BTBT/N trade ideas

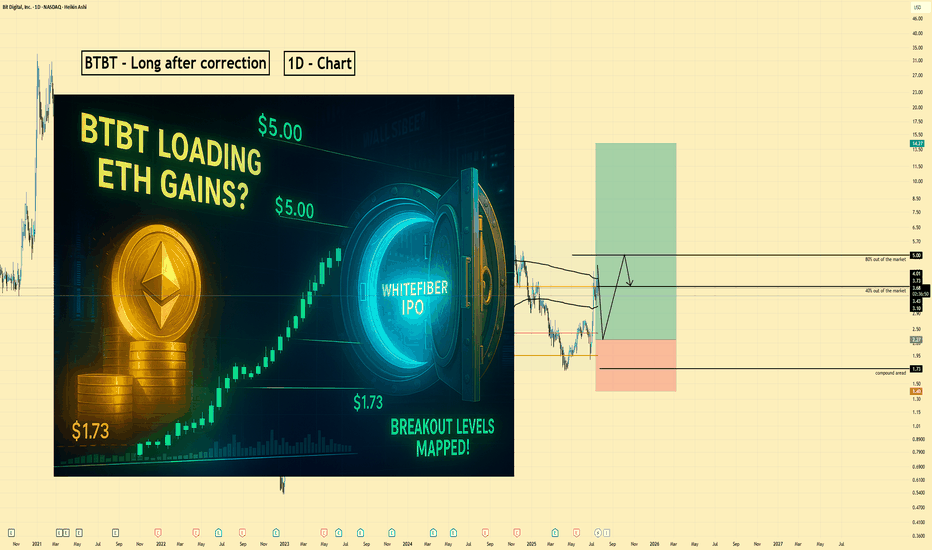

BTBT | Long | Ethereum Treasury Pivot with Capital Backing | (JuBTBT | Long | Ethereum Treasury Pivot with Capital Backing | (July 2025)

1️⃣ Short Insight Summary

Bit Digital (BTBT) is in the middle of a strategic transformation—shifting from Bitcoin mining to Ethereum treasury and staking. With heavy ETH accumulation, a pending HPC IPO, and strong cash reserves, this could be an early-stage Ethereum-aligned growth story.

2️⃣ Trade Parameters

Bias: Long

Entry: Around $2.27–$2.40 zone (attractive weekly support, favorable R:R setup)

Stop Loss: Hidden below major consolidation base at ~$1.73 (compound zone, strong invalidation)

TP1: $3.68 (first partial exit – take 40% off the table)

TP2: $5.00 (final exit for 80%+ position close)

Trailing Remainder: Keep small exposure above $5 with stop loss moved to entry or in profit

3️⃣ Key Notes

✅ BTBT has one of the largest institutional ETH holdings, and its $162M ETH-backed raise shows investor confidence

✅ Consolidation since 2023 suggests a base is forming; current range-bound structure could break upward with ETH strength

✅ WhiteFiber spin-out (HPC IPO) could be a value-unlocking catalyst

❌ Still unprofitable with a $79M net loss—execution risk remains

❌ Heavy resistance zones ahead; market needs strong ETH narrative to break through

❌ Dilution from recent offerings could cap upside if investor interest wanes

4️⃣ Optional Follow-up Note

Watching this setup closely on weekly and daily. If we break $3.68 with volume, I’ll consider re-entering or extending targets in a future update.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.

BTBT is bottomed, severely undervalued Under SEED_TVCODER77_ETHBTCDATA:1B mcap, with over 27k ETH in holdings and some BTC as well.

Price correlates to ETH but is currently lagging, options contracts are free.

This seems like a super obvious play, its bounced off its bottom well and with ETH reverse and a positive crypto admin this seems like free money.

Bit Digital Stock Chart Fibonacci Analysis 042925Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 1.74/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

BTBT is to bounce up on the short term time window. A good trade

BTBT (Bit Digital Inc.) is signalling a potential buy opportunity on the 3-hour time frame, as indicated by the recent reversal at the lower Bollinger Band. The price currently stands at $3.17, just above a potential support level, with buy signals aligning on key indicators.

