CRSP – Confirmed Breakout - Squeeze Pressure Mounting - Let's GoCRSP – Full Breakdown of the Short Squeeze Setup, Technicals, and Fundamentals

CRISPR Therapeutics (NASDAQ: NASDAQ:CRSP ) is currently setting up one of the most compelling short squeeze and momentum continuation trades in the biotech sector. After hours on July 22, 2025, the stock is trading at 67.00, pushing through a critical resistance zone with increasing volume and strong technical confirmation.

Short interest is estimated at approximately 25.5 million shares, representing between 28 and 31 percent of the float. Days to cover is between 5.8 and 9.7, which is considered high. This creates a risk zone for short sellers, especially as the stock moves higher. With the price moving above 65, many in-the-money call options are being triggered, increasing the likelihood of a gamma squeeze. This occurs when market makers must hedge their exposure by buying more shares, driving the price up further.

Open interest on call options has been building over the past month, particularly at the 65, 70, and 75 strike prices for the August 1 and August 16 expirations. October calls also show heavy volume. The August 16 70 call recently had over 1700 open contracts with more than 4400 contracts traded in a single session, indicating aggressive positioning.

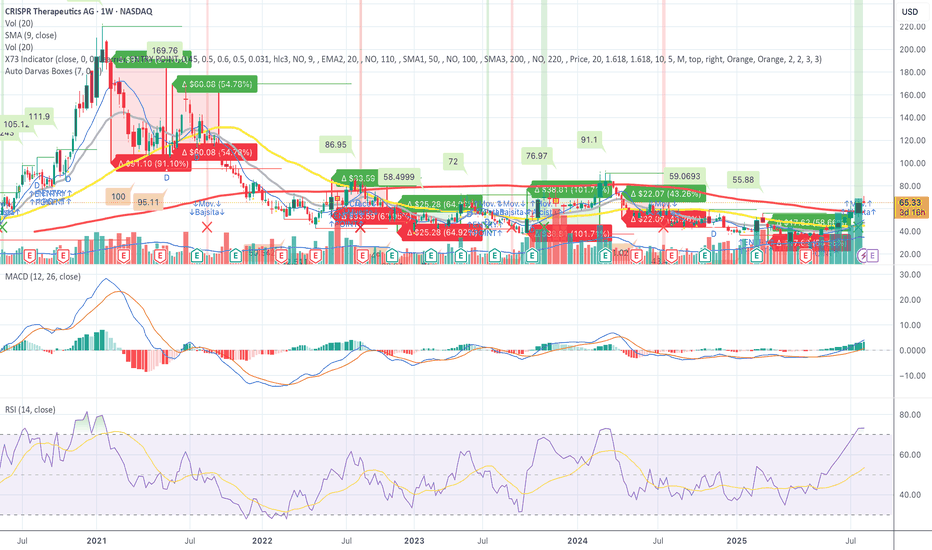

On the weekly chart, price has now broken above 66.50, a major resistance zone. RSI is above 73, signaling strong momentum. The MACD has crossed bullish with rising histogram bars. The 50-week simple moving average sits around 72 to 73, marking the next area of resistance. Price is now trading above the 10, 20, and 50-week moving averages and has broken out from the previous Darvas Box range centered around 60.88.

CRSP is expected to report earnings around August 7 to August 12, 2025. In the previous quarter, the company reported a loss of 1.58 per share, missing expectations. Current estimates for Q2 range from negative 1.78 to negative 0.93, with a consensus near negative 1.40. Investors will be watching closely for updates on CRISPR’s gene therapy pipeline, especially the CTX001 program and oncology candidates. A positive earnings surprise or encouraging pipeline update could further drive upward price movement.

CRISPR Therapeutics focuses on developing gene-editing therapies based on CRISPR-Cas9. Key programs include CTX001 for sickle cell disease and beta thalassemia, CAR-T therapies for cancer, and regenerative medicine applications. The company has a strong cash position and continues to invest heavily in research and development.

Key support levels include 60.88 and 58.50. Immediate resistance is now 67.00, with the next target range between 72.50 and 76.00. If the short squeeze intensifies, a stretch target of 86.00 to 91.00 is possible. The all-time high for the stock is 169.76, reached in early 2021.

