DDOG eyes on $116.34: Golden Genesis fib to determine the TrendDDOG bounce just hit a Golden Genesis at $116.34

The sister Goldens above and below marked extremes.

This one could mark the orbital center for some time.

It is PROBABLE that we orbit this fib a few times.

It is POSSIBLE that we see a pullback from here.

It is PLAUSIBLE but unlikely to continue non-stop.

===============================================

.

D1DG34 trade ideas

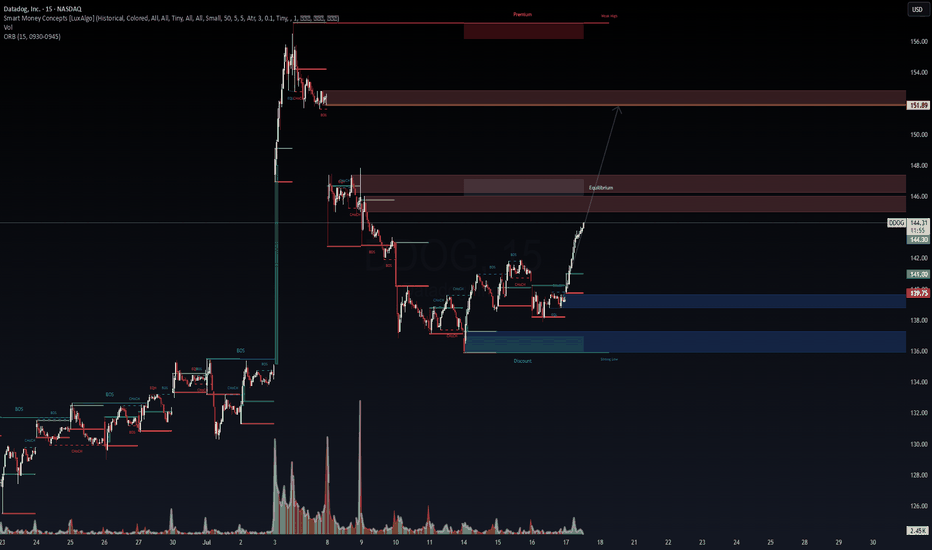

DDOG 15m – Discount Reversal Targeting $151.89 | VolanX Protocol📈 Datadog (DDOG) has completed a clean bullish structural shift off a deep discount zone, rejecting institutional demand around the $137–139 range. Now breaking above key internal CHoCH and BOS levels, price is accelerating into equilibrium, suggesting momentum is building toward premium inefficiencies.

🔍 Technical Breakdown:

Massive previous BOS on July 3rd led to an overextended move that’s now correcting.

Strong reclaim above $141 (ORB high and demand imbalance).

Price swept strong low and confirmed bullish intent via nested CHoCH → BOS → continuation.

Heading into low-resistance volume node up to $146 equilibrium, then targeting $151.89 premium supply.

📌 Critical Zones:

Demand (Support): $139.75 → $137.00 → $136.00 (discount + strong low zone)

Equilibrium Zone: $145.80–146.40 (short-term reaction likely)

Target Liquidity Zone: $151.89 (Premium + prior weak high)

📊 VolanX Protocol Read:

This setup aligns with a VolanX Reversal Protocol. The SMC framework suggests a fully developed market structure cycle (markdown → accumulation → markup). Price action is supported by consistent BOS levels and bullish reaccumulation signs.

🧠 Probabilistic Price Model:

70% → $145.8–146 (reaction near EQ + mitigation)

45% → $151.89 full premium sweep

15% → Breakdown below $139.75 invalidates bullish thesis

⚠️ VolanX Standard Disclosure:

This post is for strategic modeling and educational purposes only. It reflects WaverVanir's internal DSS logic, not financial advice. Always backtest and confirm your execution model.

DDOG: Navigating Key Support and Resistance ZonesAscending Trendline/Channel:

o A prominent green ascending trendline, starting from the lows in April, defines the current bullish momentum.

o This trendline has acted as dynamic support, with the price bouncing off it on multiple occasions. As long as the price remains above this line, the intermediate-term uptrend is considered intact.

Key Support Zones (Green Bands):

o Primary Support (130 to 135): This is the most immediate and critical support zone. Historically, this area acted as resistance in late 2024 and early 2025. Now, it is being tested as potential support—a classic example of a "role reversal" or "polarity" principle. The price is currently trading just above this zone.

o Secondary Support (118 to 120): If the primary support at 130-135 fails to hold, the next significant level of support is identified between 118 and 120. This zone provided support in the latter part of 2024.

Key Resistance / Target Zones (Red Bands):

o 1st Target / Resistance (~155): This level represents the first major overhead resistance. The chart shows a recent sharp rejection from this area, which initiated the current downward move. For the uptrend to continue, bulls would need to break and hold above this zone.

o 2nd Target / Resistance (~165): Should the price overcome the 155 level, the next major resistance is identified around 165. This corresponds to the major high seen at the end of 2024.

