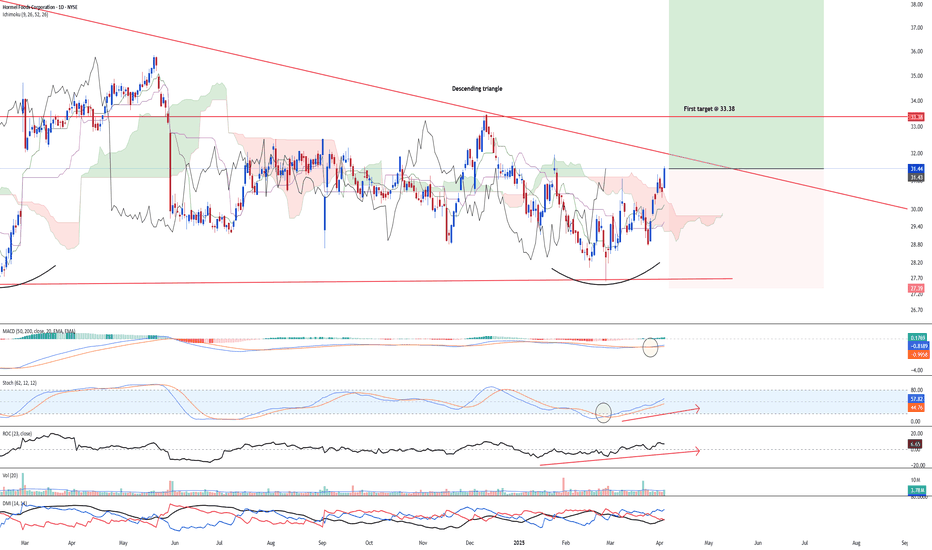

Bottoming outNYSE:HRL has formed a large descending triangle and a potential double bottom formation. Given the upside momentum, there is a strong chance of HRL trending higher after breaking above the descending triangle.

Long-term MACD is looking at a strong long-term bullish momentum after the MACD/signal

22,342.86

0.01 BRL

4.20 B BRL

62.23 B BRL

About Hormel Foods Corporation

Sector

Industry

CEO

James P. Snee

Website

Headquarters

Austin

Founded

1891

ISIN

BRH1RLBDR007

FIGI

BBG00R28WFM7

Hormel Foods Corp. engages in the manufacturing and marketing of branded food products. It operates through the following segments: Retail, Foodservice, and International. The Retail segment consists of the processing, marketing, and sale of food products sold predominantly in the retail market. The Foodservice segment includes the processing, marketing, and sale of food and nutritional products for foodservice, convenience store, and commercial customers. The International segment focuses on processing, marketing, and selling company products internationally. The company was founded by George A. Hormel in 1891 and is headquartered in Austin, MN.

Hormel Foods Co | HRL | Long at $28.98Food stocks are gaining momentum. I anticipate another round of inflation could boost them in the coming 1-2 years. Hormel NYSE:HRL is trading at a price-to-earnings of 20x and pays a dividend of 4.05%. Insiders have been awarded options and are buying shares below $30. Earnings are forecast to gr

HRL approaching Monthly 200MASince an ATH of $55.11 in April of 2022, HRL has declined -47%.

HRL has never been priced below its monthly 200MA.

If HRL produces positive ERs on Thursday 2/29, it could be set up for a solid technical bounce from its monthly 200MA.

Monthly oversold RSI... If monthly 200 support ultimately f

#HRL#Hormel Foods Corporation (NYSE: HRL), a distinguished brand in the food processing sector, has been under the lens of investors and traders alike due to its recent price actions. A meticulous examination of the technical charts reveals a narrative of a stock at a critical juncture, hinting at a pote

$HRL Bear Flag Weekly ChartNYSE:HRL Bear Flag Weekly Chart The technical analysis of a bear flag pattern on the weekly chart of Hormel Foods Corporation (ticker symbol: NYSE:HRL ) reveals a potentially bearish trend continuation signal. A bear flag is a price pattern characterized by a sharp downward move (the flagpole) fol

Hormel Foods LongHRL long position. It looks like it's ready to move and I got the signal for long position.

Market touched a lower Lin Reg and below MACD on H4.

Confirmation on H1 to take long position with 2 TP.

Tp1 at $40.40 and 2nd at $42.

SL at $38.63.

Warning!!!!

This content should not be interpreted as finan

HORMEL FOODS Stock Chart Fibonacci Analysis 070423 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 40.4/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HRL5193039

Hormel Foods Corporation 3.05% 03-JUN-2051Yield to maturity

6.86%

Maturity date

Jun 3, 2051

HRL4998173

Hormel Foods Corporation 1.8% 11-JUN-2030Yield to maturity

4.80%

Maturity date

Jun 11, 2030

HRL5193037

Hormel Foods Corporation 1.7% 03-JUN-2028Yield to maturity

4.43%

Maturity date

Jun 3, 2028

HRL5767180

Hormel Foods Corporation 4.8% 30-MAR-2027Yield to maturity

4.32%

Maturity date

Mar 30, 2027

See all H1RL34 bonds

Curated watchlists where H1RL34 is featured.