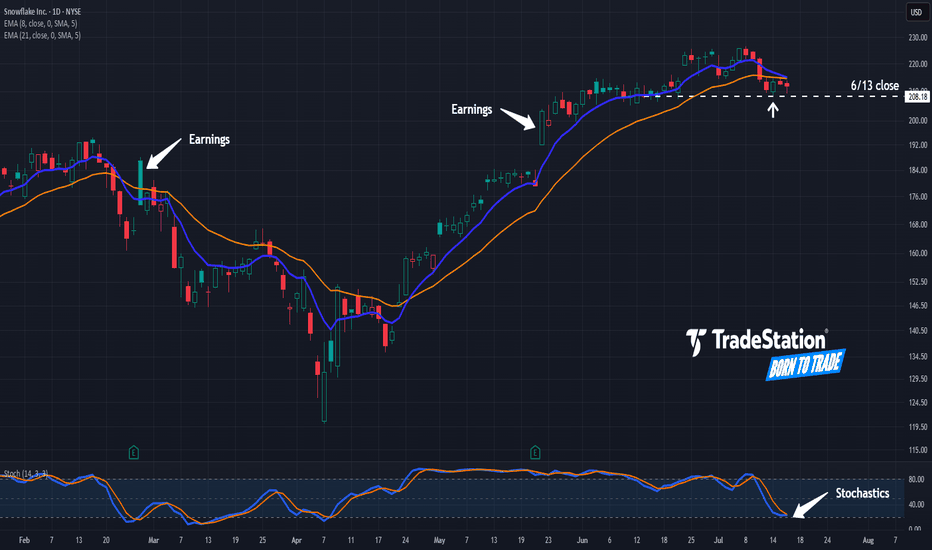

Snowflake Pulls BackSnowflake jumped to a new 52-week high last week, and now it’s pulled back.

The first pattern on today’s chart is the pair of price jumps after the last two quarterly reports. Those may reflect bullish sentiment in the software company.

Second is the June 13 weekly close of $208.18. SNOW appears to be stabilizing after revisiting that level, which may suggest support is in place.

Third, stochastics neared oversold territory and are now trying to turn higher.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

SNOW trade ideas

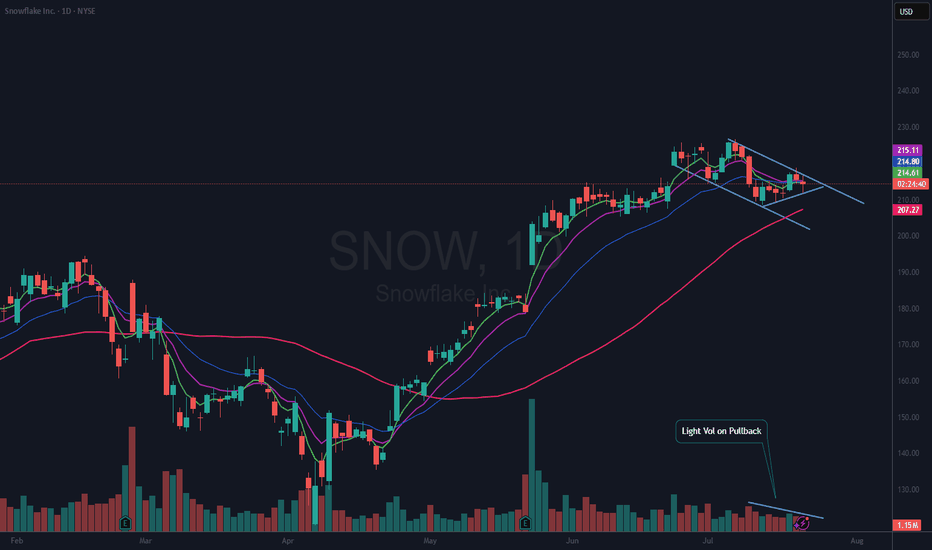

$SNOW Bull Flag?NYSE:SNOW has been and still may be one of the leaders in this market. It is forming a Bull Flag and within that flag is a nice wedging formation.

I am bullish with this name, so I have an alert set on the upper downtrend line. Should it break that, I will look for a good risk reward entry to open a position. It is possible if the market pulls back, that NYSE:SNOW could continue down to test the 50 DMA (red). All TBD.

