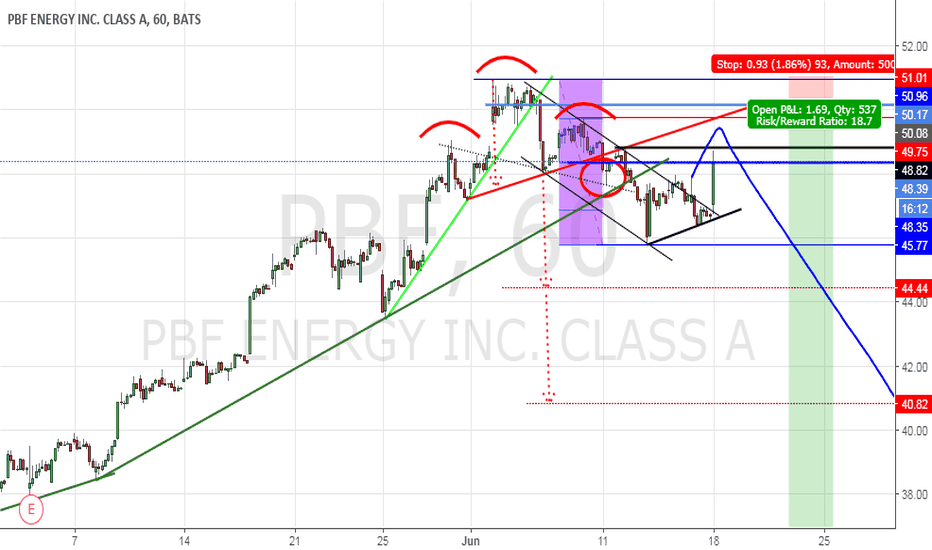

PBF trade ideas

#PBF: Weekly uptrend, increasing demand amid driving seasonI like the setup in $PBF here, 35% upside at least from here vs a 14% downside risk. I'll keep an eye on the target zone, as this could move even higher over time, until the forecasted rally duration pans out. We had some great trades in this stock since the March 2020 bottom, last weekly signal panned out perfectly before, I think it will perform once again.

Best of luck,

Ivan Labrie.

PBF EnergyChart pattern: Bull flag

Entry: 16.05$ (this would end the secondary downtrend of the correction)

Stop: 12$

Target: 24.60$

Stopmanagement: ATR Stops daily chart default settings

Risk:Reward-Ratio: > 2:1

Description: The chart is forming a bull flag with a nice corrective pattern (which retraced under the 38 Fibonacci retracement). Target is the 1:1 Fibonacci extension of the former impuslive move.

Ordersize example: If you have a 10000K to trade and you only want to risk 1% of your volume, you can enter this trade with 400$.

PBF: Bullish PennantBullish Pennant

Pros:

Descending volume during formation

PPS above 50MA and 200MA

Golden cross in blue

RS above 0, and ascending

ATR Ascending

R/R ratio above 6

Cons:

250RSI below 50

200MA flat

Target:

PT = 22.37$

1000 Followers! Thank you all!

Thank you to those who donate Coins!

Stay Humble, have fun, make money!