COINBASE GLOBAL - Technical Analysis Key Observations:

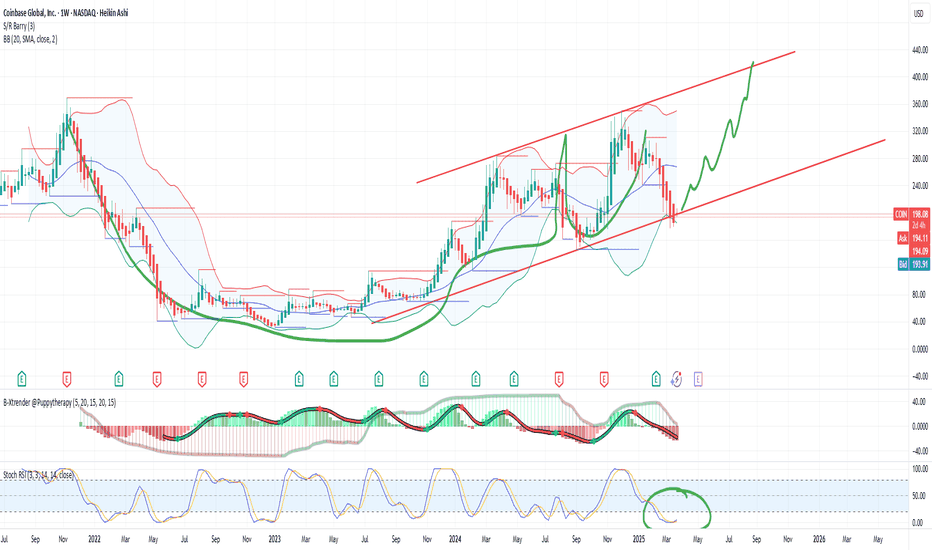

Elliott Wave Structure: COIN has been trading within a clear Elliott Wave pattern across the timeline shown. The chart displays a complete 5-wave impulse followed by a corrective phase. Currently, we are observing the development of another impulse wave which could be signaling the start of a new bullish cycle.

Fibonacci Levels: The stock finds significant support and resistance at key Fibonacci levels. Notably, after touching the 0.618 Fibonacci retracement level at approximately $239.3, COIN shows signs of a bullish reversal, initiating the potential formation of a 3rd wave which often is the strongest and longest.

Channel Trading: COIN has respected a rising channel, bouncing off the lower bounds and facing resistance at the upper. The interaction with these channel lines provides crucial entry and exit points.

Technical Indicators:

Volume: Trading volume appears to corroborate the wave counts, with spikes in buying volume at the start of impulse waves and increased selling pressure during corrective phases.

RSI: The Relative Strength Index shows fluctuating momentum, with recent readings heading towards overbought territory, which aligns with our observation of the beginning of a potentially strong upward wave.

Future Projections:

If the bullish momentum continues, and COIN respects the Elliott wave pattern, the next significant resistance is expected at the 1.618 level around $575.70. However, a break below the current support at the 0.618 level could invalidate this bullish outlook and may lead to a retest of lower support levels.

Trading Strategy:

Long Position: Traders might consider taking a long position near the 0.618 Fib level with a stop-loss just below it. The target would be the 1.618 Fib level, aligning with the peak of the projected 3rd wave.

Short Position: A break below the 0.618 Fibonacci level could be used as a signal to initiate a short position targeting the next key support level.

Conclusion:

COIN exhibits a strong technical structure that offers potential for both bullish and bearish trades depending on key levels. Monitoring these levels along with volume and RSI can provide valuable signals for entry and exit points.

COIN trade ideas

COIN - what to expecthi traders

COIN stock looks bad.

Monthly close is upon us and it looks like it's gonna be a bearish engulfing candle.

In the next few weeks I expect a bounce and retest of the previous support around 245$ where we should get a rejection and the continuation of the downtrend.

We can see a bearish divergence in the monthly time frame.

