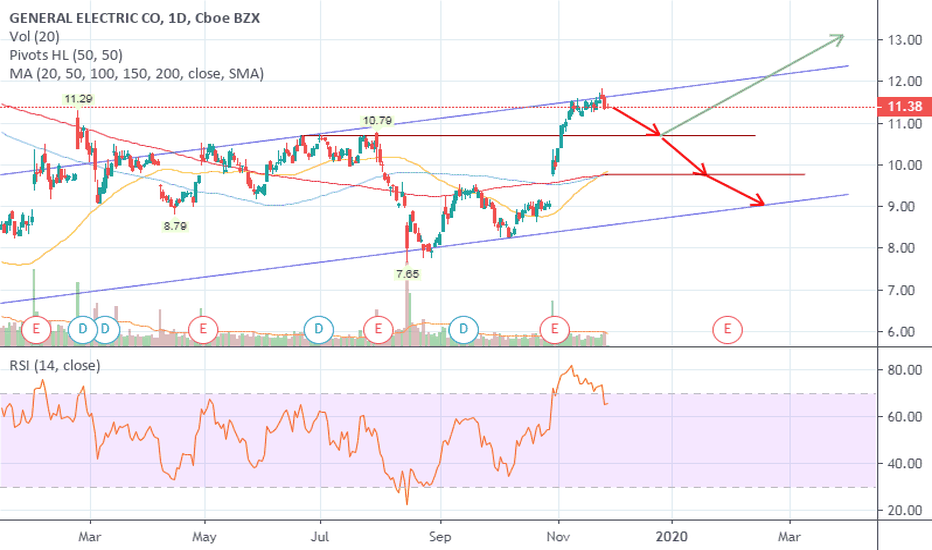

GE Pattern & ForecastGE Elliott forecast. We are in wave 5 of larger wave 3. Should see a little more upside before a larger wave 4 breakdown to the dashed horizontal lines below price. Wave 4 should be an ABC pattern and may take a week or two before completion. Upon completion of wave 4. Look out for larger wave 5 and lots of upside momentum.

Happy Trading!

NYSE:GE

GE trade ideas

$GE Trade setup in General ElectricPurely a technical trade as the fundamentals in GE we believe do not deserve any bullish sentiment.

Entry level $11.41= $12.31 = $11.16

Company profile

General Electric Co. is a technology and financial services company that develops and manufactures products for the generation, transmission, distribution, control and utilization of electricity. Its products and services include aircraft engines, power generation, water processing, security technology, medical imaging, business and consumer financing, media content and industrial products. The company operates through the following segments: Power, Oil & Gas, Aviation, Healthcare, Transportation, Appliances & Lighting and GE Capital. The Power segment serves power generation, industrial, government and other customers worldwide with products and services related to energy production. The Oil & Gas segment supplies mission critical equipment for the global oil and gas industry, used in applications spanning the entire value chain from drilling and completion through production, liquefied natural gas and pipeline compression, pipeline inspection, and downstream processing in refineries and petrochemical plants. The Aviation segment products and services include jet engines, aerospace systems and equipment, replacement parts and repair and maintenance services for all categories of commercial aircraft; for a wide variety of military aircraft, including fighters, bombers, tankers and helicopters; for marine applications; and for executive and regional aircraft. The Healthcare segment products include diagnostic imaging systems such as magnetic resonance, computed tomography and positron emission Tomography scanners, X-ray, nuclear imaging, digital mammography and molecular imaging technologies. The Transportation segment engages in global technology and supplier to the railroad, mining, marine and drilling industries. The Appliances & Lighting segment products include major appliances and related services for products such as refrigerators, freezers, electric and gas ranges, cooktops, dishwashers, clothes washers and dryers, microwave ovens, room air conditioners, residential water systems for filtration, softening and heating, and hybrid water heaters. The GE Capital segment offers financial services and products worldwide for businesses of all sizes, services include commercial loans and leases, fleet management, financial programs, credit cards, personal loans and other financial services. The company was founded by Thomas A. Edison in 1878 and is headquartered in Boston, MA.

Potential Bull Flag in General Electric as Industrials ClimbIndustrial stocks have come to life since early October as investors look for the economy to recover from the U.S. – China trade war. Now one of the biggest and most liquid names in the entire sector is rebounding from a pullback, and a classic bull-flag continuation pattern may be taking shape.

General Electric reported a potentially transformative quarter on October 30. Strong free cash flow dispelled worries about its balance sheet -- similar to the story in Tesla . In both cases, big obstacles that once kept some investors on the sidelines could be going away.

GE gapped higher after that report and then pulled back. It found support at the same $10.70 - $10.80 area that was resistance in June and July. It's climbing again today following an upgrade by UBS, which raised it price target to $14.

