signal For Trade #1: Buy @ £1.8085

Global Trailing Stop Loss Trade #1: @ £1.6597

Global Target Profit Trade #1 : @ £3.2965

Trade #2: Executed from GATS#5

This trade is activated when Trade #1 from GATS#4 reaches a Secured Unrealized Profit (SUP) of 8DATR ((Break Even Point (BEP) + 4DATR)).

That is when the trade has realized 8DATR in our favor

Global Trade Management Strategy: We applied the Global Trailing Stop System for Global Trading Strategy #4. View Updates

Trading is risky

There is a substantial risk of loss in futures and Forex trading. Online trading of stocks and options is extremely risky. Assume you will lose money. Don't trade with money you cannot afford to lose.

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security.

To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice.

To the extent that it includes references to specific securities, commodities , currencies, or other instruments, those references do not constitute a recommendation by Global Financial Engineering,Inc. to buy, sell or hold such investments.

This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers.

Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.