COIN's chart looks pretty similar to the BTCUSDT chart that we analyzed today:

Recommended strategy:

1. Short around 245$ area and take profit near 180$.

2. Play the bounce from 180$

Good luck

COIN is the Goldman Sachs of CryptoTitle says it all. Coinbase is the OG exchange that has led the US crypto space for well over a decade. COIN has over 9 Billion in cash that can be deployed on ANY crypto project in the US. With the Trump admin interested in creating a Strategic Bitcoin Reserve, the policy of smaller government, then the logical private sector partner/leader of this effort is COIN.

Add to the above that COIN is silicon valley elite, you will find that COIN stands the to gain significantly as the government moves forward with their plans.

COIN has developed a moat and there are no other crypto enterprises that can compete.

Target price is $300+ in 9months a minimum 50% gain by the end of 2025. Good luck to all.

COINBASE This is the time to buy and target $400Coinbase Global (COIN) has been trading within a Channel Up pattern since the March 25 2024 High, so effectively a whole year. In the past 10 days it has been consolidating on top of the 1W MA100 (red trend-line), which is the natural long-term Support of the market.

During the same time it entered the Mayer Multiple Bands (MMB) Buy Zone, consisting of the 3 SD (green trend-line) and 2 SD (blue trend-line) below levels, which has given the ultimate buy signals since the January 2023 market bottom. Practically, the stock is consolidating within the 2 SD below and 1W MA100, a tight buy range.

Given the symmetry of the Channel Down Bearish Legs (both -48.39%), we expect a similar symmetry on its Bullish Legs too. Since the previous one reached the 1.236 Fibonacci extension, we are confidently targeting $400 before this Cycle tops. That would also make a perfect entry within the MMB Sell Zone that consists of the Mean MM (black trend-line) and 1 SD above (grey trend-line).

Notice also how the 1W RSI touched the Support of the September 06 2024 Low.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Coinbase -- Still expecting another lowAs the title suggests I am still expecting another low before we move higher again. Looking at the prior price action, a drop to the 1.382 @ $163.02 looks like the ideal place for this intermediate (A) wave to terminate. Afterwards, if this is the correct count, we should begin moving higher with a target of $260-$300. There is always the chance that it extends a little further to the 1.618 @ $137.31, but as of now I do not anticipate that. Should we drop to the area of the 1.382 I plan on acquiring another 20 shares. If we end up coming into the 1.618 that'll be another 20 shares I pick up. I have entered into this position in layers with a plan long before I started. This is the only way to trade based on data and not emotions. Currently I only have 40 shares at an average price of $187. Another 20 shares at say $165 (the price I will buy more) would lower my avg cost to $179. If my thesis is correct, and we do target the $260 range at a minimum, that will be almost $5K in profits with the potential of $8K. Again, this is not guaranteed, but the probability of it happening is higher than it not.

Last thing I want to leave you with, crypto as a whole IMHO, has hit its high. I believe we have started the next corrective phase that will last for quite some time. We do NOT yet have confirmation of this, but I deal with probabilities. As of right now, the probabilities favor a larger consolidation phase for the foreseeable future.

Coinbase Global Inc - Triangle Descending - Selling opportunityA descending triangle pattern was form.

Descending triangle typically signals a downward breakout.

Sell trigger: Closes below 263.

Potential take profit target around 180.

You may take profit anytime.

Stop loss:

If the breakout is downward, do stop loss when the prices pull above 263.

COINBASE Stock Chart Fibonacci Analysis 031025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 166/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

$COIN - pocket full of coins or out of coins?CAPITALCOM:COIN has dropped from $349 to currently $218 over the last three days, but seems to maybe have settled at the support in this area. Working on a bounce up from support, and MACD looks to maybe cross up and RSI has crossed up. Might be time to consider a long, my target is $300. The three candles since the bounce have been long-tailed, indicating buying interest. Of course, considering CAPITALCOM:COIN one must also look at CAPITALCOM:BTCUSD as they tend to move in tandem.