Current Price Action:

DDOG recently tested the resistance near 155 and has since pulled back. The price is now situated at a crucial juncture, hovering above the primary support zone of 130-135 and approaching the main ascending trendline.

Summary of Observations:

The confluence of the horizontal support zone (130-135) and the ascending trendline creates a significant area of interest.

• A hold and bounce from this confluence could signal a continuation of the uptrend, with the 155 and 165 levels as the next potential upside objectives.

• A decisive break below both the 130 level and the ascending trendline could signal a shift in momentum and may lead to a deeper correction, with the 118-120 zone as the next major support to watch.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

DDOG - Recent entry to S&P500, looking for entry point on $150+I've started looking into #DDOG with its recent addition into the S&P500. The current chart setup looks like a cup and handle. It will be re-testing the 150 and 160 level. If it can break out beyond $155, it has momentum to climb higher with more institutional investors coming in. Note it has been above this level before in 2021 and it was close before in Q4 2024. It has got steady growth in their financials each quarter.

Datadog's S&P 500 Entry: A New Tech Paradigm?Datadog (DDOG), a leading cloud observability platform, recently marked a significant milestone with its inclusion in the S&P 500 index. This pivotal announcement, made on July 2, 2025, confirmed Datadog's replacement of Juniper Networks (JNPR), effective before the opening of trading on Wednesday, July 9. The unscheduled change followed Hewlett-Packard Enterprise Co.'s (HPE) completion of its acquisition of Juniper Networks on the same day. The market reacted robustly, with Datadog shares surging by approximately 9.40% in extended trading following the news, reaching a five-month high and underscoring the anticipated "index effect" from passive fund inflows. Datadog's market capitalization, approximately $46.63 billion as of July 2, 2025, significantly exceeded the updated S&P 500 minimum threshold of $22.7 billion, effective July 1, 2025.

Datadog's financial performance further solidifies its position. The company reported $762 million in revenue and $24.6 million in GAAP net income for the first quarter of 2025. For the full year 2024, Datadog generated $2.68 billion in revenue. While the document suggested a cloud observability market valued at "over $10 billion," independent verification from sources like Mordor Intelligence indicates the "observability platform market" was valued at approximately $2.9 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 15.9% to reach $6.1 billion by 2030. Other analyses, like Market Research Future, project the "Full-Stack Observability Services Market" to be $8.56 billion in 2025 with a higher CAGR of 22.37% through 2034, highlighting varying market definitions. Datadog operates within a competitive landscape, facing rivals such as Elastic and cloud giants like Amazon and Microsoft, alongside Cisco, which completed its acquisition of Splunk on March 18, 2024.

The S&P committee's decision to include Datadog, despite other companies like AppLovin boasting a higher market capitalization of $114.65 billion (as of July 2, 2025), underscores a strategic preference for foundational enterprise technology addressing critical infrastructure needs. This move signals an evolving S&P 500 that increasingly reflects software-defined infrastructure management and analytics as a core economic driver, moving beyond traditional hardware or consumer-facing software. While Workday's inclusion was cited as occurring in 2012 in the original document, it was added to the S&P 500 effective December 23, 2024, preceding its significant growth in the enterprise SaaS sector. Datadog's ascension thus serves as a powerful signal of the technological segments achieving critical mass and institutional validation, guiding future investment and strategic planning in the enterprise technology landscape.

Destination 160$The price is moving within a compression triangle and has turned bullish again above the purple trendline.

It may break out immediately to the upside, or it could continue moving for a few days or weeks between the two horizontal light blue trendlines before the breakout.

After the breakout, the target is the upper blue resistance area around $160.

Keep an eye on stocks offering AI solutions, as the next rally is likely to come from this sector and quantum computing.

DDOG's Shakeout & Squeeze: The Setup for an Explosive Reversal?The price of DDOG appears poised for a dip slightly below the upward trendline and Fibonacci support zone (126-116) before finding strong support. This could act as a liquidity grab, shaking out weaker positions before an explosive move higher. Compression on the weekly timeframe would be an ideal signal, with tight price action and decreasing volatility indicating accumulation. A bullish reversal confirmation, such as a strong engulfing candle, pin bar, or a breakout above short-term resistance, would provide a high-probability entry. Monitoring RSI for a hold above oversold levels and a curl upward, along with volume expansion on the breakout, will add further conviction to the trade.

Disclaimer:

This analysis is for educational purposes only and should not be considered financial advice. Trading and investing involve risk, and independent research or consultation with a professional is recommended before making any financial decisions.

Datadog: S&P 500 Candidate?! Key Levels to Watch Now!Hi there,

When we talk about the most respected stocks in the market, getting added to the S&P 500 index is a big milestone for any company. It’s not just a status symbol—it’s an event that can push the stock price higher as funds and investors rush to buy it.