Key Observations:

1. Bollinger Bands: The price has bounced off the lower Bollinger Band, suggesting oversold conditions and a possible reversal toward the mean.

2. RSI & Momentum: Oscillators in the sub-chart indicate the price is rebounding from oversold levels, confirming early bullish momentum.

3. EMA Dynamics: The short-term moving averages (e.g., 9 and 21 EMAs) are nearing a potential crossover, which could further validate a bullish trend continuation.

4. Chart Patterns: The recent price action shows a double-bottom formation around the $3.00 level, hinting at a potential base for upward movement.

5. Resistance/Support: Immediate resistance levels lie at $3.50 (psychological level and mid-Bollinger Band). Breaking this level could see the price rally to $4.00 or higher. Support remains strong around $3.00.

Trade Setup:

• Entry: $3.18 (current level)

• Stop Loss: $3.00 (below recent lows)

• Take Profit Targets: $3.50, $4.00

What I’m thinking …

This setup is ideal for short-term swing traders looking to capitalise on early reversal signals. Monitor momentum indicators for further confirmation.

Enjoy!

BTBT Short Squeeze? Will Bullish Trend Hold? BTBT and most BTC miners have been under a lot of pressure the last few days and it has investors a little upset. BTBT currently testing the support of its upward trendline, which has guided its bullish momentum. The stock is at $4.10 , a weekly low as of now, with the high for the past week reaching $5.76 . A bounce off this trendline could signal a continuation of the bullish trend, while a break below may signal a shift in momentum. Keep an eye on this key level for potential opportunities.

So why is BTBT lagging behind it's peers?

6 mo returns on miners:

BTBT - 17.14%

MARA - 49.5%

RIOT - 23.36%

WULF - 76%

Short interest in BTBT has increased drastically over the last month with approximately 28.5 million shares short in total which is over 20% of the float! BTBT has become the favorite miner for short sellers. With a short float like this, a squeeze may be on the horizon. If it happens we can expect price to fly up to around $6 or more! Might be a matter of time before this hits the scanners of short squeeze traders like WSB. What do you think, will BTBT get a squeeze before the curtains close? A significant spike in Bitcoin could be the catalyst.

Ready for liftoff? Smash that 🚀 and send this idea to the 🌙

Bit Digital, Inc. ($BTBT): High-Risk, High-Reward OpportunityBit Digital, Inc. ( NASDAQ:BTBT ): High-Risk, High-Reward Opportunity

Trade Setup:

- Entry Price: $4.30

- Stop-Loss:** $3.34

- Take-Profit Target: $8.40

- Long-Term Target: $16.77

Rationale:

Bit Digital, Inc. is a digital asset mining company focusing on Bitcoin. The stock has exhibited significant volatility, often influenced by the performance of the cryptocurrency market. This setup presents a high-risk, high-reward opportunity, appealing to traders with a higher risk tolerance.

Financial Performance:

In Q3 2024, Bit Digital reported a net loss of $2.69 million, with total revenue of $98 million over the trailing twelve months. The company's financial performance is closely tied to Bitcoin's market dynamics.

Volume and Short Interest:

The stock has experienced increased volatility, correlating with Bitcoin's price movements and recent company expansions. The acquisition of renewable energy assets reflects a strategic move towards sustainable operations.

Analyst Ratings:

Analyst sentiment is mixed, with some maintaining a "Buy" rating and price targets around $6.00, indicating potential upside from the current price.

Risk Management:

Given the stock's volatility, strict adherence to the stop-loss at $3.34 is crucial to manage potential losses. The take-profit target of $8.40 offers a favourable risk-reward ratio, but traders should be prepared for significant price fluctuations.

When the Market’s Call, We Stand Tall. Bull or Bear, Just Ride the Wave!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

$BTBT could skyrocket as ETH prepares to pump!Why NASDAQ:BTBT Could Be a Sleeper Pick + How ETH is Poised for a Pump

If you’ve been following the markets, both traditional and crypto, you’ve probably noticed how volatile things have been lately. Bitcoin (BTC) has been slipping, but here’s why this could actually set up a golden opportunity for Ethereum (ETH) and why NASDAQ:BTBT stock might be the key to capturing the upside.

