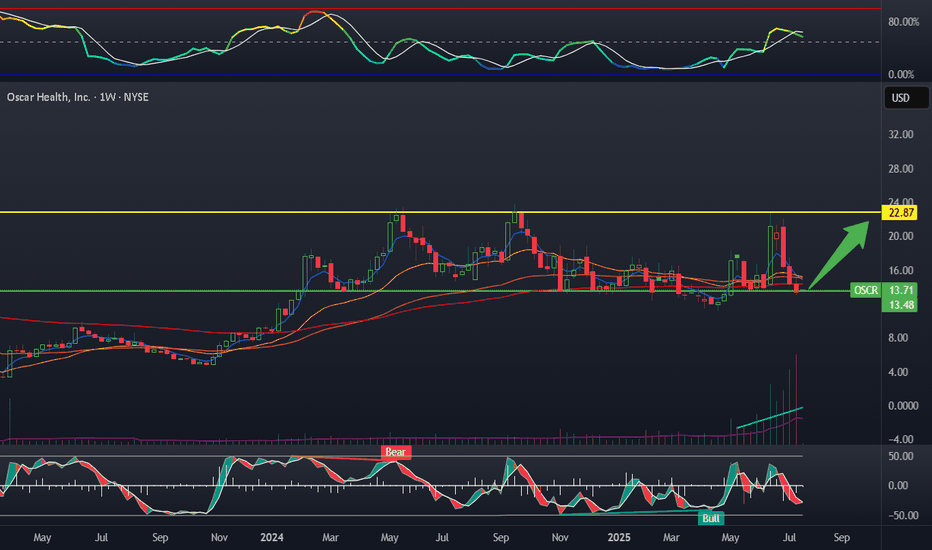

Oscar - Still bullish?Healthcare is under immense pressure, time to review the charts of the best names to own in possibly the mosted hated sector. Today I will look at Oscar Health. It's clear the trend remains down, but does this present an opportunity? Let's look at reasons to start a dca approach at key support level

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.99 MXN

530.24 M MXN

191.35 B MXN

180.17 M

About Oscar Health, Inc.

Sector

Industry

CEO

Mark T. Bertolini

Website

Headquarters

New York

Founded

2012

FIGI

BBG01V59VCH6

Oscar Health, Inc. is a health insurance company, which serves its customers through a technology platform. It offers individual and family, small group and medicare advantage plans, and technology platform to others within the provider and payor space. The company was founded by Mario Tobias Schlosser, Kevin Nazemi, and Joshua Kushner on October 25, 2012 and is headquartered in New York, NY.

Related stocks

OSCR will pumpOSCR was heavily shorted this past week despite growing fundamentals. The market seems split on the stock. I see heavy growth of baseline revenue, and operating cash flow turning positive. If the company makes 15 billion in revenue in 2023 with a 6% margin that will be 900 million in earnings. This

Oscar will go down to 10$ in next 3-4 months timeRecent Stock Pressure

Weak Q2 guidance from Centene weighed on sentiment, dragging OSCR down ~14%

.

Wells Fargo downgraded it to underweight, citing rising medical costs and pricing pressures in 2025

.