This setup includes a confirmed technical breakout, high short interest, heavy call option flow, and an upcoming earnings catalyst. The stock is now in play, and if it holds above 67.00, further upside pressure could continue into the August earnings release. This is a live squeeze and continuation setup with both technical and fundamental tailwinds.

C2RS34 trade ideas

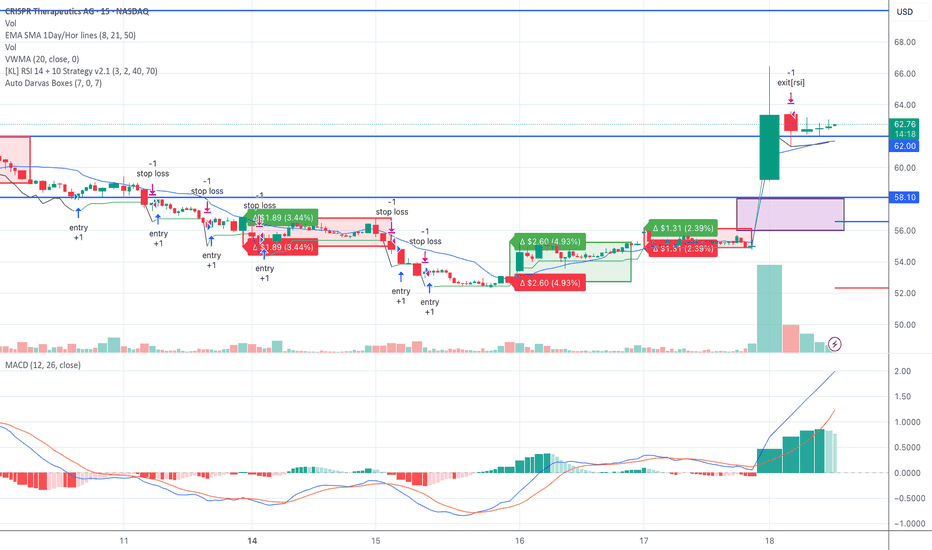

CRSP – Biotech Breakout After Insider Accumulation | Seed SystemNASDAQ:CRSP just cleared its Darvas Box top with momentum, volume, and trend all aligning.

Seed System confirmation:

Darvas Box breakout at $56–58

Massive volume surge following insider/institutional buying (ARK, UBS, T. Rowe)

EMA stack bullish (9 > 21 > 50)

VWMA trending up, price riding the band

MACD bullish cross, RSI moving through 70

Setup:

Entry Zone: $60.00–62.00 (watch for pullback)

Stop Loss: $58.00

Target 1: $70.00

Target 2: $80.00+

Catalyst: Positive CTX310 gene therapy results (LDL & triglyceride drops up to 80%), and biotech sector strength. RS Rating now 85 — breakout quality.

Expecting a retest of the breakout before continuation. Strong long setup if biotech sector holds.

Safe Entry Zone CRSPPrice will Re-test Blue Line.

Blue Line act As Strong Support level now.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock (safe way):

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

CRSP Could Crack the Holy Grails of Medicine: Cancer & AlzheimerWhen Tesla (TSLA) started, few believed a scrappy EV startup could transform the entire auto industry and ignite a green energy revolution. But it did.

Today, CRISPR Therapeutics (NASDAQ: CRSP) is quietly doing something similar for medicine — and if you squint, its upside might be even bigger than Tesla’s.

Gene Editing: The Next Industrial Revolution — For Your Cells

CRISPR/Cas9 gene editing is like biological software. It gives scientists the power to cut, delete, or rewrite genes — the source code of life — with surgical precision.

CRISPR Therapeutics was co-founded by Dr. Emmanuelle Charpentier, a Nobel Prize winner who helped pioneer this breakthrough. The company’s lead therapy, exa-cel — just FDA approved in the U.S. — is the first-ever CRISPR-based gene-editing treatment to hit the market.

First up: curing devastating blood disorders like sickle cell disease and beta-thalassemia — a $10 billion+ opportunity. But that’s only the start.

Aging: The Ultimate Disease

What if we treated aging itself as a disease?

Many scientists now argue that growing old is the result of accumulated genetic errors, cellular damage, and mutations — processes that can be slowed or even reversed.

Gene editing holds the promise to repair DNA damage, reprogram cells, and treat the root causes of age-related decline. If successful, it could extend healthy human lifespan by decades.

Think about that: Tesla made cars last longer and burn cleaner. CRSP could make you last longer and live healthier.

