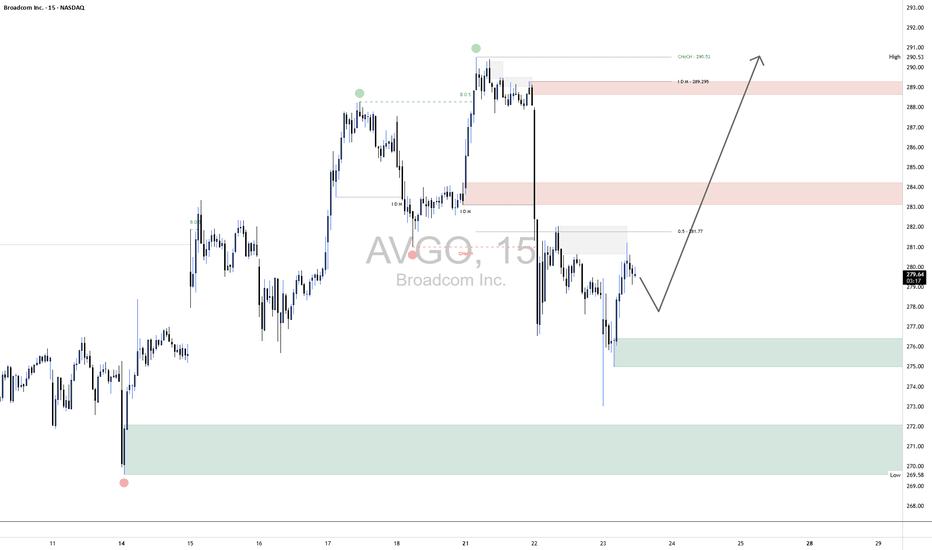

AVGO Long1. Broader Market Structure

1.1 Change of Character (CHoCH)

A clear Change of Character occurred at $290.53, where price broke below a prior higher low. This was a key early signal of a potential bearish reversal, as bullish momentum began to weaken and sellers stepped in with conviction.

1.2 Break

Key facts today

Broadcom collaborated with Google on the design of Tensor Processing Units (TPUs) used to train Google's latest AI model, Gemini, showcasing its role in the expanding AI infrastructure market.

Broadcom holds a market cap of about $1.07 trillion, placing it among top firms like Tesla, Nvidia, Microsoft, and Apple in the trillion-dollar market-cap club.

56,925.00

0.00 BRL

30.77 B BRL

269.22 B BRL

About Broadcom Inc.

Sector

Industry

CEO

Hock E. Tan

Website

Headquarters

Palo Alto

Founded

1961

ISIN

BRAVGOBDR003

FIGI

BBG00P14JPL5

Broadcom Inc. is a global technology company, which designs, develops, and supplies semiconductors and infrastructure software solutions. It operates through the Semiconductor Solutions and Infrastructure Software segments. The Semiconductor Solutions segment refers to product lines and intellectual property licensing. The Infrastructure Software segment relates to mainframe, distributed and cyber security solutions, and the FC SAN business. The company was founded in 1961 and is headquartered in Palo Alto, CA.

Related stocks

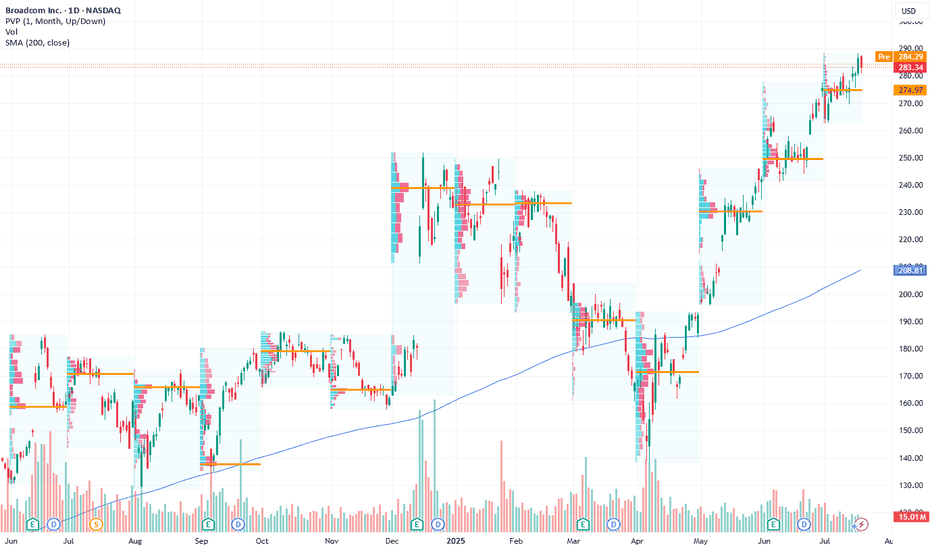

Broadcom: Positioned for Long-Term Growth in AI and EnterprisesCurrent Price: $283.34

Direction: LONG

Targets:

- T1 = $292.00

- T2 = $305.00

Stop Levels:

- S1 = $280.00

- S2 = $275.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

Steal the Breakout: Broadcom Bulls Are In!💎🔓 "Broadcom Break-In: Bullish Vault Raid in Progress!" 🔓💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers 🤑💰✈️,

It’s time for a high-stakes raid on BROADCOM, INC (AVGO) — all based on our secret Thief Trading Strategy™, combining sharp technicals & a sniff of fundamen

AVGO ( Broadcom.Inc ) NASDAQ:AVGO - Continuation of movement within the ascending channel + potential for a breakout to new historical highs. 🔍 Rationale:

• After a strong correction in the first quarter of 2025, the price formed a reversal and has been moving in a clear ascending channel since the beginning of May.

• T

Broadcom Topped?3 Weeks ago AVGO put in a topping tail candle on the weekly and for the past 3 weeks it has failed to close above the topping tail on a weekly basis. I've also highlighted some bearish divergence on the RSI. The topping tail will remain the dominant candle unless AVGO can close above the high of the

here is the #chart for $AVGOBullish with high expectations. Broadcom ( NASDAQ:AVGO ) is at $269.35, down 0.30% daily but up 11.28% monthly, as shown in the finance card above. X posts and analyst upgrades (HSBC to $400, Bernstein to $295) reflect strong optimism, driven by AI chip demand (projected $28.4B in 2026, $42.8B in 20

Broadcom - This was just the first all time high!Broadcom - NASDAQ:AVGO - just created new highs:

(click chart above to see the in depth analysis👆🏻)

Over the course of the past three months, Broadcom has been rallying an impressive +80%. However looking at market structure, all of the previous "dump and pump" was not unexpected. Following th

$AVGO above its previous ATH and holding on. 400 $ reachable. The poster child of the AI rally has been NASDAQ:NVDA and $AVGO. Here we have analysed both the stocks multiple times fundamentally and technically. But the lesser known NASDAQ:AVGO has performed better than the NASDAQ:NVDA since the April lows. NASDAQ:AVGO is still above its previous ATH an

AVGO – All-Time High Breakout with Flag Pattern TriggerBroadcom ( NASDAQ:AVGO ) is breaking out of an 11-day consolidation flag, pushing through the trendline and into all-time highs — a textbook momentum setup.

🔹 Flag Pattern Breakout

After a strong run, NASDAQ:AVGO spent 11 days chopping in a tight flag just under highs.

Today, we’re seeing a cle

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AVGO34 is featured.