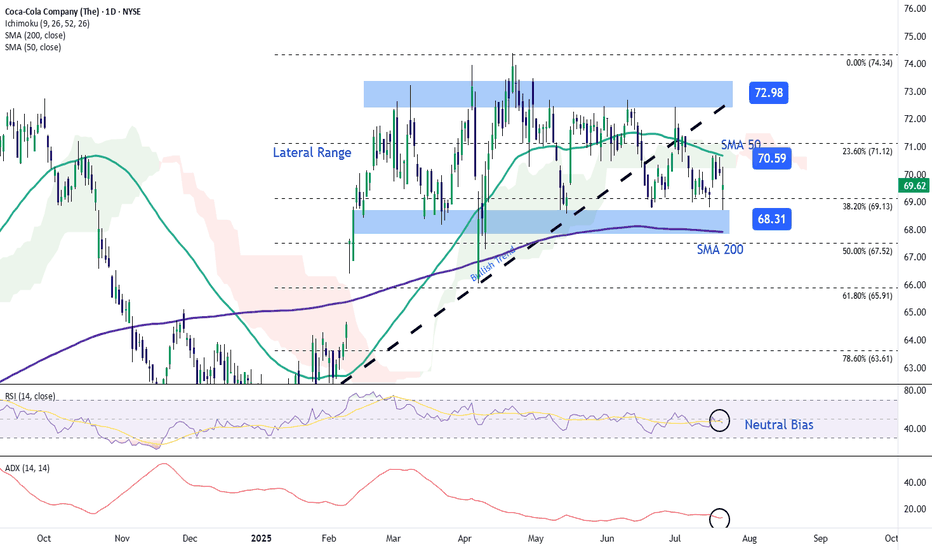

Coca-Cola Stock Falls Despite Strong EarningsDuring the latest trading session, Coca-Cola stock maintained a clear neutral bias after a nearly 1% decline, falling below the $70 per share level. This movement came despite the company reporting better-than-expected results, with earnings per share (EPS) of $0.87, above the $0.83 expected, and to

Key facts today

Coca-Cola reported better-than-expected earnings, positively impacting its stock performance.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

53.08 MXN

221.65 B MXN

975.04 B MXN

4.27 B

About Coca-Cola Company (The)

Sector

Industry

CEO

James Quincey

Website

Headquarters

Atlanta

Founded

1886

FIGI

BBG00JX0P0R4

The Coca-Cola Co is the nonalcoholic beverage company, which engages in the manufacture, market, and sale of non-alcoholic beverages which include sparkling soft drinks, water, enhanced water and sports drinks, juice, dairy and plant-based beverages, tea and coffee and energy drinks. Its brands include Coca-Cola, Diet Coke, Coca-Cola Zero, Fanta, Sprite, Minute Maid, Georgia, Powerade, Del Valle, Schweppes, Aquarius, Minute Maid Pulpy, Dasani, Simply, Glaceau Vitaminwater, Bonaqua, Gold Peak, Fuze Tea, Glaceau Smartwater, and Ice Dew. It operates through the following segments: Europe, Middle East and Africa, Latin America, North America, Asia Pacific, Bottling Investments and Global Ventures. The company was founded by Asa Griggs Candler in 1886 and is headquartered in Atlanta, GA.

Related stocks

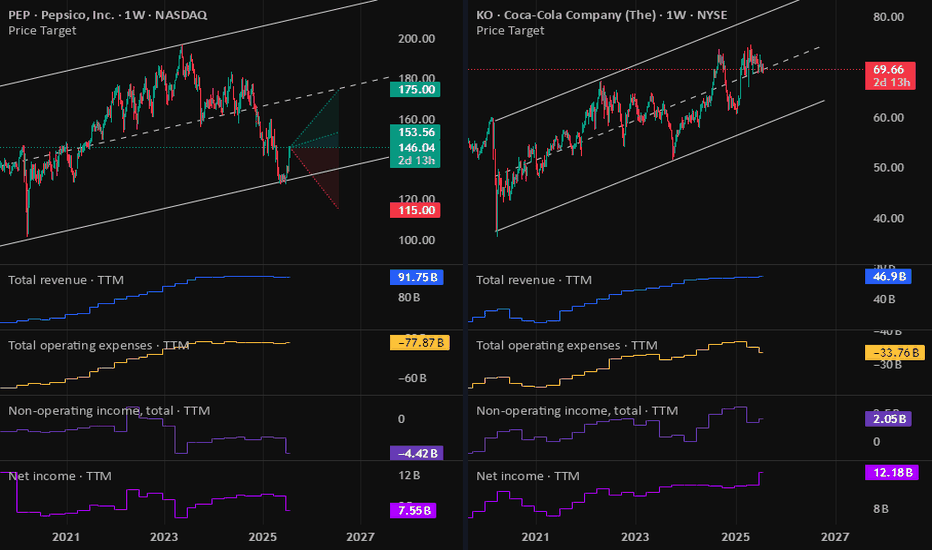

KO: Coca-Cola (CFD) Earnings 23-07-2025Yesterday we have the Coca-Cola earnings report came out and beat on both earning and revenue. But due to the technical position I do not see it a good entry on the stock CFD, still see PepsiCo stock CFD is a better option.