The Two Holy Grails: Cancer and Alzheimer’s

Beyond blood disorders, CRISPR Therapeutics is working on a pipeline targeting solid tumors, diabetes, and more. But the real game-changers are cancer and Alzheimer’s disease — the twin mountains every biotech company dreams of conquering.

With gene editing, we could one day rewrite the genetic mutations that fuel cancer growth or remove the faulty proteins that clog the brain in Alzheimer’s. These are trillion-dollar problems — and the company that cracks them will reshape human history.

Built for Scale — Like Tesla

CRSP isn’t going at it alone. Partnerships with Vertex, Bayer, and ViaCyte help spread risk and amplify impact. With over $2 billion in cash, it has the runway to execute — just as Tesla used capital to build factories and charging networks at scale.

The market still underestimates that this is a platform company — not a single-drug biotech. If Tesla went from cars to batteries, solar, and AI, CRSP could go from blood disorders to rewriting the code for life itself.

Bottom Line

Aging. Cancer. Alzheimer’s. These are the holy grails of medicine.

If you missed Tesla at $20 a share, CRISPR Therapeutics could be your second chance — the TSLA of Gene Editing.

Because the greatest disruption of all is not electric cars. It’s the chance that, one day, growing old will be optional.

Is Gene Editing's Investment Promise Within Reach?CRISPR Therapeutics stands at the vanguard of the gene editing revolution, transitioning into a commercial-stage biopharmaceutical entity following the landmark approval of CASGEVY. This first-of-its-kind gene editing treatment targets sickle cell disease and beta-thalassemia, validating the transformative potential of CRISPR-Cas9 technology and signaling the dawn of a new medical era. CASGEVY's market entry provides critical proof of concept, paving the way for broader gene editing applications in treating genetic disorders.

Despite this scientific triumph, CASGEVY's commercial launch faces immediate hurdles, primarily its high cost and complex administration, contributing to slow initial sales. While development partner Vertex Pharmaceuticals reports the revenue, CRISPR receives a profit share. The company currently operates at a loss, with operating expenses significantly exceeding revenue, primarily from grants. However, a robust cash reserve provides financial stability as CRISPR pursues an ambitious pipeline targeting widespread diseases like cancer, diabetes, and cardiovascular conditions, alongside its commercial efforts with CASGEVY.

The intellectual property landscape remains dynamic, marked by ongoing patent disputes over the foundational CRISPR-Cas9 technology, which could influence future licensing and competition. Simultaneously, CRISPR Therapeutics contributes to advancements in personalized medicine and delivery systems. A notable achievement includes the rapid development and delivery of a personalized mRNA-based CRISPR therapy for a rare metabolic disorder using lipid nanoparticles, demonstrating a potential model for swift, patient-specific treatments and highlighting the crucial role of advanced delivery technologies in expanding gene editing's therapeutic reach.

For investors, CRISPR Therapeutics presents a high-risk, high-reward opportunity. The stock has experienced volatility, reflecting current unprofitability and market conditions. Yet, strong institutional ownership and optimistic analyst ratings underscore confidence in the long-term potential. The company's deep pipeline and foundational technology position it for significant future growth if clinical programs succeed and commercial adoption of its therapies expands, suggesting that for those with a long-term perspective, the promise of gene editing may indeed be within reach.

CRSP Sickle Cell Disease - The Saudis were talking about it YestI have one horse that is just getting started, Did you hear at the Middle East Conference, the host of one of the events was talking about Sickle Cell Disease, remember? Well you know which company has the cure ? CRSP , Crispr Therapeutics, and this is a rocket that will fly, My NPV Valuation today $1,078.00 per share, giess what is the share price today???? Under $40.

Ehemmmmm eheeemmmmm - outside the radar but a powerful rocket to the stars. CRSP my opinion, is your retirement stock

DOUBLE TOP REJECTED - CRSPGood Morning,

Hope all is well. Beautiful little run for CRSP. overall this stock is still in a a bullish trend from its last low. It was rejected at both the 40$ & 39.30$ a mark creating a double top. This is showing lack of confidence in those price levels and signalling a regroup at a new support prior to climbing back up again.

I will look to buy again at a lower price level.

