BGI1! trade ideas

CattleCattle – Weekly Continuous: The gray vertical bars represent the expiration month of labeled contract and have prices of each contract as of today labeled. The 2019 low has provided a pivot for a parallel uptrend line (highlighted in yellow) that has acted as a strong magnet since moving up off the covid crash low. Any of the lines could act as Support or Resistance. Further support marked in gray, risk area marked in red, and opportunity area marked in green. Deferred contracts can use the uptrend/downtrend lines or highlighted areas as well…

April Cattle approaching Resistance/opportunity area, Risk is 128 – 132

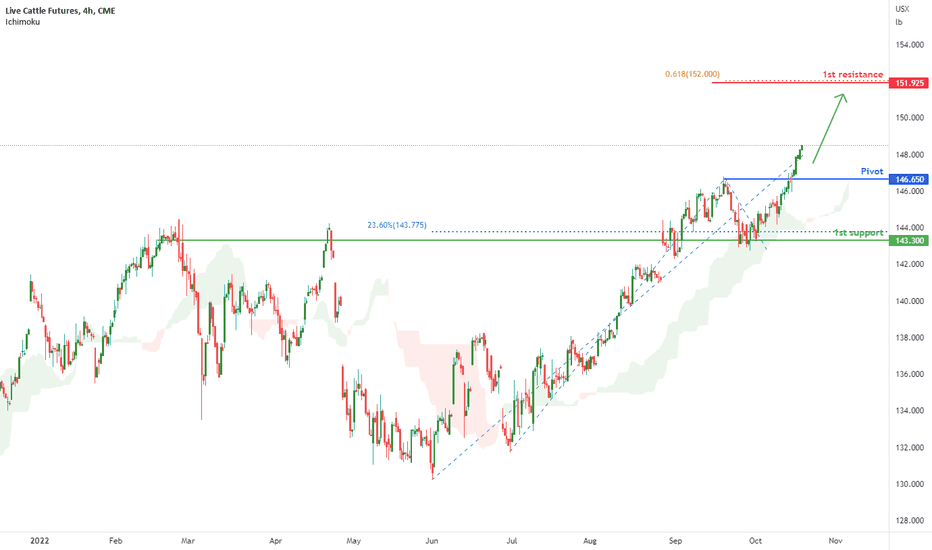

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 38.2% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseType : Bullish rise

Resistance : 151.925

Pivot: 146.650

Support : 143.300

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 146.650 where the previous swing high sits to the 1st resistance at 151.925 where the 161.8% projection sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 143.300 where the swing low, overlap support and 23.6% retracement sits

Fundamentals: No Major News

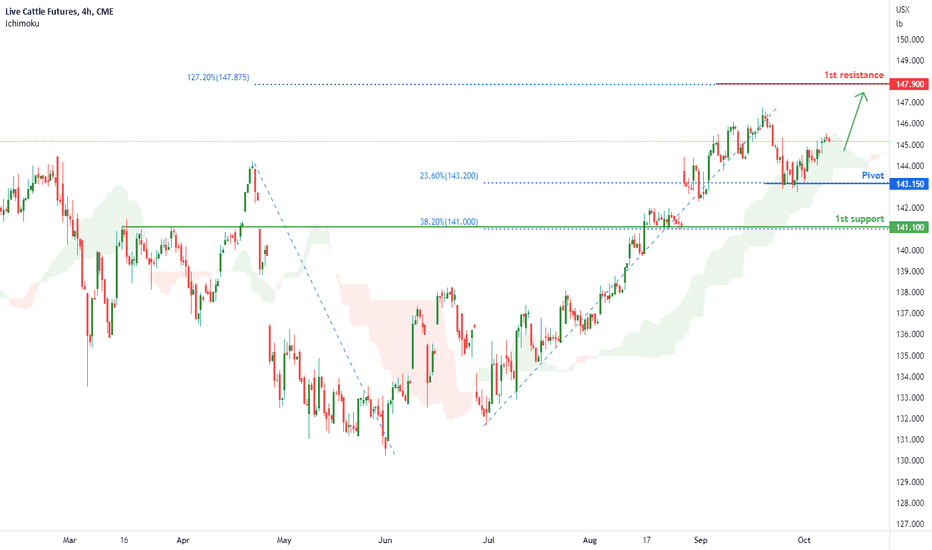

Live Cattle Futures ( LE1! ), H4 Potential for Bullish TrendType : Bullish rise

Resistance : 147.900

Pivot: 143.150

Support : 141.100

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 143.150 where the previous swing low and 23.6% retracement sits to the 1st resistance at 147.900 where the 127.2% extension sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the swing low and 38.2% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish TrendType : Bullish rise