Disclaimer: This content is NOT a financial advise, it is for educational pu

Coca Cola to protect my portfolio and help it growOne of the most important things we must try to determine as investors is what company is the best at what they do in their field. In my opinion Coca Cola is and has always been the number one soft drink manufacturer, always finding new yet subtle ways to stay ahead of their competition.

The reason

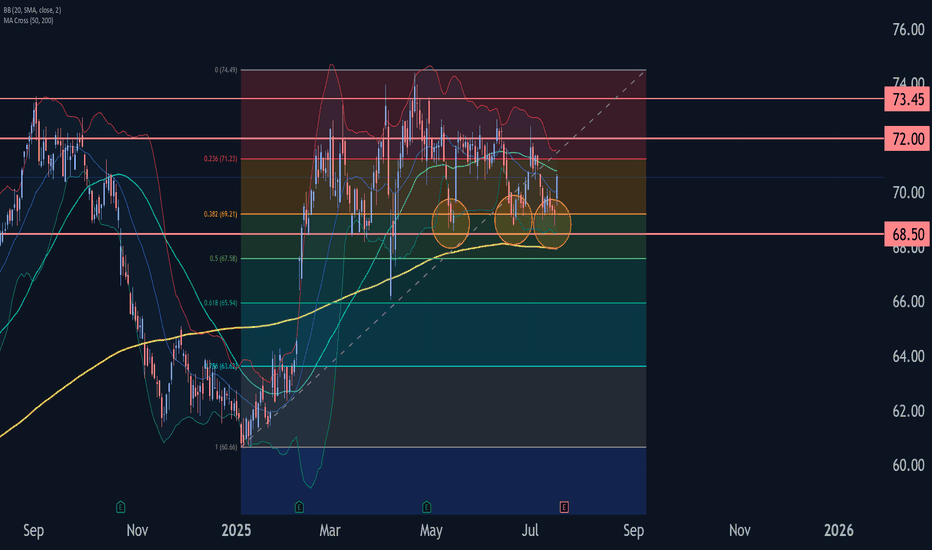

Coca-Cola Wave Analysis – 17 July 2025- Coca-Cola reversed from the support area

- Likely to rise to resistance level 72.00

Coca-Cola recently reversed from the support area between the key support level 68.55 (which has been reversing the price from May), lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impu

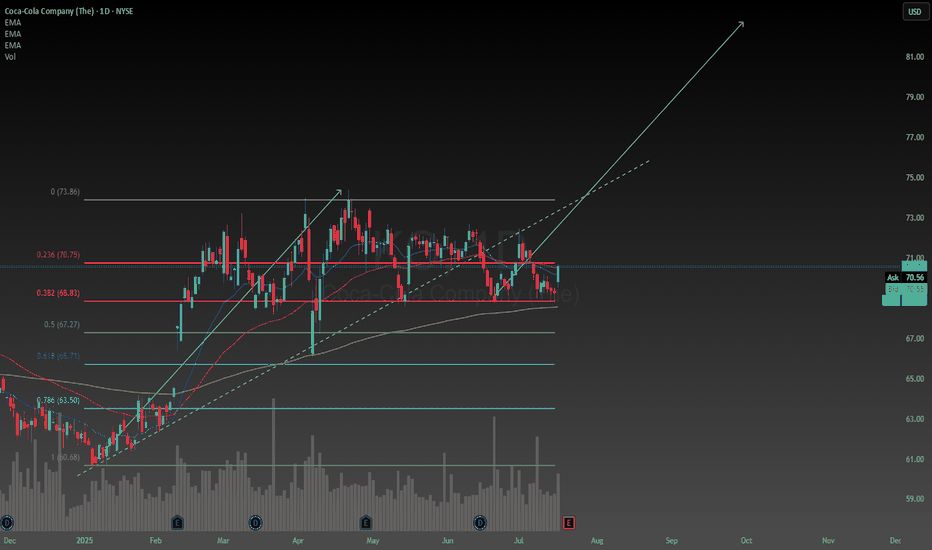

Coca-Cola: Nearing Final Wave III HighDespite recent sell-offs, we still expect Coca-Cola to reach a final high of magenta wave within our beige Target Zone between $76.58 and $81.51, which should also mark the completion of the broader beige wave III. However, an alternative scenario—with a 38% probability—remains in play: in this ca

Trading The 3 Step Rocket Booster StrategyTrading within a certain time frame has shown me that its better to set a time stop limit.

This time stop limit tells you when to stop trading your entry.

-

Now does this work? am not sure but i will try anything

that will produce results.

-

Right now am focusing on short term trading strategies.The

Coca-Cola Wave Analysis – 19 June 2025

- Coca-Cola broke the support zone

- Likely to fall to support level at 68.55

Coca-Cola recently broke the support zone located between the support level 70.35 (which reversed the price twice from May) and the 61.8% Fibonacci correction of the upward impulse 1 from May.

