TSLA trade ideas

TSLA Momentum Unstoppable To $370— Don’t Miss Out! 🚀 TSLA Weekly Options Analysis — Bullish Momentum Confirmed! (2025-08-11) 🚀

### 🔥 Key Highlights:

* **RSI Signals Bullish:** Daily RSI at **59.5**, Weekly RSI at **54.9** — momentum is building strong!

* **Massive Weekly Gain:** +13.62% this week, breaking past key moving averages & resistance levels.

* **Options Flow:** Call/Put ratio at **1.77** — traders and institutions betting big on upside!

* **Volatility:** VIX low at **15.8** — ideal environment for bullish directional trades.

* **⚠️ Volume Caution:** Weekly volume at **0.8x** last week — watch closely for institutional commitment shifts.

---

### 📈 Consensus:

Most models say: **BULLISH** ✅

* Momentum + Options Flow + Low Volatility = Perfect setup

* Volume dip is a caution flag but not a dealbreaker (yet).

---

### 🎯 Trade Setup: Buy Calls on TSLA

| Parameter | Details |

| ----------------- | ------------------------------------ |

| **Strike** | \$370 |

| **Expiry** | Aug 15, 2025 |

| **Entry Price** | \$0.53 (market open) |

| **Stop Loss** | \$0.26 (50% loss) |

| **Profit Target** | \$1.06 (100% gain) |

| **Position Size** | Risk 2-4% of account (1-2 contracts) |

---

### ⚠️ Risk Management & Notes

* Moderate gamma risk — manage actively as expiry nears

* Watch volume trends for sudden shifts

* Confidence level: **75%** — strong bullish signals but stay nimble!

---

### 📊 JSON Trade Snapshot for Algo Fans

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 370.00,

"expiry": "2025-08-15",

"confidence": 0.75,

"profit_target": 1.06,

"stop_loss": 0.26,

"size": 2,

"entry_price": 0.53,

"entry_timing": "open",

"signal_publish_time": "2025-08-11 14:59:39 UTC-04:00"