It is a strong news-driven move with the potential for brief consolidation, so traders may find some opportunities closer to $11.20.

Energy is another potential catalyst because GE owns about one-third of oil-field servicing company Baker Hughes . This has also been one of the stronger niches in the market over the last week, and also stands to benefit from trade optimism potentially lifting crude.

$GE Buy rating for General Electric Entry level at approx $11.25 with $12.60 piece target just below monthly horizontal resistance

Analyst change prompts UBS to upgrade GE to Buy from Neutral UBS analyst Markus Mittermaier assumed coverage of General Electric from prior analyst Damian Karas and upgraded the shares to Buy from Neutral with a price target of $14, up from $11.50. The stock closed Wednesday at $10.97. The shares are at a "positive inflection point" into 2020 given GE's successful de-levering, "strong" estimated earnings growth in 2020 and 2021, and a tripling of free cash flow to $2.3B next year led by Aviation and Healthcare, Mittermaier tells investors in a research note. As a result, the analyst expects the stock's narrative to change from "significant cash drag to successful transformation." He sees 26% upside in GE shares

Source thefly.com

$GE at 11.1 Expecting Big Move (+/- 10%) Mixed signals but mostly bearish signs . MFI broke its trend and RSI reversed from its trend looking forward to test 70s level then drop back again to low levels . Bullish candle sticks during last 3 sessions supported by good volume too so mainly expecting bounce to levels of 11.5 then fall back to 9.5 this is most probable scenario . other scenario became more bullish if jump above previous top at 11.84.. then its became clear bearish for mid-term targeting 18-20 on long term

A new wave up for General Electrick stocks?This stocks is interesting because we can observe that we are in the end of the consolidation triangle.

Firstly we will talk about technical analysis and then we will think about the fundamental analysis.

1) There is a nice buy zone here, this strong support can be nice point entry to see more upside.

A bullish bat forms with a bullish confirmation (doble bottom on lower time frames)

The 4th waves of the consolidation triangle were forms, we are looking to see the 5th waves which is logically the break out of the triangle.

First there is an important resistance on precedent lower higher high, this can provide us a nice TP1 and a nice reentry if it breaks up.

2) In the fundamental analysis General electric got a very looooong consolidation now, we are not seeing higher high since 20 years that can be a nice opportunity to long now considering the fact that our global economy is completely based on electricity, this means surely a potential growth in this stocks.

As we can see there is a reason why price just consolidate at this point, we can think about the dividends on actionnary which are not reinvest in the stocks for long times. A change in political economy of the society can be the release of a new golden age on this stocks and other tech stocks (we will analyse them together soon)

Can the CFO news be the savior for Ge?For years general electric has been struggling for the stock obviously, the stock has been crawling into single digits. It’s shooting star on the day and week . on January 27, 2020 it will report earnings and, let’s see if General Electric has a pulse or still on the edge of death

GE - Again bringing good things to life!Like this stock chart. GE has held its recent breakout, is consolidating nicely and appears to be under accumulation. It is however short term overbought and MACD is turning over. Suspect that we will see the $10.60 area but this looks like it wants to get back to the breakdown area that defines the upper FIB levels. Another 2020 turnaround name for me. Like this for a buy and hold.

$28,441,700,000 Concentrated Hedge Fund Bets On AmericaStarting in the 4th quarter of 2018, Eagle Capital Management -- a highly concentrated hedge fund for it's size -- began aggressively buying General Electric, and it looks like their investment is paying off -- for now; but one can only speculate what is truly stirring underneath this classic American icon. Is this the next AIG, and more importantly, will it be the catalyst that triggers the next financial crisis?

GE Short Setup - 1:4 Risk to Reward / RISKYGE daily chart shows weakness. I am expecting a pullback to $10.50. I can buy some puts for this. However there's no reversal signal yet. If I wait for a confirmation, the risk to reward will be less. I have decided to buy the risk.

GE SHORT TRADE SETUP

Entry: 11.39

Stop-Loss: 11.60 (0.21)

Take-Profit: 10.56 (0.83)

Risk to reward: 1:3.95

Winning probability: Less than 40%

NOTE: I am not very comfortable with the stop-loss. During the trade, i can move it up to 1:2 Risk to reward. That's why I'm not going to risk more than 1% of my account.

Disclaimer: This is not an investment or financial advice. Please do not copy my trades.

Remember to follow me.

Trade safe,

Atilla Yurtseven

Three Percent Trade Idea: Go long GEHere is a great opportunity to pick up GE .

At Three Percent Trades we have a price target of $13.00 / share, which is a potential upside of 42.2%.

We use a combination of fundamentals & technical analysis to trade high probability set-ups, and believe this is a great opportunity to take advantage.