Datadog (DDOG) is one of the potential candidates , so let’s analyze what the price action is telling us.

Technical Breakdown:

Right now, Datadog stock is testing a key support level of around $130. This price level has acted as both resistance and support in the past, and in November last year, the stock broke above it. Now, it has come back to retest this level, possibly looking for a base before making its next move.

If $130 holds as support, and the company’s fundamentals remain strong, this could be a solid entry point for buyers.

A secondary support zone to watch is near $100, about 25% lower than the current price. This level has seen big price movements before, meaning there could be strong interest from traders and investors if the stock drops there.

As legendary investor Peter Lynch once said:

"If you sell instead of buying when a stock drops 25%, you won’t achieve long-term profits in stocks."

This idea is also the foundation of my approach – what to do when the price drops? Am I ready to buy more at lower prices? If the answer is something like “probably not,” “not sure,” etc., then it’s worth considering whether it’s even worth buying in the first place!

Plans for different types of investors:

Short-Term Investors: If you’re looking for a quick trade, you might want to wait for a dip to $100, where a stronger bounce could happen. Buying from current prices can be a bit risky considering short-term horizons.

Long-Term Investors: If you believe in Datadog’s continued growth, the $130 level might already be a good spot to start buying. But be ready to buy more if the price drops further.

Final Thoughts:

Datadog is a fast-growing company with strong fundamentals, but the stock also has a high valuation and faces competition. As always, do your own research and make sure your investment strategy fits your risk level and goals.

Cheers,

Vaido

🚀 Stay Ahead of the Markets!

Get high-quality technical analysis, real investment ideas, and key price levels—without the noise.

📩 Subscribe to my Substack for expert insights that help you trade smarter!

📱 On mobile: Just scroll down and select your preferred language.

💻 On desktop: Find the links in my BIO—copy & paste or click the Website icon to go directly to Substack ENG.

buy to open $DDOG 140c exp June 2025 Analyst Koji Ikeda from Bank of America Securities maintains this positive outlook, citing Datadog's strong revenue growth and strategic initiatives in AI as key reasons for the recommendation

While Morgan Stanley acknowledges Datadog's strong market position and strategic growth initiatives, they also highlight near-term risks such as slower growth expectations and a high valuation

According to TipRanks, here are some of the recent price targets for Datadog (ticker: DDOG):

Barclays: $180.00

Morgan Stanley: $143.00

Truist: $140.00

DA Davidson: $165.00

Scotiabank: $155.00

Datadog (DDOG): Cloud Services Drive Continued GrowthDatadog, Inc. (DDOG) is a cloud-based monitoring and analytics company that helps organizations track their applications, systems, and infrastructure in real time. With tools for performance monitoring, security, and data visualization, Datadog empowers businesses to maintain smooth operations and quickly identify and fix issues. The company's growth is fueled by the rising demand for cloud services and the increasing complexity of IT environments.

DDOG recently displayed a confirmation bar with increasing volume, moving higher after finding new demand at the 50% Fibonacci retracement. This new demand suggests strong buyer interest and a potential turning point for the stock. Trailing stops can be set using Fibonacci levels with the snap tool, allowing traders to manage risk while capturing potential gains.

DDOGDDOGis currently in a long-term negative trend, with monthly and weekly candles showing 2D movement (i.e., dropping below the previous period's low), indicating overall seller dominance. However, in the short term, the daily chart shows signs of correction with positive movement (2U), creating a conflict with the broader trends.

On the daily chart, it is evident that the decline has halted around the gap that was previously opened, and it has even closed. This indicates a strong support level in the $136-$138 range, which could serve as a potential turning point in the short term.

To confirm a more significant trend reversal, a clear breakout above the $140 level is required, signaling a shift back to positive momentum even in the longer time frames. As long as the stock remains below these levels, the risk of continued negative pressure remains high.

At this stage, the recommended strategy is to wait for clear confirmation of a trend reversal in the longer time frames while closely monitoring the behavior around the key levels and the recently closed gap.

Datadog ,,, end of a correction One of the best strategies is to identify areas where corrections have been completed. On the chart, a correction appears to have reached a key support/resistance area or multiple support zones.

With a high probability of the corrective wave ending in this area, I'm waiting for a bullish trigger, such as a trend line or moving average breakout, to enter a buying position.

New Setup: DDOGDDOG : I have a swing trade setup signal. I'm looking to enter long if the stock can manage to CLOSE above the last candle high(BUY). If triggered, I will then place a stop-loss below (SL) and a price target above it(TP-50%,move SL to breakeven), then using the close below the 10SMA as my trailing stop loss. **Note: The above setups will remain valid until the stock CLOSES BELOW my set stop-loss level(SL).