Potential 33% gain in ELVELV has a potential for a reversal for potentially 33% gain.

Using the Data Distribution with Extreme Clusters custom indicator, we can see that the stock is overextended on both the 5D chart (longer term) and 1D (shorter term) chart.

The last weekly bar ended up on a very high volume. Looking at the trends, one thing that is often noticeable, is that moves end and begin on large volume. Since it is down 40% off its highs, coupled with large volume, there is a possibility that the stock will reverse.

Zero-Lag USI on 1D chart is showing a buy signal as the background changed to green, while Zero-Lag USI on 5D chart is showing a black background, which means that there is a possibility that momentum of the stock may change.

ELV trade ideas

Elevance is losing the long term trendlineLosing such a large trendline is always a bad signal for a company.

The price can easily fall from 15 to 25% in the upcoming weeks or months, take care with this stock unless you are shorting.

This is especially significant while we are seeing Indexs, BTC and more doing new all time highs.

A SL in the -5% zone is enough to be protected from volatility.

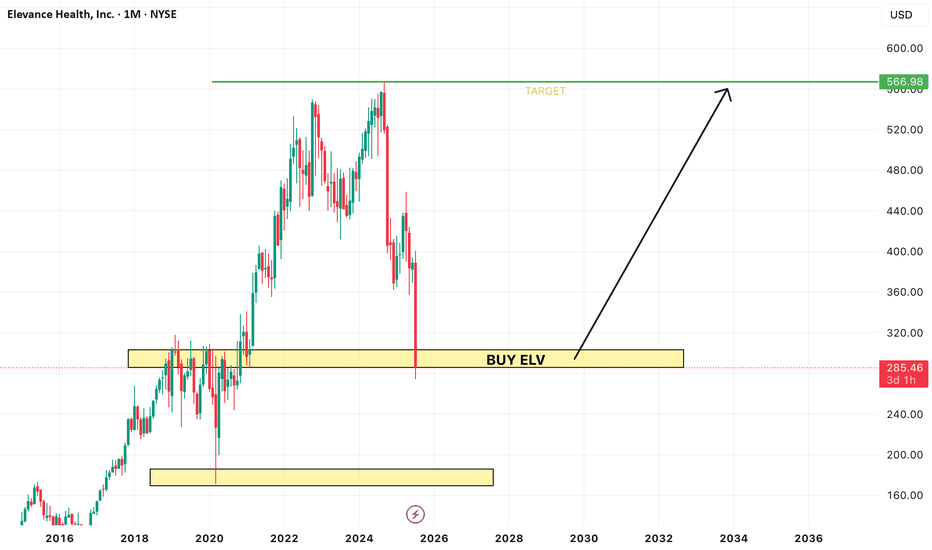

Support Levels approaching$250 could potentially be a good opportunity to pick up Elevance. We are moving towards that level and I will be patient here as the downtrend is strong. The stock is representing deep value here and insiders agree as the CEO is been acquiring shares.

The stock has dropped 50% since it's recent highs. The sector is under extreme pressure, this is the time to be looking for opportunities. We are close to hitting a Fibonacci support trendline which has held up since 2009.

I'm keeping a close eye on this one.

Elevance Health | ELV | Long at $286.00What are seeing in the healthcare and health insurance provider industry right now is destruction before a once-in-a-lifetime boom. The baby boomer generation is between 60 and 79 right now and the amount of healthcare service that will be needed to serve that population is staggering. Institutions are crushing them to get in - it's just near-term noise, in my opinion. My personal strategy is buy and hold every healthcare opportunity (i.e. NYSE:CNC , NYSE:UNH , NYSE:HUM etc).

Elevance Health NYSE:ELV just dropped heavily due to lower-than-expected Q2 2025 earnings, a cut in full-year profit guidance from $34.15-$34.85 to ~$30 EPS, and elevated medical costs in Medicaid and ACA plans. It's near-term pain (may last 1-2 years) which will highly likely lead to long-term growth. The price has touched my historical simple moving average "crash" band. I would not be shocked to see the price drop further into the $260s before a rise. However, the near-term doom could go further into the year. I am anticipating another drop to the "major crash" simple moving average band into the $190s and $220s to close out the remaining price gaps on the daily chart that occurred during the COVID crash. Not to say it will absolutely reach that area, but it's locations on the chart I have for additional buys.

Thus, at $286.00, NYSE:ELV is in a personal buy zone (starter position) with more opportunities to gather shares likely near $260 before a bounce. However, if the market or healthcare industry really turns, additional buys planned for $245 and $212 for a long-term hold.

