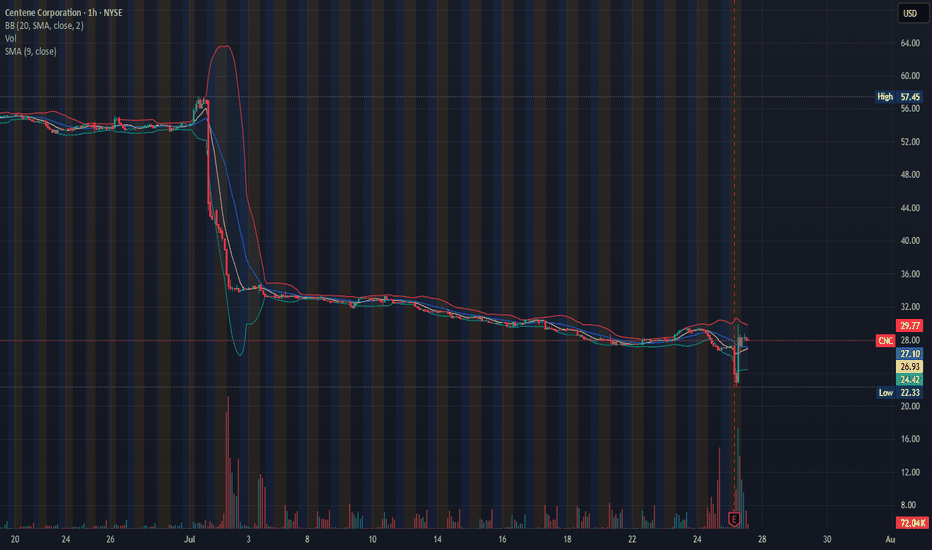

SOMETHING SEEMS NOT RIGHT: INSIDE TRADING?In the early hrs of 07/25/2025, between 6-7 am, right before the earning, the stock plummeted 16.16%. Can you smell inside trading here? because I do. Then, magically, during the earning call, with the promise of a " better future", the stock recovered and gained 6%. If you look for the beginning

Key facts today

Centene Corporation reported a surprise Q2 loss of 16 cents per share, despite a 22% revenue rise to $48.7 billion. Shares rose 5.9% after initial premarket drop.

4,317.87

0.04 BRL

17.82 B BRL

879.11 B BRL

About Centene Corporation

Sector

Industry

CEO

Sarah McGinty London

Website

Headquarters

St. Louis

Founded

1984

ISIN

BRC1NCBDR000

FIGI

BBG00R2CQ5L8

Centene Corp. is a healthcare enterprise, which engages in the provision of programs and services to government sponsored healthcare programs. It operates through the following segments: Medicaid, Medicare, Commercial, and Other. The Medicaid segment includes the Temporary Assistance for Needy Families program, Medicaid Expansion programs, the Aged, Blind or Disabled program, the Children's Health Insurance Program, Long-Term Services and Supports, Foster Care, Medicare-Medicaid Plans, which cover beneficiaries who are dually eligible for Medicaid and Medicare, and other state-based programs. The Medicare segment consists of Medicare Advantage, Medicare Supplement, Dual Eligible Special Needs Plans, and Medicare Prescription Drug Plans. The Commercial segment is involved in the Health Insurance Marketplace product along with individual, small group, and large group commercial health insurance products. The Other segment refers to pharmacy operations, Envolve Benefit Options’ vision and dental services, clinical healthcare, behavioral health, the TRICARE program, and corporate management companies. The company was founded in 1984 and is headquartered in St. Louis, MO.