What is NASDAQ:BTBT ?

Bit Digital Inc. ( NASDAQ:BTBT ) is a cryptocurrency mining company with a focus on Bitcoin and Ethereum mining operations. While many crypto-related stocks move in sync with Bitcoin’s price, NASDAQ:BTBT has exposure to Ethereum as well, which makes it an intriguing play in this current market environment.

With BTC currently dumping, the spotlight could shift toward ETH, which has lagged behind Bitcoin’s recovery over the past few months. ETH still has massive potential for growth, especially as network upgrades and Layer 2 scaling solutions gain traction.

Why Ethereum is Primed for a Pump

While Bitcoin has been dominant, ETH is overdue for its moment to shine. Here’s why:

1. The Merge and Staking Yields: Ethereum’s shift to proof-of-stake (PoS) has solidified its position as the go-to network for decentralized finance (DeFi), NFTs, and other blockchain applications. As staking gains popularity, ETH supply is shrinking, creating upward price pressure.

2. BTC Dominance Dropping: Bitcoin’s dominance often cycles with periods of altcoin pumps. With BTC struggling, funds could flow into ETH, especially given its use cases.

3. Underperformance Relative to BTC: Historically, ETH tends to follow BTC pumps but lags slightly behind before making an outsized move. If BTC is correcting now, ETH might be next in line to shine.

How NASDAQ:BTBT Fits Into This Narrative

NASDAQ:BTBT isn’t just a Bitcoin miner; its Ethereum operations give it unique exposure to a potential ETH pump. As ETH’s price rises, the profitability of mining increases, which could significantly boost NASDAQ:BTBT ’s earnings.

Moreover, NASDAQ:BTBT has been investing in green mining solutions, which aligns with the growing push for environmentally-friendly blockchain operations—a key consideration for institutional investors.

With the current discount on NASDAQ:BTBT stock (trading well below its highs), it represents a speculative but asymmetric risk/reward opportunity for investors who believe in ETH’s potential rally.

Conclusion: ETH to Pump, NASDAQ:BTBT to Benefit

If you’re bullish on ETH and expect it to outperform in the coming weeks or months, NASDAQ:BTBT is a stock to watch. Its connection to both Bitcoin and Ethereum mining makes it a hedge against broader crypto volatility while positioning it to benefit from an ETH-driven rally.

As always, this is not financial advice. Do your research and only invest what you can afford to lose. But if ETH pumps like it’s poised to, NASDAQ:BTBT could be one of the biggest beneficiaries.

What do you think? Is ETH’s time finally here, and could NASDAQ:BTBT be the hidden gem to capitalize on it?

BTBT LongWeekly, Wedge breakout + retest

Long 4.0

Stop 3.0

Target 7.5, 12

Risk management is much more important than a good entry point.

I am not a PRO trader.

In my trading plan, the Max Risk of each short term trade should be less than 1% of an account.

For non-Pro option traders, better begin from buying ITM options and keep 90+ days, Selling OTM and less than 60 days.

I will try some samples to test my chart reading and OP strategy:

"Buy in the money (ITM) calls in daily/weekly uptrend, and keep 400 days. "

Related trades:

CAN price 1.6 11/19/2024

Buy Jan2026 C1 Limit 1.0; C1 has 0.6 (ITM).

OPK price 1.6 11/20/2024

Buy Jan2026 C1 Limit 0.65x2; C1 has 0.6 (ITM).

POET price 3.9 11/20/2024

Buy Jan2026 C3 Limit 1.05; C3 has 0.9 (ITM).

ACHR price 5.06 11/20/2024

Buy Jan2026 C3.5/10 Limit 1.6; C3.5 has 1.56 (ITM).

RGTI price 1.35 11/20/2024

Buy Jan2026 C1/4 Limit 0.5x2; C1 has 0.35 (ITM).