}

```

---

💡 **TL;DR:** TSLA’s weekly surge + bullish options flow make \$370 calls a compelling play this week. Manage risk, watch volume, and aim for that 2x profit target!

TSLA Attempting Breakout – Watching $312 Key Level. Aug. 5TSLA Attempting Breakout – Watching $312 Key Level 🚀

Technical Overview (1H)

TSLA is consolidating just below the critical $312 resistance, aligning with the Highest Positive GEX and 2nd Call Wall (57.55%). A breakout above this level could trigger a gamma squeeze toward $317.5 and potentially $325.

Support sits at $300 (Major Put Support -58.42%). If this fails, bears could push toward $295 and $290. Price is currently forming a falling wedge, a bullish reversal pattern if confirmed.

GEX & Options Flow Insights

* Highest Positive GEX: $312 – Strong resistance; breaking above can fuel upside momentum.

* Major Call Walls: $317.5, $325 – Profit-taking zones for bulls.

* Major Put Support: $300 – Bears will defend here; losing it invites heavier selling.

* Call/Put Positioning: CALLs 31.3% vs Puts – Skew still leans slightly bullish, but gamma flip is near $300.

My Thoughts

TSLA is coiling for a potential move. As long as price holds above $300, the risk/reward still favors a bullish breakout play. However, failure to clear $312 could see a pullback into $305–$300 range before another attempt.

Trade Ideas

Bullish Scenario:

* Entry: On a breakout above $312 with strong volume

* Targets: $317.5 → $325

* Stop-Loss: Below $305

Bearish Scenario:

* Entry: Rejection at $312 and loss of $305

* Targets: $300 → $295

* Stop-Loss: Above $315

15-Minute Short-Term Setup

* Intraday traders should watch for a mini breakout retest above $310 for scalps to $312+.

* If $307 fails intraday, momentum could stall toward $304–$302.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

Telsa! Fake out or Buy now?We have been showing we are consolidating for a while now and we are very close to a break out and although we all want to buy into this stock, is it the right time?

Well looking at this chart there is a chance we get a Bearish Breakout towards the lower Support and facing lower Demand zones showing were there is a higher demand of Buyers.

Saying that there is every possibility that we could buy this Breakout now and get the positive response we are all hoping for. Tonight market open shall give us a strong sentiment of what the close future of Tesla is holding for us all

Good luck to any traders that follow this chart pattern

TSLABased on the provided 4-hour chart of TSLA, here is a brief summary and outlook.

Tesla's stock price has been consolidating within a symmetrical triangle pattern since late May. The price is currently trading near the upper boundary of this triangle, which is a critical resistance level. The stochastic indicator is showing a bullish crossover and is trending upwards, but it is not yet in the overbought territory.

The chart presents two potential scenarios for the immediate future. A bullish breakout (green arrow) would occur if the price successfully breaks above the upper trendline and the resistance around $320. This could lead to a significant move towards the next target, potentially around $355, as indicated by the length of the triangle's base. Conversely, a bearish scenario (red shaded area) would see the price fail to break out and instead fall back towards the lower support trendline, possibly testing the support level around $303.

The key to the next move is a decisive breakout from the current pattern. Traders should monitor for a clear break above or below the trendlines with increased volume to confirm the direction. A successful breakout to the upside would signal a continuation of the previous uptrend, while a breakdown to the downside would suggest a potential bearish reversal. The support and resistance levels marked on the chart are key reference points for managing risk and setting targets.

$TSLA – Wedge Breakout with Rotation PotentialNASDAQ:TSLA – Breaking Out of a Big Wedge After Earnings Reversal

Tesla ( NASDAQ:TSLA ) just broke its wedge pattern after a strong post-earnings recovery, and the price action says a lot about where sentiment is shifting.

🔹 Earnings Flush → Strong Absorption

Earnings reaction was ugly — big gap down and heavy selling.

Since then, NASDAQ:TSLA has been shrugging off negative news — sales data, guidance cuts, analyst downgrades — all absorbed without breaking down.

This tells me buyers are quietly accumulating.

🔹 Rotation Narrative

The rest of the Mag 7 has been ripping for months.

NASDAQ:TSLA is the laggard — and now traders are rotating into the one big name that hasn’t moved yet.

If it holds here, the upside could be sharp.

🔹 My Trade Plan:

1️⃣ Starter Long: Took an entry on the wedge trendline break.

2️⃣ Why Not Full Size Yet? This is day 4 of the move — in my playbook, that’s a starter size only.

3️⃣ Add Trigger: If we get an inside day or small dip that holds above the 9 EMA, I’ll add the rest of the position.

4️⃣ Stop: Under the wedge breakout level for now.

Why I Like This Setup:

Wedge break + rotation narrative + strong news absorption.

Market psychology turning — when a stock stops going down on bad news, it’s often about to go up.

Starter now, add on the dip = structured risk.

TESLA Lagging BehindA compelling reason to buy Tesla stock now—despite it being beaten down—is the asymmetric risk-reward setup driven by its depressed valuation relative to long-term growth potential. Sentiment is currently low due to concerns about EV demand, competition, and Elon’s distractions, but this pessimism is largely priced in. Meanwhile, Tesla still holds massive optionality: AI-driven autonomy, energy storage, and Dojo supercomputing. If even one of these verticals scales meaningfully, current prices may prove a generational entry.

At the moment, we are hitting some of my key support levels being the anchored vwap from the low , as well as the previous Value Area High range retest within the formation of this broader triangle, suggesting a potential continuation to the upside should we get a strong breakout.

I will be watching for further down side as the current risk is only approx 6-7% for a potential upside of 60%-70% , a massive Risk to reward.

Should this reclaim the downtrend vwap, it can be a strong sign of strength for this stock to move back to ATH's as tesla is massively lagging behind.

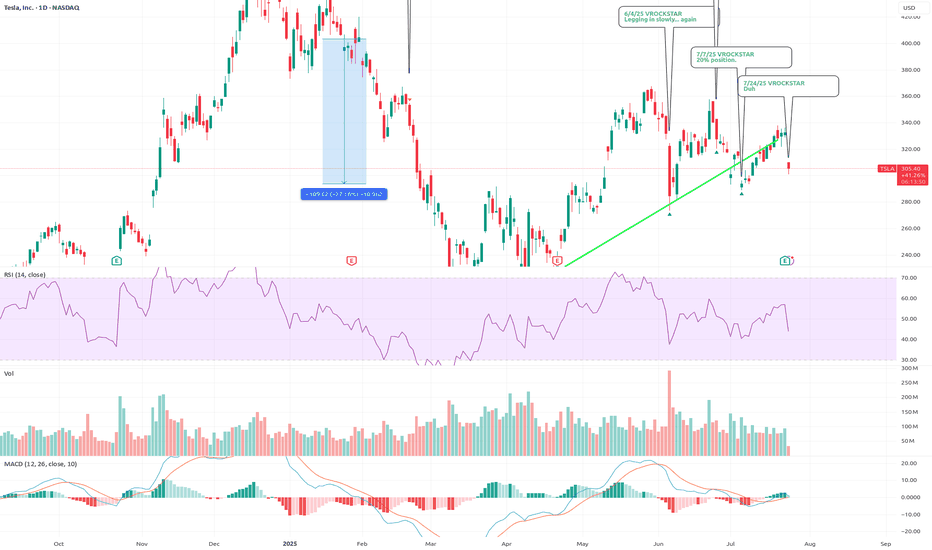

7/24/25 - $tsla - Duh 7/24/25 :: VROCKSTAR :: NASDAQ:TSLA

Duh

- ppl focused on ST FCF (all over X!) is 100% of the reason why when you put the pieces together, you realize that while ST this might not behave like anyone expects... LT, TSLA is v likely going to in, elon's own words, be the largest cap in the history of capital markets

- two leading robots with leadership position in IRL AI

- profitable, is all that matters

- have not yet hit the S-curve

was super lucky to trim some of this last week

now i'm back to sizing into a full position, not yet there like on that silly political dump, but i'm nearly 10% (20% is my max size).

V

TSLA Breaking Out — But Can It Hold Above $320? Aug. 7📊 Technical Analysis (1H + 15-Min Confluence)

TSLA has surged out of its $308–$312 consolidation range with strong bullish momentum. It's now pressing against the key resistance zone just under $320, with clean price structure and a rising trendline.

* Trend: Higher lows with a breakout above structure = bullish continuation bias

* MACD: Bullish crossover + expanding histogram = momentum building

* Stoch RSI: Overbought at 88+ = short-term cooling possible, but not a sell signal on its own

* Volume: Strong breakout volume confirms interest — now needs follow-through above $320

Key Levels to Watch:

* Support Zones:

* $317.50 (micro support)

* $312.35 (breakout base / trendline confluence)

* $308.72 (former top of range)

* Resistance Zones:

* $319.85 (current high)

* $322.50 (major gamma wall)

* $325 → $330.39 (stacked supply above)

Scalping Setup (15-Min View):

* Entry (CALLs): Break and hold above $320

* Target: $322.50 then $325

* Stop: Below $317.50

* Bias: Momentum continuation as long as price holds trendline + VWAP

🔬 GEX-Based Option Sentiment (1H GEX Map)

The options market is now showing significant gamma resistance overhead, making this a crucial inflection zone:

* CALL Walls:

* $319.85 = 2nd CALL Wall (95.21%) — this is where price is currently pausing

* $322.50 = 3rd CALL Wall (86.55%)

* $325–$330 = GEX10/GEX7 cluster — potential fade zone

* PUT Support:

* $305 = HVL + strong buyer interest

* $300 = -26.58% PUT Wall

* $297.83 = 3rd PUT Wall — major dealer de-hedging zone

* Net GEX Bias:

* Positive GEX above $312.50 → bullish momentum slows as dealers hedge

* Below $305 = faster downside risk (gamma unwind)

* IVR 5.5, IVx Avg 51.4 → IV drop = favorable for buying options, not selling them

🎯 Options Trade Ideas:

* Bullish Swing (Speculative Breakout):

* Entry: Break > $322.50

* Target: $325 / $330

* Stop: < $317.5

* Bearish Fade (Gamma Cap Reversal):

* Entry: Reject below $320 with stalling momentum

* Target: $312.5 / $308

* Stop: Close > $322.5

⚠️ My Thoughts:

TSLA is at a key gamma inflection point. Price structure supports more upside, but dealer positioning above $322.5 may cap momentum unless volume forces a squeeze. Use trendline and VWAP confluence as your confirmation anchors — and watch for failed breakout traps into overhead gamma zones.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