Thanks

CRSP – 30-Min Long Trade Setup !📈 🟢

🔹 Asset: CRISPR Therapeutics AG (CRSP – NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Ascending Triangle + Breakout Zone Compression

📊 Trade Plan – Long Position

✅ Entry Zone: $38.96 (Above triangle breakout + confluence of support)

✅ Stop-Loss (SL): $37.79 (Below trendline and structure base)

🎯 Take Profit Targets:

📌 TP1: $40.71 – Previous top and resistance

📌 TP2: $42.74 – Strong supply zone

📐 Risk-Reward Calculation:

🟥 Risk: $1.17/share

🟩 Reward to TP2: $3.78/share

📊 R/R Ratio: ~1 : 3.2 – Solid high-conviction swing setup

🔍 Technical Highlights

📌 Tight price squeeze between trendline and resistance ✔

📌 Clean breakout from triangle pattern ✔

📌 Bullish consolidation near major zone (yellow line) ✔

📌 Volume rising around breakout candle ✔

📉 Risk Management Strategy

🔁 Move SL to breakeven after TP1

💰 Take 50% profits at TP1

🚀 Let the rest ride to TP2

🚨 Setup Invalidation If:

❌ Candle closes below $37.79

❌ Fakeout breakout with no volume support

❌ Sharp rejection below triangle

🔗 Hashtags:

#CRSP #BreakoutSetup #SwingTrade #NASDAQ #ProfittoPath #TechnicalAnalysis #ChartPattern #SmartMoney #VolumeBreakout #RiskReward

CRSP – 30-Min Short Trade Setup !📉 🔻

🔹 Asset: CRISPR Therapeutics AG (CRSP – NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Pennant Breakdown + Retest Rejection

📊 Trade Plan (Short Position)

✅ Entry Zone: Below $31.30 (Confirmed Breakdown)

✅ Stop-Loss (SL): Above $33.58 (White Resistance Level)

🎯 Take Profit Targets:

📌 TP1: $28.56 (Mid-support zone)

📌 TP2: $25.61 (Key demand area)

📐 Risk-Reward Ratio Calculation

📉 Risk (SL Distance):

$33.58 - $31.30 = $2.28 risk per share

📈 Reward to TP1:

$31.30 - $28.56 = $2.74 → R/R = 1:1.20

📈 Reward to TP2:

$31.30 - $25.61 = $5.69 → R/R = 1:2.49

🔍 Technical Analysis & Strategy

📌 Bearish Pennant Breakdown: Price broke the pattern and is now rejecting the yellow zone on a retest.

📌 Lower Highs + Breakdown Structure: Indicates weakness, confirming bearish bias.

📌 Support Levels Below: Room to fall towards multiple levels of structure.

📌 Volume Check: Look for continued weak volume on bounce to confirm lack of demand.

📉 Trade Execution & Risk Management

📊 Entry Trigger: Break and hold below $31.30 with weak bullish reaction.

📉 Trailing Stop Strategy: Move SL to breakeven once TP1 is hit.

💰 Partial Profit Booking:

✔ Close 50% position at $28.56

✔ Let remaining ride toward $25.61

✔ Adjust SL to breakeven after TP1

⚠️ Setup Invalidation

❌ Strong bullish reversal candle with volume above $33.58

❌ Consolidation above yellow zone after false breakdown

❌ Positive news or catalyst reversing trend

🚨 Final Thoughts

✔ Clean breakdown pattern with confluence resistance at $33.58

✔ Bearish trend intact with lower highs and breakdowns

✔ High probability setup with strong R/R potential

💡 Stick to the plan, manage risk, and let the chart do the talking.

🔗 #CRSP #OptionsTrading #NASDAQStocks #TradingSetup #BearishTrade #ProfittoPath #SwingTradeSetup #RiskReward #ChartAnalysis #TradingView

CRISPR Therapeutics (CRSP) is the biotech rocket you’ve wanted.CRISPR Therapeutics (CRSP) is the biotech rocket you’ve been waiting for—gene-editing’s crown jewel, ready to explode! With Casgevy, the world’s first FDA-approved CRISPR therapy (sickle cell + thalassemia), they’re not just promising—they’re delivering. Revenue’s incoming, and the pipeline’s stacked: blood disorders, cancer, diabetes—multi-billion-dollar markets begging for disruption. Their tech’s a scalpel, slicing through disease at the DNA level, and the competition’s scrambling to catch up. Backed by a SEED_TVCODER77_ETHBTCDATA:2B + cash hoard (Q4 2024), they’re funded to dominate. Stock’s at $50ish (March 2025)—undervalued for a pioneer with 10x potential. Analysts whisper $100+, but whisper louder: this is a $200 beast in the making. Gene-editing’s the future, and CRSP’s the kingpin—Vertex partnership? Just the start. Shorts are sweating; the squeeze is near. Forget hype—this is science meeting profit, now. I’m in—bought at $48, pumping it to my network. CRSP isn’t a stock; it’s a revolution. Load up before the herd wakes up—this rocket’s blasting off!

