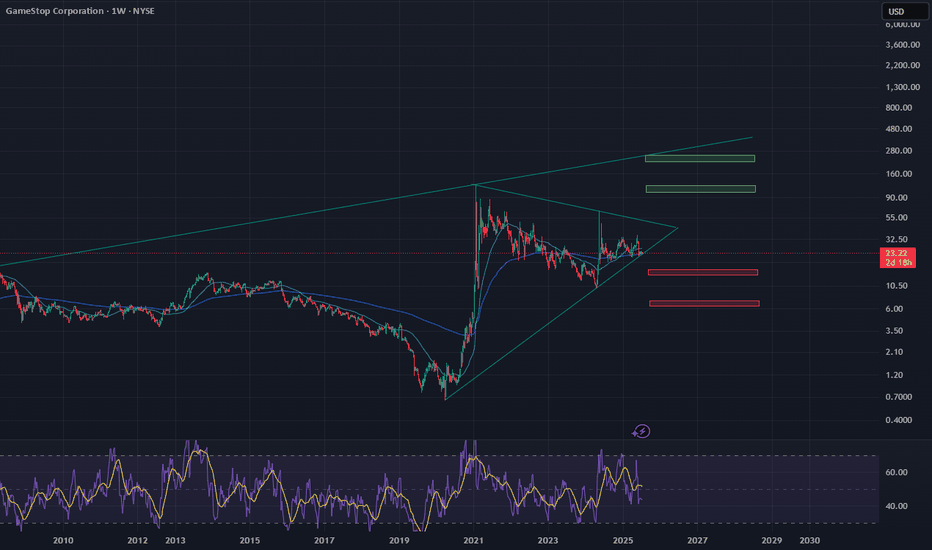

WC: 23.59 Target: 1800-2400 MOASS: 47k-100K: PROFITI am a trader...I have one goal at the end of the day: MAKE A PROFIT

This will be my final post on Gamestop as I am now dedicating ALL of my time to Macro Market Coverage...

I FIRMLY believe that there is a high potential for markets to turn SIGNIFICANTLY LOWER over the next year and plan to show

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.26 MXN

2.72 B MXN

79.21 B MXN

408.69 M

About GameStop

Sector

Industry

CEO

Ryan Cohen

Website

Headquarters

Grapevine

Founded

1996

FIGI

BBG00MQCNFP0

GameStop Corp. engages in offering games and entertainment products through its ecommerce properties and stores. The firm’s stores and ecommerce sites operate primarily under the names GameStop, EB Games, and Micromania. It operates through the following geographical segments: United States, Canada, Australia, and Europe. The company was founded by Daniel A. DeMatteo in 1996 and is headquartered in Grapevine, TX.

Related stocks

GME CRACK?Unfortunately, I keep getting forced to create new posts for the same Isea bc TV forces me to "target reached" on updates. Here is my previous post.

We have yet another bearish formation setting up in GME. Rising bearish wedge.

Wait for the CRACK!

Click Boost, like, follow, and subscribe for mo

GME LONG IDEA UPDATEDIn my previous post regarding the long opportunity on GME stock, I called a long signal after a break out of a downtrend line. However, price had dropped down to the demand zone, giving another long opportunity.

To take advantage of this long opportunity, you can buy at the current market price, w

GME Potential UpsideGME looks attractive from a risk to reward perspective. I am not interested in the short squeeze speculation but the technicals and recent acquisition of BTC in their balance sheet has caught my attention as they have been sitting on capital for quite some time now.

Theres a clear gap around 28.50

Golden Cross on GME WeeklyGME Chart Breakdown, Déjà Vu or Destiny? Something big just lit up the weekly chart, the 50 MA has pierced through the 200 MA, forming that golden cross traders dream about. On the weekly timeframe. Not a drill.

Now, let’s rewind. The last time this pattern appeared? January 2021. The infamous squ

ITS TIMEGME coiled on the 4hr RSI break 50 were launching from the POC area to 24.50 to next MA. Overall target after taking 26 is VAH around 27.58. The drop down was profit taking/ overextended /sell the news after all the hype leading into the btc purchase announcement they didn't disclose purchase price

GME is ready to decide (weekly candles)I'm bullish because the market is bullish

Reasons for being Bullish

-above 200sma weekly and have held it as support

-200sma day crossed above 200sma weekly

-everyone knows about the stock, momentum could be something never seen before because of the notion of becoming rich in a day. Treating this

WC: 23.59 Target: 1800-2400 MOASS: 47k-100K: Waves of MomentumYes I still believe the 20 week cycle theory is still valid...lets get that out the way

Volatile stocks like GME are driven by two things mainly: SENTIMENT and the OPTIONS CHAIN

So what I plan to focus on from here on out is MOMENTUM

What I have been focused on behind the scenes is a better way t

Cant Stop Wont Stop GameStopLast Weekly Golden Cross was January 25th, 2021.

We are now coming very close to our next Weekly Golden Cross 4 years later.

Fast MA on the Rainbow Ribbon has crossed over the Slow MA.

OBV has spiked and been building up in the same manner.

Stochastic-RSI is almost at ultra oversold & is general

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where GME is featured.

Frequently Asked Questions

The current price of GME is 443.50 MXN — it has decreased by −0.45% in the past 24 hours. Watch GAMESTOP CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange GAMESTOP CORPORATION stocks are traded under the ticker GME.

GME stock has risen by 2.19% compared to the previous week, the month change is a 3.80% rise, over the last year GAMESTOP CORPORATION has showed a −7.63% decrease.

We've gathered analysts' opinions on GAMESTOP CORPORATION future price: according to them, GME price has a max estimate of 255.57 MXN and a min estimate of 255.57 MXN. Watch GME chart and read a more detailed GAMESTOP CORPORATION stock forecast: see what analysts think of GAMESTOP CORPORATION and suggest that you do with its stocks.

GME stock is 1.94% volatile and has beta coefficient of 0.07. Track GAMESTOP CORPORATION stock price on the chart and check out the list of the most volatile stocks — is GAMESTOP CORPORATION there?

Today GAMESTOP CORPORATION has the market capitalization of 195.81 B, it has decreased by −5.88% over the last week.

Yes, you can track GAMESTOP CORPORATION financials in yearly and quarterly reports right on TradingView.

GAMESTOP CORPORATION is going to release the next earnings report on Sep 3, 2025. Keep track of upcoming events with our Earnings Calendar.

GME earnings for the last quarter are 3.34 MXN per share, whereas the estimation was 1.57 MXN resulting in a 112.50% surprise. The estimated earnings for the next quarter are 3.58 MXN per share. See more details about GAMESTOP CORPORATION earnings.

GAMESTOP CORPORATION revenue for the last quarter amounts to 14.37 B MXN, despite the estimated figure of 14.72 B MXN. In the next quarter, revenue is expected to reach 16.97 B MXN.

GME net income for the last quarter is 879.07 M MXN, while the quarter before that showed 2.72 B MXN of net income which accounts for −67.69% change. Track more GAMESTOP CORPORATION financial stats to get the full picture.

GAMESTOP CORPORATION dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 17, 2025, the company has 6 K employees. See our rating of the largest employees — is GAMESTOP CORPORATION on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GAMESTOP CORPORATION EBITDA is 1.57 B MXN, and current EBITDA margin is 0.56%. See more stats in GAMESTOP CORPORATION financial statements.

Like other stocks, GME shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GAMESTOP CORPORATION stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GAMESTOP CORPORATION technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GAMESTOP CORPORATION stock shows the sell signal. See more of GAMESTOP CORPORATION technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.