TSLA – Testing Key Gamma & Structure Levels. TA for Aug. 6TSLA – Testing Key Gamma & Structure Levels

Technical Overview

TSLA has been consolidating just under a key resistance zone at 310–312, which also aligns with the highest positive GEX / gamma resistance area. Price is forming a higher-low structure off the 303–305 support trendline, suggesting buyers are still defending key levels despite recent selling pressure.

MACD is flattening out and Stoch RSI is cycling near mid-range, indicating a potential momentum build but no confirmed breakout yet.

GEX / Options Sentiment

* Gamma Resistance: Heavy call wall at 312 with 52% concentration, and further stacked resistance into 320–325. This creates a ceiling unless strong bullish momentum steps in.

* Gamma Support: Large put positioning at 300 (-64% concentration) and 295 acting as a key defensive floor.

* Dealer Positioning: Above 312, gamma flip could drive momentum toward 320–325 quickly. Below 300, dealer hedging could accelerate selling into 295 and possibly 290.

Trade Scenarios

Bullish Case

* Trigger: Break & hold above 312 with volume.

* Target 1: 320

* Target 2: 325

* Stop: <305

Bearish Case

* Trigger: Close below 300 with momentum.

* Target 1: 295

* Target 2: 290

* Stop: >312

Options Thoughts

* Bullish: Consider short-term calls if price breaks above 312 with strong volume and momentum confirmation.

* Bearish: Consider puts targeting 300 if rejection occurs at 310–312 and sellers regain control.

* Neutral / Premium Selling: Selling an iron condor around 295–325 could work if expecting continued range trading until a catalyst emerges.

📌 My Take: TSLA is coiling for a decisive move. GEX shows a tight battle between 312 call resistance and 300 put support. A break in either direction could lead to a fast expansion move. I’m leaning neutral-to-bullish as long as 305 holds, but I’ll switch bearish if 300 breaks.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always do your own research and manage risk accordingly.

Tesla Breakout? For the majority of the calendar year TESLA has been in a range between $220 - $365 with a clear midpoint of $295.

From March to the beginning of May TESLA bounced between range low and the midpoint until finally breaking through into the upper half of the range where it has stayed ever since. However, there is a clear diagonal resistance level that is preventing higher highs.

So will TESLA breakout, or will it lose the midpoint? Structurally it is clear that the bulls have a set level they are happy to buy at (Midpoint) but the bears are getting more aggressive with their selling, hence the lower highs. This compression inevitably leads to an impulse move but the direction is not so clear.

Bullish scenario: A clean breakout with volume that makes a new higher high, signaling a shift in structure. A pullback and retest of the breakout would be an ideal opportunity to go long and aim for that range high before expecting resistance.

Bearish scenario: The lower highs keep printing until the midpoint is lost and price accepts below it, that would then signify to me the new trading range is between Range Low and Midpoint.

The fakeout scenario is a risk but with price so close to the midpoint already it follows the same invalidation criteria as the bullish scenario, the midpoint is vital to both sides.

Sitting Right on the 200-Day EMATSLA is sitting right on the 200-Day EMA here while holding this wedge for quite some time. TSLA's Bollinger Bands are starting to squeeze, indicating a significant move is forthcoming, and moving averages (MA 5/10/30/60) are flattening, indicating a loss of bullish momentum. It will be interesting to watch from here.

Tesla's Consolidation Suggests Breakout Potential—Act Current Price: $329.65

Direction: LONG

Targets:

- T1 = $336.50

- T2 = $343.00

Stop Levels:

- S1 = $326.00

- S2 = $322.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Tesla.

**Key Insights:**

Tesla is currently in a crucial consolidation phase, reflected through a wedge pattern that indicates mounting pressure for a directional breakout. The company continues to impress investors with innovations such as its progression toward robo-taxi certification and mobility expansion via its Texas ride-share license. These developments, coupled with its robust growth narrative, make Tesla an attractive asset. However, technical indicators suggest that traders should monitor key resistance and support levels to capture the market's next move effectively.

Furthermore, the stock is positioned in a high-volatility zone, where its MACD crossover and RSI steadying near 50 emphasize the possibility of a bullish breakout. Analysts suggest that a breach above $335 could unlock upside momentum, while a failure to hold $326 might trigger temporary pullbacks.

