ICF1! trade ideas

KC, Coffee C Futures - Symmetrical Triangle on Coffee FuturesICEUS:KC1!

Commodities are very volatile assets that can generate excellent profits if traded with discipline and awareness of their volatility.

In this case we are monitoring the compression of the price that is represented by the symmetrical triangle pattern, often symptom of potential breakout with subsequent trend.

We have set the alerts and we are waiting.

www.theice.com

LONG KC!1 / Coffee Futures til year end 2019Fundamentals seem to be aligning up just perfectly (BRL strength coming up, current cyclical low yield year, solid to steadily growing global demand etc.),

all the while the until-recently uber bearish chart already started to brighten significantly - to me at least!

Reasons enough for a cautiously bullish view of things.. and for me to open a small position :P

Tell me what yall think!

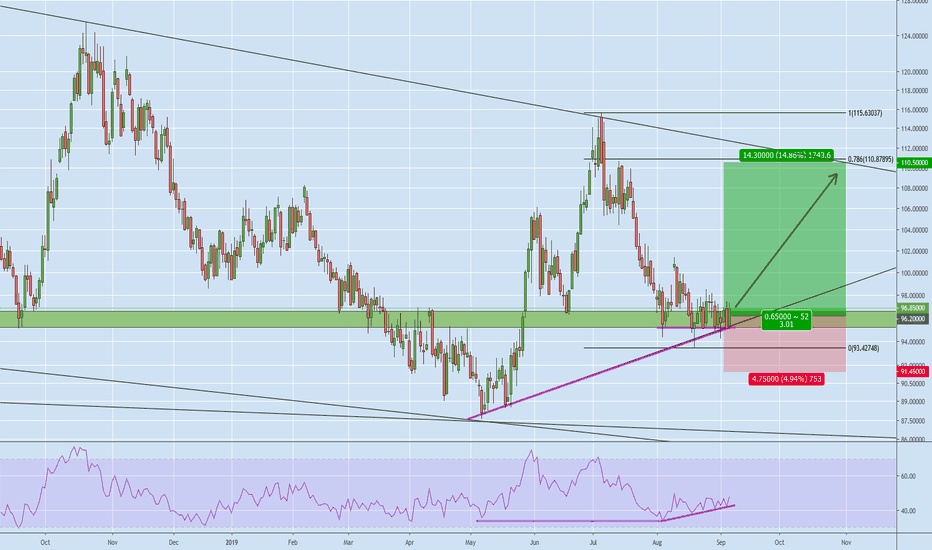

Coffee at "grounds" level, a buy, 95 cents/pound DecemberCoffee price has declined the deep Fib retrace level and nested in the arms of the centerline of linear regression channel. Also a Schiff fork tine appropriately supports price here now. Downright dreadful wails of surplus, overproduction and crop abundance combined with currency fiasco provide a contrarian context for reversal propulsion surprise. To quote "Popeye the Sailorman", 'Thats all I can stands, I cant stands no more!'