If you like this idea, please make it your own and follow your trading plan. Remember, it is your money at risk.

In addition, Nvidia NASDAQ:NVDA and Snowflake NYSE:SNOW were among the investors that backed artificial intelligence company Reka's $110 million funding round, Reka said Tuesday.

Reka said the investment will accelerate its technical development efforts and will also scale its multimodal platforms.

The investment boosts the startup's valuation to more than $1 billion from the previous $300 million in a 2023 funding round, Bloomberg reported Tuesday.

[SNOW] SNOW InvestmentReally late on this investment so half size for me on this one and will not add to the downside.

I missed the reversal pattern but I have strong convictions on the fundamental part so I wanted to be part of it ... maybe I am wrong otherwise I am holding for a while ... can be a major stock for the future.

Great Trade !

Weekly SMC Macro Structure – Snowflake ($SNOW)🔹 Key Technical Observations

✅ Massive Cup & Handle Structure

Handle forming at the top of equilibrium

Clean breakout from descending macro trendline

✅ Multi-year CHoCH + BOS sequences

2023–2025: Consolidation range accumulation confirmed

✅ Final Liquidity Sweep in Discount Zone

Price reclaims structure post-sweep from $120s

📊 VolanX DSS Macro Trade Thesis

Element Signal / Zone

Current Price $223.26 (Weekly Close)

Target 1 $235.00 (Short-Term Strong High)

Target 2 $320–$400 (Repricing Zone)

Target 3 (Max Fib) $760–$800 (1.618 Projection)

Invalidation <$160 (Loss of structure)

🛡️ Strategic Risk Profile

Risk-Reward Ratio: 5–8x (depending on entry refinement)

Time Horizon: 6–24 months

Bias: Long-only, accumulation phase confirmed

📢 Suggested TradingView/LinkedIn Caption

🧠 NYSE:SNOW – VolanX Macro Breakout Framework

After nearly 3 years of compression, Snowflake Inc. ( NYSE:SNOW ) has completed a multi-year accumulation range and broken its descending macro structure. The equilibrium reclaim + multi-CHoCH confirmations signal the onset of institutional reaccumulation.

📍 Current thesis:

“You don’t chase breakouts. You trace where the liquidity was engineered.”

🎯 Long bias toward $320+, with macro targets extending to $760–$800 over the next 18–24 months.

🔗 Follow: tradingview.com/u/Wavervanir_International_LLC

#Snowflake #SNOW #SmartMoneyConcepts #VolanX #MacroTrading #WaverVanir #BreakoutSetup #LongTermInvesting #DSS #AITrading

Long Overdue Breakout for $SNOW - take the leapOn the monthly chart, NYSE:SNOW just broke out of a 3 year channel. This presents a strong bullish signal. With growing demand for AI and a significant expansion in the sector, I see this moving up the scale.

On the weekly chart, it has also formed one of my now favorite patterns - the "DOUBLE BUMBUM".

This undoubtedly confirms the trend upwards.

There is some resistance at $300 but I perceive this going to about $350 in the coming months.

I would take a leap on this stock.

SNOW Based on the current 15-minute chart for SNOW (Snowflake Inc.), we are observing a clear liquidity sweep and internal CHoCH (Change of Character) following a strong bearish impulse. Price has aggressively retraced and is now approaching a key supply zone near 222.00, which also aligns with the most recent internal high and potential inducement zone.

I anticipate price may push slightly above 222, tapping into remaining liquidity from late buyers before reversing. This aligns with a higher timeframe resistance, suggesting the up-move is corrective rather than impulsive.

From a structural standpoint:

The prior Break of Structure (BoS) confirms bearish intent.

Liquidity was taken both at the highs and lows, typical of distribution before a larger move.

The ideal short entry is upon confirmation of rejection from this 222+ level, targeting the demand zones around 217.00 and possibly as low as 211.00, respecting the higher timeframe bearish narrative.

Risk Management Tip: Wait for a bearish engulfing or clear rejection pattern on the lower timeframes within the 222–223.20 range before entering short. Set stop-loss slightly above the last high and manage position accordingly as price approaches each demand zone.

SNOWFLAKE to $369Snowflake Inc. is an American cloud-based data storage company.