Resistance : 147.900

Pivot: 143.150

Support : 141.100

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 143.150 where the previous swing low and 23.6% retracement sits to the 1st resistance at 147.900 where the 127.2% extension sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the swing low and 38.2% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish TrendType : Bullish rise

Resistance : 147.900

Pivot: 143.150

Support : 141.100

Preferred Case: On the H4, with price moving in an ascending trend and trading above the ichimoku indicator, we have a bullish bias that price may rise from the pivot at 143.150 where the previous swing low and 23.6% retracement sits to the 1st resistance at 147.900 where the 127.2% extension sits

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the swing low and 38.2% retracement sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish TrendTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Trend

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: The price is moving in a bullish trend on the H4. Price fell below the Pivot at 144.275, but quickly recovered and closed above it. If the bullish momentum continues, we can expect price to move towards the first resistance level at 147.875 (the 127.2% Fibonacci extension line).

Alternative scenario: Price could break the pivot structure and return to the first support level at 141.100, where the 38.2% Fibonacci retracement line is.

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bearish TrendTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bearish Trend

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving in the descending trend and breaking the ichimoku indicator, we have a bearish bias that price may drop from the pivot at 144.275 where the previous swing high sits to the 1st support at 141.100 where the 38.2% retracement sits

Alternative scenario: Alternatively, price could break pivot structure and rise to the 1st resistance at 147.900 where the swing high and 127.2% extension sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bearish TrendTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bearish Trend

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving in the descending trend and breaking the ichimoku indicator, we have a bearish bias that price may drop from the pivot at 144.275 where the previous swing high sits to the 1st support at 141.100 where the 38.2% retracement sits

Alternative scenario: Alternatively, price could break pivot structure and rise to the 1st resistance at 147.900 where the swing high and 127.2% extension sits

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 146.750

Pivot: 142.650

Support : 139.175

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 142.650 where the 23.6% retracement sits to the 1st resistance at 146.750 where the previous swing high sits.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 139.175 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.275 to the 1st resistance at 147.900 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures ( LE1! ), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.275 to the 1st resistance at 147.900 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the overlap support is.

Fundamentals: No Major News

What would you have on a date night? Chicken or steak? We’re going to go out on a limb here and say your date night budgets and recessionary risk are likely inversely correlated! As recessionary risk starts to weigh on investors’ minds, purse strings for date nights are likely to be tightened, which spells trouble for the date night classic, wine & steak pair.

Cattle Futures have joined the broad market selloff over the past few days as investors remain on edge. This recent move lower has confirmed a break below the neckline support for a double top pattern observed on a shorter timeframe, which is noted as a bearish reversal pattern.

On a longer timeframe, the decline has also broken the 4-month long uptrend for Live Cattle. With not much in the way of support, it’s quite possible to see another leg lower, similar to the pattern we observed in May 2022 where prices corrected around 4.5% once the uptrend was broken.

Using this as a reference, the 143 range marks the next potential stop for live cattle prices if we were to extrapolate a 4.5% decline from the breakout point.

The broken uptrend followed by the confirmation of the double top pattern spells trouble for live cattle prices. As such, we lean bearish on live cattle futures and will likely swap the date night steak for perhaps chicken…

Entry at 148.550, stop at 150.325. Target at 144.850 and 143.075.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios.

Live Cattle Futures (LE1!), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.275 to the 1st resistance at 147.900 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the overlap support is.

Fundamentals: No Major News

Live Cattle Futures (LE1!), H4 Potential for Bullish RiseTitle: Live Cattle Futures ( LE1! ), H4 Potential for Bullish Rise

Type : Bullish rise

Resistance : 147.900

Pivot: 144.275

Support : 141.100

Preferred Case: On the H4, with price moving along the ascending trendline and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 144.275 to the 1st resistance at 147.900 where the 127.2% fibonacci extension is.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 141.100 where the overlap support is.

Fundamentals: No Major News