Bottom is in IMHO - Long term bullish COIN game plan # **Coinbase (COIN) – Technical Analysis**

## **Current Market Overview**

- **Price:** $214.17

- **Trend:** Bullish within an **ascending channel**

- **Support Zone:** $200 - $205 (Trendline Support)

- **Resistance Levels:**

- **Short-Term:** $230 - $240

- **Mid-Term:** $270

- **Long-Term:** $300+

---

## **Chart Patterns & Indicators**

### **1. Ascending Channel**

- Price is **respecting the lower trendline**, indicating a potential bounce.

- **Holding above the trendline** supports a continuation towards $270+.

### **2. Stochastic RSI – Oversold**

- Deeply oversold **(below 20)**, signaling potential upward momentum.

- Historically, price has bounced after hitting this level.

### **3. Volume & Confirmation**

- Need a **break above $230 with volume** to confirm upside strength.

---

## **Trade Plan & Price Targets**

### **Short-Term (1-2 weeks)**

- **Bias:** Bullish

- **Entry Zone:** $210 - $215

- **Stop Loss:** Below $200 (trendline break invalidates setup)

- **Target 1:** $230 (resistance level)

- **Target 2:** $240 (next key level)

### **Near-Term (1-3 months)**

- **Bias:** Bullish

- **Price Target:** $270 (upper range of channel)

- **Risk:** Medium (watch for rejection at $230)

### **Long-Term (6-12 months)**

- **Bias:** Strongly Bullish

- **Target 1:** $300 (upper trendline resistance)

- **Target 2:** $350+ (breakout scenario)

---

## **Risk Considerations**

- A **break below $200 invalidates** the setup.

- Macro conditions and crypto market correlation **impact price action**.

---

### **Final Thesis**

✅ **Bullish continuation likely if price holds $205-$210.**

🚀 **Breakout above $230 needed for strong upward momentum.**

⚠️ **Break below $200 = potential trend shift, bearish risk.**

COINBASE: Reached the bottom of the 1 year Channel Up.Coinbase is bearish on its 1D technical outlook (RSI = 39.040, MACD = -17.200, ADX = 47.118) and has hit the bottom of its 1 year Channel Up following a 4H Death Cross. This is typically seen at the end of downtrends and with the 4H RSI already rebounding after turning oversold, we technically have the best buy opportunity since September 6th 2024. The trade is long, TP = 395.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

COIN - BUY! This is a market I looked at last week but here is why im going to be Long Term buying for this company now.

Firstly the fundamentals show that we have a very close and strong Demand zone that has already had a strong reaction, secondly this happens to be sitting near a key level that price is also respecting as a support level.

We can notice prior the Demand zone touch that we have swept Sell side Liquidity and now price is very clearly Consolidating. Except, we have had multiple reactions from this level and Elliot's now suggests that the end of that Consolidation cycle is here.

Im looking to buy in a Market order, to add confluence to my decisions this market runs off the Nas100 which is also in a key level on a very strong Bullish Trend.

Im looking for this to be a very large move with respecting the Demand and hopefully taking out Buy side Liquidity and on its way into a new Swing Range

Good luck to all the traders that Decide to follow and please message and comment any questions

Cheers

Bull/Bear case for $COINKey Resistance Levels: $263, $222

Key Support Levels: $200, $193, $189

Bull Case

The stock is testing a major ascending trendline near $200. If it holds, a bounce toward $221–$263 is possible.

Oversold RSI (40.78) and Stochastic (14.33) indicate a potential relief rally if buying interest picks up.

If COIN reclaims $222, it could push toward $250 and even $263, breaking out of the descending triangle.

Above $263, the next major target would be $320.

Bear Case

COIN remains in a descending triangle, signaling continued weakness unless a breakout occurs.

A break below $189 could trigger a deeper correction to $166–$143 (Fib retracement zones).

If $143 fails, the next major support lies at $115, with an extreme bearish target of $70.

Final Verdict

Bullish Above $222: Expect $250–$263, then $320+.

Bearish Below $189: Expect $166–$143 downside.

Best Trading Approach

Aggressive Bulls: Buy near $200–$193, SL $189.

Conservative Bulls: Buy at $166–$143, SL $138.

Bears: Short below $189 for $166–$143.