Targets into 2028:

$335.00 (+17.1%)

$386.00 (+35.0%)

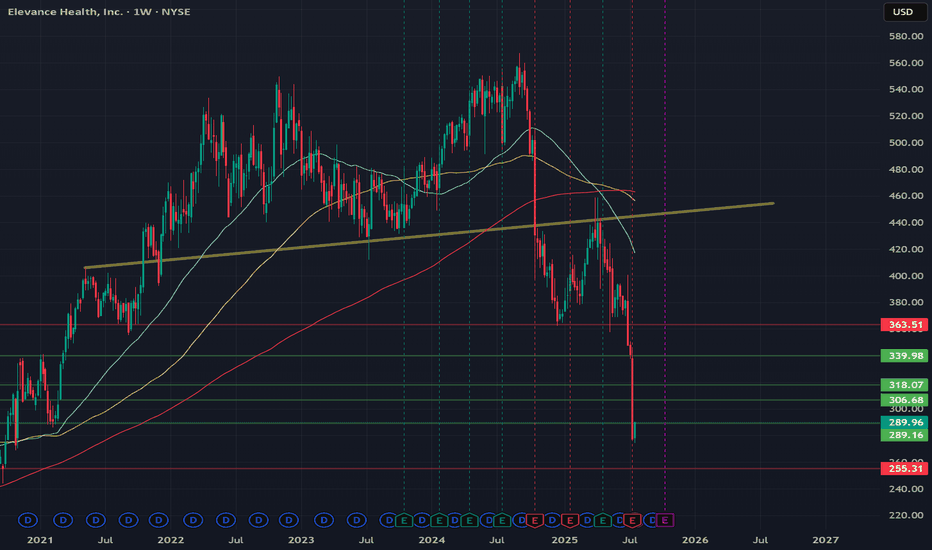

ELV (Elevance Health) – Catching the Knife or Catching Value?Elevance (ELV) just took a 12% hit after Q2 earnings missed estimates and full-year guidance was cut significantly. But here's the thing—the selloff may be overdone. The stock now trades at a forward P/E of ~10, well below industry peers, and is approaching multi-year support levels.

📥 Entry Plan :

✅ Entry 1: $302.45 (market price)

✅ Entry 2: $285 (historical support zone)

✅ Entry 3: $250 (capitulation panic level)

🎯 Target Levels:

TP1: $330 – recent gap zone + psychological resistance

TP2: $360 – key horizontal + potential MLR rebound narrative

TP3: $400 – longer-term recovery level, aligns with prior institutional range

🔔 Follow me for more deep-value setups, smart risk-reward trades, and weekly strategy posts!

⚠️ Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice. I am not a financial advisor. Always do your own research and consult with a qualified professional before making any investment decisions. Trading and investing involve risk, including the potential loss of capital

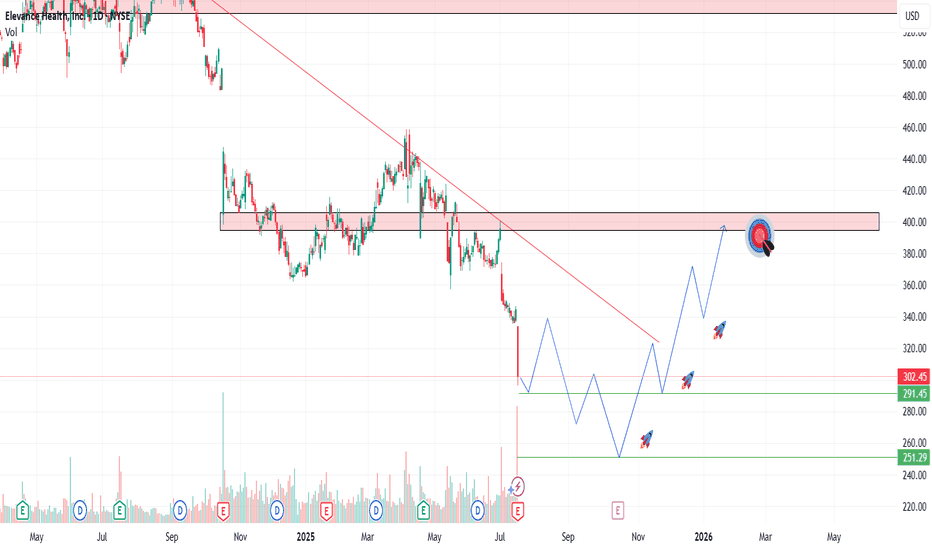

ELV Swing Trade Setup - May 2025Fundamentally undervalued with a strong balance sheet, consistent earnings beats, and a low P/E ratio. Recent drop (~33% from 52-week highs) appears overdone relative to earnings strength likely due to short-term Medicaid cost concerns, not long-term deterioration.