BTBT Bit Digital Options Ahead of EarningsIf you haven`t bought BTBT before the previous earnings:

Now analyzing the options chain and the chart patterns of BTBT Bit Digital prior to the earnings report this week,

I would consider purchasing the 3.50usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $0.27.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BTBT: A small $BTC Miner and $ETH HODLr with nice upsideI am working on a fundamental article for BTBT, but it will take some time to complete. The chart looks good here with a good risk/reward.

Thought Process:

-Above 200DMA & (Falling 200DMA) makes it even better support

-Upward trend for the last month

-Earnings outlook is improving

-ETH ETF & BTC ETF

Trade Process:

Buy: $2.60 or Below

SL: $2.14

Target 1: $3.50

Happy Trading

Bit Digital - Gunning for a recovery on bitcoin optimism Bitdigital NASDAQ:BTBT has broken out of the falling wedge and upon breaking out, the volume has shown a steady increase, which in turn supports the breakout. Mon bullish bar was considered strong and has been confirmed by the spike in volume and subsequent bullish upside.

Momentum indicators show a strong buy signal after long-term MACD has shown the first light of a positive histogram and a bottom crossover, which support a bottom reversal. The stochastic Oscillator rose above the 20-line and has confirmed the oversold signal.

Hence, maintain buy with spot entry at 2.72 and a 2nd buy limit at 2.27.

BTBT could break out of the falling wedge.BTBT is forming a very nice falling wedge.

There could be one more leg down, but I think we will break out as the crypto sector should be on a turnaround right know. Iris, Wulf and Mara seem to have bullish patterns, too.

So, if the correction of the King BTC is over, we will have some party. If we will have some more downside, the party will be shifted to late Juli.

Happy trading!

BTBT could break out of the falling wedge.BTBT is forming a very nice falling wedge.

There could be one more leg down, but I think we will break out as the crypto sector should be on a turnaround right know. Iris, Wulf and Mara seem to have bullish patterns, too.

So, if the correction of the King BTC is over, we will have some party. If we will have some more downside, the party will be shifted to late Juli.

Happy trading!

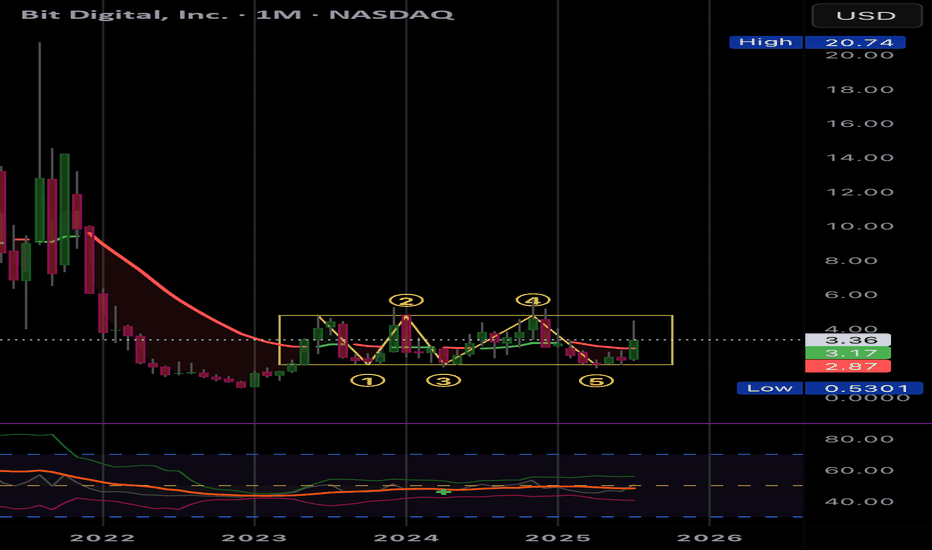

BTBT: Push to $3.36 🚀Hi everyone,

If BTBT manages to maintain its current price levels, we're likely to see an upward move towards the $3.36 mark, aligning with the monthly indicators. However, if it drops below this week's level, expect to find support between $2.52 and $2.59.

Wishing everyone good luck!

BTBT Bit Digital Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BTBT Bit Digital prior to the earnings report this week,

I would consider purchasing the 2.50usd strike price Calls with

an expiration date of 2024-4-19,

for a premium of approximately $0.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.