EQT – 30-Min Long Trade Setup!📈

🔹 Ticker: EQT (NYSE)

🔹 Setup Type: Triangle Breakout + Support Retest

🔸 Breakout Price: ~$53.84

📊 Trade Plan (Long Position)

✅ Entry Zone: $53.70–$53.90 (breakout above yellow zone)

✅ Stop Loss (SL): Below $53.13 (white structure support)

✅ Take Profit Targets:

📌 TP1: $55.00 (red zone – short-ter

Key facts today

EQT Corporation's price targets have been raised by analysts: Wolfe Research to $63, Stephens to $62, and Bernstein to $74, all maintaining positive ratings.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

8.76 MXN

4.81 B MXN

108.88 B MXN

592.32 M

About EQT Corporation

Sector

Industry

CEO

Toby Z. Rice

Website

Headquarters

Pittsburgh

Founded

1888

FIGI

BBG016FNR972

EQT Corp. is a natural gas production company, which engages in the provision of supply, transmission, and distribution of natural gas. The company was founded in 1888 and is headquartered in Pittsburgh, PA.

$EQT - BREAKOUT INCOMING LONG TERM BULLISHEQT Corp. is a leading natural gas production company that's been around for over 135 years! Founded in 1888, this Pittsburgh-based company specializes in providing supply, transmission, and distribution of natural gas.

Whether you're interested in the energy industry or just want to learn more abo

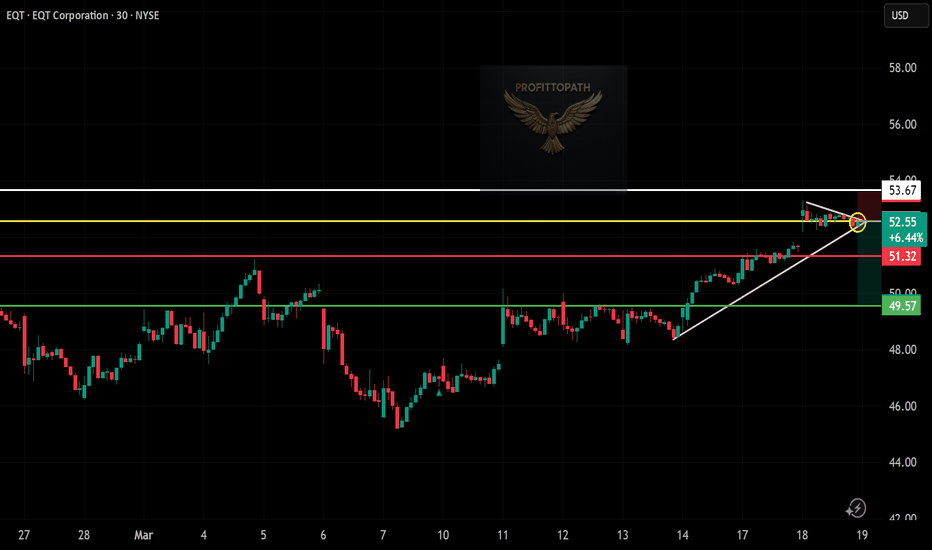

EQT (EQT Corporation) – 30-Min Short Trade Setup! 📉🚨

🔹 Asset: EQT – NYSE

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown (Rising Wedge Reversal)

📊 Trade Plan (Short Position)

✅ Entry Zone: Below $52.50 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $53.67 (Key Resistance Level)

🎯 Take Profit Targets

📌 TP1: $51.32 (Support Level)

📌 TP

EQT – 30-Min Long Trade Setup !📌🚀📈

🔹 Asset: EQT Corporation (NYSE: EQT)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above 46.99 (Breakout Confirmation)

✅ Stop-Loss (SL): Below 45.91 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: 48.40 (First Resistance Level)

📌

E-cutieAll year EQT, an unloved natural gas producer has been a swing trader's paradise. I've harvested so many gains from these E-cutie trees I thought I'd make a thread just for it and post trading updates.

The macro technical picture is clear. Years of being battered by shorts ended with capitulation i

Building long term position in $EQT I’m changing the process for picking tickers to make it more affordable while avoiding risky penny lots. Comment your favourite TSX tickers under $150 & NYSE or NAS under $100.