📊 Position Type:

✅ Swing Trade to Core Position

Start small and build over time if technicals stabilize. Could evolve into a 6–12 month hold depending on market environment and how the stock reacts to future earnings or policy updates.

Entry Zone:

📍$380-360

📍$340

📍$300

Profit Targets

🎯 TP1: $415

🎯 TP2: $445

🎯 TP3: $500+

📌 Final Word

ELV is trading near a critical support zone after a 30% drop, yet it keeps delivering solid earnings. With strong cash flow and a powerful Carelon segment, this could be one of the best risk-reward setups in healthcare right now.

Disclaimer: This is not financial advice. Do your own research before investing.

$ELV Earnings Preview: Oversold Potential + Key Metrics AheadEarnings Estimates: Analysts forecast an EPS of $3.82 for the upcoming quarter, indicating a 32% year-over-year decline. Revenue is projected at $44.67 billion, a 5.2% increase from the same period last year.

Oversold Potential: With an oversold score of 59%, NYSE:ELV appears attractive for accumulation.

PEG Ratio: The PEG ratio stands at -0.77, suggesting undervaluation despite negative growth.

Valuation Metrics: A forward P/E of 11.03, lower than the trailing P/E of 14.14, indicates potential undervaluation.

Revenue Growth: Positive quarterly revenue growth estimates point to resilient performance.

In the previous quarter, Elevance reported an EPS of $8.37, missing the consensus estimate of $9.66, but achieved a 5.3% year-over-year revenue increase to $44.72 billion.

Guidance: In the previous quarter, Elevance Health revised its full-year 2024 adjusted EPS guidance downward to approximately $33, down from the prior estimate of $37.20, due to challenges in its Medicaid business.

Despite these hurdles, Elevance's diversified portfolio and strategic initiatives position it for potential growth.

Elevance - Short interest declining, buy the dip?The shorts have done extremely well here, dragging the price down by over 34%. ELV has been under severe pressure due to a miss on EPS on their last earnings report. However, they did beat on revenue (by $1.58B) but that did not stop holders exiting their positions.

Unless you're living under a shell, you will know that the entire sector has been under increased public scrutiny following the death of the United Health Group's CEO. President Trump has also had some harsh words for the sector and has appointed RFK in a key position, he is not perceived as a friend of in the industry. The whole industry will likely face further scrutiny over the coming quarters, I don't expect things to change soon.

Whilst there is blood on the streets (quite literally), I do feel that this presents an excellent opportunity for a patient, long term investor, who is happy to buy on the major dips and hold for the longer term. I don't see the stock falling more than 20% of the current price. Short interest has also been declining, so we should see the downside pressure starting to ease.

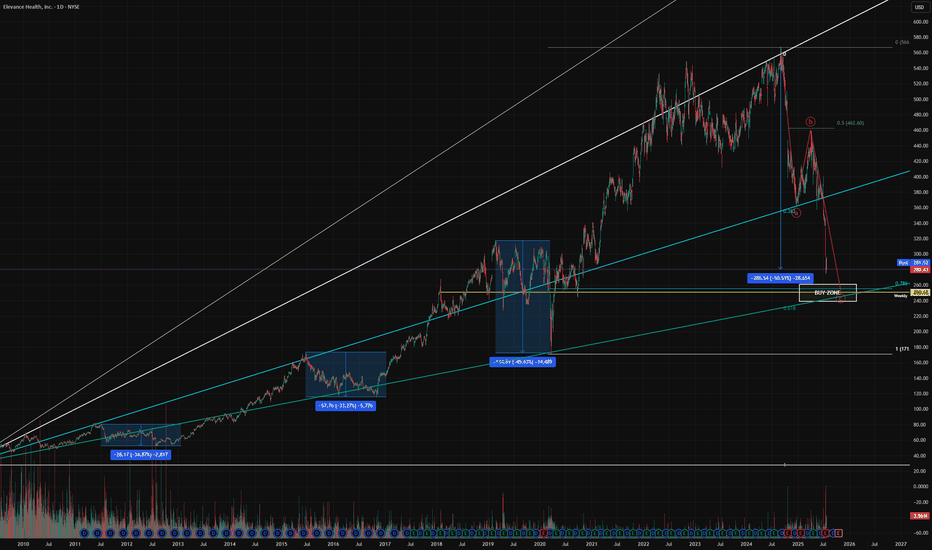

Looking at the TA, it is not unusual for this stock to drop 30-40% from it's peak before continuing to move up. The 0.382 Fibonacci speed fan has hisotrically held as support on the major dips. We are now dipping below this level but we also have strong support below at a Monthly level along with the Golden Fibonacci support zone.