**Recent Performance:**

Tesla has displayed strength despite broader market volatility, posting a 2.2% gain over the last week as the tech sector corrected from recent highs. The stock has stayed within the $325–$335 range, consolidating gains from earlier upward movements. This stability contrasts with the momentum seen in other tech giants, suggesting Tesla might be gearing up for its next leg higher. Institutional investors appear to be eyeing this stock as a value play within the stretched valuation landscape of mega-cap peers.

**Expert Analysis:**

Experts view Tesla's consolidation as a bullish wedge, where lows are climbing and highs are becoming narrower. This formation often precedes breakout events, and the setup aligns with Tesla's steady operational performance. Sales growth in key Asian markets has remained strong, countering lukewarm European results. With external catalysts such as macroeconomic data and Fed decisions percolating in the background, Tesla's rebound potential could align seamlessly with improving overall market sentiment.

The $335–$345 range is identified as a breakout area; sustained movement above this level could shift into higher gear. Sentiment, which has recently flipped neutral-positive, supports a move to retest $343 in the near term.

**News Impact:**

Tesla's innovation spree and operational wins, such as advancements in its autonomous driving technology, along with receiving new mobility certifications in Texas, provide bullish tailwinds.However, mixed international sales add a hint of caution to the growth story. Still, its position as a leading innovator in the renewable energy and EV space ensures consistent market attention.

**Trading Recommendation:**

Tesla's consolidation presents a compelling risk-reward scenario. A long trade is recommended with entry near $329.65, targeting $336.50 and $343.00. Stops should be placed at $326.00 and $322.00 to mitigate downside risks. This strategy aligns with technical setups and the company's overall growth narrative. As sentiment improves and fundamentals align, Tesla could be poised for its next major move upward. Timing a breakout entry is crucial, so traders should remain vigilant for confirmation signals this week.

$TSLA - High CAGR Strikes againTesla’s long-term bullish structure remains intact on the 2-month logarithmic chart, with price breaking out of a two-year ascending triangle capped near $350. This move tests the 78.6% retracement level at $347, opening the door to Fibonacci extension targets at approximately $595, $892, and $1,189 if momentum follows through.

The volume profile highlights strong historical support in the $180–$250 range, a key zone to defend on any pullback. Notably, the macro backdrop adds a tailwind — the last significant Fed rate cut in early 2020 coincided with Tesla’s parabolic advance, and the next major cut is projected for late 2025.

Long-term momentum indicators are turning higher, suggesting the early phase of a new bullish cycle. A sustained hold above $300 on any retest would reinforce the breakout, while a drop back under $280 risks a move toward $200–$220.

I wouldn't want to be short long term.

TSLA nearing breakout TSLA’s been winding tighter for weeks, and we’re finally pressing right up against the top of this symmetrical triangle on the 4H chart. Sitting at $333 price level after breaking out of that $315 area with some momentum behind it. Volume’s picking up, RSI’s pushing north of midline, and the MACD just flipped bullish.

If we can get a clean break and hold above that $335–$340 range, there’s room to stretch toward $367–$370, basically a retest of those June highs. But if we get rejected here, we probably stay stuck in this coil a bit longer. This is one of those decision point moments for TSLA where the next few candles could tell the story.

TESAL HEADING TO $500+ RANGE ANALYSIS HERE Afternoon Trading Fam

So here is our in-depth look at Tesla: Currently the monthly trend is bullish giving us levels of $500 and above.

Locally though we can break this $338 top expect to see $444 and $480 getting hit next

If we need to correct and we break the lows of $319 expect to see the levels of $307 then $301 being hit

Happy Trading

Trade Smarter Live Better

Kris

TSLA: We're in a rangeLet's put it this way, we aren't going below $260.

Fo those that have been accumulating since 2022, patience has been a virtue. It may continue to be one. However, I can confidentially say, I think $815 is a mix term target. Long term... The sky is the limit.

I have my reasons for my investments.

If you want to or don't want to invest that's up to you and more power to you.