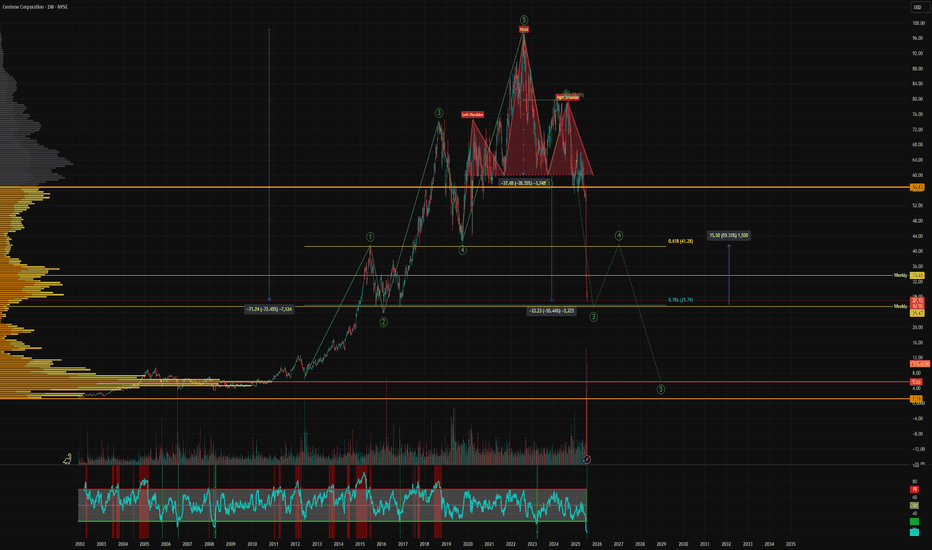

Related stocks

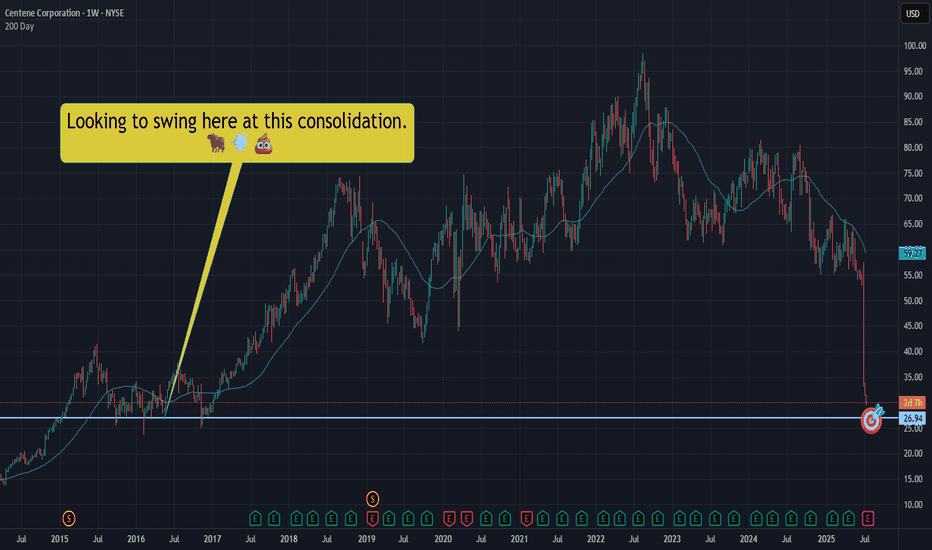

Textbook Head & ShouldersThis looks like an epic wave 3 drop of a larger 5 wave crash, completing a textbook head and shoulders pattern. This is not a stock I'd be looking to be a bag carrier of, but it's peaked my interest as it has the potential of a 59% dead-cat-bounce to the upside. With these types of falling knives yo

