GGB/N trade ideas

Gerdau S.A. Pfd Sponsored ADR Repr 1 Pfd ShA play on steel price recovery & dropped raw materials

Supporting Arguments

▪ Steel prices to gain from China’s support measures & rate cuts

▪ A drop in raw materials prices to support Gerdau’s margins

▪ Valuation multiples also imply upside for the name

Investment Thesis

Gerdau is a Brazilian long steel producer, the largest in the Americas, as well as the top special steel supplier globally. The company is a leading steel scrap recycler in the world, offering a wide range of long, flat and HVA steel products. The stocks of Gerdau are listed on the São Paulo (B3) and New York (NYSE) stock exchanges.

Anticipated steel price rebound is to boost the stock. Steel prices in the US and globally have been under pressure especially since the Q2 2024, amid high interest rates and sluggish end-user demand. But we expect steel prices to gain from a number of factors going forward. First, recently approved new wave of measures to support construction industry in China in the amount of around CNY 1.4 tn ($196 bn). The amount substantially exceeded the preliminary agreement with commercial banks. Second, the monetary policy easing cycle in the US that is expected to start in September is likely to support steel demand and prices in the country.

Raw materials slump is to uphold industry margins. Even if we assume that steel price growth might be capped due to structural risks, support is provided by the recent drop in benchmark hard coking coal prices by c.23% (since the start of Q3) to $231/t FOB AU, in iron ore prices by 13% m/m to $101/t CIF China, and in Turkish scrap – by 6,8% m/m to $364/t. Non-fully vertically integrated steelmakers like Gerdau should especially benefit from such conditions in the S-T. The matter is that their (operating) marginality is likely to grow at a faster pace than fully integrated plants’ margins, thanks to a stronger dependency on market prices. In addition, the company’s focus on high value-added (HVA) products ) products should also be a factor of support for its financials and margins. Thus, potential of some rebound in steel prices and publication of the 3rd quarter results (expected on November 6), investor day (appointed on October 4) and declaration of dividends should be the key drivers for the stock.

Valuation may also be a factor of support. Analysis of EV/EBTIDA and P/E multiples shows that Gerdau is trading substantially lower than industry average level implying upside potential from the fundamental point of view. EV/EBITDA is at 4,2x vs 6,9x of M&M industry average, while P/E is at 7,1x vs almost 14,3x of industry average. Technical analysis suggests that breakout above the 50-day moving average and approaching of stochastic RSI readings to a relatively oversold level may imply a potential shift in the market sentiment.

We forecast a 14% upside in the stock, with a 2-month price target of $3.75/share and a “Buy” rating. A stop-loss order is recommended at $2.70/share (−18%).

$GGB breaking out of a ~11month base!Notes:

* Great earnings in the recent quarters

* Strong up trend in the recent years

* Breaking out of a ~11 month cup shaped base with higher than average volume

* During the recent pull back the volume was decreasing indicating bullishness.

Technicals:

* Sector: Basic Materials - Steel

* Relative Strength vs. Sector: 7.19

* Relative Strength vs. SP500: 13.71

* U/D Ratio: 0.8

* Base Depth: 56.93%

* Distance from breakout buy point: 0.31%

* Volume 14.02% above its 15 day avg.

Trade Idea:

* You can enter now as the price is just breaking out of the base

* Manage risk accordingly

GGB - Stan Weinstien early stage two First post for a while, been a long year.

Stan Weinstein wrote a classic investment book in the 1980's

Basically, it's based on recognising the rotation in the market between stage 1,2 3 and 4 - instead of inserting loads of waffle about it check out this link - the7circles.uk

Stan’s general rules on buying are:

1. Check the major trend of the overall market.

2. Uncover the few groups that look best technically.

3. Make a list of those stocks in the favourable groups that have bullish patterns but are now in trading ranges. Write down the price that each would need to break out.

4. Narrow down the list. Discard those that have overhead resistance nearby.

5. Narrow the list further by checking relative strength.

6. Has volume at least doubled recently on the rally.

7. Put in your buy-stop orders for half of your position for those few stocks that meet our buying criteria. Use buy-stop orders on a good-'til-cancelled (GTC) basis.

8. If volume is favourable on the breakout and contracts on the decline, buy your other half position on a pullback toward the initial breakout.

9. If the volume pattern is negative (not high enough on break out). sell the stock on the first rally. If it fails to rally and falls back below the breakout point, immediately dump it.

So going by the above rules in relation to this stock I get:

1. General Market shows an uptrend.

2. The present best performing weekly groups are Technology Services, Electronic Technology and Non-Energy Materials – GGB is in Non-Energy Materials

3. Yep, got a list and will post the best as they come up to near stage 2

4. This stock has no overhead resistance nearby

5. Mansfield Relative Strength – relative to the S&P 500 the share price has shown better strength than the market. The sector has also shown relative strength to the market too.