📊 Key Drivers for OSCR

1. 🩺 Healthcare Reform & the ACA / Medicare Advantage

Trump’s tariffs

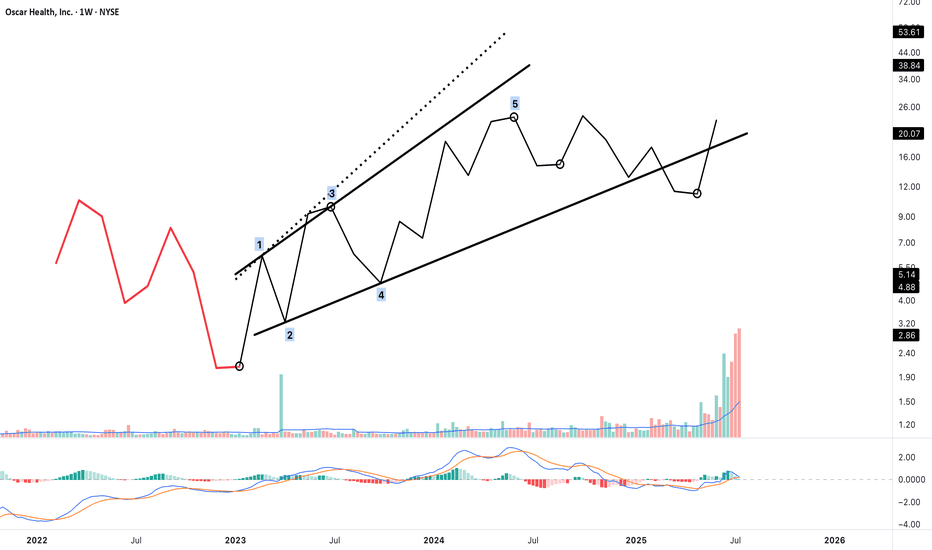

Possible Terminal Impulse as Wave 1 or A — Structure Completion?This chart presents a potential 5-wave terminal impulse structure — most likely a 5-extension terminal, where waves 1, 3, and 5 display impulsive character.

This move may represent the beginning of a new sequence — either as:

"Wave 1 of a larger motive structure"

"or Wave A of a corrective formati

OSCR LONG IDEALooking at the weekly chart of OSCR stock, there's a long opportunity which can be taken advantage of to make some money provided that market follows the projection.

In order to take advantage of this long opportunity, a buy order limit can be placed at $12.38 while the exit can be at $11.09 and th

OSCR: Pullback Setup with 30% UpsideOscar Health NYSE:OSCR has pulled back into a logical area of support after a strong breakout in June. While the aggressive move may be over, this trade still offers solid upside with controlled risk.

🔍 Technical Breakdown

Price is basing above the cloud with a clean series of higher lows.

Ichim

Oscar Health Bullish Continuation Oscar Health has broken out of a long descending wedge and is now resuming its broader bullish channel trend. With volume surging and smart money signals appearing near key supports, the chart targets a 94% measured move to $26.76, with the possibility of continuation toward $50.00 if trend strength

Potential Upside for OSCR.US – Targeting $23Oscar Health (OSCR.US) is currently trading near the technical support zone of $14–$15, a level that has historically acted as a base for rebounds. In May and June 2025, the stock saw sharp upward movements, breaking through the $20 mark, which confirms strong bullish potential. The current pullback

OSCR - Cyclical Expansion and Algorithmic ConfluenceOscar Health moves in cycles. It's possible to observe algorithmic confluence with the 3rd extension at 1.618 (~$60). The price reacted to the algorithmic expansion channel as expected and retraced to the equilibrium of the weekly bullish breaker. Therefore, the price behavior I anticipate is an agg

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where OSCR is featured.

Frequently Asked Questions

The current price of OSCR is 266.40 MXN — it has increased by 0.90% in the past 24 hours. Watch OSCAR HEALTH, INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange OSCAR HEALTH, INC stocks are traded under the ticker OSCR.

OSCR stock has risen by 2.34% compared to the previous week, the month change is a −30.06% fall, over the last year OSCAR HEALTH, INC has showed a −2.18% decrease.

We've gathered analysts' opinions on OSCAR HEALTH, INC future price: according to them, OSCR price has a max estimate of 334.08 MXN and a min estimate of 148.48 MXN. Watch OSCR chart and read a more detailed OSCAR HEALTH, INC stock forecast: see what analysts think of OSCAR HEALTH, INC and suggest that you do with its stocks.

OSCR stock is 2.60% volatile and has beta coefficient of 0.19. Track OSCAR HEALTH, INC stock price on the chart and check out the list of the most volatile stocks — is OSCAR HEALTH, INC there?

Today OSCAR HEALTH, INC has the market capitalization of 68.30 B, it has decreased by −0.64% over the last week.

Yes, you can track OSCAR HEALTH, INC financials in yearly and quarterly reports right on TradingView.

OSCAR HEALTH, INC is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

OSCR earnings for the last quarter are 18.85 MXN per share, whereas the estimation was 16.24 MXN resulting in a 16.06% surprise. The estimated earnings for the next quarter are −13.06 MXN per share. See more details about OSCAR HEALTH, INC earnings.

OSCAR HEALTH, INC revenue for the last quarter amounts to 61.38 B MXN, despite the estimated figure of 58.35 B MXN. In the next quarter, revenue is expected to reach 54.91 B MXN.

OSCR net income for the last quarter is 5.64 B MXN, while the quarter before that showed −3.20 B MXN of net income which accounts for 276.16% change. Track more OSCAR HEALTH, INC financial stats to get the full picture.

No, OSCR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 2.4 K employees. See our rating of the largest employees — is OSCAR HEALTH, INC on this list?

Like other stocks, OSCR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade OSCAR HEALTH, INC stock right from TradingView charts — choose your broker and connect to your account.