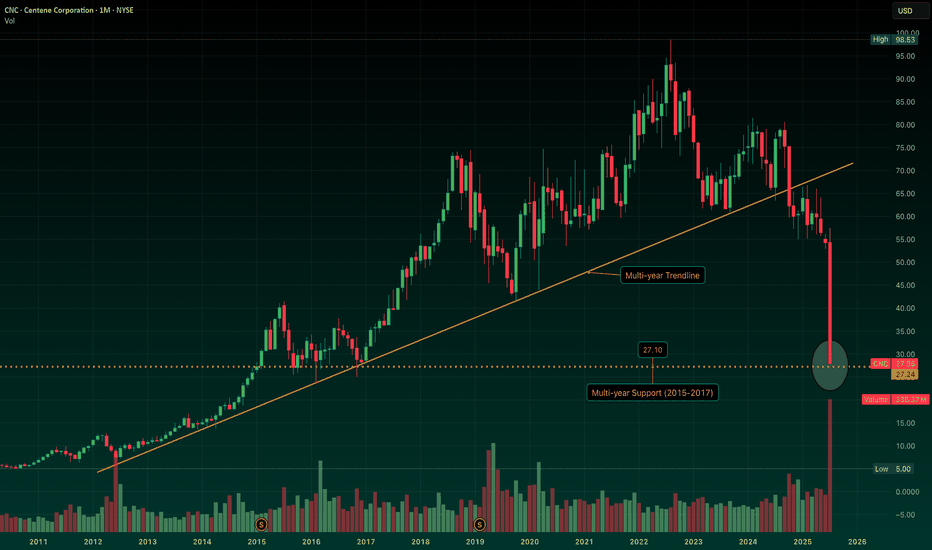

CNC: Strategic Defined Risk LEAPS Entry w/ Room for FlexibilityCNC broke its multi-year trendline months ago, and the recent flush drove it straight into key support from the 2015–2017 range (~$27). Big structural break, but also a spot where longer-term buyers may start stepping in.

As noted earlier, I began building a defined-risk long via 2026 LEAPS (Jun

Math isn't mathing! Long $CNC for earnings- I'm taking contrarian stance on NYSE:CNC as fears are overdone.

- NYSE:CNC has cash in hand around14 billion and market cap is around 13.5 billion.

- I call bullshit on the market. Math isn't mathing.

- Company isn't going bankrupt. There are headwinds but they will navigate the headwinds an

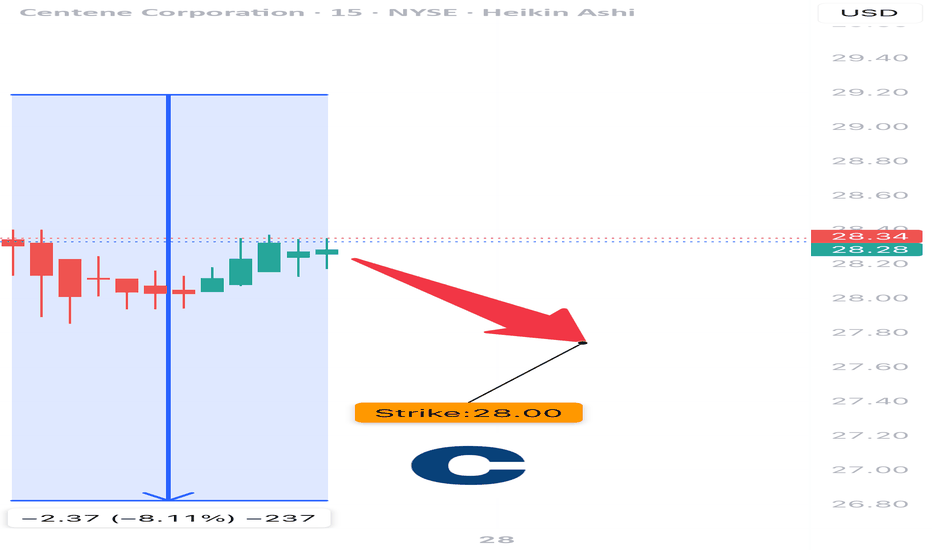

CNC|Let's take a swing at a falling dagger! NYSE:CNC slicing through the void, well.... like a falling dagger through a void.

Not trying to catch this bad boi, but we should expect a bounce at some point. Let's swing for a bounce in that $26.90ish area.