CRSP's Genetic SurgeCRISPR Therapeutics AG (CRSP) is exhibiting strong bullish momentum, with a notable gap forming around the $40.00 level. A breakout above the $58.07 resistance would confirm further strength, positioning the stock to target the $73.90 resistance. This trade setup offers an excellent risk-to-reward ratio, with a stop-loss set at $29.52 to manage downside risk.

The company's recent achievements bolster this bullish outlook. In December 2023, CRISPR Therapeutics, in collaboration with Vertex Pharmaceuticals, received U.S. FDA approval for Casgevy (exagamglogene autotemcel), the first CRISPR-based gene therapy, targeting sickle cell disease and beta-thalassemia. This groundbreaking therapy has also been approved for use by the UK's National Health Service (NHS), marking a significant milestone in gene-editing treatments.

These developments underscore CRISPR Therapeutics' leadership in gene-editing technologies and its potential to revolutionize treatments for genetic disorders. The successful commercialization of Casgevy could substantially enhance the company's financial performance and investor confidence.

This combination of technical momentum and fundamental strength supports a bullish push toward $73.90, making CRSP an attractive opportunity for traders and investors alike.

NASDAQ:CRSP

I insist Crispr Therapeutics is ready for a massive assent Yes this is an update, here is the fantastic company mired by shorts with an incredible line of therapies to churn trillions of dollars in revenue, with all the financing it needs to make this business become larger than and yof the pharma largest players including Pizer

CRISPR THERAPEUTICS - IS ABOUT TO LIFT OFF - EARNINGS ARE COMING AND THE WORD IS. THEY WILL SHOW REVENUE FOR THE 1ST TIME SINCE THEY STARTED. THIS STOCK IS 47% SHORTED.

Did you know that just with the two therapies that have been approved, sickle cell disease and the other one related to cancer and T cells being overactive crisper therapeutics has an intrinsic value of $1075 per share. Just do the calculation. 70,000,000 afflicted with sickle cell disease, 5 million new afflicted people per year, and the T cell hyperactive condition on cancer patients flick 7% of all cancer patients. And you know that cancer will be the ultimate killer when you get old. That means that sickle cell therapy is pricing a 2,600,000 per treatment and the sickle cell hyperactive and cancer patients costs $1 million per treatment. I'll leave you with that thought. And by the way, if you think that Pharma will not go for this, you're wrong the payment upfront is much bigger than the payment overtime. And a chronic treatment for a patient afflicted with any of this diseases after you do the NPV net pressing value you realize that Chris therapy it's much better. Not only this, but the government has an incentive to actually cover part of the insurance cost of this therapies so they can integrate patients afflicted into the productive, workforce and generate income from tax revenue. This is why I believe that Chris therapeutics will be licensing very successfully. This therapies to Pharma far and wide, so the only bottleneck was insurance so the government will pick up the insurance that's for sure because it makes sense from a mathematical perspective.

I gave you Tesla then Boeing, Then Smci and Now CrSp This one CRSP is the most massive rocket you will ever ride. ...

it is a trillion dollar company that has just been born.....

I will post more latter over the weekend.

I bought for my daughter and myself today, I bought more... at any minute now, it will explode Up....

So many shorts huge amount of them, this sis typical of a new Monster Grower, in the begining, they shorted it, they is the ones with the power to move the needle. But soon enough they have all the shares and then the good news start. The good news already started, look for them

CrSp Crispr Therapeutics - the next Trillion Dollar Company Dear reader, I've been following Crispr therapeutics for a long time. It is a fantastic company. They have FDA approval in the United States and in Europe for sickle cell disease that is a melody that are fixed 70 million people and has a market value of $2

