Key facts today

Vodafone Group (VOD) saw a 1.5% rise in stock price, reflecting trends in UK and Ireland equities and boosting overall European equity performance in the US.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−36.62 MXN

−91.69 B MXN

823.64 B MXN

2.46 B

About VODAFONE GROUP ORD USD0.2095238

Sector

Industry

CEO

Margherita della Valle

Website

Headquarters

Newbury

Founded

1984

FIGI

BBG00JX0NTC9

Vodafone Group Plc engages in the telecommunication services in Europe and International. It offers mobile services that enable customers to call, text and access data, fixed line services, including broadband, television offerings, and voice and convergence services under the GigaKombi and Vodafone One names. It also provides mobile, fixed and a suite of converged communication services, such as Internet of Things (IoT) comprising managed IoT connectivity, automotive and insurance services, as well as smart metering and health solutions, cloud and security portfolio comprising public and private cloud services, as well as cloud-based applications and products for securing networks and devices and international voice, IP transit and messaging services to support business customers that include small home offices and large multi-national companies. The company was founded on July 17, 1984 and is headquartered in Newbury, the United Kingdom.

Related stocks

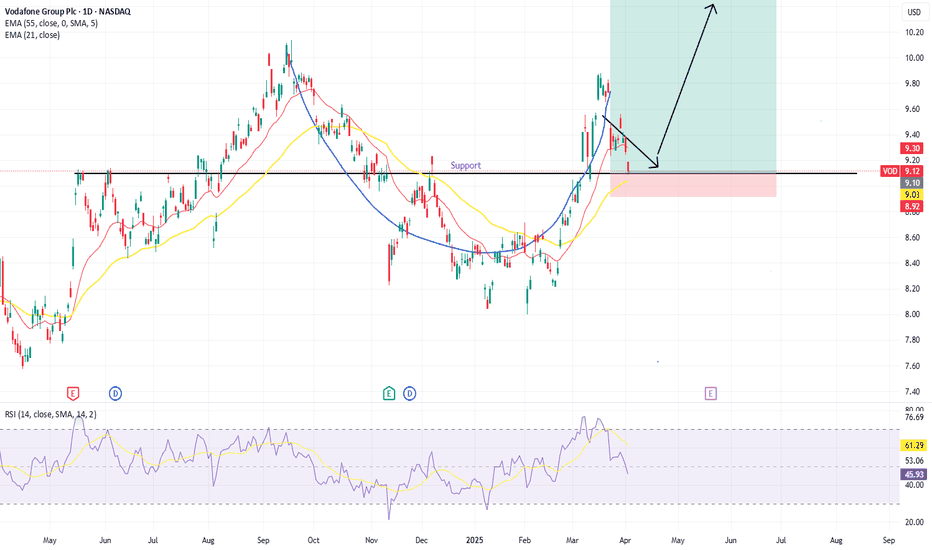

VOD - Cup and HandleThere appears to be a cup and handle pattern forming in $NASDAQ:VOD. It had strong push upward last summer and has drifted back down through the end of the year, with another strong increase back near its highs. We are now seeing a retraction following the handle portion of the pattern and today rea

Vodafone ended 10 year long bear ride?

After 10 years, Vodafone seems to have reach the bottom.

Long consolidation periods (yellow), and 2 downward channels led us to a rock bottom of 63GBP.

The last downward channel appears now to be broken with immediate resistance at 103 GBP.

Positive outlook as long term investment.

Breakout After multiple attempts at failing to break the blue resistance line price has closed strongly above this level today.

The catalyst for this was the release of good results, check them out for yourself.

In addition to this they have just got approval from their Spanish business for $5 billion. Ker-

Vodafone Set to Integrate Crypto Wallets With SIM CardsVodafone ( NASDAQ:VOD ) is utilizing SIM card technology to meet the anticipated surge in demand for cryptocurrency on mobile phones. CPO David Palmer discussed how the company is advancing blockchain use on mobile devices to manage crypto transactions. He highlighted the use of Pairpoint, a brand t

Vodaphone. Golden cross on 4hr time frame.Vodafone is currently near recent lows. Recent Price action has formed a rising wedge pattern.

Looking at the 4 hour chart the 50ma has crossed above the 200ma, a golden cross.

Rising rsi is also in an uptrend.

I suspect the price will move out of wedge, my guess is it will be upwards.