Key Stats:

• Market Cap: ~$30B

• P/E Ratio: ~61.21

• Dividend Yield: ~1.5%

• Next Earnings Date: February 1

EQT Corporation (EQT) Analysis Company Overview:

EQT Corporation NYSE:EQT is the largest natural gas producer in the United States, headquartered in Pittsburgh, PA, and focused on the prolific Appalachian Basin. The company’s strategy centers on operational excellence, disciplined financial management, and maximizing shareholde

EQT Corporation. Oil Gas & Consumable FuelsKey arguments in support of the idea.

▪ Rising natural gas prices.

▪ Undervaluation.

Investment Thesis

EQT Corporation is one of the largest natural gas producers in the US. Natural gas

constitutes over 90% of the Company's hydrocarbon revenues, with LPG sales

comprising 8% and oil contributing

Natural Gas - Time to buy? Natural Gas is going through some much needed consolidation.

Holding above the 50 & 200 MA, a golden cross is setting up.

Typically golden cross signals see sellers in the near term before medium and ling term buyers step in.

Nat gas equities have been struggling lately and appear to be needi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

E

EQT4647467

EQM Midstream Partners, LP 6.5% 15-JUL-2048Yield to maturity

8.75%

Maturity date

Jul 15, 2048

E

EQT5422708

EQM Midstream Partners, LP 7.5% 01-JUN-2030Yield to maturity

6.91%

Maturity date

Jun 1, 2030

E

EQT5758335

EQM Midstream Partners, LP 6.375% 01-APR-2029Yield to maturity

6.44%

Maturity date

Apr 1, 2029

E

EQT5422706

EQM Midstream Partners, LP 7.5% 01-JUN-2027Yield to maturity

6.40%

Maturity date

Jun 1, 2027

E

EQT5002743

EQM Midstream Partners, LP 6.5% 01-JUL-2027Yield to maturity

6.37%

Maturity date

Jul 1, 2027

E

EQT5106353

EQM Midstream Partners, LP 4.75% 15-JAN-2031Yield to maturity

5.51%

Maturity date

Jan 15, 2031

See all EQT bonds

Curated watchlists where EQT is featured.

Midstream oil: The middlemen of the energy sector

35 No. of Symbols

Upstream oil: Liquid gold extractors

34 No. of Symbols

See all sparks

Related stocks

Frequently Asked Questions

The current price of EQT is 988.00 MXN — it has increased by 2.92% in the past 24 hours. Watch EQT CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange EQT CORPORATION stocks are traded under the ticker EQT.

We've gathered analysts' opinions on EQT CORPORATION future price: according to them, EQT price has a max estimate of 1,454.09 MXN and a min estimate of 687.74 MXN. Watch EQT chart and read a more detailed EQT CORPORATION stock forecast: see what analysts think of EQT CORPORATION and suggest that you do with its stocks.

EQT stock is 3.41% volatile and has beta coefficient of 1.31. Track EQT CORPORATION stock price on the chart and check out the list of the most volatile stocks — is EQT CORPORATION there?

Today EQT CORPORATION has the market capitalization of 572.31 B, it has increased by 5.32% over the last week.

Yes, you can track EQT CORPORATION financials in yearly and quarterly reports right on TradingView.

EQT CORPORATION is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

EQT earnings for the last quarter are 24.17 MXN per share, whereas the estimation was 21.03 MXN resulting in a 14.94% surprise. The estimated earnings for the next quarter are 9.27 MXN per share. See more details about EQT CORPORATION earnings.

EQT CORPORATION revenue for the last quarter amounts to 44.10 B MXN, despite the estimated figure of 44.30 B MXN. In the next quarter, revenue is expected to reach 35.06 B MXN.

EQT net income for the last quarter is 8.72 B MXN, while the quarter before that showed −5.93 B MXN of net income which accounts for 247.17% change. Track more EQT CORPORATION financial stats to get the full picture.

Yes, EQT dividends are paid quarterly. The last dividend per share was 3.19 MXN. As of today, Dividend Yield (TTM)% is 1.29%. Tracking EQT CORPORATION dividends might help you take more informed decisions.

EQT CORPORATION dividend yield was 1.37% in 2024, and payout ratio reached 140.56%. The year before the numbers were 1.57% and 14.40% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Apr 24, 2025, the company has 1.46 K employees. See our rating of the largest employees — is EQT CORPORATION on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EQT CORPORATION EBITDA is 44.41 B MXN, and current EBITDA margin is 40.78%. See more stats in EQT CORPORATION financial statements.

Like other stocks, EQT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EQT CORPORATION stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EQT CORPORATION technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EQT CORPORATION stock shows the strong buy signal. See more of EQT CORPORATION technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.