.49 trillion.in therapies. Yes that's correct each therapy costs about 2,600,000 and they are 70 million afflicted so even with the 3% of the population being able to pay for this therapy, you get to $2.49 trillion then they have another FDA approved therapy for air condition where the T cells will attack healthy cells. This happens in patients that are recovering from cancer and the population afflicted by this is 3.9% of all cancer patients, which is an enormous amount because cancer is what kills people in old age so that therapy costs about $1 million and has a massive market. Like this therapy Crispr therapeutics, has many other therapies. This is a new technology their friends it is a kin to the discovery of penicillin before penicillin. This is miles ahead of anything, and this therapies will serve to do a number of things to correct food shortages for example plants modify genetically many many many organisms this is just the beginning for now Crispr therapeutics is doing manipulation outside the body sickle cell for example, are extracted manipulated outside and rejected in the patient same with the T cells, but in the future as technology progresses, there will be vaccines that will be in vivo inside of this. I'm sure but even if nothing happens and we continue doing the same things we're doing manipulating cells outside the body Crispr therapeutics is the next trillion dollar company I see this happening within one to two years. The progress is outstanding amazing you should all be looking into it. It's really something else so this is my tip for the year so you can get rich by invest investing in the company that is just now starting to grow.

$CRSP: A BioTech to add to the watchlist! 95% UpsideNASDAQ:CRSP

Not a High Five Setup...yet

-H5 Indicator is GREEN

-Filling Volume Profile GAP and setting up at a new Volume Profile Shelf

-Need Wr% to push up above -20 and form Williams Consolidation Box

-Need to breakout of Symmetrical Triangle at $56ish

If we get that it will be a H5 Trade and look for targets:

🎯$73 🎯$91 📏$110 ⏳Before mid-2026

NFA

Looking for the next Amazon or Tesla to invest at the Start?CRISPR Therapeutics - revenue projection = Massive

I am accumulating shares. you may want to start looking into CrSp.Let's calculate the revenue potential for CRISPR Therapeutics based on their approved therapy and pipeline:

THERAPY 1: BEING ROLLED OUT AND APPROVED IN THE USA AND EUROPE

Casgevy (approved for sickle cell disease and beta-thalassemia):

Price per therapy: $2.2 million

Potential patient pool: 70 million

Assuming 2% adoption: 1.4 million patients

Potential revenue: $3.08 trillion

THERAPY 2:

CTX310 (Phase 1 for cardiovascular disease):

Assuming similar pricing and 1% adoption of global cardiovascular patients (520 million)Potential revenue: $1.144 trillion

THERAPY 3:

CTX320 (Phase 1 for elevated Lp(a)):20% of global population has elevated Lp(a), assuming 0.5% adoption

Potential revenue: $1.716 trillion

THERAPY 4:

CTX340 and CTX450 (preclinical):

Assuming more modest adoption due to earlier stage, estimate $500 billion each.Combined potential revenue: $1 trillion

Total potential revenue: $6.94 trillion

ASSUMPTION OF REVENUE POTENTIAL DISCOUNTED TO NET PRESENT VALUE AND THEN CALCULATION OF SHARE PRICE ASSUMPTION GIVEN THIS DATA:

Assuming this revenue is spread over 10 years and using a conservative 10% discount rate for NPV calculation:NPV = $6.94 trillion / (1.1^5) ≈ $4.31 trillion

CRISPR Therapeutics has approximately 79 million shares outstanding.Value per share: $4.31 trillion / 79 million ≈ $54,557

Projected share price (multiplied by 25, 25 is the mlptiple at which companies trade on average): $1,363,925

This calculation suggests an extremely high potential value. Competition, many copy cats and swindlers purporting the expertise, as usual with Biotech, you remember INO Inovio and that Korean Doctor, a fraud in my opinion (the stock wen from $33 to almost zero). Well CRSP is lead by two Nobel Prize winners, Harvard is in the mix and the Swiss are financing it, and they have already 44 Therapy Centers, and licensing the technology very quickly. This company is the real deal. Careful investing in the rest of the space, Pfizer already flopped, imagine Pfizer, that should tell you that this BioTech Space is only for salient technologies.

When people go back to see how they would have done with Amazon or Netflix, well here you have another technology company that can very well outdo them all.