The breakout of this supp

How To Buy A Short Squeeze Using This 3 Step SystemToday i felt lifted and happy.

But Yesterday i was very sad

because of a silly fight

with a drunk friend of mine.

Need i mention i was sober.

I had to self defense myself but i feel much

better after writing down my feelings.

Basically i had to run away from the

fight.There is nothing

wrong wi

Simple Coca Cola daily chart analysisCoca Cola, my favorite defensive stock seems to be at a price decision in time. I have found a single trend line that looks reasonable. There seems to be a lot of congestion in price over the last few days this leads me to believe a breakout is coming soon. 25% of my portfolio is Coca Cola, it pays

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CCCC

COCA-COLA CO 20/51Yield to maturity

6.97%

Maturity date

Mar 15, 2051

KO4982890

Coca-Cola Company 2.6% 01-JUN-2050Yield to maturity

6.79%

Maturity date

Jun 1, 2050

KO4982891

Coca-Cola Company 2.75% 01-JUN-2060Yield to maturity

6.74%

Maturity date

Jun 1, 2060

US191216DL1

COCA-COLA 21/51Yield to maturity

6.61%

Maturity date

Mar 5, 2051

KO4982889

Coca-Cola Company 2.5% 01-JUN-2040Yield to maturity

6.09%

Maturity date

Jun 1, 2040

CCCB

COCA-COLA 21/41Yield to maturity

6.03%

Maturity date

May 5, 2041

US191216CQ1

COCA-COLA CO 20/50Yield to maturity

5.93%

Maturity date

Mar 25, 2050

KO5807227

Coca-Cola Company 5.4% 13-MAY-2064Yield to maturity

5.72%

Maturity date

May 13, 2064

KO5868479

Coca-Cola Company 5.2% 14-JAN-2055Yield to maturity

5.65%

Maturity date

Jan 14, 2055

KO5807226

Coca-Cola Company 5.3% 13-MAY-2054Yield to maturity

5.60%

Maturity date

May 13, 2054

US191216CP3

COCA-COLA CO 20/40Yield to maturity

5.49%

Maturity date

Mar 25, 2040

See all KO bonds

Curated watchlists where KO is featured.

Frequently Asked Questions

The current price of KO is 1,278.20 MXN — it has decreased by −0.14% in the past 24 hours. Watch THE COCA-COLA COMPANY stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange THE COCA-COLA COMPANY stocks are traded under the ticker KO.

KO stock has fallen by −3.52% compared to the previous week, the month change is a −4.32% fall, over the last year THE COCA-COLA COMPANY has showed a 5.87% increase.

We've gathered analysts' opinions on THE COCA-COLA COMPANY future price: according to them, KO price has a max estimate of 1,577.35 MXN and a min estimate of 1,298.99 MXN. Watch KO chart and read a more detailed THE COCA-COLA COMPANY stock forecast: see what analysts think of THE COCA-COLA COMPANY and suggest that you do with its stocks.

KO stock is 0.42% volatile and has beta coefficient of 0.18. Track THE COCA-COLA COMPANY stock price on the chart and check out the list of the most volatile stocks — is THE COCA-COLA COMPANY there?

Today THE COCA-COLA COMPANY has the market capitalization of 5.52 T, it has decreased by −0.20% over the last week.

Yes, you can track THE COCA-COLA COMPANY financials in yearly and quarterly reports right on TradingView.

THE COCA-COLA COMPANY is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

KO earnings for the last quarter are 16.32 MXN per share, whereas the estimation was 15.64 MXN resulting in a 4.37% surprise. The estimated earnings for the next quarter are 14.61 MXN per share. See more details about THE COCA-COLA COMPANY earnings.

THE COCA-COLA COMPANY revenue for the last quarter amounts to 236.67 B MXN, despite the estimated figure of 235.74 B MXN. In the next quarter, revenue is expected to reach 232.18 B MXN.

KO net income for the last quarter is 71.47 B MXN, while the quarter before that showed 68.22 B MXN of net income which accounts for 4.76% change. Track more THE COCA-COLA COMPANY financial stats to get the full picture.

Yes, KO dividends are paid quarterly. The last dividend per share was 9.67 MXN. As of today, Dividend Yield (TTM)% is 2.88%. Tracking THE COCA-COLA COMPANY dividends might help you take more informed decisions.

THE COCA-COLA COMPANY dividend yield was 3.12% in 2024, and payout ratio reached 78.83%. The year before the numbers were 3.12% and 74.52% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 69.7 K employees. See our rating of the largest employees — is THE COCA-COLA COMPANY on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. THE COCA-COLA COMPANY EBITDA is 269.71 B MXN, and current EBITDA margin is 23.34%. See more stats in THE COCA-COLA COMPANY financial statements.

Like other stocks, KO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade THE COCA-COLA COMPANY stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So THE COCA-COLA COMPANY technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating THE COCA-COLA COMPANY stock shows the neutral signal. See more of THE COCA-COLA COMPANY technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.