6. Volume has more than double in recent weeks.

7. I have a limit order for 5.85 with a tight stop at 4.5, at half my proposed position.

8. TBC

9. TBC

So, let’s see how this will progress…

On a plus point the company actually makes money and pays a dividend and forecats look good.

GGB Breakout Stock AlertBREAKOUT STOCK ALERT

$GGB - Gerdau S.A. Common Stock

Initial Alert Price: $4.6

Potential Price: $5.47

Potential Gains: 18.91

Stop Loss Limit: $

Looking for a small 20% Swing Trade on GGB as the company moves to retest the $5.34 Price Levels over the next few trading sessions. If we're able to break above those levels and find support above the $5.34, then we will be moving to retest the $8.32 Levels of Resistance which could potentially provide an additional 60% on the trade if the stock works in our favor.

From a Fundamental/Long-Term Perspective, the company is showing great recover QoQ from seeing devastating performance YoY, encouraging the fact that the company will move to go net positive by the end of 2021 to Mid-2022, showing 59.82% EPS Growth and 43.91% Net Profit Margin Growth QoQ. #Breakout #Stocks #Trading #Investing #Alerts #StockMarket #Daily #News #Today

BREAKOUT CUP WITH HANDLE AND HIGH VOLUM BUY GGB 9.79$As you can see from this slide, in the second quarter 2020, we posted a positive free cash flow of BRL205 million, even considering the drier period of the COVID-19 pandemic. This improvement vis-a-vis Q1 2020 reflects the combination of an EBITDA 12% higher than in Q1 and the maintenance of a stringent financial discipline in terms of capex and the control of some items like delinquency and accounts payable. It's worth mentioning that in the last 12 months, the company posted positive free cash flow of around BRL four billion, reinforcing its liquidity position

Finviz

1% CAPITAL

GGBR4 Perdeu Canal de AltaGGBR4 vinha numa ascendente forte desde outubro/19, formando um belo canal de alta, mas parece que perdeu um pouco do momentum a partir de 13/01, quando ficou um pouco de lado.

Perdeu o canal no dia 27/01 com a queda generalizadas das bolsas no mundo e não recuperou o movimento de alta ainda. A MM20 no diário começou a virar para baixo e preço está bem longe da MM200 no mesmo timeframe. Pode ser que venha uma correção, aproveitando o viés negativo desse mau humor na renda variável.

Não estranharia se fizesse um pullback no canal de alta perdidode e depois recuasse até a região dos R$17,70 (próximo suporte e região de retração de 50% de Fibonacci da super perna de alta).

Segue em observação.

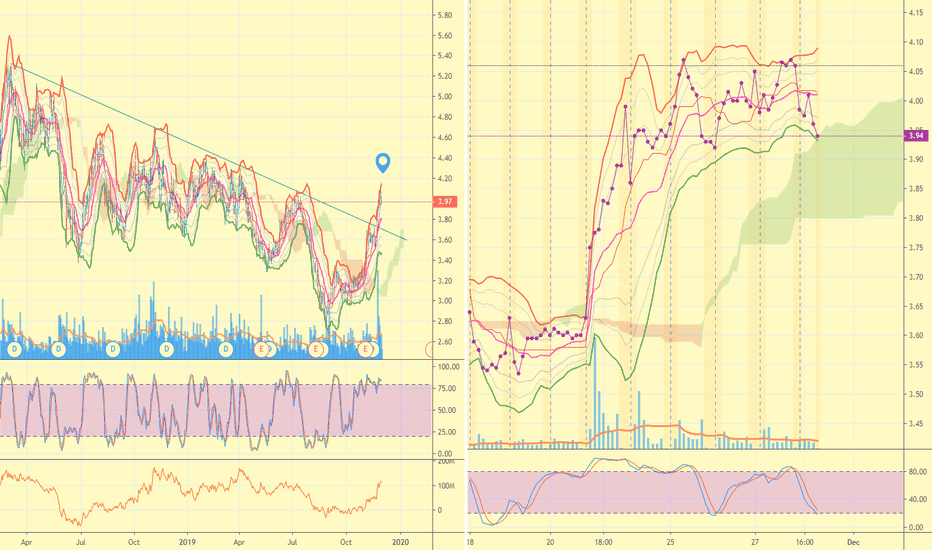

#GGB looks promising in mid- to -long-term technical viewit has broken a long-term declining trend.

you can wait for a pullback until 3.70 - 3.80 range.

short-term ( 4-8 weeks ) target 4.40

long-term ( 6-12 months ) target 5.20

Financials are doing quite well ;

Revenue : 11.274 B

Income : 562.7 M (profitability has a room for improvement)

EPS : 0.21 , ROA : 2.76 NYSE:GGB