Do your own r

Vodafone Set to Sell Italian Operations to Swisscom for $8.7BVodafone Group Plc ( LSE:VOD ) has announced the sale of its Italian division to Swisscom AG for a hefty sum of 8 billion euros ($8.7 billion). This deal marks the culmination of Vodafone's European restructuring strategy under the leadership of CEO Margherita Della Valle, propelling the telecom gia

VOD UP TO 15 / 27Vodafone's current share price is remarkably at a level not seen since 1996, presenting a unique investment opportunity. The company has demonstrated impressive financial growth, with earnings surging by 382.5% over the past year. When compared to industry standards, Vodafone's valuation metrics are

VOD Vodafone Buyout Rumors Today !!Vodafone (VOD) Surges on Speculation of Major Corporate Moves and Potential Takeover

In today`s trading sessions, Vodafone (NASDAQ: VOD) has experienced a significant uptick in share value, rising as much as 7.1% in London trading. This surge can be attributed to growing speculation and rumors circ

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS147248377

VODAFONE GRP 16/56 MTNYield to maturity

8.35%

Maturity date

Aug 12, 2056

XS146849423

VODAFONE GRP 16/49 MTNYield to maturity

7.70%

Maturity date

Aug 8, 2049

US92857WBX7

VODAFONE GRP 21/81 FLRYield to maturity

7.58%

Maturity date

Jun 4, 2081

XS263049357

VODAFONE GRP 23/86 FLRMTNYield to maturity

7.30%

Maturity date

Aug 30, 2086

US92857WBU3

VODAFONE GRP 19/50Yield to maturity

6.80%

Maturity date

Sep 17, 2050

US92857WBT6

VODAFONE GRP 19/59Yield to maturity

6.71%

Maturity date

Jun 19, 2059

US92857WBS8

VODAFONE GRP 19/49Yield to maturity

6.61%

Maturity date

Jun 19, 2049

VOD5538098

Vodafone Group Public Limited Company 5.75% 10-FEB-2063Yield to maturity

6.50%

Maturity date

Feb 10, 2063

US92857WBM1

VODAFONE GRP 18/48Yield to maturity

6.39%

Maturity date

May 30, 2048

VOD5839595

Vodafone Group Public Limited Company 5.875% 28-JUN-2064Yield to maturity

6.35%

Maturity date

Jun 28, 2064

US92857WBD1

VODAFONE GRP 13/43Yield to maturity

6.31%

Maturity date

Feb 19, 2043

See all VOD/N bonds

Curated watchlists where VOD/N is featured.

Frequently Asked Questions

The current price of VOD/N is 193.70 MXN — it has increased by 4.31% in the past 24 hours. Watch VODAFONE GROUP PLC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange VODAFONE GROUP PLC stocks are traded under the ticker VOD/N.

VOD/N stock has risen by 3.32% compared to the previous week, the month change is a 3.41% rise, over the last year VODAFONE GROUP PLC has showed a 18.02% increase.

We've gathered analysts' opinions on VODAFONE GROUP PLC future price: according to them, VOD/N price has a max estimate of 334.35 MXN and a min estimate of 141.26 MXN. Watch VOD/N chart and read a more detailed VODAFONE GROUP PLC stock forecast: see what analysts think of VODAFONE GROUP PLC and suggest that you do with its stocks.

VOD/N stock is 4.23% volatile and has beta coefficient of 0.34. Track VODAFONE GROUP PLC stock price on the chart and check out the list of the most volatile stocks — is VODAFONE GROUP PLC there?

Today VODAFONE GROUP PLC has the market capitalization of 478.77 B, it has increased by 0.23% over the last week.

Yes, you can track VODAFONE GROUP PLC financials in yearly and quarterly reports right on TradingView.

VODAFONE GROUP PLC is going to release the next earnings report on Nov 11, 2025. Keep track of upcoming events with our Earnings Calendar.

VOD/N net income for the last half-year is −113.60 B MXN, while the previous report showed 22.80 B MXN of net income which accounts for −598.27% change. Track more VODAFONE GROUP PLC financial stats to get the full picture.

Yes, VOD/N dividends are paid semi-annually. The last dividend per share was 4.50 MXN. As of today, Dividend Yield (TTM)% is 6.82%. Tracking VODAFONE GROUP PLC dividends might help you take more informed decisions.

As of Jun 21, 2025, the company has 92 K employees. See our rating of the largest employees — is VODAFONE GROUP PLC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. VODAFONE GROUP PLC EBITDA is 332.43 B MXN, and current EBITDA margin is 40.37%. See more stats in VODAFONE GROUP PLC financial statements.

Like other stocks, VOD/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade VODAFONE GROUP PLC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So VODAFONE GROUP PLC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating VODAFONE GROUP PLC stock shows the neutral signal. See more of VODAFONE GROUP PLC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.