Short Interest: 19.39 million shares

Float: Approximately 83.94 million shares (calculated from 23.10% of float shorted)

Cash: $2.0 billion as of June 2024

Growth Rate: Revenue growth of 19% over the past year

Debt: Zero debt reported

Volume: Average trading volume of 1.48 million shares per day

Days to Cover: 14.8 days

Additional information:

Short Interest Ratio: 13.31 Days to Cover

Short Interest % of Float: 23.10%

Cash Burn: $129 million in the last year

Cash Runway: Several years based on current burn rate

Market Capitalization: Approximately $4.2-$4.3 billion

The P/E ratio is not provided in the search results, which is common for biotechnology companies that may not yet have consistent earnings.

THE PERFECT CANDIDATE FOR A MASSIVE SHORT SQUEEZE.

#investments, #CRSP, #Crispr, #Therapy, #Therapeutics, #Get, #Rich, #Biotech, #Technology, #Medicine, #SickelCell

link to article: "https://www.linkedin.com/pulse/looking-next-amazon-tesla-invest-very-beginning-well-read-s-sc-n--0r8be/?trackingId=o%2B1DocTdTi%2BO%2Bwk%2FqKV1yA%3D%3D"

Cound this be ? and yet maybe is will.....CRISPR Therapeutics - the next Trillion Dollar Company.

November 14, 2024

Investing ins SpaceX before it goes Public.... This is good advice !!! Space is the new War Economy, I mead the defense machine needs a new business line, and space is more profitable than any war economy X 50 - war economy today 34 Trillion Annually according to my calculations.

Space realignment, so much more - the 1st massive breakthrough will be in biotech, breakthrough, I mean extremely profitable manufacturing will be in bio-manufacturing of parts for transplant, oh yeah. it is coming.

In the meantime read my posts on Crispr Therapeutics.

Truly Amazing times. Go to my profile and sort for posts, all three some 10 - describing the founders winning the Nobel Price for Chemistry, their first products being approved by the FDA and expanding revenue, the pipeline, and lastly an NPV Valuations of $1,075 per share today.... that is coming, kid you not.

This is the collection of post I made about CRISPR THERAPEUTICS - It discusses all the positives about this stock. The positives are truly overwhelming in quantity, in speed of development, in how this company will upgrade life itself, from humans to nature, prepare for a quantum leap. Even terraforming Mars, it is all in the cards for CIRSPR Therapeutics, ticker CrSp, traded in USA Markets. Oh, before I forget, these posts also discuss the acceleration of development of new therapies, because of AI.

CRISPR THERAPEUTICS is expected to greatly accelerate discoveries and implementation of therapies

The integration of AI with CRISPR technology is poised to revolutionize medicine by enabling precise, effective, and personalized therapies. AI enhances the CRISPR genome editing process by optimizing guide RNA design, predicting outcomes, and minimizing off-target effects, leading to safer and more efficient treatments for diseases such as sickle cell anemia and cancer.

Transformation Timeline

• Short-Term (1-3 years): Expect advancements in existing therapies, with AI improving the precision of CRISPR applications in clinical settings.

• Medium-Term (3-5 years): Introduction of tailored gene therapies based on individual genetic profiles, leveraging AI for real-time data analysis.

• Long-Term (5+ years): A shift towards a new paradigm of medicine where AI-driven CRISPR technologies dominate, making chemical-based processes seem outdated.

The synergy between AI and CRISPR is expected to accelerate the development of next-generation therapies, transforming healthcare into a more personalized and effective approach

“CRISPR Therapeutics Shares Hold Strong Potential: The Calculated NPV Surpasses $1,073!”

CRISPR Therapeutics commercializes its FDA-approved therapies primarily through strategic partnerships, particularly with Vertex Pharmaceuticals. Here’s how the commercialization process works:

Commercialization Strategy

1. Partnership with Vertex Pharmaceuticals:

• Vertex leads the global development, manufacturing, and commercialization of CTX001 (exagamglogene autotemcel) for sickle cell disease and transfusion-dependent beta-thalassemia.

• Under their agreement, Vertex is responsible for 60% of program costs and profits, while CRISPR retains 40% .

2. Revenue Structure:

• CRISPR received a $900 million upfront payment from Vertex, with potential milestone payments of up to $200 million upon regulatory approval .

• CRISPR also benefits from royalties on future sales of CTX001 and other products developed under this partnership.

3. Regulatory Approvals:

• CRISPR has successfully submitted Biologics License Applications (BLAs) for exa-cel, which have received priority review from the FDA, enhancing the speed of commercialization .

