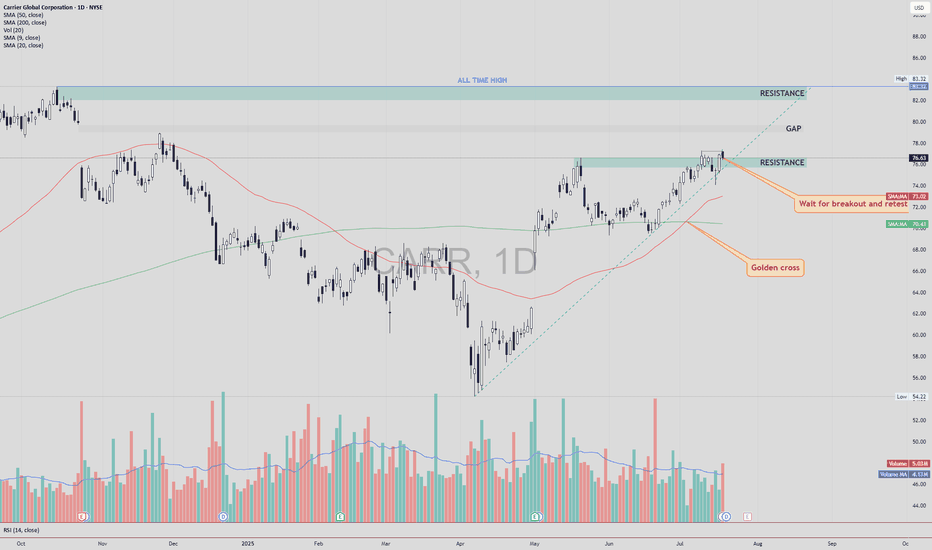

CARR – Bullish Breakout Toward Gap and ATHCarrier Global NYSE:CARR has closed above a key resistance zone near $76.50–$77.00 , indicating a possible breakout setup in progress. This move comes after a Golden Cross , where the 50 SMA crossed above the 200 SMA — a long-term bullish signal.

🔍 Technical Highlights:

✅ Golden Cross: Bull

17,742.373

0.006 BRL

2.31 B BRL

121.22 B BRL

About Carrier Global Corporation

Sector

Industry

CEO

David L. Gitlin

Website

Headquarters

Palm Beach Gardens

Founded

1915

ISIN

BRC1RRBDR009

FIGI

BBG00XV4PYC9

Carrier Global Corp. engages in the provision of climate and energy solutions with a focus on providing differentiated, digitally-enabled lifecycle solutions to its customers. Its portfolio includes brands such as Carrier, Viessmann, Toshiba, Automated Logic and Carrier Transicold that offer innovative heating, ventilating, air conditioning (HVAC) and cold chain transportation solutions. It also provides a broad array of related building services, including audit, design, installation, system integration, repair, maintenance and monitoring. The firm operates through the following segments: Climate Solutions Americas (CSA), Climate Solutions Europe (CSE), Climate Solutions Asia Pacific, Middle East & Africa (CSAME) and Climate Solutions Transportation (CST). The CSA segment provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in North and South America. The CSE segment provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in Europe. The CSAME segment provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in Asia Pacific, the Middle East and Africa. The CST segment includes global transport refrigeration and monitoring products, services and digital solutions for trucks, trailers, shipping containers, intermodal and rail. The company was founded by Willis Haviland Carrier on June 26, 1915 and is headquartered in Palm Beach Gardens, FL.

Related stocks

CARR potential Buy setupReasons for bullish bias:

- Strong resistance breakout

- Price has broken all-time high

- Accumulation phase breakout

Here are the recommended trading levels:

Entry Level(CMP): 62.18

Stop Loss Level: 52.73

Take Profit Level 1: 65.33

Take Profit Level 2: 68.78

Take Profit Level 3: Open

🏢 Bullish Outlook on Carrier Global Corporation (CARR) 📈🔍 Analysis:

Strategic Focus: Carrier Global Corporation (CARR) is concentrating on its core operations by divesting its Commercial Refrigeration and Fire & Security businesses after acquiring Viessmann. This move aims to expand its presence in food retail refrigeration.

Asset Optimization: Carrier

Cross-Checking News Trading with Technicals on CARR-USDDear Esteemed Investors,

Everyone asked me to write an analytics on CARR. Although my forecasts achieved some success with this stock, let me remind you it's only a very small percentage of my portfolio. I can measure my exposure in hundreds of thousands, which is relatively small compared to my g

Carrier Global - Starter?Carrier Global purchases the Viessmann Heat pumps unit. The market reacts very negative due to the high price but nevertheless the deal provides big business potential for the future. A opportunity to enter? The technical situation is not 100% supportive a seems more bearish than bullisch. Neverthel

Carrier is a no brainer, if it makes a new ATH soon The impulse wave structure is pretty obvious here. Should get a big run on a breakout ATH confirmation with a lot of accumulation already. On a 10yr span I see a possible 1600%+ gain.

Why Carrier? They are the biggest worldwide HVAC company on the NYSE and Europe is in desperate need for A/C units

CARR Entry, Volume, Target, StopEntry: with price above 60.04

Volume: with volume greater than 4.1M

Target: 72.18 area (this is an area, no guarantee it reaches this price, but you should be selling on the way up)

Stop: Depending on your risk tolerance; Based on an entry of 60.05 & target of 72.18, a stop at 58.54 gets you

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UTX5077957

Carrier Global Corporation 3.577% 05-APR-2050Yield to maturity

6.43%

Maturity date

Apr 5, 2050

UTX5077958

Carrier Global Corporation 3.377% 05-APR-2040Yield to maturity

6.10%

Maturity date

Apr 5, 2040

UTX5742149

Carrier Global Corporation 6.2% 15-MAR-2054Yield to maturity

5.64%

Maturity date

Mar 15, 2054

UTX5704471

Carrier Global Corporation 6.2% 15-MAR-2054Yield to maturity

5.31%

Maturity date

Mar 15, 2054

UTX5704273

Carrier Global Corporation 5.9% 15-MAR-2034Yield to maturity

5.04%

Maturity date

Mar 15, 2034

UTX5742151

Carrier Global Corporation 5.9% 15-MAR-2034Yield to maturity

4.93%

Maturity date

Mar 15, 2034

UTX5077963

Carrier Global Corporation 2.7% 15-FEB-2031Yield to maturity

4.76%

Maturity date

Feb 15, 2031

UTX5077959

Carrier Global Corporation 2.722% 15-FEB-2030Yield to maturity

4.62%

Maturity date

Feb 15, 2030

UTX5077960

Carrier Global Corporation 2.493% 15-FEB-2027Yield to maturity

4.42%

Maturity date

Feb 15, 2027

XS272357714

CARRIER GLOB 23/32 REGSYield to maturity

3.99%

Maturity date

Nov 29, 2032

XS293134421

CARRIER GLOB 24/37 REGSYield to maturity

3.87%

Maturity date

Jan 15, 2037

See all C1RR34 bonds