Headquartered in Bozeman, Montana, it operates a platform that allows for data analysis and simultaneous access of data sets with minimal latency. It operates on Amazon Web Services, Microsoft Azure, and Google Cloud Platform.

As of November 2024, the company had 10,618 customers, including more than 800 members of the Forbes Global 2000, and processed 4.2 billion daily queries across its platform

#DoubleBottom

#Wformation

Put a lid on what smells badWe are within a resistance range that is as old as 5 years. It has been confirmed impressively in February 2024 again. Perhaps we will test these high again within the next weeks. But I oubt that we may decisive exceed the 230-240 level as this resistance is very strong and even stronger due to the 2024 Fibonacci extension.

The top on Wednesday could no be overcome. This means to me that we are in a decisive zone now with a possible correction attempt towards the open window of mid May.

Another upward attempt may be followed then.

Super performance candidate NYSE:SNOW , cloud-based data platform leader in its fast growing industry as its business model is expected to grow significantly, with strong customer growth and integrating with the A.I rush, positioning itself to capture significant market share.

Sitting at a RS Rating of 94,

I have reasons to believe this security could increase

$SNOW $200 target, sooner than laterHello. Not much analysis here besides a monster gut feeling. NYSE:SNOW has earnings May 21. I’m looking to get in $200c for May 16 expiration. For some reason this name can’t scorch $200 and I believe it should. If NASDAQ:CRWD moves the way it does so can $SNOW. I think it’s made a strong support and mental level at $150. I was apart of the latest push to $180-$190 before its most recent earnings which jolted it from $150s to $180 AND it got sent back to that $150 to $160 level. I think this is a high conviction swing especially into earnings; premiums can go up off the IV.

NFA.

WSL.

SNOW earning: short strangleExpected movement for the option expiring on May 23 is around +/- $20, and the stock price has increased quite a bit in the past a few weeks. Hence, setting up a short strangle with strike price out of the scope of expected movement when the stock price was around $180. Hoping that "good news" if any to be released during earning call is (partially) priced-in so that stock price won't go crazy above $205.

Max profit: $320 for 2 contracts in each direction if all contracts expire worthless

Exit strategy: if stock price moves aggressively toward one direction, consider buying back one contract of that direction to reduce risk exposure.

Instrument | Entry Date

SNOW 23MAY25 207.5P | 2025-05-19

SNOW 23MAY25 155P | 2025-05-19

SNOW Finds Support at 200-Day SMASnowflake has been trading within a wide range between 108 and 240 over the past three years. During this period, revenue growth has remained steady, but operating and R&D expenses have consistently increased. This is a company that prioritizes growth and invests heavily in research, expanding its product offerings and business relationships.

However, the recent downturn, driven by tariffs and the broader selloff in AI and cloud-related stocks has exposed Snowflake's vulnerabilities.

The company reports reflect this caution. Recently, SNOW has received both downgrades and buy signals, highlighting analyst and market indecision. In such an environment, the stock’s performance will likely lean heavily on broader index movement. With a beta above 1.5, SNOW is expected to react more sharply to market swings. The consensus 12 month target still shows 38% upward potential.

