VZ trade ideas

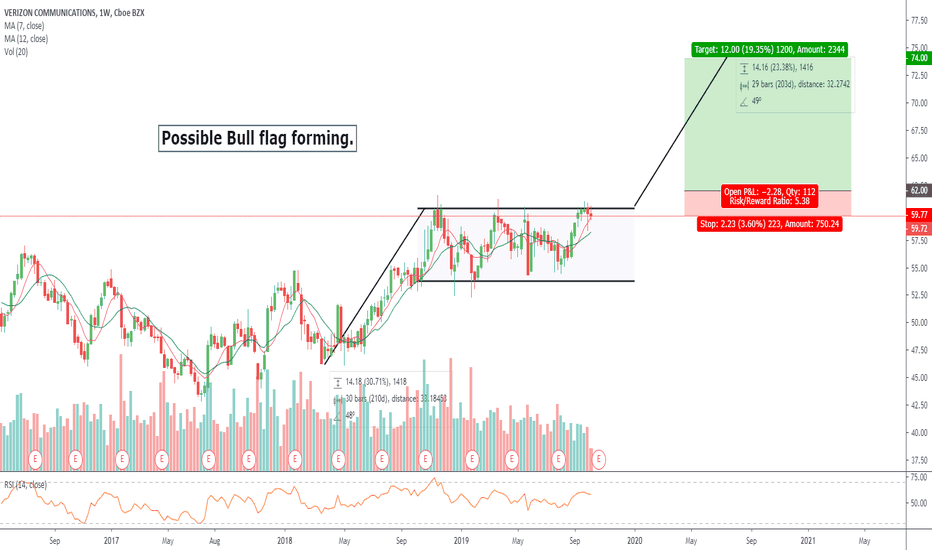

$VZ Watch for Bull-flag Breakout in Verizon Entry level $62 = Price Target $74 = Stop loss $60

Alert set for possible bull flag breakout @ $61 , sentiment, fundamentals and technicals are all bullish.

Very reasonable 15 P/E ratio.

Long term growth with 5G adoption.

Company profile

Verizon Communications, Inc. is a holding company, which engages in the provision communications, information and entertainment products and services to consumers, businesses and governmental agencies. It operates through Wireless and Wireline segments. The Wireless segment provides wireless voice and data services and equipment sales, which are provided to consumer, business, and government customers. The Wireline segment offers broadband video and data; corporate networking solutions; data center and cloud services; security and managed network services; and local and long distance voice services. It also offers voice, data and video services and solutions. The company was founded in 1983 and is headquartered in New York, NY.

$VZ short positionFor the public record -- I've taken a short position on $VZ at $60.58 this day, October 7th, 2019.

My trade is technical and not sociopolitical, and my analysis is too complex to adequately describe on one chart. Posting the truth of this trade does not constitute a recommendation to anyone to buy or sell any financial instrument.

LONG - VZ - Trading OpportunityAfter many years of downside after reaching a peak NYSE:VZ , seems to be trying to go on an uptrend again and break the previous resistance, an ascending triangle formation has been taking place for quite some time now, hitting it's head against the same resistance while continuously making higher lows, this is a chart to keep an eye on and buy a possible breakout, which would be a candle on at least the weekly chart closing above the resistance.

Possible targets would be to take profits at ~10%, and trail the stop-loss for the remainder, as the break of this resistance would probably start another huge uptrend.

CryptoCue is not providing investment advice and is not taking subscribers’ personal circumstances into consideration when discussing investments. Investment involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire position.

CryptoCue is not registered, licensed or authorized to provide investment advice and is simply providing an opinion, which is given without any liability or reliance 1.71% whatsoever. The information contained here is not an offer or solicitation or recommendation or advice to buy, hold, or sell any security. CryptoCue makes no representation as to the completeness, accuracy or timeliness of the material provided and all information and opinions provided by CryptoCue are subject to change without notice and provided on a non-reliance basis and without acceptance of any liability or responsibility whatsoever or howsoever arising. You hereby irrevocably and unconditionally waive, release and discharge: (a) any and all accrued rights and/or benefits you may have against CryptoCue in respect of any opinion expressed or information conveyed by CryptoCue at any time; (b) any and all Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time; (c) CryptoCue from all and any claims (whether actual or contingent and whether as an employee, office holder or in any other capacity whatsoever) including, without limitation, Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time. ("Claims" shall include any action, proceeding, claim, demand, judgment or judgment sum of whatsoever nature or howsoever arising.) You hereby agree to indemnify and hold harmless CryptoCue in respect of any and all Losses paid, discharged, sustained or incurred by CryptoCue in the event of bringing any Claim against CryptoCue. (“Losses” shall include any and all liabilities, costs, expenses, damages, fines, impositions or losses (including but not limited to any direct, indirect or consequential losses, loss of profit, loss of earnings , loss of reputation and all interest, penalties and legal costs (calculated on a full indemnity basis) and all other reasonable professional costs and expenses and any associated value-added tax) of whatsoever nature and/or judgement sums (including interest thereon).)