This is NOT a YOLO and I hope it's not an "oh no!" Let's keep our wits about us - sta

CNC EARNINGS TRADE IDEA – JULY 25, 2025

⚠️ CNC EARNINGS TRADE IDEA – JULY 25, 2025 ⚠️

💊 Healthcare Pressure + Missed Guidance = Bearish Setup for AMC

⸻

📉 Sentiment Snapshot:

• 🚨 Last quarter: Broke 100% beat streak

• 📉 Thin margins + rising medical costs

• 💬 Analyst bias: Neutral to Negative

• 🧮 Fundamentals Score: 4/10

⸻

📊 Tech

House of Cards CrumblingAnother Healthcare Insurance stock plummeting from it's high. This time it's Centene pulling guidance, this would have been a great short since UNH was the first to do this. Classic head and shoulders pattern formed after the end of the 5 wave move up. The healthcare insurance stocks are tumbling, t

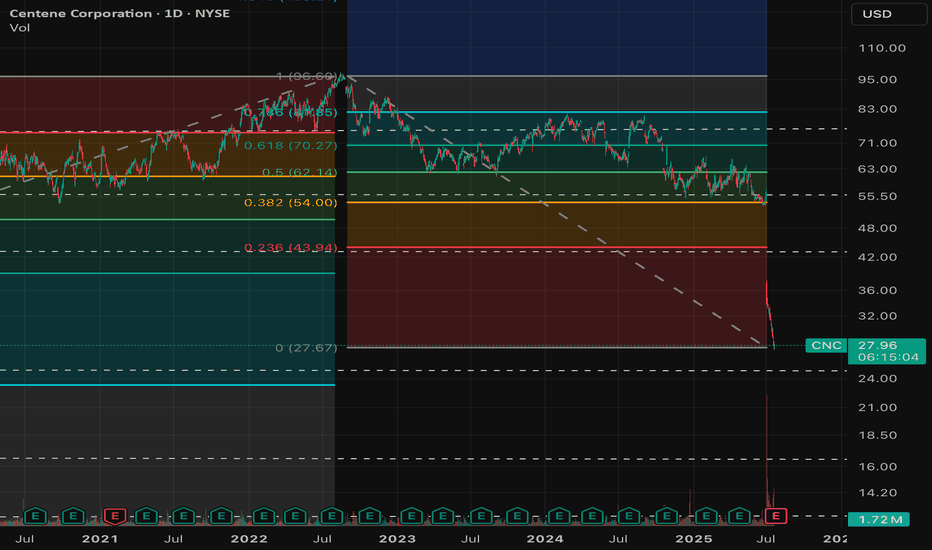

Centene Corp | CNC | Long at $35.00Centene Corp NYSE:CNC is a healthcare enterprise providing programs and services to under-insured and uninsured families, commercial organizations, and military families in the U.S. through Medicaid, Medicare, Commercial, and other segments. The stock dropped almost 40% this morning due to recent

Likely candidate 64 with gaps to fill and trends to bounceGiven the current circumstances, the past 12 months have been exciting, disenfranchising, and failed to meet expectations. It could be dilution, too many acquisitions, an overhaul, or setting expectations for a few years. This stock will take off; the question is how far it can go once it does. For

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

QENB

CENTENE 21/31Yield to maturity

6.44%

Maturity date

Aug 1, 2031

CNC5130037

Centene Corporation 2.5% 01-MAR-2031Yield to maturity

6.34%

Maturity date

Mar 1, 2031

US15135BAW1

CENTENE 20/30Yield to maturity

6.17%

Maturity date

Oct 15, 2030

CNC4947534

Centene Corporation 3.375% 15-FEB-2030Yield to maturity

6.09%

Maturity date

Feb 15, 2030

CNC4976670

Centene Corporation 4.625% 15-DEC-2029Yield to maturity

5.99%

Maturity date

Dec 15, 2029

US15135BAY7

CENTENE 21/28Yield to maturity

5.92%

Maturity date

Jul 15, 2028

CNC4976671

Centene Corporation 4.25% 15-DEC-2027Yield to maturity

5.50%

Maturity date

Dec 15, 2027

CNC4916042

Centene Corporation 4.25% 15-DEC-2027Yield to maturity

3.43%

Maturity date

Dec 15, 2027

CNC4947504

Centene Corporation 3.375% 15-FEB-2030Yield to maturity

3.27%

Maturity date

Feb 15, 2030

See all C1NC34 bonds