4. Market Access and Distribution:

• The collaboration allows CRISPR to leverage Vertex’s established infrastructure for market access and distribution, ensuring that therapies reach patients effectively.

Future Commercialization Efforts

• CRISPR is also advancing its pipeline of therapies in various stages of clinical trials, including CAR T-cell therapies like CTX110 and CTX131, which are expected to follow a similar commercialization strategy through partnerships or independent efforts once they receive regulatory approval .

This collaborative approach maximizes CRISPR’s resources while allowing it to focus on innovation and development in gene editing technologies.

Crispr therapeutics (CRSP)

Currently Approved Therapies

1. Casgevy (exagamglogene autotemcel): Approved for sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT).

2. Zolgensma (onasemnogene abeparvovec-xioi): Gene therapy for spinal muscular atrophy.

3. Kymriah (tisagenlecleucel): CAR T-cell therapy for certain types of leukemia and lymphoma.

4. Yescarta (axicabtagene ciloleucel): CAR T-cell therapy for large B-cell lymphoma.

5. Luxturna (voretigene neparvovec-rzyl): Gene therapy for inherited retinal disease.

Pending Approval Therapies

1. CTX001 (exagamglogene autotemcel):

• Indications: Sickle cell disease and transfusion-dependent beta thalassemia.

• Estimated Approval Dates:

• SCD: December 8, 2023 (FDA)

• TDT: March 30, 2024 (FDA)

2. CTX110: Allogeneic CAR T-cell therapy targeting CD19.

• Estimated Approval Date: TBD, currently in Phase 2 trials.

3. CTX131: Allogeneic CAR T-cell therapy targeting CD70.

• Estimated Approval Date: TBD, currently in Phase 1 trials.

4. CTX310 and CTX320: Targeting lipoprotein(a) for cardiovascular diseases.

• Estimated Clinical Entry: First half of 2024.

These therapies represent significant advancements in gene editing and cellular therapies, with CTX001 being particularly notable as the first CRISPR-based therapy expected to gain FDA approval

CRSP TICKER SYMBOL - To arrive at a theoretical share value for CRISPR Therapeutics (CRSP), we can use the projected future revenues and the company’s market capitalization.

Current Market Data

• Current Share Price: $51.62

• Market Capitalization: Approximately $4.4 billion

Revenue Projections

Using the speculative revenue projections:

• 2024: $4 billion

• 2028: $7.1 billion

• 2030: $9.5 billion

• 2034: $17.8 billion

Valuation Method

Assuming a price-to-sales (P/S) ratio of 18.93 (as per current data) for future revenue projections, we can estimate the theoretical share value.

Theoretical Share Value Calculation

1. Projected Revenue for 2028: $7.1 billion

2. Estimated Market Cap in 2028:

3. Shares Outstanding: Approximately 85 million .

4. Theoretical Share Value in 2028:

Discounting to Present Value

To find the present value of this share price using a discount rate of 10% over 4 years (from 2024 to 2028):

Conclusion

The theoretical present share value of CRISPR Therapeutics today could be approximately $1,073, based on speculative future revenues and current market conditions. This projection assumes successful commercialization of their therapies and sustained growth in the gene editing market

The CRISPR THERAPIITICS market is projected to grow significantly, with estimates suggesting it will reach approximately $17.8 billion by 2034, up from $3.4 billion in 2023, reflecting a compound annual growth rate (CAGR) of 16.1% from 2024 to 2034.

Speculative Revenue Projections

• 2024: $4 billion

• 2028: $7.1 billion

• 2030: $9.5 billion (based on a CAGR of 15.6% from 2023)

• 2034: $17.8 billion

Present Value Calculation

Using a discount rate of 10%, the present value (PV) of future cash flows can be estimated as follows:

Where is the discount rate and is the number of years until the cash flow occurs.

Summary

The total present value of projected revenues from CRISPR initiatives could amount to approximately $19.67 billion, indicating a significant potential return on investment in this rapidly evolving market

4 hour bullish divergence It was pointed out to me earlier that the last time I posted was back in May so I thought I’d pull my finger out and share this one.

The company has developed a cure for sickle cell disease, by gene editing, this disease is seriously debilitating and affects millions of people of African descent, this is a game changer for people with this disease.

The company are still loss making but this groundbreaking technology has the potential to cure other previously incurable diseases.

Cathie Wood has been accumulating shares in her Ark fund, it has huge potential, picked up a few shares earlier today