$vz Verizon has had the ULTIMATE shift-with 5g and a looming #classaction settlement. Our firm is short 125k shares with our clients. Our price target is 32

Not to hard to chart but easy to point out on a fundamental chart.

The secrets of this are held in 2014 short purchases as well as recent events related to data in late q3 2019.

#business model shrinking and now a possible walkout of #employees that are now working from home with Verizon customer service. Working from home is easy BUT putting down what limits you @ home will be the demise of this company and the CSM teams all over the country.

VZ on a tear!Verizon on a tear after breaking out of a flag that looks like a mostly bullish channel after a pitchfork was applied. may see some resistance around $60-$61. 5G sentiment may be coming into fruition which may bolster sentiment. This could be a good stock to have due to the potential upside to US 5G telecoms have under President Trump's China Tariffs that started August 1st. It has formed a bullish structure around that time which may have helped the stocks weak earnings on Wall Street. VZ is a decent dividend stock which also may see an increase in volumes since such stocks are in demand. Should be buy if this impulse line breaks 59.50 than resistance around 60$-$61 may have a shorter duration; however, Bollinger bands show that it is slightly overbought but not much.

Daily VZ stock forecast trend analysis 10-JUL

Price trend forecast timing analysis based on pretiming algorithm of Supply-Demand(S&D) strength.

Investing position: In Rising section of high profit & low risk

S&D strength Trend: In the midst of an upward trend of strong upward momentum price flow marked by the temporary falls and strong rises.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 1.9% (HIGH) ~ -0.2% (LOW), 0.5% (CLOSE)

%AVG in case of rising: 1.2% (HIGH) ~ -0.3% (LOW), 0.9% (CLOSE)

%AVG in case of falling: 0.4% (HIGH) ~ -1.3% (LOW), -0.7% (CLOSE)

VERIZON COMMUNICATIONS IS A SAFE AND REWARDING INVESTMENTVerizon is never going to be a high flyer with 5% daily moves, but that should be the appeal to investors, at times of uncertainty and volatility Verizon is safe and rewards you with a nice dividend. The 5g revolution may be a little over hyped but it will be a tailwind to the stock.

From a technical perspective the stock has consolidated and is ready for a positive move to the $60 level short term.

Daily VZ forecast analysis report by Supply-demand strength.03-Jul

Price trend forecast timing analysis based on pretiming algorithm of Supply-Demand(S&D) strength.

Investing position: In Falling section of high risk & low profit

S&D strength Trend: In the midst of a rebounding trend of upward direction box pattern price flow marked by limited falls and upward fluctuations.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 0.7% (HIGH) ~ -0.2% (LOW), 0.2% (CLOSE)

%AVG in case of rising: 1.0% (HIGH) ~ -0.5% (LOW), 0.5% (CLOSE)

%AVG in case of falling: 0.4% (HIGH) ~ -1.4% (LOW), -1.2% (CLOSE)

Daily VZ forecast timing analysis by Supply-Demand strength21-Jun

Investing strategies by pretiming

Investing position about Supply-Demand(S&D) strength: In Falling section of high risk & low profit

Supply-Demand(S&D) strength Trend Analysis: About to begin a rebounding trend as a downward trend gradually gives way to slowdown in falling and rises fluctuations

Today's S&D strength Flow: Supply-Demand strength has changed from a strong selling flow to a suddenly strengthening buying flow.

View a Forecast Candlestick Shape Analysis of 10 days in the future: www.pretiming.com

(You can easily create a trading plan.)

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.1% (HIGH) ~ -1.2% (LOW), -0.8% (CLOSE)

%AVG in case of rising: 0.9% (HIGH) ~ -0.5% (LOW), 0.5% (CLOSE)

%AVG in case of falling: 0.3% (HIGH) ~ -1.6% (LOW), -1.3% (CLOSE)

Price Forecast Timing Criteria: Price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

Verizon to $61 within the next 2 monthsNYSE:VZ for me this is an easy long call. I'm an options trader and will be looking to make profit on the next few weeks of VZ about to have a turn around. I like to try to enter a position before the break has happened and the momenture is underway as option contracts are based majority of the time on current direction. I was able to get in 10+ contact for .22 and a call greater than $61. I have no intention of staying in the position until expiration but looking to exit the trade when my contract sits on about 100% ROI. Any question please feel free to ask.