DBAG34 trade ideas

LEHMAN = DEUTSCHE BANK ??If Deutsche Bank stock price close on a weekly basis below 5.90 then the bank will be in serious trouble ... need a bailout ? LEHMAN = DEUTSHE BANK ??

Also the current ratio was always under 1

Current Ratio = Total Current Assets / Total Current Liabilities

The current ratio of a good bank should always be greater than 1. A ratio of less than 1 poses a concern about the bank's ability to cover its short-term liabilities.

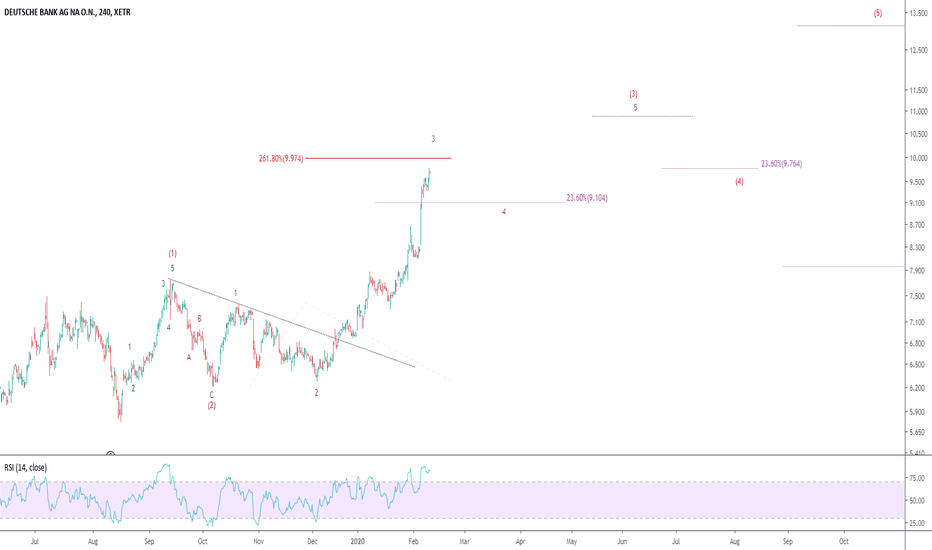

Getting bullish on DBI am getting more optimistic about Deutsche Bank. It seems like these fellas are done with problems amidst broader gloom in the market. While it is certainly possible that the stock may decline with the rest of the market, it is also possible that it may rally on some fiscal policy shift called to avert the collapse in stocks.

Deutsche Bank (DB) is close to the 4-Years Low!We can open Sell in Zone.

Reasons:

- the price is close to the 4-Years Low 11.20;

- the trend has changed direction by trading large volumes;

- potential profit will be in 3...5 times bigger than risk.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

DBK with clean reversal patternDBK has struggled for years, but at current levels it is showing some strength. Price broke from descending channel after the news that Capital Group invested in the bank. There was also higher lows structure which was supported with positive movement on MACD and RSI.

Deutsche Bank’s restructuring plan was handed a vote of confidence after US asset manager Capital Group disclosed a large stake in the German lender, sending its shares up more than 10 per cent. Capital Group is one of the oldest and largest names in the US asset management industry with almost $2tn of assets. It has stuck with stock picking even as the threat from passive investing has grown over the past decade. The 3.1 per cent stake, which is worth more than €500m, makes Capital Group Deutsche’s fifth-largest shareholder. The Qatari Royal family and BlackRock are among the other top investors.

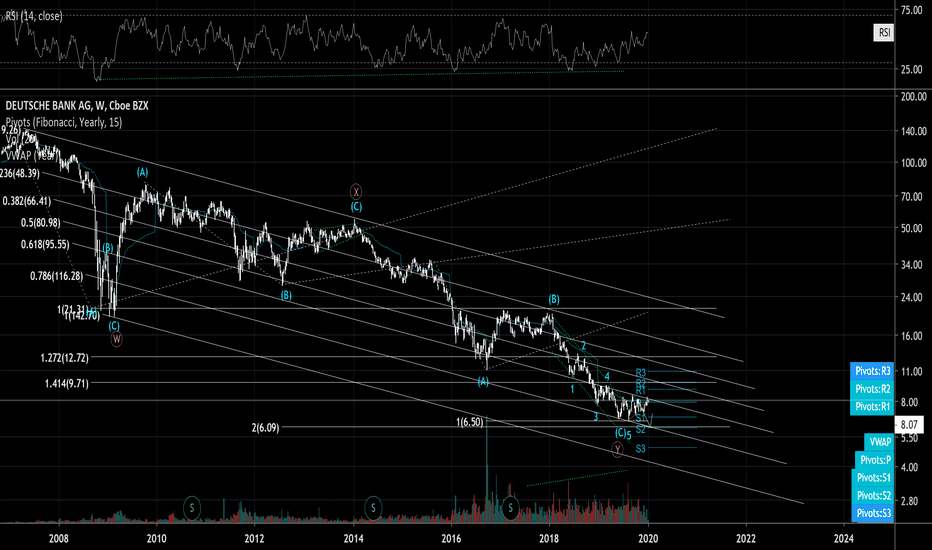

Deutsche Bank: Projected top and long term Sell Entry.Deutsche Bank (DB) has been on a strong medium term rise on the 1W chart since the August low (RSI = 65.146, MACD = 0.232, ADX = 21.619, Highs/Lows = 0.9691). This rise is the bullish leg of the long term Channel Down (since 2012), that is aiming for a Lower High inside the pattern.

The previous Lower High bounces have been 85% on average and the last one made a peak on the 0.500 Fibonacci retracement level. Currently this level is at 11.35, which fits the +85% rise model. This is also where the price meets the technical rejection point of the 1W MA200 (orange line) which has been acting as a Resistance since May 2008.

With the RSI already inside the Sell Zone, we believe it is best to wait for this top to form and sell back towards the 6.45 Low.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

More Pain for GermanyWhat a disaster! Thinking this is just the first leg with some positive news news approaching in the future. Once that news has been digested by investors and coffee breathed bankers, we'll surely see DB head towards the target of... well... zero.

Good luck DB bulls if there are any remaining and if there are, they're going against trend, and could turn out to be absolute legends.

not advice to buy or sell. best of luck!