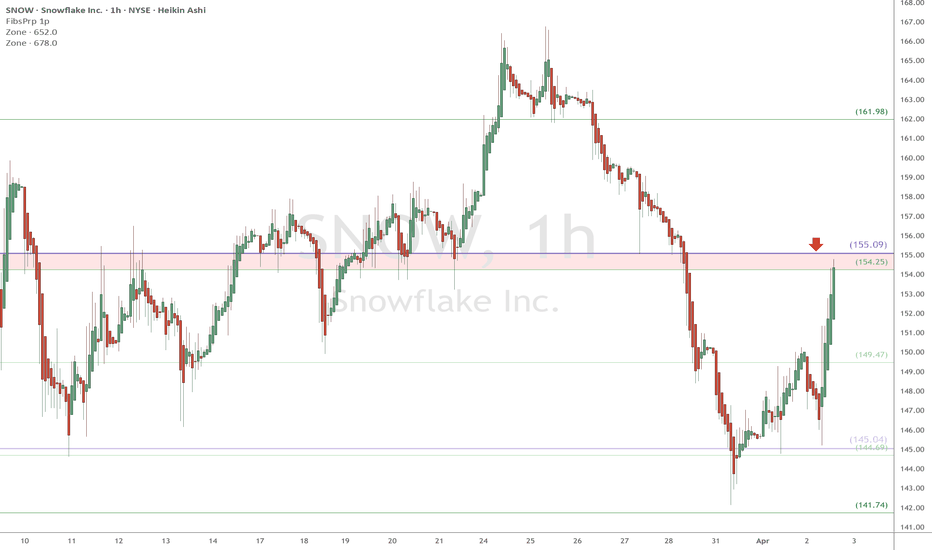

Currently, Snowflake is finding support at the 200-day simple moving average. If the market manages to weather the impact of the April 2 tariffs and potential countermeasures, SNOW could stage a solid rebound. On the downside, the 130–135 zone stands out as a key support area just below the moving average.

Risky Pre-Earnings Play ~ SHORT~Hey everyone!

Let's make an analysis for a potential pre-earnings trade on SNOW. This is very risky so we have to be extra careful and analyze the price action until the last trading session before earnings report. I have made a successful trade on the previous earnings report. My entry was at $128 during the trading session the day before the earnings announcement and my exit was at the next day at the open at $165 (almost 29%). I took that trade because the stock price had broke out from the downward channel, a week before the report (see in graph), so in my analysis going long before the report was a good idea (and thank god yes, it was).

For our new proposed short trade we have the following:

1) There is some pattern (seasonality) that unfolds during the period NOVEMBER to FEBRUARY. As you can see, price has increased from NOV 2023 to FEB 2024 by approximately 37%, while a quite similar behavior is observed from NOV 2024 to FEB 2025, but the increase is greater (approximately 52%)

2) In both cases, before earnings announcement there was a consolidation period. However, the "jump" in price was far greater in the last earning report (NOV 2024), but the following weeks the price was not increasing at such a fast rate when comparing with the period from NOV 2023 to FEB 2024

3) RSI had almost the exact behavior in both cases. It was near the overbought territory before the earnings report, jumped higher after the announcement, then fell in a quite similar way till it reached 50 and then grew once again to the upper level (70)

4) Current price levels were resistance levels back in 2023 and support levels from Q4 2023 to Q1 2024

5) As you can see in the upper left rectangle, the price retraced in previous levels. I am not saying that this will happen again, since that implies a drop of nearly 30%, but I can see the price falls between $155-$160 level.

6) Market sentiment is not that good for tech stocks the last couple of days and let's admit that valuations are quite high. Even if companies announce great results, market finds a small thing to overreact and send the stock price the opposite way

Having all these in mind I am "guessing" on a 10%+ decrease in share price.

I'll keep watching SNOW until the announcement. This was an analysis that seemed interesting (at least in my head).

Happy to discuss on this!!

Not a financial advice!

Let it SNOW - Long Term SETUP! 183% UpsideLet it SNOW - Long-Term SETUP! 183% Upside

If you have time on your hands and are looking for a patient buy and hold then here is your name!

- Rising Wr%

- Bullish Cross on H5 Indicator

Bull market continues this name will fly.

Bull market ends then retest the breakout area and could hold as long as earnings stay good.

Again, LONG TERM (Noted by Monthly chart) Trade or Investment here.

$470 Target

Not financial advice

one of my favorite setups for 2025!boost and follow for more ❤️🔥

SNOW is almost ready for a parabolic move higher, a 100%+ rally from here is very possible in my opinion.. the trend resistance from late 2021 is finally breaking! But we still have that major resistance zone around 200.

once we break 209 on the weekly time frame I think it will start flying to 280-393 targets 🎯🚀

last chart from me today I hope you all have a profitable week! see you soon with more ❤️🔥

$SNOW Trying to Break-Out

NYSE:SNOW as of today has tested the breakout / resistance area Six times in the last 9 trading sessions. Today it tried again but it is hard to fight the market trend. However, the more it tests this area the more likely it is to successfully breakout. As always, there is no guarantee that it will or will continue higher.

I am long this name at 186.90 and have a stop just below the most recent low @ 175.25. Once it breaks out and holds, I will use a trailing stop on the 21 EMA (green). It will need to close convincingly under the 21 EMA. Let’s see what happens.

If you like this idea, please make sure it fits your trading plan.