ELV has historically outperformed the S&P500, so in my opinion this is a good time to think about getting involved in the sector if you have no exposure to Healthcare sector. Or you can wait for the Buy Zone to be hit around $300-330.

Not financial advise, do what's best for you.

ELV buying opportunityNYSE:ELV buying opportunity, in my opinion.

Elevance Health, Inc. (ELV), formerly known as Anthem, Inc., is a health benefits company that provides medical, pharmaceutical, dental, behavioral health, and other insurance-related services to its members. It operates through affiliated health plans, primarily under the Blue Cross and Blue Shield brand, in the United States.

Key Information:

Ticker: ELV

Sector: Healthcare (Health Insurance)

Market Cap: ~$100 billion

Business Focus: Elevance Health provides a range of health insurance products and services, including individual, group, and government-sponsored health plans. The company serves millions of members across the U.S. and is focused on improving healthcare outcomes while reducing costs.

Recent Developments:

Elevance Health is one of the largest health insurance providers in the U.S., playing a key role in the managed care industry. The company has been focusing on digital health and data-driven solutions to enhance patient care and outcomes. Given the increasing focus on healthcare technology, they continue to invest in improving access to healthcare services while managing costs.

This stock is considered a relatively stable investment in the healthcare sector, benefiting from the growing need for healthcare services and insurance coverage.

ELV - capitalizing on misses from UNH and HUMNYSE:ELV had a great earnings, beating on top and bottom line estimates and following through with a 10% dividend increase. This comes as NYSE:UNH and NYSE:HUM each disappoint and lower guidance.

ELV has put in a strong consolidation after retracing from 2022 highs. Using a fib fan from the 2022 all time high to the April 2023 high, and another from the September 2020 low to the September 2022 low give us an idea of the support and resistance areas that we can expect.

At the beginning of 2023 we can see a breakdown of the sentiment cycle that leads into a year long consolidation. Taking a fib retrace from this timeframe to the July 2023 low identifies ~573 as a 1.618 target, which is very close to consensus 12 month price targets and aligns to the top of the next fib fan. However, be aware that we could expect resistance anywhere in the blue area overhead when price begins to match prior highs.

ELV - 12.41% Potential Profit - Swing Trading SetupGood risk / reward ratio on this trade.

Ascending Triangle.

- Target Entry: $485.50

- Stop Loss: $474.67

- Target Exit Conservative: $520.50

- Target Exit Aggressive: $545.52

- Risk / Reward Ratio: 3.23 / 5.54

About me

- Note that I tend to adjust stop losses in order to secure profits early and preserve capital. This means that the target price is going to be achieved as long as there are no strong pullbacks that trigger my new adjusted stop loss

- When I see that the market is opening too high/low, I wait for 30 min from the opening bell before placing my order. This is to avoid the initial spikes/drops that get me into a position and out right after.

ELV | Informative NYSE:ELV

If the stock price manages to surpass the bullish line, which is positioned around $469.79, the main target on the bullish side to monitor would be Target Price 1 at $480.96.

On the other hand, if the stock price breaks below the bearish line, set at $458.39, there are several potential downside targets. The first target on the bearish side would be Target Price 1 at $450.10. Should this level be breached, the subsequent target to keep an eye on would be Target Price 2 at $440.76.

ELV Elevance Health Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ELV Elevance Health prior to the earnings report this week,

I would consider purchasing the 450usd strike price Puts with

an expiration date of 2023-10-20,

for a premium of approximately $4.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ELV approaching significant overhead resistanceElevance Health Inc. (ELV) approaching significant overhead resistance, able to absorb monthly buying pressures.

From here, (ELV) can reject and fall lower to channel support, eliciting losses of 15% - 20% over the following 2 - 3 months.

Inversely, a weekly settlement above resistance would place (ELV) into a buy-signal where gains of 15% - 20% would be expected over the following 2 - 5 months.